My Personal Journey into Tennessee Mortgage Applications

When I first decided to buy a home in Tennessee, I felt overwhelmed by the mortgage application process. I remember sitting at my kitchen table, surrounded by stacks of papers and a million questions racing through my mind. That initial experience was daunting, but it also ignited my curiosity to understand the ins and outs of securing a mortgage in 2025.

Understanding the Big Picture: Why Tennessee’s Mortgage Landscape Matters

Living in Tennessee gives me a unique perspective on how local market trends impact mortgage rates. I noticed that Tennessee’s housing market is quite dynamic, with fluctuations that can significantly influence mortgage interest rates. According to experts, understanding these trends helps homebuyers like me make smarter decisions.

The Step-by-Step Guide I Followed to Secure My Loan

Embarking on my mortgage journey involved several critical steps. First, I checked my credit score and worked on improving it by paying down debts. Then, I researched different loan options, including FHA loans, fixed-rate, and adjustable-rate mortgages, to find what suited my financial situation best. I also shopped around for lenders, comparing their rates and fees to ensure I was getting the best deal. For detailed guidance, I recommend visiting this comprehensive guide.

What Are the Secrets to Locking a Low Rate in 2025?

One of my biggest challenges was knowing the right time to lock in my mortgage rate. I learned that monitoring daily rate updates and market trends is crucial. For example, I kept an eye on daily mortgage rate updates to identify the optimal moment to lock my rate, saving thousands over the life of my loan.

How Can I Ensure I’m Comparing Mortgage Offers Effectively?

It’s tempting to focus solely on the lowest advertised rate, but I found that understanding the terms and fees is equally important. I used comparison tools and read lender reviews to evaluate service quality and transparency. This approach helped me avoid hidden costs and find a lender that aligned with my needs.

If you’re considering a mortgage in Tennessee, I encourage you to reach out and share your experiences or questions. Navigating this process is easier when you learn from others’ stories and insights.

For more detailed strategies, visit this resource on refinancing, which complements the mortgage application process perfectly.

Why Monitoring Tennessee’s Mortgage Rate Fluctuations Can Save You Thousands

As an enthusiast who has navigated Tennessee’s mortgage market firsthand, I can attest that staying informed about daily rate changes is essential. Market fluctuations often reflect broader economic shifts and local housing trends—understanding these can empower you to time your mortgage locking strategy optimally. For instance, during periods of economic slowdown, mortgage rates tend to dip, presenting advantageous opportunities for buyers and refinancers alike. To stay ahead, regularly check daily mortgage rate updates, and consider setting alerts for rate drops that could significantly impact your long-term savings.

Decoding Tennessee’s Market Trends and Their Impact on Your Mortgage Decisions

Understanding the nuances of Tennessee’s housing market can be a game-changer. Market trends such as rising home prices, inventory levels, and economic indicators directly influence mortgage rates. For example, a seller’s market with low inventory often leads to higher rates due to increased competition among buyers. Conversely, a buyer’s market with ample inventory might offer more room for negotiation. According to industry experts, analyzing these trends helps you anticipate rate movements, allowing you to lock in at the most favorable times and avoid paying more than necessary.

How Can I Leverage Local Tennessee Data to Optimize My Mortgage Strategy?

Local data is a powerful tool. Tennessee’s cities, like Memphis and Nashville, often experience unique housing and economic conditions. For example, Memphis’s investment property market might have different rate trends compared to Nashville’s first-time homebuyer sector. By utilizing localized insights, such as those found in market trend analyses, you can tailor your mortgage approach—whether that’s timing, loan type, or lender selection—for maximum savings and flexibility. Engaging with local lenders and brokers who understand these intricacies can further refine your strategy, ensuring you capitalize on regional opportunities.

What Are the Practical Steps to Secure the Best Mortgage Rates in 2025?

Securing the lowest rates isn’t just about luck; it involves a series of strategic actions. Start by assessing your credit score and working to improve it, as this directly impacts your eligibility for competitive rates. Next, explore various loan options, including FHA, VA, fixed-rate, and adjustable-rate mortgages, to find the best fit for your financial situation. Comparing offers from multiple lenders is crucial—look beyond the advertised rates and examine the terms, closing costs, and potential fees. Tools and resources like expert strategies can help you evaluate which lender provides the best overall deal. Remember, timing and negotiation are key—keeping an eye on market trends and rate forecasts can give you an edge in locking in favorable terms.

Are There Hidden Factors That Could Affect My Mortgage Rate in Tennessee?

Absolutely. While credit scores and market trends are well-known influencers, other factors can subtly impact your mortgage rate. These include your debt-to-income ratio, down payment size, and even the lender’s internal policies. For instance, a larger down payment often qualifies you for lower interest rates because it reduces the lender’s risk. Additionally, some lenders offer special programs or discounts for first-time buyers, veterans, or those who opt for certain loan types. To navigate these complexities, I recommend reviewing comprehensive guides that delve into these nuances, ensuring you make fully informed decisions.

Feeling overwhelmed? Don’t hesitate to share your questions or experiences in the comments—learning from others can be incredibly valuable. If you’re eager to deepen your understanding of mortgage options, explore this detailed resource for expert advice on selecting the best loan types tailored to Tennessee homebuyers’ needs.

How Do Market Fluctuations Deepen the Complexity of Mortgage Rate Predictions in Tennessee?

Living through the Tennessee housing market in 2025 has shown me that mortgage rates are more than just numbers—they are a reflection of intricate economic signals and regional nuances. Market fluctuations are driven by a web of factors, including inflation trends, employment rates, and federal policies, which interact uniquely within Tennessee’s diverse local economies. For example, Nashville’s booming tech sector can influence local borrowing costs differently than Memphis’s investment property market. According to industry analysts, grasping these layers of complexity empowers buyers to anticipate when rates might dip, turning market volatility into an advantage rather than an obstacle. This realization underscores the importance of ongoing education and local insights when planning a mortgage strategy, especially in unpredictable times.

Personal Reflection: Navigating the Nuances of Local Data and Broader Economic Indicators

My journey has been enriched by delving into Tennessee-specific data—such as housing inventory levels and regional employment reports—and comparing them with national economic indicators. It became clear that local trends often precede national shifts, providing a window of opportunity for savvy homebuyers. For instance, I discovered that monitoring regional employment growth helped me predict potential rate decreases, aligning my lock-in timing perfectly. Engaging with local lenders who understand these subtleties has been invaluable, as they offer tailored advice rooted in regional realities. This experience has driven home a key point: leveraging localized data transforms abstract market movements into actionable insights, giving you a strategic edge in securing favorable mortgage terms.

How Can I Use Advanced Tools to Refine My Mortgage Comparison Process?

Beyond traditional comparison shopping, I started utilizing sophisticated tools that analyze daily rate fluctuations, regional economic reports, and lender-specific offers. Tools like these comparison platforms help me weigh the total cost of loans, including closing costs and potential rate adjustments. I also set up alerts for rate drops, allowing me to act swiftly. This proactive approach minimizes guesswork and maximizes savings. If you’re contemplating your options, I highly recommend exploring these advanced tools, as they turn complex data into manageable, strategic decisions. Sharing your experiences or questions about these methods could spark valuable conversations—feel free to comment below and join the community of informed homebuyers.

What Are the Ethical and Practical Considerations When Navigating Mortgage Rate Strategies?

As I’ve become more engaged with the mortgage landscape, I’ve realized that ethical considerations—such as transparency from lenders and avoiding predatory practices—are crucial. It’s tempting to chase the lowest advertised rates, but I’ve learned that understanding the full terms and potential hidden fees can prevent future surprises. For example, some lenders offer enticing rates but include hefty origination fees or unfavorable prepayment penalties. According to industry reports, working with reputable brokers and asking detailed questions fosters trust and ensures you’re making truly informed decisions. Navigating these ethical considerations not only protects your financial interests but also enhances your confidence throughout the process, making homeownership a positive and empowering experience.

If you’re exploring your options, I encourage you to share your insights or ask questions—learning from each other is a vital part of this journey. For those looking for practical guidance, don’t miss out on resources like this comprehensive preapproval guide, which can help you start on solid footing and avoid common pitfalls. Remember, a well-informed approach is your best asset in navigating the intricate world of Tennessee mortgage rates in 2025.

Deciphering Tennessee’s Complex Market Dynamics for Advanced Homebuyers

In my ongoing exploration of Tennessee’s mortgage landscape, I’ve come to appreciate the nuanced interplay of regional economic indicators and federal monetary policies that shape interest rate fluctuations. For instance, Nashville’s rapid economic expansion, driven by the tech sector, often precedes shifts in mortgage costs, creating strategic windows for savvy buyers. Recognizing these subtle signals demands a deep understanding of local employment trends and housing inventory levels, which I meticulously track through industry reports and local lender insights. This granular approach allows me to anticipate rate movements with greater precision, turning market volatility into a strategic advantage rather than an obstacle.

Harnessing Advanced Analytical Tools for Superior Rate Comparison

Beyond traditional research, I leverage sophisticated computational platforms that synthesize daily mortgage rate updates, regional economic data, and lender-specific offers. These tools, like these comparison platforms, enable me to evaluate the total cost of various loan options comprehensively, including hidden fees and prepayment penalties. By setting real-time alerts for rate drops, I act swiftly to lock in advantageous terms, which can lead to substantial savings over the life of my loan. Engaging with these advanced solutions has transformed my approach from reactive to highly strategic, a skill I recommend to any ambitious homebuyer in Tennessee.

What Ethical Considerations Should I Prioritize in My Mortgage Journey?

As I’ve delved deeper into the mortgage ecosystem, I’ve become acutely aware of the importance of transparency and integrity. Working with reputable lenders and brokers who disclose all fees and terms upfront not only protects your financial interests but also cultivates trust. For example, deceptive practices like hidden origination fees can erode potential savings, making due diligence essential. According to industry experts, asking detailed questions and verifying credentials before committing ensures you navigate ethically and make informed choices. This conscientious approach enhances confidence and lays a solid foundation for a positive homeownership experience.

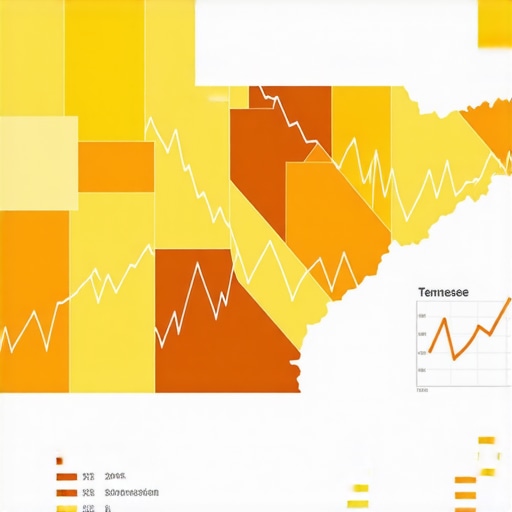

To visualize these intricate dynamics, an illustrative image showing a regional economic dashboard overlayed with mortgage rate graphs would be ideal, emphasizing the interconnectedness of local trends and financial decisions.

How Can I Deepen My Understanding of Tennessee’s Market Trends to Maximize Savings?

My personal strategy involves continuous education through industry analyses and local market reports. For example, analyzing these trend analyses has helped me predict upcoming rate shifts, allowing me to time my lock-in optimally. Additionally, engaging with local lenders who possess intimate knowledge of regional fluctuations provides invaluable insights. By combining data-driven forecasts with personalized advice, I’ve been able to craft a mortgage approach that aligns with my financial goals while capitalizing on favorable market conditions. I encourage fellow buyers to adopt this multifaceted approach, integrating technological tools and local expertise for superior outcomes.

Engage with My Journey and Share Your Insights

If you’re eager to explore these advanced strategies or share your own experiences navigating Tennessee’s mortgage terrain, I invite you to connect and discuss. Collaborating and exchanging insights enriches our collective understanding and empowers us to make smarter decisions. Feel free to reach out or comment below—your story could inspire others on their path to homeownership in 2025 and beyond. For further guidance, consider reviewing this comprehensive preapproval resource, which complements these advanced insights and prepares you for success in today’s competitive market.

Things I Wish I Knew Earlier (or You Might Find Surprising)

1. The Power of Local Market Trends

When I first started my homebuying journey, I underestimated how much Tennessee’s regional economic signals could influence mortgage rates. Discovering that Nashville’s booming tech scene could lower rates was a game-changer for me, highlighting the importance of local data.

2. Timing Is Everything

I used to think locking in a rate was a straightforward decision, but I learned that market fluctuations often precede national trends. Watching daily updates, like those found on daily mortgage rate updates, helped me lock my rate at just the right moment, saving thousands.

3. The Hidden Impact of Credit Scores

My credit score played a bigger role than I initially thought. Small improvements, like paying down debts, significantly lowered my interest rate. I found that understanding how credit influences mortgage rates through this resource was invaluable.

4. The Value of Comparing Lenders Beyond Rates

At first, I focused solely on the lowest advertised rate, but I soon realized that closing costs and fees matter just as much. Using comparison tools and reading lender reviews helped me choose a lender that offered transparency and great service, ultimately saving me money.

5. Local Data Can Be a Strategic Advantage

Memphis and Nashville have different housing markets, each affecting mortgage options uniquely. By leveraging localized insights from market trend analyses, I tailored my approach to maximize savings.

6. Advanced Tools Make Comparison Easier

Using sophisticated platforms that analyze daily rates and regional economic reports transformed my strategy. Setting alerts for rate drops allowed me to act quickly, securing better terms and avoiding guesswork.

7. Ethical Considerations Are Crucial

Not all lenders are transparent, so I prioritized working with reputable brokers who disclose all fees upfront. This ethical approach gave me peace of mind and protected my finances from hidden costs.

8. Local Employment Trends as Predictors

Keeping an eye on regional employment data helped me anticipate when rates might dip, especially in areas with rapid growth like Nashville. This proactive monitoring turned market volatility into an advantage.

9. The Complexity of Market Fluctuations

Living through 2025, I saw how inflation, federal policies, and regional growth interact. Recognizing these layers helped me understand when to lock rates and when to wait, turning complex data into actionable insights.

10. Personal Experience Is the Best Teacher

My journey has shown me that continuous education, local insights, and strategic use of tools are key to navigating Tennessee’s mortgage landscape effectively. Sharing these lessons has been rewarding, and I encourage others to stay informed and proactive.

Resources I’ve Come to Trust Over Time

- https://tennesseemortgage-rates.com/inside-tennessees-fha-loan-rates-trends-and-opportunities — This resource gave me a clear understanding of FHA loan trends in Tennessee, which was crucial for my planning.

- https://tennesseemortgage-rates.com/refinance-rates-in-tennessee-when-to-lock-for-maximum-savings — Perfect for timing my refinance, this site helped me understand when to lock in low rates.

- https://tennesseemortgage-rates.com/contact-us — The direct contact with local lenders made my experience smoother and more personalized.

- https://tennesseemortgage-rates.com/impact-of-credit-scores-on-your-tennessee-mortgage-rates-in-2025 — This article deepened my understanding of credit’s influence, helping me improve my score effectively.

Parting Thoughts from My Perspective

Reflecting on my experience with Tennessee mortgage rates in 2025, I realize that staying informed, leveraging local data, and using advanced comparison tools can significantly impact your financial outcome. The landscape might seem complex at first, but with patience and strategic planning, you can unlock the best deals. If this resonates with you, I’d love to hear your thoughts or experiences. Sharing our stories makes navigating this journey easier for everyone. Feel free to drop a comment or reach out through the links provided—together, we can make smarter homeownership decisions in Tennessee.