Why Tennessee Homebuyers Can’t Stop Debating Fixed vs Adjustable Rates

Imagine you’re at a crossroads in Nashville, the city’s skyline glowing as you clutch the keys to your dream home. But before you can celebrate, there’s the inevitable head-scratcher: Should you lock in a fixed mortgage rate or dare to dance with an adjustable one? Welcome to the Tennessee mortgage maze, where rates can feel like the unpredictable Tennessee River—beautiful but ever-changing.

Fixed Rates: The Reliable Old Friend You Can Count On

Fixed mortgage rates in Tennessee offer you a steady ship in choppy financial waters. The charm? Your interest rate and monthly payments stay the same for the entire loan term, often 15 or 30 years. This predictability is a sanctuary for those who crave consistency and dislike surprises in their budget. It’s like having a front porch in Memphis where you know the weather won’t suddenly change your plans.

But let’s not sugarcoat it: fixed rates tend to start off a bit higher than adjustable rates, which means you might pay a premium for peace of mind. Yet, when market conditions are volatile, that premium can feel like a bargain.

Adjustable Rates: The Wild Card with a Potential Upside

Adjustable-rate mortgages (ARMs) lure you in with tantalizingly low initial rates, often below fixed rates in Tennessee. The catch? These rates can change after an initial period, typically 5, 7, or 10 years, adjusting according to the market.

For the adventurous buyer who plans to move or refinance before the adjustment kicks in, ARMs can mean significant savings. Consider it the equivalent of catching a live bluegrass show in Knoxville—thrilling and rewarding if you time it right. But for those who stay put, rising rates could lead to higher monthly payments and financial headaches.

So, which mortgage rate dance should Tennessee homebuyers choose: the steady waltz or the unpredictable two-step?

That question echoes through living rooms across the state. The answer hinges on your financial rhythm, future plans, and appetite for risk. Do you prefer the calm certainty of fixed rates or the potential savings (and risks) of adjustable rates? Understanding these nuances is essential to making a savvy decision.

For an in-depth exploration of this topic, check out this expert guide to fixed vs adjustable mortgage rates in Tennessee. And remember, as the Federal Reserve influences interest rates, keeping an eye on national trends is key. According to Federal Reserve’s official monetary policy site, their decisions ripple through mortgage markets nationwide, including Tennessee.

Curious about what this means for your wallet? Share your thoughts or experiences with fixed and adjustable rates below, or explore how credit scores shape your mortgage interest rates here. Because in the end, understanding the difference between fixed vs adjustable rates in TN isn’t just about numbers—it’s about making your homeownership dreams a reality.

Hidden Costs and Long-Term Considerations in Tennessee Mortgages

When Tennessee homebuyers evaluate fixed versus adjustable mortgage rates, they often focus on the headline interest rate but overlook the subtle, long-term costs. Fixed rates provide predictability, but that can sometimes come with higher initial rates and potentially less flexibility. Conversely, ARMs offer lower initial payments but carry the risk of payment shocks if rates rise sharply.

It’s crucial to factor in the total cost of the loan over your expected holding period. For instance, if you plan to remain in your Tennessee home for many years, a fixed-rate mortgage might save money over time despite higher upfront rates. On the other hand, if your horizon is shorter or you anticipate refinancing, an adjustable-rate mortgage could be advantageous.

Additionally, watch out for caps and adjustment intervals on ARMs—these can substantially affect your monthly payment unpredictability. Understanding these nuances helps you avoid surprises and align mortgage choice with your financial goals.

When Does Refinancing Make Sense in Tennessee’s Mortgage Landscape?

Refinancing can be a powerful tool to optimize your mortgage rate, but timing is everything. Tennessee homeowners should consider refinancing when current rates drop significantly below their existing loan rates or when their credit profile improves substantially.

However, refinancing involves closing costs and fees that need to be balanced against potential savings. Experts recommend calculating the break-even point — the time it takes for refinancing savings to offset these costs — before committing. Tools and calculators specific to Tennessee’s market can assist in this evaluation.

For strategic refinancing advice tailored to Tennessee homeowners, explore our comprehensive refinancing strategies guide.

How Can Tennessee Buyers Leverage Credit Scores to Secure Better Mortgage Rates?

Your credit score remains one of the most influential factors in determining your mortgage interest rate. A higher credit score often translates to lower interest rates and better loan terms, which can save thousands over the lifetime of your mortgage. Conversely, a lower score may result in higher rates and less favorable conditions.

For Tennessee buyers, investing time in improving credit—such as paying down debt, correcting errors on credit reports, and maintaining a healthy credit utilization ratio—can be transformative. The impact of credit scores on mortgage rates in Tennessee is well documented and supported by industry data.

Financial advisors suggest starting credit improvement efforts well before applying for a mortgage to maximize your benefit. Remember, even a modest credit score increase can reduce your mortgage rate by a fraction of a percent, which compounds into substantial savings.

Industry Insight: What Do Leading Mortgage Experts Say?

According to Freddie Mac, a key authority in the mortgage industry, “Mortgage rates reflect a complex interplay of macroeconomic factors, including inflation expectations, Federal Reserve policies, and global financial markets.” Their weekly Primary Mortgage Market Survey provides up-to-date insights that Tennessee buyers can use to gauge market direction and make informed decisions.

Understanding these broader economic signals can help Tennessee homebuyers anticipate rate movements and choose the mortgage type that best fits their financial strategy.

Have you navigated the fixed vs adjustable mortgage debate in Tennessee? Share your experiences or questions in the comments below to help others make informed choices. For more expert advice, don’t miss our latest updates on current mortgage rates in Tennessee and how to lock in the best rates at the right time.

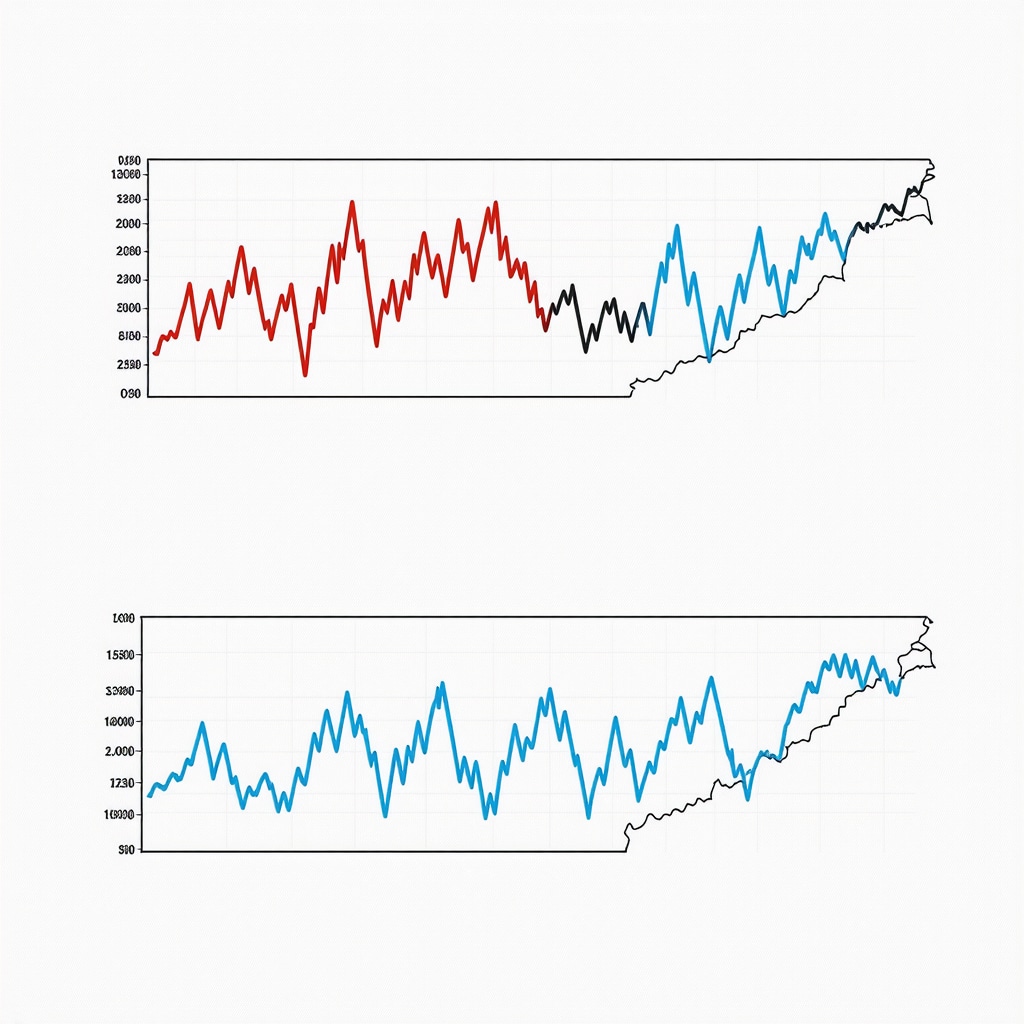

Decoding Tennessee Mortgage Rate Trends: Expert Forecasts and Economic Indicators

To truly master the fixed versus adjustable mortgage debate, Tennessee homebuyers must dive beyond surface-level rate comparisons and explore the economic undercurrents shaping these options. The interplay of inflation trends, Federal Reserve policy adjustments, and regional housing market dynamics creates a complex backdrop influencing mortgage rates.

For instance, the Federal Reserve’s recent signaling towards tightening monetary policy to combat inflation directly impacts mortgage yield curves, often causing fixed rates to rise in tandem with long-term Treasury bond yields. Conversely, adjustable-rate mortgages, which often tie to short-term indices like the LIBOR or SOFR, may react differently, sometimes offering temporary reprieve before adjustments occur.

Understanding these macroeconomic drivers empowers Tennessee buyers to anticipate shifts and strategically time their mortgage lock-ins. Industry analysts at Freddie Mac’s Primary Mortgage Market Survey advise monitoring Treasury yields and Fed announcements closely, as they provide early signals for rate trajectory changes.

Innovative Mortgage Products: Blending Fixed Stability with Adjustable Flexibility

The mortgage market in Tennessee has witnessed the emergence of hybrid products that aim to fuse the predictability of fixed rates with the initial affordability of adjustable rates. Popular among savvy buyers is the 7/1 ARM, which offers a fixed rate for the first seven years, then adjusts annually thereafter. This model caters well to homeowners planning medium-term residence or anticipating refinancing options.

Moreover, some lenders are now providing “cap-protected” ARMs, limiting the maximum interest rate increase over the loan’s life, thus mitigating the risk of payment shocks. These innovations demonstrate a growing trend towards personalized mortgage solutions tailored to diverse financial goals.

What advanced risk mitigation strategies can Tennessee homebuyers employ when choosing between fixed and adjustable rates?

Risk mitigation in mortgage selection transcends the basic fixed versus adjustable spectrum. Tennessee buyers can implement strategies such as:

- Interest Rate Buydowns: Paying upfront points to reduce initial interest rates, effective in both fixed and adjustable loans.

- Rate Locks with Float-Down Options: Securing a mortgage rate while retaining flexibility to benefit if rates decline before closing.

- Refinancing Contingency Planning: Preparing financially and credit-wise to refinance if adjustable rates rise beyond affordability.

Additionally, integrating financial products like interest rate caps or hedging instruments can further protect against market volatility, although these are less common and typically reserved for high-value transactions or investment properties.

Credit Nuances and Their Tactical Impact on Tennessee Mortgage Terms

Beyond the headline credit score, mortgage lenders in Tennessee scrutinize a composite of credit factors including debt-to-income ratios, credit mix, and recent credit inquiries. Each element subtly influences the mortgage rate and terms offered.

For example, a borrower with a stellar credit score but high debt-to-income ratio might face higher rates or require larger down payments. Conversely, a balanced credit profile can unlock premium fixed-rate offers or more favorable ARM caps.

Consulting with credit counselors or mortgage advisors to fine-tune these components prior to application can yield significant cost savings and loan flexibility.

Leveraging Local Tennessee Market Intelligence for Smarter Mortgage Decisions

The diversity of Tennessee’s housing markets—from the urban dynamism of Nashville to the suburban spread in Chattanooga—means mortgage strategies must be contextually adapted. Local economic growth rates, housing supply constraints, and regional employment trends all influence mortgage risk assessments by lenders.

For instance, in rapidly appreciating markets, locking in a fixed rate early may protect buyers from escalating costs, while in more stable regions, ARMs might offer cost-effective entry points.

Engaging with local real estate experts and lenders who understand these nuances can provide Tennessee buyers with competitive advantages.

Ready to deepen your expertise and tailor your mortgage approach to Tennessee’s unique market? Explore our advanced analysis and interactive tools here to start crafting a mortgage plan that aligns with your long-term homeownership ambitions.

Decoding Advanced Mortgage Rate Strategies for Tennessee Homebuyers

As Tennessee’s housing market continues evolving, savvy buyers are delving deeper into mortgage intricacies beyond just fixed or adjustable rates. With economic signals shifting rapidly, understanding nuanced strategies can empower you to optimize borrowing costs and safeguard your financial future. This means not only picking a mortgage type but leveraging timing, credit positioning, and lender offerings to your advantage.

How Can Tennessee Buyers Use Market Timing and Rate Locks to Maximize Savings?

Mortgage rate volatility can be daunting, but Tennessee homebuyers equipped with strategic timing tools gain a competitive edge. One effective approach is utilizing rate locks with float-down options. This allows you to secure a current rate while retaining the flexibility to capitalize if rates decline before closing, blending certainty and opportunity.

Another pivotal factor is understanding regional market rhythms. Tennessee’s diverse housing landscapes—from Nashville’s rapid price appreciation to more stable markets like Knoxville—affect mortgage risk and timing. Aligning your mortgage lock with local economic indicators, such as employment growth or housing supply constraints, can optimize your borrowing costs.

What expert techniques mitigate risks associated with adjustable-rate mortgages in Tennessee?

Adjustable-rate mortgages (ARMs) pose unique challenges, especially in fluctuating interest environments. Experts recommend several advanced risk mitigation tactics tailored for Tennessee buyers:

- Cap-Protected ARMs: Opt for ARMs with well-defined caps on rate increases to prevent payment shocks over the loan term.

- Interest Rate Buydowns: Paying upfront points can reduce initial and potentially adjusted rates, smoothing long-term affordability.

- Refinancing Preparedness: Maintain a strong credit profile and financial buffer to refinance if rates spike, leveraging resources such as refinancing strategies for Tennessee homeowners.

These strategies, combined with careful personal financial assessment, help Tennessee borrowers navigate ARMs’ inherent uncertainties confidently.

According to the Mortgage Bankers Association’s recent report, Mortgage Market Indicators, buyers adopting proactive risk control measures enjoy more stable housing costs and fewer refinancing surprises.

Leveraging Tennessee-Specific Credit Insights to Unlock Better Loan Terms

Credit nuances extend beyond scores to impact mortgage terms significantly. Tennessee lenders weigh factors like debt-to-income ratios, credit mix, and recent inquiries, affecting rate offers and down payment requirements. A finely tuned credit profile can unlock premium fixed-rate mortgages or more favorable ARM caps.

Homebuyers aiming to enhance credit components should consult local mortgage advisors or credit counselors. These experts provide tailored guidance to improve credit health before application, yielding substantial savings over the loan duration. For more detailed credit improvement tactics, explore how credit scores shape your mortgage interest rates today.

Why Local Tennessee Market Intelligence Is a Game-Changer for Mortgage Decisions

Mortgage decision-making in Tennessee gains depth when informed by localized data. Economic drivers unique to cities like Memphis, Chattanooga, or the Tri-Cities influence lender risk assessments and mortgage pricing. For example, rapidly appreciating neighborhoods often warrant early fixed-rate locks to hedge against rising costs, whereas stable markets might favor ARMs for initial affordability.

Engaging with local experts familiar with regional trends offers Tennessee buyers an invaluable edge. Resources such as local mortgage markets in Tennessee rate trends and insights for 2025 provide actionable intelligence to position buyers advantageously.

Ready to sharpen your mortgage strategy with expert insights and tailored tools? Dive deeper into the nuances of Tennessee mortgage options with our comprehensive expert guide to fixed vs adjustable mortgage rates in Tennessee.

Have you mastered advanced mortgage strategies or faced unique challenges navigating Tennessee’s market? Share your experiences and questions below to join the conversation and help fellow homebuyers make empowered choices.

Expert Insights & Advanced Considerations

Balancing Long-Term Stability with Market Agility

Choosing between fixed and adjustable mortgage rates in Tennessee requires weighing the comfort of predictable payments against the opportunity of initial savings. Experts emphasize a nuanced approach: assess your anticipated tenure in your home, credit strength, and refinancing capacity. For example, a 7/1 ARM may offer a strategic blend, providing fixed stability initially with flexibility later. This approach fits well in Tennessee’s dynamic markets like Nashville and Chattanooga.

Learn more about fixed vs adjustable mortgage nuances.

Incorporating Credit Profile Nuances Beyond Scores

While credit scores are pivotal, Tennessee lenders also scrutinize debt-to-income ratios, credit mix, and recent inquiries. Fine-tuning these elements can unlock better mortgage terms and lower rates, especially for ARMs where caps and adjustments matter. Engaging with local credit counselors and mortgage advisors is highly recommended for tailored strategies.

Explore credit impact on mortgage rates in Tennessee.

Timing Rate Locks to Local Market Dynamics

Securing the best mortgage rate in Tennessee isn’t only about national trends but also local economic signals. Monitoring employment growth, housing supply, and regional appreciation patterns can guide optimal rate lock timing. Using rate locks with float-down options offers buyers flexibility amid volatility, a vital tool especially in rapidly appreciating areas like Memphis.

Expert tips on locking mortgage rates in Tennessee.

Strategic Refinancing as a Dynamic Financial Lever

Refinancing decisions in Tennessee should be data-driven and timely. With closing costs and break-even points in mind, refinancing can significantly reduce long-term costs if done when rates dip below your current loan’s rate. Maintaining credit health and financial readiness is crucial to capitalize on refinancing opportunities.

Refinancing strategies tailored for Tennessee homeowners.

Curated Expert Resources

- Freddie Mac Primary Mortgage Market Survey: Offers weekly, authoritative insights on national mortgage trends impacting Tennessee homebuyers. Access here.

- Federal Reserve Monetary Policy Updates: Critical for understanding macroeconomic factors shaping mortgage rate movements. Official site.

- Tennessee Mortgage Rates Today: Daily updates and local market intelligence to track real-time rate fluctuations. Explore now.

- Credit Score Impact Guides: Detailed analyses on how credit nuances influence mortgage terms in Tennessee. Learn more.

- Tennessee Local Mortgage Market Analyses: Deep dives into regional economic and housing market trends shaping mortgage strategies. Read insights.

Final Expert Perspective

Navigating the fixed vs adjustable mortgage rates landscape in Tennessee demands more than a simple choice; it requires a sophisticated understanding of market dynamics, credit profiles, and timing strategies. By blending these elements thoughtfully, buyers can tailor mortgage plans that not only align with their financial goals but also adapt to evolving economic conditions. Harnessing expert insights and localized intelligence elevates home financing from a transactional step to a strategic advantage. Engage further with our comprehensive guide on fixed vs adjustable mortgage rates in Tennessee, share your experiences, or connect with specialists via our contact page to deepen your mortgage mastery and secure your homeownership future.