Decoding the Complex Mechanisms Behind Mortgage Interest Rate Formation

Mortgage interest rates profoundly influence homeownership affordability and the broader housing market dynamics. Understanding how these rates are determined today requires navigating a multifaceted web of economic indicators, lender risk assessments, and policy influences. This discussion elucidates the intricate factors shaping mortgage interest rates, moving beyond surface-level explanations to reveal the nuanced interplay of market forces, credit considerations, and macroeconomic trends.

Macroeconomic Drivers: The Unseen Forces Steering Mortgage Rates

At the macroeconomic level, mortgage interest rates are tethered closely to benchmark yields such as U.S. Treasury bond rates, especially the 10-year Treasury note. These government bond rates reflect investor sentiment on inflation, economic growth, and Federal Reserve monetary policy. When bond yields rise due to inflation expectations or tightening monetary policy, mortgage rates generally follow suit to compensate lenders for increased funding costs and inflation risk.

Moreover, Federal Reserve decisions on the federal funds rate indirectly influence mortgage rates by affecting short-term borrowing costs and liquidity in financial markets. However, mortgage rates do not move in lockstep with Fed policy; they incorporate long-term risk premiums and secondary market dynamics, notably the trading of mortgage-backed securities (MBS).

How Do Lenders Incorporate Borrower Credit Profiles and Market Risk into Mortgage Interest Rates?

Lenders meticulously evaluate individual borrower risk profiles, including credit scores, debt-to-income ratios, and employment stability, to price mortgage interest rates appropriately. Higher creditworthiness typically translates to lower risk premiums and consequently, more favorable rates. This individualized pricing reflects lenders’ need to mitigate default risk while remaining competitive.Understanding credit score impact on mortgage rates is critical for borrowers seeking optimal financing terms.

Additionally, market risk factors such as housing market volatility, regional economic conditions, and loan product type (fixed vs. adjustable rate) further influence rate determination. For example, adjustable-rate mortgages (ARMs) may start with lower rates but embed interest rate reset risks that lenders price into initial terms. Exploring fixed vs. adjustable mortgage rates offers insight into these differentiated risk assessments.

The Role of Secondary Mortgage Markets and Mortgage-Backed Securities (MBS)

Mortgage lenders often sell originated loans to investors in the secondary market, bundling them into MBS. The demand and pricing of these securities significantly impact mortgage interest rates. When investor appetite for MBS is strong, lenders can offer lower rates owing to improved liquidity and reduced funding costs. Conversely, diminished MBS demand elevates rates to compensate for increased risk and capital costs.

This financial intermediation creates a feedback loop where macroeconomic trends, investor sentiment, and credit market conditions collectively shape mortgage rates available to consumers.

Expert Insights on Regional Market Factors Affecting Tennessee Mortgage Interest Rates

Local economic indicators, housing supply constraints, and state-specific lending regulations also modulate mortgage interest rates in markets like Tennessee. Understanding how Tennessee mortgage rates are determined requires accounting for regional labor market health, real estate demand, and lender competition. For instance, metropolitan areas such as Nashville and Knoxville exhibit distinct rate trends influenced by localized economic growth and housing inventory dynamics.Knoxville mortgage market trends provide a case study in these nuanced regional factors.

Call to Action: Deepen Your Expertise on Mortgage Rate Strategies in Tennessee

To further enhance your understanding and make informed mortgage decisions, explore our advanced guides on refinance timing and rate locks in Tennessee and engage with professional mortgage brokers who leverage local market insights to secure optimal loan terms. Your active participation in this evolving market will empower smarter financial outcomes.

For comprehensive research on the correlation between Treasury yields and mortgage interest rates, see the Federal Reserve Bank of St. Louis’s economic research publication: 10-Year Treasury Constant Maturity Rate.

Unpacking the Impact of Inflation Expectations on Tennessee Mortgage Rates

Inflation expectations play a pivotal role in shaping mortgage interest rates within Tennessee’s housing market. When investors foresee rising inflation, lenders adjust mortgage rates upward to maintain real returns on their loans. This adjustment compensates for the erosion of purchasing power over time. Tennessee’s diverse economic sectors, including manufacturing and tourism, influence localized inflation trends, which lenders must consider when pricing loans. Therefore, understanding the relationship between inflation forecasts and mortgage rates can help borrowers anticipate rate movements and plan their financing strategies accordingly.

How Does Mortgage Rate Volatility Affect Homebuyer Behavior in Tennessee?

Mortgage rate volatility directly impacts buyer confidence and timing in Tennessee. Fluctuating rates may cause potential homeowners to accelerate purchases to lock in lower rates or delay buying decisions amid uncertainty. This dynamic often manifests in regional markets like Nashville and Memphis, where rapid economic changes create variable demand for housing loans. Mortgage brokers in Tennessee play a critical role in guiding buyers through these fluctuations by providing up-to-date market intelligence and tailored advice. Exploring mortgage rate trends today in Tennessee can provide further clarity on this topic.

What Advanced Strategies Can Tennessee Homebuyers Use to Mitigate Mortgage Rate Risks?

Homebuyers can adopt several advanced strategies to mitigate the risks posed by rising or volatile mortgage rates. One approach is rate locking, which allows borrowers to secure a current rate while completing the home purchase process. Borrowers can also consider adjustable-rate mortgages (ARMs) with initial lower rates and caps on future increases, balancing risk and affordability. Additionally, improving credit scores and reducing debt-to-income ratios can qualify buyers for better rates. Collaborating with experienced mortgage brokers who understand Tennessee’s local market conditions enhances the ability to identify optimal timing and loan products. For a comprehensive guide on these strategies, visit refinance rates in Tennessee and when to lock for maximum savings.

The Influence of Federal Reserve Policy Shifts on Tennessee Mortgage Markets

Federal Reserve policy decisions, particularly changes to the federal funds rate, ripple through the Tennessee mortgage market with nuanced effects. While the Fed targets short-term rates, its policies influence long-term borrowing costs and investor appetite for mortgage-backed securities. For Tennessee lenders, these shifts translate into adjustments in offered mortgage rates, affecting affordability and housing market activity. Tracking federal announcements and understanding their local implications is essential for both borrowers and lenders aiming to navigate rate fluctuations effectively.

Leveraging Local Mortgage Brokers to Secure Competitive Tennessee Rates

Local mortgage brokers in Tennessee offer invaluable expertise in interpreting market signals and negotiating loan terms suited to individual borrower profiles. Their deep knowledge of regional economic indicators, lender relationships, and loan products enables them to identify competitive mortgage rates that might not be accessible through direct lender interactions. Engaging with these specialists can streamline the mortgage application process and optimize financing outcomes. For insights into how Tennessee mortgage brokers enhance the loan experience, see how local mortgage brokers in Tennessee secure the best home loan deals.

Expert Citation: Deepening Understanding of Mortgage Rate Dynamics

For a rigorous, data-driven analysis of the relationship between macroeconomic indicators and mortgage rates, the National Association of Realtors offers authoritative research: NAR Quick Real Estate Statistics. This resource provides updated market trends, lending conditions, and economic factors influencing mortgage interest rates nationwide, including Tennessee.

Join the Conversation: Share Your Mortgage Rate Experiences and Questions

We invite readers to share their experiences with mortgage rate fluctuations in Tennessee, questions about navigating complex rate environments, or tips for securing favorable loan terms. Engaging with our community enriches collective knowledge and empowers all homebuyers to make informed decisions. Leave a comment below or share this article with others seeking expert guidance on mortgage interest rates.

Innovative Financial Instruments Shaping Tennessee Mortgage Rate Opportunities

Beyond traditional fixed and adjustable-rate mortgages, Tennessee borrowers increasingly encounter advanced financial instruments designed to optimize borrowing costs amid fluctuating interest rate environments. Products such as interest-only loans, hybrid ARMs, and buy-down options provide nuanced mechanisms to tailor mortgage expenses in alignment with individual financial trajectories and market forecasts. For instance, hybrid ARMs, which combine initial fixed-rate periods with adjustable phases, can be strategically utilized when a borrower anticipates increased income or plans to refinance before the adjustment period. Understanding these complex offerings requires discerning the embedded risk-return profiles and lender pricing models that reflect market volatility and borrower creditworthiness.

Furthermore, buy-downs, where borrowers or sellers pay upfront points to reduce the interest rate temporarily or for the loan’s life, can be a potent tool in Tennessee’s competitive housing markets. This tactic demands rigorous cost-benefit analysis, factoring in anticipated holding periods and opportunity costs. Expert mortgage brokers adept in Tennessee’s regional trends can guide borrowers through these intricacies, ensuring alignment with long-term financing goals.

Integrating Behavioral Economics Insights into Tennessee Mortgage Rate Decision-Making

Mortgage choices are not solely dictated by financial metrics; behavioral economics reveals how cognitive biases and heuristics influence borrower decisions. In Tennessee, where cultural and economic diversity shape housing market participation, factors like loss aversion, anchoring to past rate levels, and overconfidence in rate forecasts can skew borrower preferences. Recognizing these psychological tendencies enables lenders and advisors to frame product options and risk disclosures more effectively, enhancing decision quality.

For example, loss aversion may cause borrowers to avoid adjustable-rate mortgages despite potential cost savings, fearing rate increases disproportionately. Educational interventions and transparent communication about risk mitigation strategies, such as rate caps and refinancing options, can recalibrate borrower perceptions and foster more optimal mortgage selections. Incorporating these behavioral insights into mortgage counseling is increasingly recognized as a best practice within Tennessee’s lending community.

What Role Does Mortgage Rate Hedging Play for Tennessee Lenders and Borrowers?

Mortgage rate hedging involves financial strategies that lenders and, occasionally, sophisticated borrowers use to mitigate interest rate risk exposure. Tennessee lenders often utilize derivatives like interest rate swaps or caps to stabilize funding costs, allowing them to offer competitive and more predictable mortgage rates. This risk management translates into enhanced market stability and potentially narrower spreads for borrowers.

From the borrower’s perspective, while direct hedging instruments are less common, innovative products such as rate lock extensions or float-down options provide a form of implicit hedging. These mechanisms permit rate adjustments in response to market movements within predefined parameters, balancing flexibility and cost. Understanding the availability and terms of such products in Tennessee requires engagement with experienced mortgage professionals familiar with local lender offerings.

For an in-depth exploration of these financial instruments and their applications, consult the Securities Industry and Financial Markets Association’s guide on Interest Rate Derivatives and Hedging Strategies.

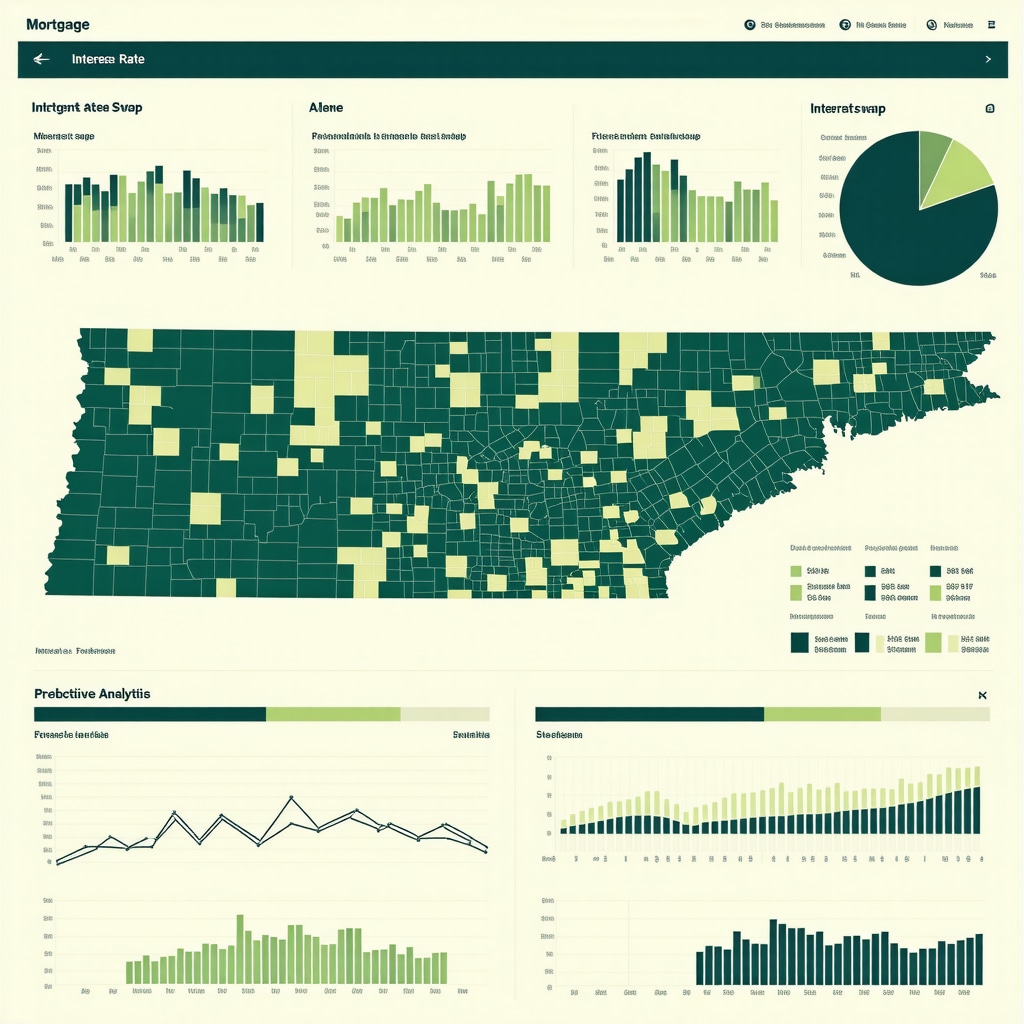

Harnessing Predictive Analytics and Big Data to Forecast Tennessee Mortgage Rate Trends

The advent of big data and predictive analytics has revolutionized mortgage rate forecasting. Tennessee lenders and brokers increasingly deploy machine learning algorithms analyzing vast datasets — from macroeconomic indicators to localized employment statistics — to anticipate mortgage rate movements and borrower demand patterns.

This advanced analytics approach enables more dynamic pricing models, customized loan product offerings, and proactive risk management. In Tennessee’s heterogeneous markets, predictive insights facilitate tailored strategies that optimize loan origination timing and portfolio performance. Borrowers benefit indirectly through improved rate competitiveness and personalized mortgage solutions.

However, the integration of these technologies necessitates rigorous data governance and transparency to ensure equitable lending practices and maintain borrower trust. As this domain evolves, stakeholders in Tennessee’s mortgage ecosystem must balance technological innovation with regulatory compliance and ethical considerations.

Engage Further: Explore Tennessee Mortgage Market Innovations with Our Expert Resources

To stay ahead in Tennessee’s complex mortgage landscape, delve into our specialized content on innovative loan products, behavioral finance applications, and advanced risk management strategies. Collaborate with seasoned mortgage brokers who harness these insights to secure advantageous financing tailored to your unique profile. Explore our expert guides on advanced Tennessee mortgage strategies and elevate your home financing acumen today.

Refining Risk Mitigation: The Nuances of Mortgage Rate Hedging Instruments

In Tennessee’s mortgage lending ecosystem, advanced hedging techniques are instrumental in stabilizing interest rate exposures. Lenders employ derivatives such as interest rate swaps, caps, and floors to modulate funding cost volatility. These financial instruments enable institutions to offer more competitive and stable mortgage rates, mitigating systemic risks from unpredictable rate swings. Borrowers indirectly benefit from this risk transfer mechanism through narrower lender spreads and enhanced rate predictability.

Beyond institutional strategies, select sophisticated borrowers may access tailored products like rate lock extensions or float-down options. Such mechanisms provide a degree of flexibility to adapt to evolving rate environments, balancing the trade-offs between immediate rate security and potential future savings. Engaging with mortgage professionals adept in Tennessee’s lender offerings is imperative to leverage these complex instruments effectively.

Machine Learning and Big Data: Transforming Tennessee Mortgage Rate Forecasting

The integration of machine learning algorithms and big data analytics has revolutionized mortgage rate prediction. Tennessee lenders increasingly harness granular economic data — including regional employment metrics, housing inventory fluctuations, and macroeconomic indicators — to refine dynamic pricing models. These advanced analytics facilitate responsive adjustments to loan products and origination strategies in near real-time, optimizing lender portfolios and borrower outcomes.

However, deploying predictive technologies necessitates rigorous governance frameworks to uphold data privacy, mitigate algorithmic bias, and ensure compliance with fair lending laws. Tennessee’s mortgage ecosystem is progressively embracing these innovations while balancing ethical and regulatory imperatives, thereby enhancing transparency and borrower trust.

How Can Tennessee Borrowers Leverage Predictive Analytics Insights to Optimize Mortgage Timing and Terms?

Borrowers informed by predictive analytics can strategically time their mortgage applications to capitalize on anticipated rate trends. By monitoring lender forecasts and localized economic indicators, Tennessee homebuyers can anticipate favorable market windows and select loan products aligned with projected interest rate trajectories. Moreover, engaging with brokers who utilize analytic tools enables personalized rate negotiations and risk assessments tailored to individual financial profiles.

These data-driven strategies empower borrowers to make proactive decisions, reduce borrowing costs, and align mortgage commitments with broader financial goals. For deeper guidance on integrating predictive insights into mortgage planning, explore our expert resources on advanced Tennessee mortgage strategies.

Authoritative Resource Highlight: Navigating Interest Rate Derivatives and Hedging Strategies

To deepen expertise in the sophisticated financial instruments shaping mortgage markets, consult the Securities Industry and Financial Markets Association’s comprehensive guide on Interest Rate Derivatives and Hedging Strategies. This resource elucidates the mechanics, applications, and risk management frameworks vital for lenders and advanced borrowers navigating volatile interest rate environments.

Engage with Tennessee’s Mortgage Innovation Frontier

We encourage Tennessee homebuyers, lenders, and industry professionals to actively engage with these cutting-edge mortgage rate management strategies. Collaborate with expert brokers and financial advisors who integrate predictive analytics and hedging solutions to tailor mortgage offerings uniquely suited to your profile and market conditions. Dive into our specialized guides today and elevate your mortgage decision-making sophistication.

Expert Insights & Advanced Considerations

Behavioral Economics Shapes Borrower Decisions Beyond Traditional Metrics

Understanding mortgage interest rates in Tennessee requires acknowledging how cognitive biases influence borrower choices. Loss aversion and anchoring to previous rates often lead to suboptimal mortgage selections, such as avoiding adjustable-rate mortgages despite potential savings. Mortgage advisors who incorporate behavioral finance can better guide clients towards balanced decisions that optimize long-term financial outcomes.

The Growing Role of Predictive Analytics in Mortgage Rate Forecasting

Machine learning and big data analytics empower Tennessee lenders to refine dynamic pricing models using localized economic indicators and macro trends. Borrowers leveraging brokers familiar with these predictive insights can strategically time applications and select loan products aligned with anticipated market movements, reducing borrowing costs and increasing rate competitiveness.

Mortgage Rate Hedging Instruments Enhance Market Stability and Borrower Flexibility

Tennessee lenders employ derivatives such as interest rate swaps and caps to mitigate funding cost volatility, providing more stable mortgage rates. Simultaneously, advanced borrowers may access rate lock extensions or float-down options to hedge against unfavorable rate shifts during the application process, balancing security and potential savings.

Regional Economic Nuances Demand Tailored Mortgage Strategies

From Nashville’s dynamic growth to Knoxville’s distinct market trends, Tennessee’s regional diversity affects mortgage interest rates and lending conditions. Borrowers benefit from engaging local mortgage brokers who understand these subtleties and can negotiate terms that reflect both macroeconomic and community-specific factors.

Innovative Loan Products Offer Strategic Opportunities Amid Rate Volatility

Hybrid adjustable-rate mortgages, buy-downs, and interest-only loans provide Tennessee borrowers with tools to tailor financing costs to personal financial forecasts and market expectations. However, these products require expert guidance to weigh risks and benefits effectively in fluctuating interest rate environments.

Curated Expert Resources

- Securities Industry and Financial Markets Association’s Guide on Interest Rate Derivatives and Hedging Strategies: An authoritative overview of complex financial instruments that underpin mortgage rate risk management for lenders and advanced borrowers (SIFMA Interest Rate Derivatives Guide).

- National Association of Realtors – Quick Real Estate Statistics: Provides up-to-date data on national and regional housing market trends impacting mortgage interest rates (NAR Quick Real Estate Statistics).

- Federal Reserve Bank of St. Louis – 10-Year Treasury Constant Maturity Rate: Essential for understanding the macroeconomic benchmark influencing long-term mortgage rates (Federal Reserve Economic Data).

- Tennessee Mortgage Rates Advanced Strategy Guides: Explore nuanced loan product options, refinancing timing, and mortgage broker advantages tailored for Tennessee borrowers (Advanced Tennessee Mortgage Strategies).

- Local Tennessee Mortgage Broker Expertise: Insights on securing the best home loan deals through regional broker knowledge and market navigation (Local Mortgage Broker Advantages).

Final Expert Perspective

Mortgage interest rates in Tennessee for 2025 are shaped by a sophisticated blend of macroeconomic trends, regional market dynamics, borrower behavioral factors, and innovative financial instruments. Mastery of these elements is crucial for borrowers aiming to secure favorable mortgage terms amid evolving economic conditions. Engaging with knowledgeable local mortgage brokers and leveraging predictive analytics can position Tennessee homebuyers advantageously to navigate rate volatility and optimize financing outcomes. For those seeking to deepen their expertise or explore advanced mortgage strategies, we encourage you to visit our comprehensive guides and connect with industry professionals who can tailor solutions to your unique financial profile. Reach out through our contact page to start a conversation about your mortgage opportunities today.