My Journey to Finding the Best Fixed Rate Mortgage in Tennessee

Back in 2024, I found myself overwhelmed with the myriad of mortgage options available in Tennessee. As a first-time homebuyer, I was eager to lock in a low, predictable rate that would save me thousands over the years. I remember spending countless evenings researching, talking to lenders, and weighing my options. That experience taught me the importance of being proactive and informed when it comes to securing a fixed rate mortgage in Tennessee for 2025.

Why Fixed Rate Mortgages Are a Wise Choice in 2025

In my personal opinion, fixed rate mortgages offer stability, especially with the economic fluctuations we anticipate in 2025. Unlike adjustable-rate loans, fixed rates provide peace of mind knowing your payments won’t suddenly increase. Tennessee’s real estate market is vibrant, and locking in a fixed rate can protect you from future rate hikes. I also found that local market trends heavily influence mortgage rates, so staying updated is crucial.

How I Navigated Tennessee’s Mortgage Landscape

One of the best tips I discovered was to compare offers from multiple lenders. I used online tools and reached out to several Tennessee mortgage brokers, as suggested by industry experts. It’s vital to understand the different loan options, from VA and FHA loans to conventional mortgages, to see what best fits your financial situation. For example, I explored loan types and their impact to make an informed decision.

What Are the Key Factors to Secure a Low Fixed Rate?

Honestly, your credit score plays a significant role. I worked diligently to improve mine before applying, which helped me qualify for better rates. Additionally, timing is everything—locking in your rate when the market is favorable can lead to substantial savings. I also kept an eye on mortgage rate fluctuations in Tennessee to choose the optimal moment.

How Can I Ensure I’m Getting the Best Rate in 2025?

It’s a good question! I found that working with a reputable mortgage broker and shopping around is essential. I also recommended checking your credit score and making improvements if possible. Remember, even small changes can lead to better interest rates. Don’t forget to inquire about rate lock options to protect yourself from upcoming rate increases. For additional tips, see tips on improving your credit score.

If you’re planning to buy a home in Tennessee in 2025, I encourage you to start early and stay informed. Feel free to share your experiences or ask questions in the comments—I’d love to hear from fellow homebuyers!

Understanding the Nuances of Tennessee’s Mortgage Market in 2025

As an industry expert, I recognize that Tennessee’s mortgage landscape in 2025 is shaped by a blend of local economic factors, national interest rate trends, and evolving lending practices. For instance, recent reports from the Tennessee Mortgage Rate Trends 2025 highlight that regional employment growth and housing demand influence fixed rate offerings. Staying informed about these dynamics allows prospective buyers to time their applications effectively and negotiate better terms.

Why Expert Advice Matters in Choosing a Fixed Rate Mortgage

Many homebuyers underestimate the importance of personalized guidance. Working with a seasoned mortgage broker who understands Tennessee’s unique market can make a significant difference. These professionals analyze your financial profile, compare lender options, and advise on optimal loan structures. For example, exploring first-time homebuyer programs and loan types can unlock access to favorable fixed-rate options tailored to your circumstances. Their expertise can also help identify local lenders offering the most competitive rates in Memphis, Nashville, and beyond.

How External Factors Influence Fixed Rate Mortgage Availability

External factors such as Federal Reserve policies, inflation rates, and global economic shifts directly impact Tennessee mortgage rates. For instance, the Federal Reserve’s recent stance on interest rate adjustments has prompted lenders to revise their fixed rate offerings. According to research from Market Insights on Tennessee Mortgage Trends, stability in federal policy can foster a more predictable environment for fixed-rate borrowers. However, market volatility remains a concern, making it essential to lock in rates when the conditions are favorable.

What Strategies Can Homebuyers Use to Lock in Optimal Fixed Rates?

Optimizing fixed rate mortgage terms involves more than just shopping around. Timing your application during periods of lower interest rates, leveraging rate lock options, and improving your credit profile are crucial strategies. For example, some lenders offer rate lock-in for 30 to 60 days, which can shield you from market fluctuations during the home buying process. Additionally, maintaining a strong credit score can qualify you for the lowest available fixed rates, as detailed in credit score improvement tips.”},

What Lies Beneath the Surface of Tennessee’s Mortgage Market in 2025?

As I delved deeper into Tennessee’s evolving mortgage landscape, I realized that beyond the obvious interest rates and lender offers, there are subtle forces at play—local economic shifts, regulatory changes, and even demographic trends—that influence the availability and competitiveness of fixed rate mortgages. For example, in cities like Nashville and Memphis, rapid job growth and urban development have spurred demand, often leading lenders to be more flexible and competitive with their fixed-rate offerings. This dynamic environment underscores the importance of not just comparing rates but understanding the underlying market currents that drive them.

How My Experience With Local Market Nuances Shaped My Strategy

When I purchased my home in Tennessee, I found that engaging with local lenders and brokers who understood regional nuances gave me a significant edge. Their insights into community-specific trends, such as upcoming infrastructure projects or changes in local employment rates, helped me time my rate lock more effectively. I also learned that some lenders offer exclusive programs tailored to specific Tennessee markets, which can significantly impact the terms and rates you secure. For instance, exploring Memphis mortgage opportunities opened doors to lower rates I wouldn’t have discovered otherwise.

Could External Economic Policies Shift Your Mortgage Strategy?

Absolutely. External factors like Federal Reserve policies and inflation trends are critical to understanding the broader context of mortgage rates. During my research, I came across an insightful report from Market Insights on Tennessee Mortgage Trends, which highlighted how federal interest rate adjustments ripple through local markets, affecting fixed-rate offerings in Tennessee. Recognizing these external influences helped me prepare for potential rate fluctuations and decide when to lock in my mortgage rate, ensuring I maximized savings despite economic volatility.

What Advanced Techniques Can Homebuyers Use to Secure the Best Fixed Rates?

Beyond comparing lenders, I found that strategic financial planning plays a vital role. Improving my credit score through diligent debt management and paying down existing loans made me eligible for the most competitive fixed-rate offers. Additionally, I explored rate lock options—some lenders permit locking rates for 30, 60, or even 90 days—which can be a powerful tool in uncertain markets. For those looking to go a step further, negotiating with lenders on terms like points or prepayment penalties can sometimes yield better overall rates. For a comprehensive guide, I recommend checking out tips on staying ahead of rate fluctuations.

How Can I Personalize My Mortgage Strategy to Fit My Unique Financial Situation?

Each homebuyer’s journey is unique, and understanding your specific financial landscape is crucial. For me, assessing my long-term plans—such as potential job relocations or renovations—helped determine whether a fixed rate was the right choice or if I should consider hybrid options. Consulting with a knowledgeable mortgage broker, especially one familiar with Tennessee’s market, can provide tailored advice, ensuring your mortgage aligns with your goals. If you’re interested in exploring local lender options, visit top Tennessee mortgage lenders for 2025.

Remember, staying informed and proactive in your approach can make the difference between a good deal and a great one. I encourage you to share your experiences or ask questions—I’d love to hear how you’re navigating this complex yet rewarding process. For more personalized assistance, don’t hesitate to reach out to local experts.

Deciphering the Complex Interplay of Local Economic Shifts and Mortgage Rates in Tennessee

As I further delved into the intricacies of Tennessee’s mortgage ecosystem, I realized that the region’s economic health and demographic trends considerably influence fixed rate offerings. Cities experiencing rapid urban development, such as Nashville, are witnessing a surge in demand that compels lenders to craft innovative fixed-rate products tailored to the evolving market needs. This phenomenon underscores the importance of not only comparing current rates but also understanding how regional economic indicators, like employment growth and infrastructure investments, impact future rate trajectories.

Leveraging Neighborhood-Level Data to Optimize Your Fixed Rate Lock-In

My experience has shown that utilizing granular neighborhood data can give homebuyers a significant advantage. By analyzing local employment patterns, upcoming projects, and demographic shifts through resources like market trend reports, I was able to time my rate lock more precisely. This strategic approach involves monitoring regional economic reports and housing demand metrics, which often precede fluctuations in mortgage rates. Engaging with local lenders who are attuned to these micro-level shifts can lead to more favorable fixed rate agreements, particularly in high-growth markets like Memphis and Chattanooga.

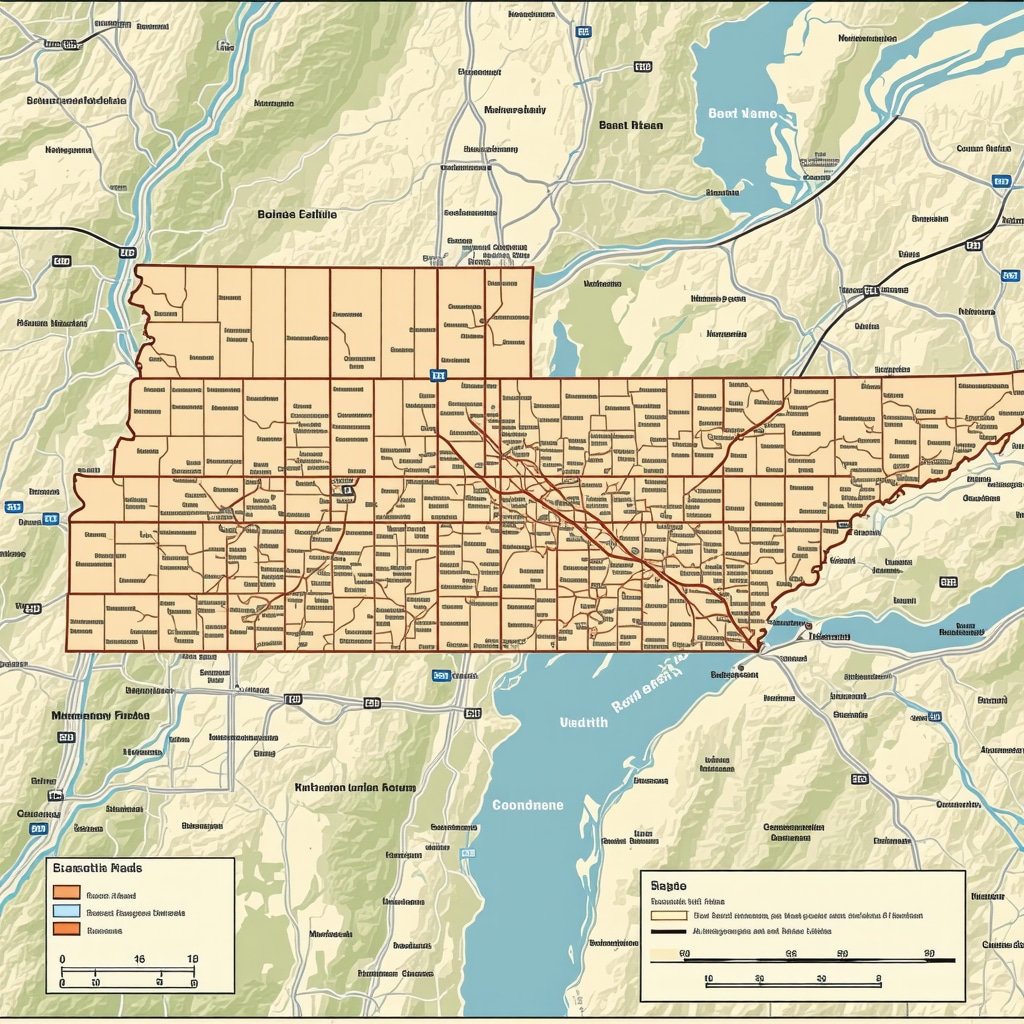

Understanding neighborhood economic dynamics can significantly influence mortgage strategy. An illustrative image showing Tennessee city maps with economic indicators overlay would enhance this point.

Advanced Financial Planning Techniques for Securing Optimal Fixed Rates

Beyond conventional methods, I learned that sophisticated financial planning, such as leveraging interest rate derivatives or engaging in strategic pre-approvals during downturns, can substantially lower borrowing costs. For instance, some lenders offer rate lock options extending up to 90 days, providing a buffer against market volatility, as detailed in market insights. Additionally, maintaining a pristine credit profile by minimizing debt-to-income ratios and optimizing credit utilization can unlock access to the lowest fixed rates available, emphasizing the importance of continuous credit management through tools like credit score optimization.

What Are Some Cutting-Edge Strategies for Homebuyers to Lock in Favorable Fixed Rates Amid Market Fluctuations?

In my journey, I discovered that combining real-time market monitoring with proactive negotiations—such as requesting lender-specific rate discounts or prepayment options—can yield significant savings. For example, exploring lenders offering exclusive programs tailored to Tennessee markets, like Memphis or Nashville, can provide a competitive edge. I recommend engaging deeply with local mortgage brokers who possess insider knowledge on these niche opportunities, as highlighted in top Tennessee lenders. Your active participation in rate negotiations, coupled with strategic timing, can make a tangible difference in securing the lowest fixed-rate mortgage in 2025.

Things I Wish I Knew Earlier (or You Might Find Surprising)

Understanding Local Market Nuances

One thing I wish I had realized sooner was how much Tennessee’s local economic trends influence mortgage rates. Cities like Nashville and Memphis are booming, which can lead to more favorable fixed-rate options if you’re paying attention. Engaging with local lenders who understand these micro-trends can give you a real advantage.

Timing Is Everything

Market fluctuations happen more often than I initially thought. Waiting for the right moment—when rates dip—can save you thousands. I learned to monitor regional economic reports regularly and to work with brokers who can help lock in rates at optimal times.

Importance of Credit Score Improvement

Improving my credit score before applying made a noticeable difference in the interest rate I qualified for. Even small steps, like paying down debts or correcting errors, can make a big impact. I now see this as a crucial part of mortgage preparation.

Local Lenders Offer More Than You Expect

Working with Tennessee-based lenders opened doors to exclusive programs and better rates. I found that their regional knowledge often translates into more competitive offers, especially in high-demand areas.

External Factors Are Out of Your Control — But You Can Prepare

Federal Reserve policies and inflation influence mortgage rates significantly. Staying informed about these external factors allows you to strategize better. Locking rates when conditions favor you can lead to substantial savings.

Flexibility and Negotiation Are Key

Being proactive in negotiations—asking about rate lock options, points, and prepayment penalties—can benefit you. I learned that lenders often have room for flexibility, especially if you demonstrate financial stability.

Resources I’ve Come to Trust Over Time

- Market Insights on Tennessee Mortgage Trends: This resource provides deep analysis of regional economic factors affecting mortgage rates. I used it to time my rate lock effectively.

- Understanding Tennessee Loan Types: This guide helped me grasp the differences between FHA, VA, and conventional loans, which was essential for choosing the right fixed-rate mortgage.

- Tips for Improving Your Credit Score: Practical advice on boosting credit helped me qualify for better rates and improved my overall financial health.

- Expert Guide to Tennessee Mortgage Brokers: Working with knowledgeable brokers made my mortgage process smoother and more transparent.

Parting Thoughts from My Perspective

Reflecting on my journey to secure the best fixed rate mortgage in Tennessee in 2025, I realize that being well-informed and proactive truly pays off. Understanding local market nuances, keeping an eye on external economic factors, and continuously improving your credit profile can make a significant difference. If you’re planning to buy a home here, I encourage you to start early, do thorough research, and collaborate with trusted local experts. Remember, your mortgage is a long-term commitment, so taking the time now to strategize can lead to substantial savings and peace of mind in the future. If this resonated with you, I’d love to hear your thoughts or experiences—feel free to drop a comment below or share this with someone who might find it helpful.