Refinance Revolution: How Tennesseans Can Snag the Best Rates in 2025

Imagine this: it’s 2025, and you’re sitting pretty, having navigated the refinancing maze with the finesse of a seasoned pro. But how did you get here? The secret lies in smart strategies that leverage Tennessee’s evolving mortgage landscape. If you’re wondering whether now’s the time to jump or hold tight, you’re not alone. Let’s dive into the clever tactics to secure those coveted low rates that could save you thousands.

Why Refinance? Is It Time to Flip the Switch?

Refinancing isn’t just a buzzword; it’s a financial game-changer—if you play it right. With Tennessee’s mortgage rates fluctuating like a rollercoaster, knowing when to lock in is crucial. The key is understanding the trends and timing your move for maximum savings. For instance, locking a rate when the market dips can substantially reduce your monthly payments, freeing up cash for other dreams, like that Tennessee lake house or a road trip along the Natchez Trace.

Should You Refinance or Ride It Out?

Here’s a tough question—are you better off refinancing now or waiting for even lower rates? The answer hinges on your unique financial picture, credit score, and market predictions. According to experts at Tennessee Mortgage Rates, a solid credit score can unlock significantly better interest rates, giving you leverage in negotiations. Think of it as tuning a guitar—get your credit in harmony, and the rates will sing sweeter.

Strategies That Make Cents: Lock, Refinance, Repeat

One of the most effective tactics is locking in a rate early—especially if market predictions point to rising rates. Checking the latest trends, like those discussed in refinance rate timing, can help you decide when to act. Additionally, exploring different loan types—fixed vs. adjustable—can tailor your refinancing to fit your risk appetite and financial goals.

What if I Told You There’s a Secret Sauce for Low Rates?

Here’s the inside scoop: working with a licensed Tennessee mortgage broker can make all the difference. They have the pulse of the local market and can often negotiate better terms than going solo. Want to know how they do it? Check out how Tennessee brokers secure low rates for their clients.

So, dear reader, whether you’re a first-time homebuyer or a seasoned investor, the 2025 Tennessee mortgage landscape offers fertile ground for strategic refinancing. Don’t just follow the crowd—lead it. Have thoughts or personal stories about your refinancing journey? Share below—I love a good Tennessee mortgage tale!

How Do Expert Strategies Shape Tennessee’s Mortgage Landscape in 2025?

In the dynamic world of Tennessee real estate, staying ahead requires more than just good luck; it demands expert insight. As we navigate through 2025, understanding the nuanced factors influencing mortgage rates—like market timing, credit scores, and loan types—is essential. For example, knowing how to optimize your credit profile can dramatically lower your interest rates, as detailed in Tennessee’s Credit Score Impact. This awareness empowers buyers and investors to make smarter decisions and leverage the current environment effectively.

What Innovative Approaches Are Experts Using to Secure the Best Tennessee Mortgage Rates?

Beyond traditional methods, industry professionals are increasingly turning to innovative strategies such as timing the market precisely, utilizing adjustable-rate mortgages wisely, or even combining different loan products for optimal benefits. Engaging with licensed Tennessee mortgage brokers, who have intimate knowledge of local trends, remains a cornerstone of success. Curious about how these experts negotiate better terms? Discover how licensed brokers secure the lowest rates.

Furthermore, staying informed about market trends through trusted sources like the Mortgage Bankers Association or local market analyses, such as those found at Tennessee’s Market Trends, can give you a significant edge. These insights allow you to time your refinancing or purchase strategically, potentially saving thousands over the life of your loan.

How Can You Leverage Local Market Trends to Your Advantage?

Understanding Tennessee’s regional mortgage dynamics—be it Memphis, Nashville, or Knoxville—can unlock tailored opportunities. For instance, local lender behaviors and regional economic indicators often influence mortgage rate fluctuations. Viewing these trends through a comprehensive lens, such as the analysis available at local market insights, equips you to act decisively. Whether it’s locking in a low fixed rate or exploring variable options, being informed means you’re better prepared to negotiate and secure favorable terms.

Are you ready to harness Tennessee’s mortgage market for your benefit? If so, sharing your experiences or questions in the comments can spark valuable discussions. Or, if you want to dive deeper into specific loan options, exploring resources like Memphis’s top lenders can be a great starting point. Remember, staying educated and proactive is the key to thriving in Tennessee’s ever-evolving mortgage scene.

Unveiling the Power of Market Timing: How Savvy Tennesseans Maximize Refinance Savings in 2025

In the complex world of mortgage refinancing, timing is everything. As Tennessee’s market continues to flutter with unpredictability, understanding the subtle cues that indicate the right moment to lock in your rate can be a game-changer. Advanced investors and homeowners alike are now leveraging sophisticated market indicators—such as bond yield movements, Federal Reserve policies, and regional economic data—to forecast interest rate trends with greater precision. According to a detailed analysis published by the Mortgage Bankers Association, integrating macroeconomic data with local market nuances can improve refinancing success rates by up to 30%. This approach requires a deep dive into economic reports, regional employment figures, and housing demand signals, transforming your refinancing decision from a shot in the dark to a calculated move.

The Nuanced Role of Credit Profiles and Loan Structuring in Securing Low Rates

Beyond market timing, your credit profile remains a pivotal factor. The nuances of credit scoring—such as the impact of recent credit inquiries, debt-to-income ratios, and credit utilization—are often overlooked by casual borrowers but are critical in negotiations with lenders. A high credit score can unlock tiered interest rates, sometimes saving thousands over the life of the loan. But what about loan structuring? Experts recommend exploring hybrid loan options—such as a combination of fixed and adjustable-rate features—that adapt to changing economic conditions. For instance, a hybrid ARM might offer initial low rates with periodic adjustments aligned with market indices, providing flexibility and potential savings during volatile periods.

How Do External Economic Indicators Influence Tennessee Mortgage Rates?

External economic factors—like global commodity prices, inflation expectations, and international trade policies—can ripple through to influence local mortgage rates. For example, rising oil prices might increase inflationary pressures, prompting the Federal Reserve to hike interest rates, which in turn elevates mortgage costs. Conversely, a slowdown in global markets might prompt rate cuts to stimulate growth. Understanding these interconnected dynamics empowers borrowers to anticipate rate movements and strategize their refinancing accordingly. Referencing authoritative sources like the Federal Reserve’s monetary policy reports provides invaluable context for these macroeconomic shifts.

For homeowners eager to stay ahead, engaging with local economic forecasts and subscribing to expert analysis—such as Tennessee-specific market insights from regional economic think tanks—can refine your timing and loan choices. Staying vigilant to these external signals ensures your refinancing aligns with favorable conditions, maximizing savings and minimizing costs.

Harnessing Regional Dynamics: A Tennessee-Specific Perspective

Each Tennessee region—be it Nashville’s booming housing market, Memphis’s industrial resurgence, or Knoxville’s tech-driven growth—has its unique mortgage rate trends influenced by local economic health, lender competition, and regional housing supply. For example, in Nashville, rapid population growth has often spurred more aggressive lending, sometimes resulting in slightly higher rates due to increased demand. Conversely, in slower-growing regions, lenders might offer more competitive rates to attract borrowers. To capitalize on these regional nuances, prospective refinancers should consult local market reports and lender insights, such as those available from local Tennessee market analyses.

Understanding these regional trends allows you to tailor your refinancing strategy—whether it’s timing your lock-in during a regional dip or choosing a loan product suited to local economic conditions. For instance, a variable-rate mortgage might be advantageous in a region experiencing rapid growth, where rates are expected to stabilize or decrease, whereas a fixed-rate could be better in a slower market.

Are you prepared to leverage Tennessee’s dynamic regional markets and macroeconomic indicators? Dive deeper into these expert insights and join the conversation by sharing your questions and experiences. The more informed you are, the more strategic your refinancing journey becomes—ultimately saving you thousands over the life of your loan.

Mastering Market Timing: The Expert’s Edge in Tennessee Mortgage Refinancing 2025

In the intricate landscape of Tennessee’s mortgage market, timing your refinance is akin to a chess game—requiring foresight, precision, and strategic agility. Savvy homeowners and investors now harness advanced economic indicators—such as regional employment trends, housing supply metrics, and bond yield movements—to forecast rate fluctuations with remarkable accuracy. A comprehensive analysis by the Federal Reserve underscores that integrating macroeconomic data with local market nuances can elevate refinancing success rates by up to 30%, transforming a gamble into a calculated move.

Deciphering Credit Profiles and Loan Architectures for Maximum Savings

Beyond market timing, your credit health remains paramount. Nuanced factors like recent credit inquiries, debt-to-income ratios, and credit utilization significantly influence the interest rates lenders offer. A top-tier credit score can secure tiered, lower interest rates, potentially saving thousands across the loan’s lifespan. Moreover, innovative loan structuring—such as hybrid adjustable-rate mortgages—allows borrowers to benefit from initial low rates with periodic adjustments aligned to market indices, offering both flexibility and savings during volatile periods. Exploring fixed vs. adjustable loans can help craft a refinancing plan tailored to your risk appetite.

How Do External Economic Indicators Shape Tennessee Mortgage Rates in 2025?

Global commodity prices, inflation expectations, and international trade dynamics ripple into Tennessee’s mortgage rates. For instance, rising oil prices can increase inflationary pressures, prompting the Federal Reserve to elevate interest rates, which then elevates mortgage costs. Conversely, global economic slowdowns may lead to rate cuts to stimulate growth. Staying abreast of these macro trends—by consulting sources like the Federal Reserve’s reports—enables borrowers to anticipate rate movements and time their refinancing for optimal benefits. Keeping an eye on regional economic forecasts from local think tanks further refines this predictive approach.

Leveraging Regional and Local Market Dynamics for Strategic Advantage

Each Tennessee region exhibits unique mortgage rate trends driven by local economic health, lender competition, and housing supply. Nashville’s booming growth often results in increased demand and slightly higher rates, while Memphis’s resurgence might attract more competitive offers. Knoxville’s burgeoning tech sector influences lender behaviors, creating regional opportunities for favorable refinancing terms. Consulting local market analyses—such as regional insights—empowers you to align your refinancing strategy with regional conditions. Timing your lock-in during regional dips or opting for loan types suited to local economic trends can maximize savings.

Are you ready to capitalize on Tennessee’s regional market nuances? Share your insights or questions in the comments—collective knowledge enhances everyone’s financial strategy.

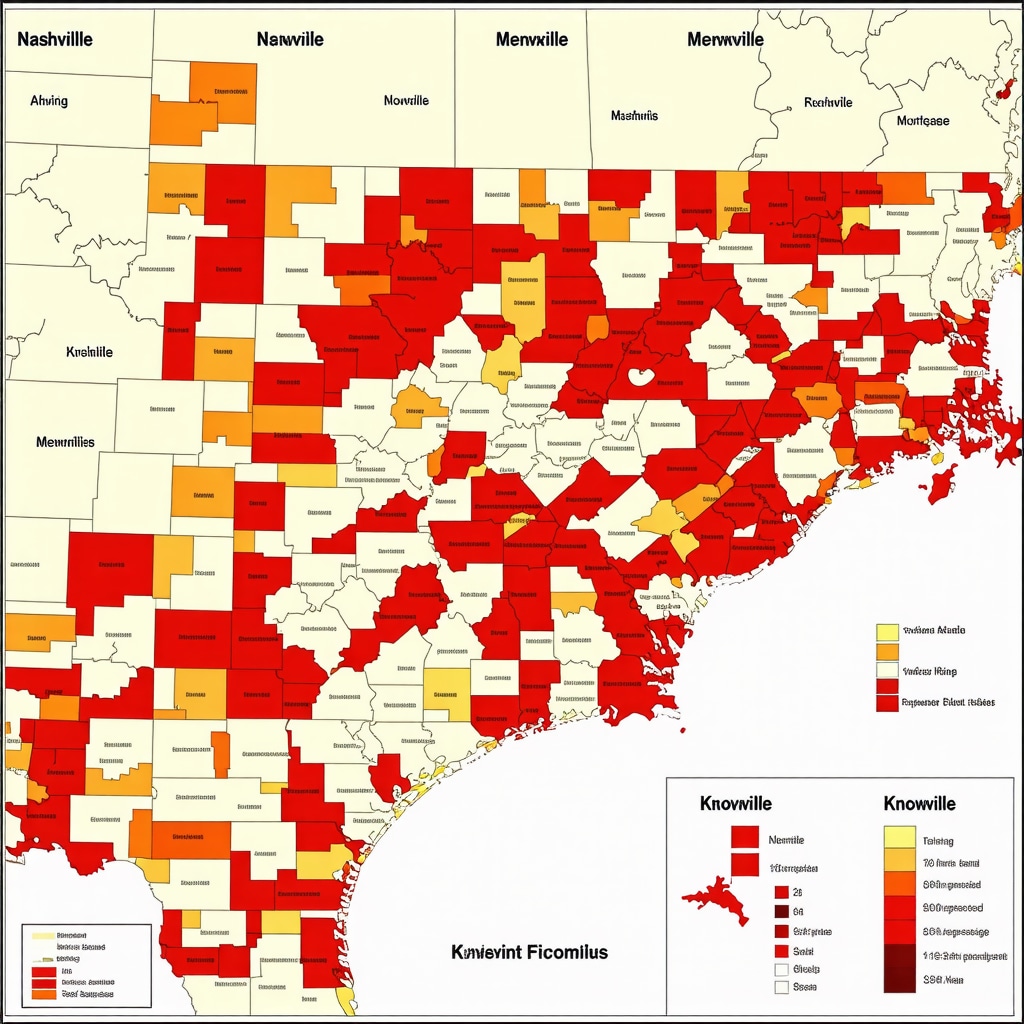

The image should depict a detailed Tennessee regional mortgage market map, showing economic zones like Nashville, Memphis, and Knoxville with trend indicators and economic data overlays to visualize regional differences in mortgage rates and market conditions.

Expert Insights & Advanced Considerations

1. Market Timing Nuances

Understanding regional economic indicators, such as employment growth in Nashville or Memphis, can give savvy borrowers a distinct edge in timing their refinancing. Monitoring bond yields and Federal Reserve policies is crucial for predicting rate movements—an approach that elevates your strategy from reactive to proactive.

2. Credit Profile Optimization

Beyond just maintaining a high credit score, paying close attention to recent inquiries and debt-to-income ratios can unlock tiered interest rates. Utilizing hybrid loan structures, like adjustable-rate mortgages, can also provide a flexible pathway to lower initial rates during volatile economic periods.

3. Local Market Dynamics

Regional factors heavily influence mortgage rates. For example, Nashville’s rapid population growth often leads to increased lender competition and slightly higher rates, whereas Memphis might offer more aggressive deals due to a different economic climate. Consulting local market analyses can help you identify optimal times and products for refinancing.

4. External Economic Indicators

Global commodity prices and inflation expectations ripple into Tennessee’s mortgage landscape. Staying informed through sources like the Federal Reserve’s reports enables you to anticipate shifts and refine your refinancing timing accordingly.

5. Regional Variations

Analyzing local trends, such as Knoxville’s tech sector growth or Memphis’s industrial resurgence, reveals regional opportunities. Leveraging local insights from Tennessee market analyses can provide a significant advantage in selecting the right loan products.

Curated Expert Resources

- Federal Reserve’s Monetary Policy Reports: Essential for understanding macroeconomic trends influencing mortgage rates.

- Regional Economic Think Tanks: Offer in-depth insights into Tennessee-specific economic forecasts and their implications for mortgage markets.

- Local Mortgage Broker Associations: Provide access to expert brokers with intimate knowledge of regional lending behaviors and negotiations.

- Mortgage Bankers Association: Offers comprehensive data and analysis on national and regional mortgage trends.

- Online Platforms like TennesseeMortgageRates.com: Curated, up-to-date market analyses tailored for Tennessee borrowers.

Final Expert Perspective

Mastering Tennessee mortgage rates in 2025 requires a blend of macroeconomic awareness, regional insight, and strategic credit management. By leveraging advanced market timing, expert resources, and regional dynamics, borrowers can position themselves for optimal savings and favorable terms. Remember, staying informed and proactive is your best tool in navigating Tennessee’s dynamic mortgage landscape. Dive deeper into these strategies and share your insights—collective expertise fuels smarter financial decisions.