Decoding Tennessee’s Mortgage Landscape: What 2025 Holds for Homebuyers

As the housing market in Tennessee continues to evolve, understanding the nuances of mortgage rate trends in 2025 becomes paramount for prospective homebuyers. The interplay of national economic shifts, local market dynamics, and lending policies creates a complex environment that demands a savvy approach. This article unpacks the subtle movements in Tennessee mortgage rates and reveals what buyers need to watch to make informed, strategic decisions in the coming year.

Riding the Wave: How Economic Indicators Are Steering Tennessee Mortgage Rates

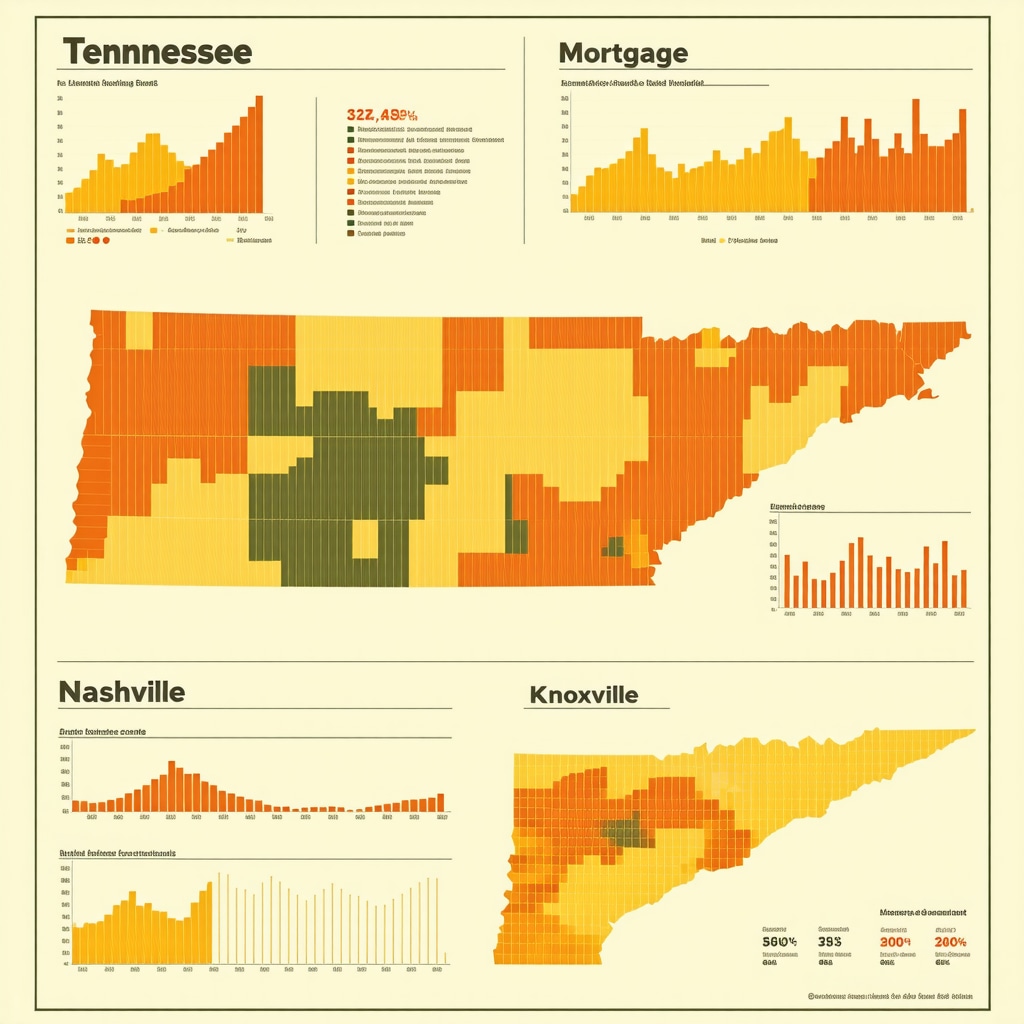

Tennessee’s mortgage rates in 2025 are being influenced by a mosaic of factors including inflation trends, Federal Reserve policies, and regional housing demand. For instance, adjustments in the Federal Reserve’s benchmark rates ripple down to mortgage interest rates, directly affecting affordability for buyers. Moreover, Tennessee’s robust job market and population growth in urban hubs like Nashville and Knoxville intensify demand, often nudging rates upward. This delicate balance between macroeconomic forces and local market pressures means homebuyers must stay alert to economic signals that could impact their borrowing costs.

Why Are Tennessee Mortgage Rates So Volatile in Early 2025?

The volatility in Tennessee mortgage rates this year largely stems from uncertainties in the broader economic recovery, fluctuating inflation expectations, and shifts in housing inventory levels. Buyers have observed unexpected rate swings reflecting investors’ reactions to economic data releases and geopolitical developments. Understanding this volatility helps homebuyers time their mortgage lock-ins strategically, avoiding costly delays or premature commitments. Keeping abreast of daily mortgage rate updates in Tennessee can offer critical insights for timing decisions.

Navigating Fixed vs. Adjustable Rates: Tailoring Your Tennessee Mortgage Strategy

Choosing between fixed and adjustable mortgage rates is more nuanced in 2025’s fluctuating environment. Fixed-rate loans provide stability amid uncertainty, locking in predictable payments, which appeals to risk-averse buyers. Conversely, adjustable-rate mortgages (ARMs) often start with lower rates that may rise or fall, ideal for buyers anticipating short-term homeownership or expecting rate declines. Tennessee buyers benefit from consulting expert guides such as Navigating Fixed vs Adjustable Mortgage Rates: Expert Guide 2025 to align mortgage products with their financial goals.

Credit Scores and Tennessee Mortgage Rates: Unlocking Better Deals

Creditworthiness remains a critical determinant of mortgage rates in Tennessee. Higher credit scores can translate into significantly lower interest rates and better loan terms. In 2025, lenders are increasingly scrutinizing credit profiles amid economic uncertainty, making credit improvement strategies essential for homebuyers. Practical steps such as reducing outstanding debts and correcting credit report errors can enhance approval odds and secure more favorable rates. For detailed strategies, see How Credit Scores Shape Your Mortgage Interest Rates Today.

Local Market Nuances: Memphis and Knoxville Mortgage Rate Snapshots

While statewide trends provide a broad view, regional variations in Tennessee’s mortgage market are noteworthy. Memphis, for example, has maintained relatively competitive rates due to stable housing inventory and economic conditions, as explored in Unlocking Memphis Mortgage Rates for 2025. Conversely, Knoxville’s rate trends reflect its growing appeal and rising demand, detailed at Knoxville Home Loan Rates Forecast for 2025. These regional insights allow buyers to tailor their mortgage strategies effectively.

When Is the Best Time to Lock Your Tennessee Mortgage Rate in 2025?

Timing a mortgage rate lock can dramatically affect a homebuyer’s long-term financial commitment. Given the market’s unpredictability, locking in early during a dip in rates may protect against future increases, but premature locking risks missing potential declines. Experts recommend monitoring real-time rate updates and economic forecasts to strike the optimal balance. Resources like Refinance Rates in Tennessee: When to Lock for Maximum Savings offer actionable advice on timing strategies.

How Can Homebuyers Leverage Mortgage Rate Trends to Their Advantage in Tennessee?

Savvy buyers harness mortgage trends by staying informed, improving credit profiles, and choosing tailored loan products that align with their financial situation and market forecasts. For example, first-time buyers might explore specialized loan programs that offer competitive rates, while investors should analyze rate fluctuations specific to investment properties. Engaging with licensed mortgage brokers and lenders knowledgeable in Tennessee’s market nuances can provide personalized guidance that maximizes savings and approval chances.

If you’re navigating Tennessee’s evolving mortgage landscape, sharing your experiences or questions below can enrich our community’s insight. For tailored assistance, visit our contact page to connect with expert advisors.

Authoritative insights referenced from the Federal Reserve’s monetary policy updates underpin the analysis of economic impacts on mortgage rates, ensuring our guidance aligns with the latest financial frameworks.

Beyond the Numbers: Personal Stories of Navigating Tennessee’s Mortgage Market

When I first started exploring mortgage options in Tennessee, the sheer volume of information felt overwhelming. I remember sitting down with a mortgage broker and realizing that beyond interest rates, factors like lender fees, loan terms, and even local housing policies could dramatically shift the overall cost. It wasn’t just about locking in a low rate but understanding how all the pieces fit together. For many, especially first-time buyers, this holistic view is crucial for making sound decisions.

The Unseen Costs: What Tennessee Homebuyers Often Overlook

One of the biggest lessons I’ve learned is that mortgage rates are just the tip of the iceberg. Closing costs, appraisal fees, and sometimes even mortgage broker fees can add thousands of dollars upfront. For instance, understanding mortgage broker fees in Tennessee helped me negotiate better terms and avoid surprises. These hidden costs can skew your budget if you’re not prepared, so budgeting beyond just the monthly payment is essential.

What’s the smartest move when mortgage rates fluctuate so much?

This question often pops up, especially given how volatile the market has been. From my experience, the key is to stay flexible but informed. I found that setting alerts for daily mortgage rate changes and regularly consulting expert forecasts allowed me to spot favorable windows to lock in rates. It’s a balancing act between patience and decisiveness. Sometimes, waiting pays off; other times, locking early saves you from an unexpected spike. I highly recommend using tools like daily mortgage rates updates in Tennessee to stay ahead.

Leveraging Local Insights: How Regional Differences Impact Your Mortgage Strategy

Living near Memphis, I noticed how local economic factors influence mortgage offerings differently than in Nashville or Knoxville. For example, Memphis tends to have more competitive rates due to stable housing inventories, but that also comes with regional lender practices unique to the area. Tapping into resources specific to your city, like Memphis mortgage rates insights, can provide a strategic edge. I found that combining statewide trends with local knowledge gave me a much clearer picture.

Why Does Understanding the Mortgage Preapproval Process Matter More Than Ever?

Before diving into house hunting, I learned that mortgage preapproval was a game changer. It not only clarifies your budget but strengthens your negotiating position. The process has become more rigorous in 2025 due to tighter lending standards, so being prepared with thorough documentation and understanding each step saved me headaches. If you’re curious about the step-by-step details, check out this guide on Tennessee’s mortgage preapproval process. It helped me navigate the paperwork and timelines smoothly.

Reflecting on all these aspects, it’s clear that buying a home in Tennessee today requires more than just watching mortgage rates—it calls for a comprehensive strategy, patience, and local insight. I invite you to share your own experiences or questions below so we can all learn from one another’s journeys. If you’re ready to take the next step or need personalized advice, don’t hesitate to visit our contact page and connect with expert advisors who understand Tennessee’s unique market.

Strategic Refinancing: When and How Tennessee Homeowners Should Act Amid Rate Fluctuations

Refinancing remains one of the most powerful tools for Tennessee homeowners seeking to optimize their mortgage costs in 2025. However, the decision to refinance is intricately tied to market timing, loan terms, and individual financial health. Given the recent volatility in mortgage rates, a nuanced approach is paramount. Refinancing too early might incur unnecessary costs without significant rate reduction, while waiting too long could mean missing out on historically favorable conditions. Advanced homeowners often leverage predictive analytics tools and consult with mortgage advisors who incorporate local Tennessee market data and national economic forecasts to identify optimal refinancing windows.

Additionally, refinancing options have expanded beyond traditional fixed-rate loans to include hybrid ARMs and cash-out refinances tailored to Tennessee’s demographic and economic profile. These products offer flexibility for homeowners looking to capitalize on equity for home improvements or debt consolidation while managing interest exposure. For a comprehensive understanding, the Consumer Financial Protection Bureau’s report on refinancing trends provides authoritative insights into borrower behaviors and optimal strategies.

Decoding Mortgage Rate Hedging: Can Tennessee Buyers Mitigate Risks in 2025?

Mortgage rate hedging, a concept more commonly associated with institutional finance, is increasingly relevant for sophisticated Tennessee buyers navigating uncertain interest environments. Rate locks, float-down options, and buy-down points represent tactical tools that can shield buyers from unfavorable rate swings. For instance, a float-down provision allows borrowers to benefit if rates decrease after locking in, a valuable feature amid 2025’s unpredictable rate movements. However, these strategies come with trade-offs, including upfront fees or slightly higher initial rates.

Understanding these instruments requires detailed knowledge of lender policies and the current mortgage market structure in Tennessee. Buyers who master these tactics can potentially save thousands over the life of their loan. Engaging directly with mortgage professionals who specialize in risk management can uncover bespoke solutions tailored to individual risk tolerance and financial goals.

How Effective Are Rate Locks and Float-Down Options in Tennessee’s 2025 Mortgage Market?

Rate locks provide certainty by fixing the interest rate for a set period, often 30 to 60 days, protecting against upward movements. In contrast, float-down options add flexibility, allowing borrowers to adjust to lower rates if the market declines. In Tennessee’s dynamic 2025 market, these tools have proven effective for mitigating interest rate risk but require careful cost-benefit analysis. For example, float-downs typically involve a fee or slightly higher initial rate, which might not justify the potential savings if rate declines are minimal.

Studies in mortgage finance emphasize that the value of rate locks and float-downs aligns closely with market volatility levels and borrower timelines. Understanding when to deploy these instruments can be the difference between significant savings and unnecessary premium payments. Thus, Tennessee buyers should consult with trusted advisors and leverage real-time rate trend data to make informed decisions.

Harnessing Local Economic Data: A Blueprint for Predicting Tennessee Mortgage Rate Movements

While national economic indicators lay the foundation for mortgage rate trends, localized data provides critical granularity for Tennessee buyers. Factors such as regional employment growth, housing supply changes, and municipal policy shifts can directly influence lender risk assessments and thus mortgage pricing. For example, rapid job creation in Nashville’s tech sector or infrastructure expansions in Chattanooga may prompt lenders to adjust risk premiums accordingly.

Advanced buyers and investors analyze datasets from sources like the Tennessee Department of Economic and Community Development alongside Federal Reserve regional reports to forecast localized mortgage rate trajectories. This multi-layered analysis enables proactive mortgage planning, such as timing purchases or refinancing to coincide with favorable local economic cycles.

Incorporating such comprehensive data-driven strategies elevates the mortgage decision-making process beyond simple rate watching to an anticipatory and strategic discipline.

If you’re ready to deepen your understanding and craft a tailored mortgage strategy that aligns with Tennessee’s unique economic rhythms, don’t hesitate to explore our detailed resources or connect with our expert advisors through the contact page. Empower your home financing journey with expert insights and personalized guidance today.

Innovative Risk Mitigation Techniques for Tennessee Homebuyers

In the volatile mortgage environment of 2025, Tennessee buyers are increasingly turning to advanced risk mitigation strategies beyond traditional rate locks. These include financial derivatives like interest rate caps and swaps, typically utilized by institutional investors but now accessible through specialized mortgage products offered by select lenders. By incorporating such instruments, sophisticated borrowers can effectively hedge against unpredictable rate hikes, thus ensuring greater payment stability over the loan term.

Additionally, emerging fintech platforms are enabling Tennessee buyers to simulate various interest rate scenarios, empowering them to optimize mortgage terms before commitment. This shift towards data-driven decision-making reflects the growing complexity of the mortgage landscape and the need for customized risk management solutions.

What Are the Practical Benefits and Limitations of Using Mortgage Rate Hedging Tools in Tennessee’s Market?

Mortgage rate hedging tools present both opportunities and challenges. On the benefit side, they provide Tennessee buyers with financial safeguards that can translate into substantial long-term savings by capping potential payment increases. However, these instruments often involve upfront costs or increased initial rates, which may not be cost-effective for all borrowers, especially those with shorter expected homeownership horizons.

Moreover, the complexity of these products necessitates expert consultation to navigate terms and lender-specific policies accurately. Lenders such as Wells Fargo’s mortgage rate lock and float-down options offer illustrative examples of how these features can be structured to benefit borrowers while balancing cost considerations.

Leveraging Predictive Analytics: The Frontier of Tennessee Mortgage Rate Forecasting

Advanced predictive analytics now play a pivotal role in forecasting mortgage rate trajectories tailored to Tennessee’s unique economic context. By integrating macroeconomic indicators, local employment data, housing supply metrics, and Federal Reserve signals, machine learning models can generate nuanced rate forecasts. These insights enable buyers and homeowners to time mortgage locking or refinancing with enhanced precision, mitigating the risks of adverse market movements.

Such analytical tools are increasingly embedded in mortgage advisory services and fintech applications, democratizing access to sophisticated financial foresight previously limited to institutional actors.

Capitalizing on Localized Economic Trends for Strategic Mortgage Planning

Understanding Tennessee’s microeconomic fluctuations is critical for advanced mortgage strategy development. For example, the ongoing expansion of Nashville’s healthcare and tech sectors creates pockets of heightened demand that can pressure mortgage rates upward locally. Conversely, rural areas experiencing slower economic growth may offer more favorable borrowing conditions.

Incorporating granular insights from regional economic development reports and municipal infrastructure projects allows Tennessee buyers and investors to anticipate lender risk adjustments, potentially negotiating better loan terms or timing acquisitions optimally.

How Can Tennessee Homebuyers Effectively Integrate Local Economic Data Into Mortgage Decisions?

Effectively integrating local economic data requires a multi-faceted approach encompassing continuous monitoring of employment trends, housing starts, and policy changes within targeted Tennessee markets. Buyers should utilize resources such as the Tennessee Department of Economic and Community Development reports to access up-to-date regional statistics. Combining this with insights from local real estate market analyses and lender behavior patterns enables a strategic mortgage approach that anticipates rate movements and capitalizes on favorable conditions.

Engaging with mortgage professionals who have deep regional expertise can further enhance decision-making, providing tailored advice that aligns with both macro and microeconomic factors.

If you aspire to elevate your mortgage strategy with cutting-edge insights and localized expertise, connect with our seasoned advisors today through our contact page and transform your home financing experience.

Frequently Asked Questions (FAQ)

What factors primarily influence mortgage rates in Tennessee in 2025?

Mortgage rates in Tennessee are shaped by a combination of national economic indicators such as Federal Reserve policies and inflation trends, alongside local factors including housing demand, regional employment growth, and housing inventory levels. These dynamics interact to create a fluctuating rate environment that buyers must carefully monitor.

How can I decide between a fixed-rate and an adjustable-rate mortgage in the current Tennessee market?

Choosing between fixed and adjustable-rate mortgages depends on your financial goals and market outlook. Fixed-rate loans offer payment stability, ideal if you plan long-term homeownership or want to avoid interest rate uncertainty. Adjustable-rate mortgages start with lower rates but can fluctuate, suiting buyers expecting to move within a few years or anticipating rate declines. Consulting expert guides and local market forecasts can help tailor this decision.

How does my credit score affect the mortgage interest rate I can get in Tennessee?

Credit scores significantly impact the mortgage interest rates offered by lenders. Higher scores generally qualify for lower rates and better loan terms, while lower scores may result in higher costs or tougher approval criteria. Improving your credit profile by reducing debts and resolving errors can unlock substantial savings on your mortgage in 2025.

When is the best time to lock my mortgage rate in Tennessee?

The optimal time to lock a mortgage rate depends on market volatility and individual circumstances. Locking early during a rate dip can protect against increases but risks missing further declines. Staying informed through daily rate updates and economic forecasts enables strategic timing to maximize savings.

Are there regional differences in mortgage rates within Tennessee?

Yes, Tennessee’s diverse housing markets mean mortgage rates and lender offerings can vary between cities like Memphis, Nashville, and Knoxville due to differences in local economic conditions, housing supply, and demand. Leveraging city-specific insights allows buyers to optimize loan terms based on their location.

What hidden costs should Tennessee homebuyers be aware of beyond the mortgage rate?

Beyond interest rates, buyers should plan for closing costs, appraisal fees, mortgage broker fees, and potential lender-specific charges. These upfront expenses can add thousands to the total cost and should be factored into your overall home financing budget.

How can mortgage rate hedging tools benefit buyers in Tennessee?

Mortgage rate hedging tools like rate locks, float-down options, and buy-down points can protect buyers against unfavorable rate changes. While these tools offer financial safeguards, they may involve upfront fees or higher initial rates and require careful evaluation to ensure cost-effectiveness based on your homeownership timeline.

What role does local economic data play in forecasting Tennessee mortgage rates?

Local economic indicators such as employment growth, housing starts, and infrastructure projects directly affect lender risk assessments and mortgage pricing in Tennessee. Incorporating these data points helps buyers anticipate rate movements more accurately and strategize mortgage decisions accordingly.

Is refinancing a good option for Tennessee homeowners in 2025?

Refinancing can reduce mortgage costs if done during favorable rate environments. However, timing is critical to avoid unnecessary expenses. Advanced refinancing products and market analyses tailored to Tennessee’s unique market conditions can help homeowners identify the optimal moment to refinance.

How can predictive analytics improve mortgage decision-making in Tennessee?

Predictive analytics integrate multiple economic and market variables to forecast mortgage rate trends with greater precision. Utilizing these tools enables buyers and homeowners in Tennessee to make informed decisions about rate locking, refinancing, and loan product selection, reducing financial risk.

Trusted External Sources

- Federal Reserve Board (https://www.federalreserve.gov/monetarypolicy.htm): The primary authority on U.S. monetary policy, providing critical insights on interest rate decisions and economic outlooks that directly influence mortgage rates nationwide, including Tennessee.

- Tennessee Department of Economic and Community Development (https://www.tnecd.com/reports-and-data/): Offers comprehensive regional economic data, housing statistics, and employment trends essential for understanding local mortgage market dynamics.

- Consumer Financial Protection Bureau (https://www.consumerfinance.gov/data-research/research-reports/refinancing-mortgage-borrowers/): Provides authoritative research on refinancing trends and borrower behavior, informing strategic decisions for Tennessee homeowners.

- Wells Fargo Mortgage Resources (https://www.wellsfargo.com/mortgage/rate-lock/): Illustrates practical examples of mortgage rate lock and float-down options, helping buyers evaluate risk mitigation strategies in the current market.

- Tennessee Mortgage Rates Official Portals (https://tennesseemortgage-rates.com): Specialized platforms delivering up-to-date, localized mortgage rate information and expert guides tailored to Tennessee’s unique real estate landscape.

Conclusion

As Tennessee’s mortgage landscape in 2025 continues to reflect a complex interplay of national economic trends and localized market forces, prospective homebuyers and homeowners must adopt a multifaceted approach to mortgage decisions. Staying informed on the latest mortgage rate fluctuations, understanding credit score impacts, and leveraging both fixed and adjustable loan options allow buyers to align financing with personal goals. Moreover, integrating granular local economic data and utilizing advanced risk mitigation tools like rate locks and predictive analytics can significantly enhance strategic planning. Awareness of hidden costs and regional market nuances further empowers Tennessee buyers to avoid pitfalls and optimize affordability.

Ultimately, navigating Tennessee’s mortgage market today demands a blend of vigilance, expert guidance, and proactive financial management. We encourage readers to share their experiences or questions to foster a knowledgeable community and explore related expert content for deeper insights. Take advantage of the resources and professional advisors available to craft a mortgage strategy that not only secures your dream home but does so with confidence and financial prudence.