Decoding the Tennessee Mortgage Maze: Brokers and Lenders Unveiled

Embarking on the journey to homeownership in Tennessee invariably brings you face-to-face with pivotal decisions—none more crucial than choosing between a mortgage broker and a lender. While both serve as gateways to financing your dream home, their roles, advantages, and potential pitfalls diverge in ways that can significantly impact your borrowing experience and financial outcome. This exploration peels back the layers of Tennessee mortgage brokerage and lending to illuminate their key differences, empowering you to navigate the local market with confidence and savvy.

Mortgage Brokers: The Tennessee Homebuyer’s Personalized Market Navigators

Mortgage brokers act as intermediaries who connect borrowers with a diverse range of lenders. Leveraging their extensive network, they scour Tennessee’s lending landscape to find tailored loan options that best suit your unique financial profile and goals. Imagine a seasoned guide who knows the shortcuts and hidden gems in the sprawling Tennessee mortgage market—this is your broker. They often possess nuanced knowledge about local lending trends, such as those outlined in Mortgage Brokers in Tennessee: How to Find Trusted Lending Experts, making them invaluable for buyers seeking personalized attention and competitive rates.

Lenders: The Direct Tennessee Loan Architects

Conversely, lenders are the financial institutions or entities that directly underwrite and fund your mortgage. Whether a local bank, credit union, or a national mortgage company operating in Tennessee, lenders evaluate your creditworthiness and issue the loan based on their own criteria and products. Dealing directly with lenders can mean streamlined communication and potentially lower upfront fees, but may also limit your access to a broad spectrum of loan products compared to what a broker might offer.

Why Does the Choice Between Broker and Lender Matter for Tennessee Homebuyers?

Choosing between a mortgage broker and a lender is more than a procedural step; it shapes the trajectory of your mortgage experience. For example, brokers can often negotiate better terms due to their relationships with multiple lenders, yet their fees might be embedded in your loan costs, requiring careful scrutiny. Lenders, while direct, may offer fewer options but can present clearer fee structures. Understanding these nuances equips Tennessee buyers to match their comfort levels and financial strategies with the right mortgage partner.

Understanding the Financial Implications: Fees, Rates, and Flexibility

Mortgage brokers typically charge a commission or fee, which can be paid by you or the lender, influencing your effective interest rate. Lenders, meanwhile, may have origination fees, processing fees, and other costs that vary widely. Notably, in Tennessee’s dynamic mortgage market, factors such as credit scores deeply affect rate offers—see insights in How Credit Scores Shape Your Mortgage Interest Rates Today. Brokers’ ability to tap into multiple lenders can sometimes buffer these costs through rate shopping, while lenders offer direct negotiation but limited choices.

Practical Scenario: Choosing Your Mortgage Ally in Tennessee

Consider a first-time Tennessee homebuyer with moderate credit and a complex financial background. A mortgage broker can explore specialized lenders or government-backed programs to secure favorable terms, such as FHA loans detailed in FHA Loans Tennessee: How to Get the Best Rates This Year. Conversely, a buyer with strong credit and straightforward finances might benefit from approaching a lender directly to capitalize on lower fees and faster approvals. Such scenarios underscore the importance of aligning your mortgage approach with your financial profile and homebuying goals.

For Tennessee homebuyers eager to delve deeper and make well-informed mortgage decisions, exploring detailed comparisons like Mortgage Broker vs Lender in Tennessee: Which is Best for Your Loan? can provide essential clarity and actionable advice.

Feel free to share your experiences or questions about working with mortgage brokers or lenders in Tennessee—engaging with this community can uncover insights and tips that textbooks don’t offer.

For authoritative guidance on mortgage industry standards and consumer protections, the Consumer Financial Protection Bureau offers comprehensive resources to help homebuyers understand these roles and their rights.

Peeling Back the Layers: How Fees and Flexibility Shape Your Tennessee Mortgage Journey

Reflecting on my own experience navigating mortgage options in Tennessee, one lesson stands out vividly: understanding the nuances of fees and flexibility can be a game-changer. While mortgage brokers often shine by offering access to multiple lenders and tailored loan products, their fees sometimes lurk quietly within your loan’s interest rate or closing costs. This layered pricing means it’s essential to ask upfront about broker commissions and how they impact your overall cost. On the flip side, lenders usually have more transparent fee structures but might not provide the variety a broker can tap into. This tradeoff between diversity and clarity influenced my decision-making more than I initially anticipated.

Local Market Knowledge: Why It Matters More Than You Think

I recall a time when a broker’s intimate knowledge of Tennessee’s lending landscape helped me uncover a specialized loan program I hadn’t heard of before. For instance, certain local banks or credit unions offer attractive rates or incentives that aren’t widely advertised. This is why tapping into brokers with a strong Tennessee presence can sometimes save you thousands. The ability to leverage insider knowledge is something I found invaluable, especially after reading insights on how credit scores shape your mortgage interest rates. It became clear that even subtle differences in credit profiles could open or close doors to better deals.

How Do You Decide Which Path Fits Your Unique Financial Story?

When I faced the question of choosing a broker or lender, I realized it boiled down to my personal comfort with complexity and my financial profile. If you’re someone who enjoys shopping around, asking detailed questions, and comparing nuanced offers, a mortgage broker might be your best ally. However, if you prefer a more straightforward approach with fewer moving parts, dealing directly with a lender could be more your style. Have you ever felt torn between these options? What factors tipped the scale for you?

Real-World Tip: Transparency Is Your Best Friend

One practical piece of advice I wish I’d known earlier is to get every fee and rate detail in writing. Tennessee’s mortgage landscape can be fluid, and sometimes verbal promises don’t translate into the final paperwork. Clear, documented transparency helped me avoid surprises and gave me peace of mind.

If you’re curious about the specifics of mortgage fees in Tennessee or want strategies to lock in the best rates, check out this guide on locking in a mortgage rate in Tennessee before it rises. It’s full of actionable tips that I found particularly useful when rates started climbing.

Have you had experiences working with mortgage brokers or lenders in Tennessee? Maybe you discovered hidden fees or uncovered a lender who went above and beyond? Share your stories in the comments below—our collective experiences can be a powerful resource for fellow homebuyers navigating these important decisions.

Unraveling Complex Fee Structures: Beyond the Basics in Tennessee Mortgages

While many homebuyers understand that fees exist in the mortgage process, the layers and interplay of these fees can be bewildering, especially in Tennessee’s varied market. Fees such as origination, underwriting, processing, and broker commissions are often bundled or hidden within points and interest rates. An expert approach involves dissecting the Loan Estimate and Closing Disclosure documents line-by-line to identify which fees are negotiable and which are fixed by regulation or lender policy.

For instance, mortgage brokers may receive yield spread premiums from lenders — a form of compensation that can affect your interest rate without direct upfront fees. Being aware of such indirect costs empowers you to negotiate better terms or request a credit to offset closing costs. Lenders, on the other hand, might offer ‘no-cost’ loans that roll fees into the interest rate, resulting in higher payments over time despite zero upfront fees. Understanding these nuances is critical in optimizing your long-term financial outcome.

According to the Consumer Financial Protection Bureau’s Mortgage Closing Disclosure Guide, borrowers should scrutinize all costs and seek transparency to avoid unpleasant surprises at closing.

Leveraging Lender Flexibility: Tailoring Mortgage Solutions to Your Tennessee Financial Profile

Flexibility from lenders can take many forms, including adjustable rate options, loan term variations, and eligibility for special local programs. Tennessee lenders may offer unique incentives such as down payment assistance or grants, especially in rural or underserved areas. An adept mortgage broker can uncover these niche opportunities, but direct negotiation with lenders can sometimes yield custom solutions if you have a strong relationship or significant borrowing history.

For borrowers with fluctuating income or nontraditional financial backgrounds — such as self-employed professionals or those with multiple income streams — some Tennessee lenders provide alternative documentation loans that don’t rely solely on traditional pay stubs or tax returns. Understanding which lenders offer these products can be pivotal, underscoring the importance of a well-informed mortgage strategy.

How Can Tennessee Homebuyers Effectively Compare Broker and Lender Flexibility to Maximize Loan Benefits?

Comparing flexibility between brokers and lenders involves assessing not just interest rates and fees, but also the availability of specialized loan programs, willingness to negotiate terms, and responsiveness to unique financial circumstances. Brokers excel at casting a wide net to find diverse options, while lenders may offer deeper customization within their product lines.

Engaging in direct discussions and requesting prequalification letters from both brokers and lenders can provide comparative insights. Additionally, consulting with a Tennessee mortgage expert who understands the local nuances and regulatory environment can provide a strategic advantage. Remember, flexibility isn’t just about loan terms — it also encompasses service quality, speed, and transparency that ultimately impact your homebuying experience.

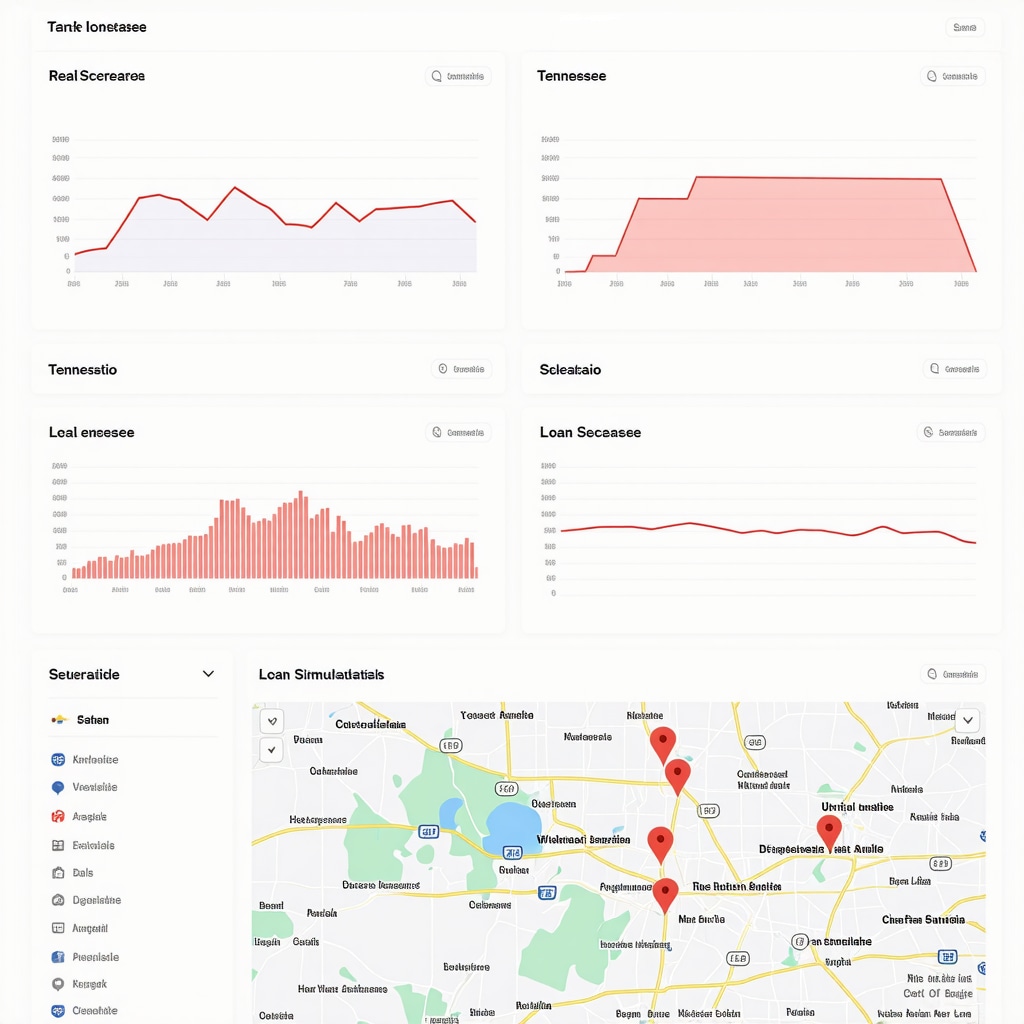

Expert Insight: Utilizing Advanced Mortgage Analytics Tools for Tennessee Borrowers

In today’s data-driven world, advanced mortgage analytics platforms offer borrowers a granular view of how different loan structures, fees, and rate scenarios affect long-term costs. These tools simulate amortization schedules, sensitivity to prepayment penalties, and potential refinancing benefits under fluctuating market conditions. Tennessee homebuyers leveraging such technology can make informed decisions beyond surface-level rate comparisons, aligning mortgage choices with their financial goals and risk tolerance.

For instance, platforms like Mortgage Bankers Association provide comprehensive resources and calculators that reflect real-time market conditions, enabling sophisticated scenario planning.

Are you ready to deepen your understanding and harness these expert-level strategies to optimize your Tennessee mortgage journey? Explore our comprehensive guides and connect with seasoned mortgage professionals who can tailor solutions to your unique financial narrative.

Mastering the Intricacies of Tennessee Mortgage Negotiations: Beyond Basic Choices

As the Tennessee housing market evolves, seasoned buyers and investors increasingly demand a granular understanding of mortgage structures and negotiation tactics. Beyond simply choosing between brokers and lenders, discerning borrowers must analyze how contractual nuances, lender incentives, and broker affiliations interplay to influence both immediate closing costs and long-term financial outcomes. This elevated perspective enables you to leverage every advantage within Tennessee’s competitive lending environment.

Dissecting Broker-Lender Relationships: Hidden Dynamics Influencing Your Mortgage

Mortgage brokers in Tennessee often cultivate exclusive partnerships with select lenders, granting them access to specialized loan products or preferential pricing tiers unavailable to direct applicants. However, these alliances may also channel borrowers toward lenders offering higher commissions rather than optimal terms. Advanced borrowers recognize the importance of scrutinizing these affiliations and requesting full disclosure of broker compensation structures. Transparent dialogue can prevent conflicts of interest and ensure alignment with your best financial interests.

What Are the Key Indicators of a Mortgage Broker’s Alignment With Borrower Interests in Tennessee?

Evaluating a broker’s commitment to your financial goals involves assessing their willingness to provide a comprehensive loan comparison, transparency about fees, and responsiveness to your unique financial profile. Brokers who proactively educate clients about yield spread premiums, lender incentives, and alternative loan programs demonstrate a client-centric approach. Additionally, verifying licensure and complaint records through the Nationwide Multistate Licensing System & Registry can provide assurance of ethical practices.

Advanced Fee Negotiation Techniques: Securing Optimal Terms in Tennessee Mortgages

Expert negotiators employ strategies such as leveraging competing lender offers, requesting lender credits to offset broker fees, and structuring rate buy-downs to minimize total cost of borrowing. Understanding the regulatory framework, including the Real Estate Settlement Procedures Act (RESPA), empowers borrowers to identify prohibited kickbacks and demand fair fee disclosures. In Tennessee’s diverse market, these tactics can translate into thousands of dollars saved over the loan’s lifetime.

Integrating Technology and Data Analytics: The New Frontier in Mortgage Decision-Making

Utilizing sophisticated mortgage analytics platforms that incorporate Tennessee-specific data allows borrowers to simulate various scenarios including interest rate fluctuations, amortization impacts, and refinancing break-even points. These tools can integrate local economic indicators and regulatory changes, offering a dynamic roadmap tailored to your financial trajectory. Combining this data-driven approach with human expertise enhances negotiation leverage and decision accuracy.

Strategic Partnerships With Local Tennessee Lenders: Unlocking Exclusive Opportunities

Forming direct relationships with regional lenders in Tennessee may yield access to bespoke loan products, such as community development loans or state-sponsored assistance programs that larger national lenders might not offer. Seasoned mortgage professionals advise cultivating these connections early in your homebuying journey to capitalize on limited-time incentives and flexible underwriting standards that accommodate complex financial situations.

For further expert guidance, the Consumer Financial Protection Bureau remains an invaluable resource for understanding evolving mortgage regulations and borrower protections.

Elevate Your Mortgage Strategy: Engage With Tennessee’s Top Mortgage Experts Today

Harnessing these advanced insights and negotiation strategies can markedly enhance your Tennessee mortgage experience. Whether you seek to decode complex fee structures, leverage cutting-edge analytics, or build strategic lender relationships, partnering with seasoned mortgage professionals is paramount. Start your journey toward a financially optimized home loan by consulting experts who specialize in Tennessee’s unique market dynamics.

Ready to transform your mortgage approach and unlock superior financing solutions? Connect with our network of trusted Tennessee mortgage brokers and lenders who bring unparalleled expertise and personalized service to your doorstep.

Frequently Asked Questions (FAQ)

What is the main difference between a mortgage broker and a lender in Tennessee?

A mortgage broker acts as an intermediary connecting you with multiple lenders, providing diverse loan options tailored to your needs, whereas a lender is the institution that directly underwrites and funds your mortgage. Brokers offer breadth and personalized matchmaking, while lenders offer direct processing and potentially more transparent fee structures.

Are mortgage broker fees in Tennessee negotiable, and how do they affect my loan?

Yes, broker fees can sometimes be negotiated depending on the broker’s policies and the lender’s agreements. These fees may be paid upfront or embedded within your loan’s interest rate or closing costs, potentially influencing the overall cost of borrowing. Transparency about broker commissions and their impact on your Loan Estimate is crucial to avoid surprises.

Can working with a mortgage broker help me qualify for specialized Tennessee loan programs?

Absolutely. Experienced brokers often have knowledge of niche or government-backed programs such as FHA loans, down payment assistance, or community development loans unique to Tennessee. They can guide you to lenders offering these specialized products that might not be widely advertised.

Is it better to go directly to a lender if I have excellent credit?

For borrowers with strong credit and straightforward financial profiles, going directly to a lender can simplify the process and reduce upfront fees. However, using a broker may still provide access to competitive rates or loan products you might otherwise miss. It’s wise to compare offers from both channels.

How can I identify if a Tennessee mortgage broker truly has my best interests in mind?

Look for brokers who provide comprehensive loan comparisons, full disclosure of all fees including yield spread premiums, and responsiveness to your specific financial situation. Checking their licensure and complaint records via the Nationwide Multistate Licensing System & Registry (NMLS) adds an extra layer of assurance.

What should Tennessee homebuyers watch out for in complex fee structures?

Be vigilant about bundled fees such as origination, underwriting, broker commissions, and points that may be hidden within documents like the Loan Estimate and Closing Disclosure. Understanding which fees are negotiable and which are fixed helps you optimize your mortgage’s total cost.

How important is local Tennessee market knowledge when choosing a mortgage partner?

Local expertise can uncover regional loan programs, incentives, and lenders with flexible underwriting standards tailored to Tennessee’s market. Brokers and lenders with strong local presence often have access to exclusive offers that can save you money and streamline approval.

Can advanced mortgage analytics tools benefit Tennessee borrowers?

Yes. Analytics platforms enable detailed scenario simulations including amortization, prepayment impacts, and refinancing break-even points using Tennessee-specific data. This empowers borrowers to make informed decisions aligned with their long-term financial goals.

How do broker-lender relationships influence the mortgage options I receive in Tennessee?

Brokers often have exclusive partnerships granting access to special loan products or pricing tiers, but these affiliations may also influence which lenders they prioritize. Transparent disclosure of these relationships helps ensure your loan options align with your best interests rather than broker commissions.

What negotiation strategies can Tennessee homebuyers use to lower mortgage costs?

Effective tactics include leveraging competing offers to negotiate better fees or rate buy-downs, requesting lender credits to offset broker commissions, and understanding regulatory protections under RESPA to avoid prohibited kickbacks. Engaging knowledgeable mortgage experts can amplify these strategies.

Trusted External Sources

- Consumer Financial Protection Bureau (CFPB) — Offers authoritative guidance on mortgage disclosures, borrower rights, and fee transparency essential for understanding the nuances of mortgage brokers and lenders in Tennessee.

- Nationwide Multistate Licensing System & Registry (NMLS) — Provides access to broker and lender licensing and complaint records, ensuring you engage with reputable and compliant mortgage professionals.

- Mortgage Bankers Association (MBA) — Delivers advanced mortgage analytics tools, market research, and educational resources crucial for strategic mortgage planning in Tennessee’s dynamic environment.

- Tennessee Housing Development Agency (THDA) — A key resource for localized loan programs, down payment assistance, and community development loans tailored to Tennessee homebuyers.

- Federal Housing Administration (FHA) — Offers federally insured loan programs that many Tennessee borrowers access through specialized lenders or brokers, especially first-time homebuyers or those with complex credit profiles.

Conclusion

Navigating the Tennessee mortgage landscape requires a nuanced understanding of the distinct roles mortgage brokers and lenders play, the intricate fee structures involved, and the unique local market dynamics at hand. Mortgage brokers bring valuable access to a broad spectrum of lenders and specialized loan products, often uncovering opportunities invisible to direct lenders. Conversely, working directly with a lender can offer streamlined processes and clearer fee transparency, especially for borrowers with strong credit profiles.

Mastering these complexities—ranging from broker-lender affiliations to leveraging advanced analytics and negotiation tactics—empowers Tennessee homebuyers to secure optimal financing tailored to their individual financial narratives. Local expertise and transparency remain paramount pillars of a successful mortgage journey.

If you are embarking on your homebuying adventure in Tennessee, leverage these insights to make informed decisions. Engage trusted mortgage professionals, scrutinize all fees, and consider both brokers and lenders to unlock the best possible loan tailored to your circumstances. Share your experiences, ask questions, and explore our comprehensive guides to stay ahead in Tennessee’s competitive mortgage market.