Unlocking the Best Time to Refinance Your Tennessee Home

For many Tennessee homeowners, refinancing can be a game-changer in managing mortgage expenses and unlocking financial flexibility. But the question remains: when is the optimal moment to act? Understanding refinancing strategies in the context of Tennessee’s unique market dynamics can help homeowners secure significant savings and long-term benefits.

Decoding Tennessee’s Mortgage Rate Patterns: A Local Perspective

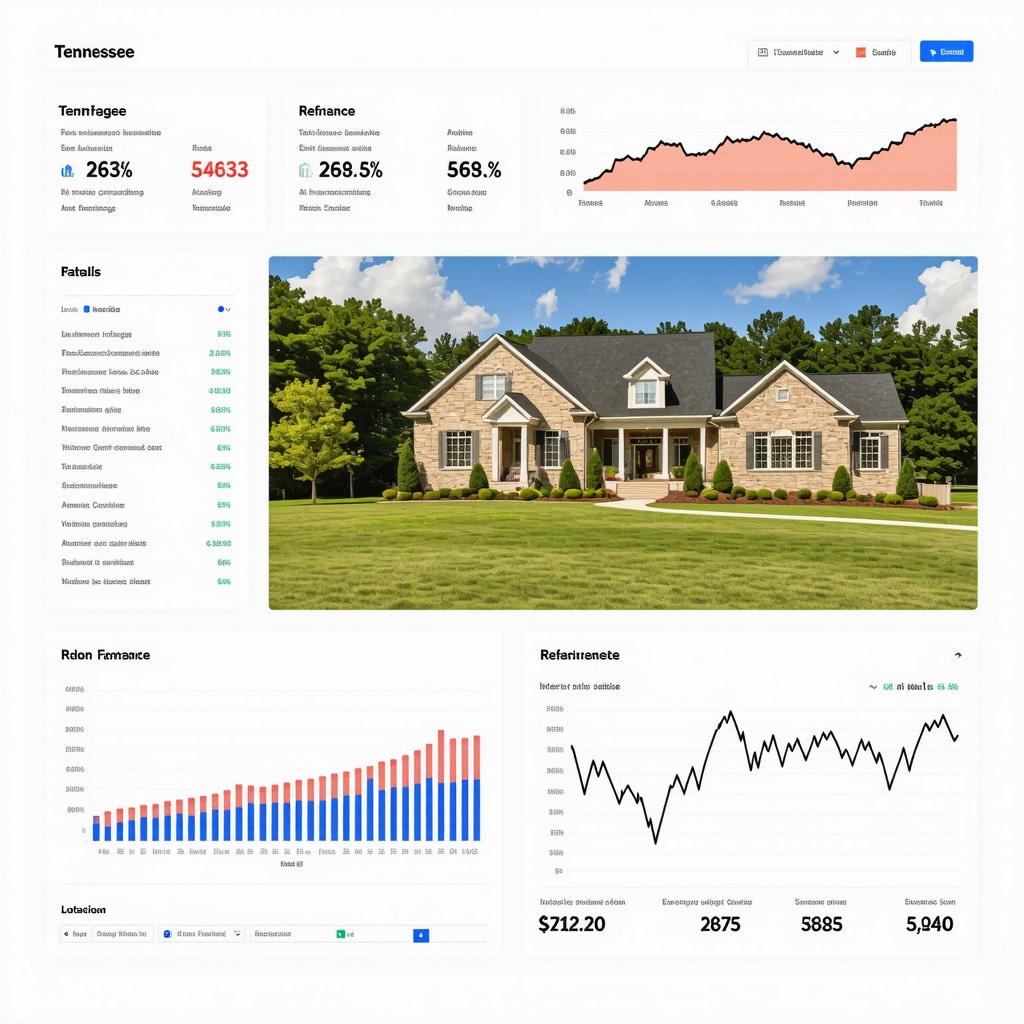

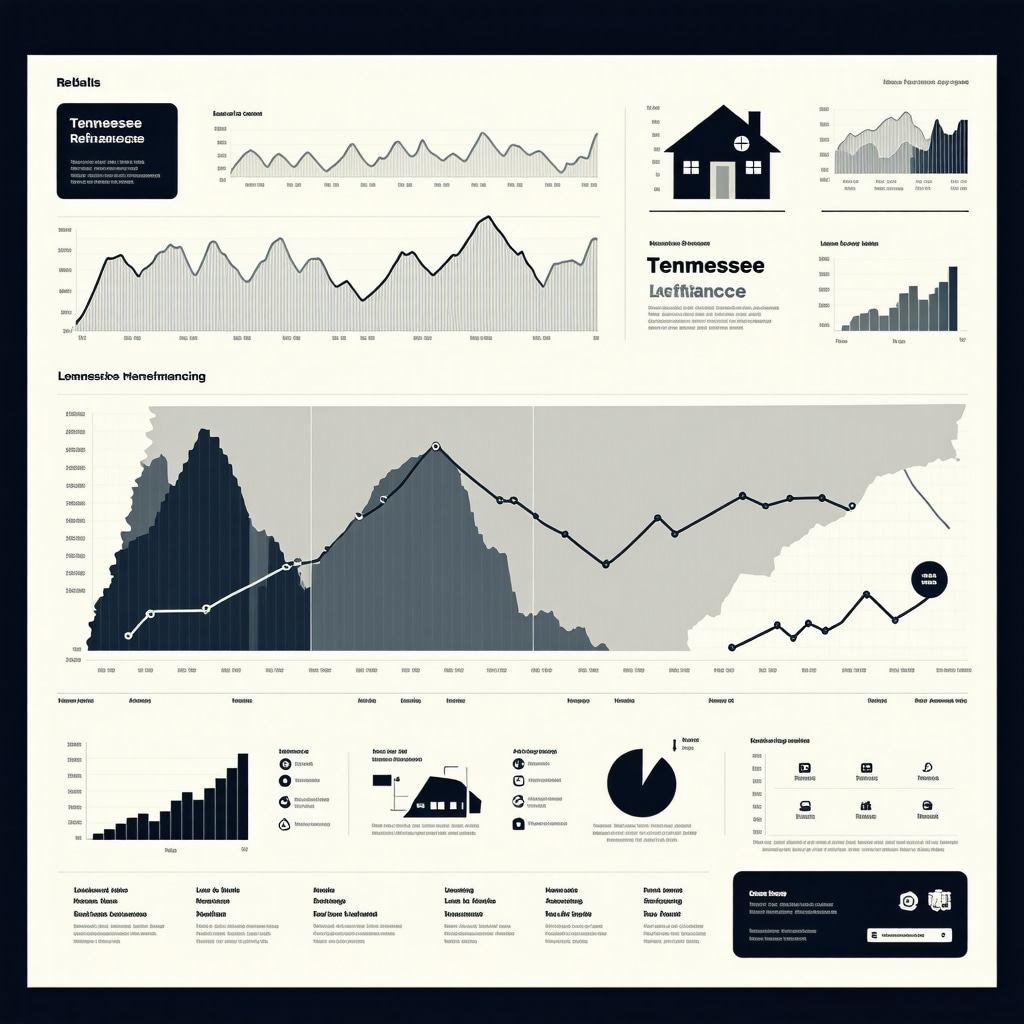

Mortgage rates in Tennessee are influenced by broader economic trends, but also by state-specific factors such as local lending competition and regional housing demand. For example, Memphis and Nashville markets might show differing refinance rate trends, reflecting local economic growth and housing inventory shifts. Tracking these nuanced patterns is essential to timing your refinance move effectively.

How Do Tennessee Homeowners Know If Refinancing Now Makes Financial Sense?

One key indicator is the spread between your current mortgage interest rate and the prevailing refinance rates. Industry experts often recommend refinancing when rates drop by at least 0.75% to 1%, as this threshold tends to cover closing costs and deliver monthly payment relief. Additionally, consider your remaining mortgage term — refinancing early in your loan tenure offers greater interest savings over time, whereas late-term refinancing might only make sense to reduce monthly cash flow burdens.

Creative Refinancing Approaches: Beyond the Standard Rate Drop

Refinancing is not solely about securing a lower interest rate. Tennessee homeowners can explore strategic options like shortening the loan term to build equity faster or switching from an adjustable-rate to a fixed-rate mortgage for greater payment stability. Another savvy approach is cash-out refinancing, which taps into home equity to fund renovations or consolidate debt — but it requires a careful cost-benefit analysis to avoid overleveraging.

Leveraging Credit and Local Expertise to Maximize Savings

Your credit score plays a pivotal role in the refinance rate you qualify for. Tennessee homeowners with higher credit scores typically access more favorable terms. Proactively improving your credit profile before refinancing can unlock better rates and reduce fees. Moreover, partnering with licensed Tennessee mortgage brokers who understand local market intricacies can provide tailored advice and access to competitive products not widely advertised.

Explore more on how credit scores impact Tennessee mortgage interest rates here and consider consulting with experts for personalized guidance.

Maximizing Your Refinance Timing: Practical Tips for Tennessee Homeowners

Seasonal trends can also influence refinance rates. Historically, mortgage rates may be more favorable in late fall and winter due to reduced lending demand. However, economic shifts such as Federal Reserve policy changes or inflation reports can abruptly change the landscape. Staying informed through reliable sources and locking in rates when the market hints at an upward trajectory can protect your savings.

For a detailed breakdown of when to lock your refinance rate in Tennessee for maximum savings, visit this expert resource.

Why Do Closing Costs Matter in Your Refinancing Decision?

Closing costs can significantly influence the net benefit of refinancing. Tennessee homeowners should calculate break-even points carefully — the time it takes for monthly savings to surpass upfront refinancing expenses. For instance, if closing costs total $4,000 and monthly savings are $200, the break-even is 20 months. Understanding this metric helps avoid refinancing too early or when planning to move soon.

Ready to explore refinancing options tailored for Tennessee? Contact expert mortgage advisors today for personalized strategies that align with your financial goals.

Embracing Refinancing as a Dynamic Financial Tool

Refinancing your Tennessee home loan is more than just a financial transaction—it’s an opportunity to recalibrate your mortgage for evolving life circumstances and market conditions. By combining local market knowledge, credit management, and strategic timing, homeowners can unlock significant savings and enhanced financial security.

According to the Mortgage Bankers Association, careful timing and strategic refinancing decisions can save homeowners thousands over their loan life, underscoring the importance of an informed approach (MBA Official Site).

Learning From My Own Refinance Journey in Tennessee

Reflecting on my personal experience with refinancing here in Tennessee, I realized how much timing and local knowledge matter. When I first considered refinancing, I focused solely on the interest rate drop. But as I dug deeper, I discovered that factors like closing costs, credit score improvements, and local lender expertise were equally crucial. It wasn’t just about chasing the lowest rate; it was about maximizing overall financial benefit.

How Can You Tell If Refinancing Is Right for You Beyond the Numbers?

This question often puzzled me during my refinance process. It’s not just about the immediate monthly savings but also about your long-term plans and financial health. For example, if you plan to move within a few years, the break-even point on closing costs becomes a vital metric. Similarly, if your credit score has improved significantly since you took your original loan, refinancing might open doors to better mortgage terms that weren’t accessible before.

What’s Your Strategy for Timing a Refinance in Tennessee’s Market?

One thing I learned is that keeping an eye on economic indicators and local market trends can be a game changer. For instance, when the Federal Reserve signals interest rate shifts, that ripple effect can quickly influence mortgage rates in Tennessee. I found the Mortgage Bankers Association’s website (MBA Official Site) to be a reliable source for understanding these market movements.

The Importance of Partnering With Local Mortgage Brokers

During my refinancing, working with a licensed Tennessee mortgage broker made a noticeable difference. They had insights into lender specials, local market fluctuations, and even helped me navigate the paperwork without feeling overwhelmed. This local expertise is something I highly recommend for anyone considering refinancing. If you’re curious about choosing the right professional, check out this guide on licensed mortgage brokers in Tennessee.

Balancing Closing Costs With Your Long-Term Savings Goals

One practical tip I’d share is to calculate your break-even period carefully. For instance, I faced a decision where my closing costs were higher than average, but the monthly savings still justified it because I planned to stay in my home long-term. For others, a quick move might mean that refinancing isn’t financially smart right now. Using online calculators or consulting with experts can help clarify this.

If you want to dive deeper into how closing costs affect your refinancing, this article on Tennessee refinance rates explained is a helpful resource.

Have You Experienced Surprising Benefits or Challenges When Refinancing Your Tennessee Home?

I’d love to hear about your journey. Did you find timing the refinance tricky? How did your credit score impact your options? Sharing your experience can provide valuable insight for others navigating this process. Feel free to comment below or reach out via our contact page. Your story might just help someone else make a smarter refinancing decision.

Harnessing Market Analytics: Predictive Indicators for Tennessee Mortgage Refinancing

Delving deeper into refinancing timing requires mastery over predictive analytics and an understanding of macroeconomic indicators that influence Tennessee’s mortgage landscape. Savvy homeowners and investors alike monitor key data points such as the Federal Reserve’s interest rate outlook, regional employment statistics, and housing inventory levels. For example, an uptick in Tennessee’s job growth often forecasts increased housing demand, which can tighten lending conditions and push mortgage rates higher. Conversely, economic slowdowns may trigger rate dips, presenting opportune moments to refinance.

Utilizing advanced tools like yield curve analysis and forward rate agreements can provide nuanced foresight into interest rate movements. Yield curve inversion, often signaling economic contractions, might prompt lenders to adjust their risk premiums, affecting refinance rates. Homeowners equipped with this knowledge can time their refinancing to capitalize on dips before a market rebound.

How Can Tennessee Homeowners Leverage Loan-to-Value (LTV) Ratios for Optimal Refinance Outcomes?

Loan-to-Value ratio is a critical metric influencing refinancing eligibility and terms. In Tennessee’s diverse housing markets, understanding how LTV affects refinancing can unlock better rates and reduce mortgage insurance requirements. Typically, maintaining an LTV under 80% eliminates the need for private mortgage insurance (PMI), substantially lowering monthly payments.

Homeowners can enhance their LTV by making principal payments before refinancing or through home improvements that boost appraised value. This strategic increase in home equity not only qualifies borrowers for premium rates but also opens avenues for cash-out refinancing with favorable terms. However, it’s essential to balance cash extraction against the risk of overleveraging, which can compromise financial stability.

Innovative Refinancing Products Tailored for Tennessee Homeowners: Beyond Conventional Loans

The refinancing landscape in Tennessee is evolving with products designed to meet complex financial goals. For instance, “blend-and-extend” loans allow borrowers to combine existing mortgage rates with new terms, mitigating rate shock and preserving favorable conditions. Additionally, bi-weekly payment plans, often integrated into refinancing packages, facilitate accelerated principal reduction, saving thousands in interest over the loan lifespan.

Another cutting-edge option is the use of Home Equity Investment (HEI) products, where investors provide cash in exchange for a share of future home appreciation. While not traditional refinancing, this alternative can supplement or replace cash-out refinancing, especially for homeowners wary of increased debt.

Psychological and Behavioral Considerations in Refinancing Decisions

Financial decisions like refinancing are not purely quantitative; behavioral economics profoundly influence outcomes. Homeowners often face decision fatigue, overestimate short-term gains, or underestimate long-term costs. Recognizing cognitive biases such as anchoring to initial loan rates or loss aversion can empower Tennessee homeowners to make more rational refinancing choices.

Engaging with certified financial planners or mortgage consultants trained in behavioral finance can provide personalized strategies to overcome these biases. For example, setting clear refinancing goals aligned with life events—such as retirement planning or college funding—can shift focus from impulsive rate chasing to sustainable financial health.

Consulting with Tennessee Mortgage Experts: When and Why It Matters Most

Partnering with seasoned professionals who understand Tennessee’s localized market dynamics is paramount. Expert mortgage advisors can dissect complex loan products, forecast market trends, and tailor refinancing strategies to individual financial profiles. Their insights often reveal hidden costs or benefits invisible to the average borrower.

For those seeking authoritative guidance, the Mortgage Bankers Association (MBA) offers comprehensive resources and certified professional directories. Collaborating with experts not only streamlines the refinancing process but optimizes financial outcomes in a competitive market.

Interested in a customized refinance plan that aligns with Tennessee’s evolving market? Connect with our expert advisors today and take the next step toward smarter home financing.

Harnessing Predictive Analytics for Strategic Tennessee Refinancing

Elevating your refinancing strategy involves more than surface-level rate watching—it demands a keen understanding of predictive analytics and macroeconomic signals that uniquely affect Tennessee’s mortgage environment. Sophisticated homeowners analyze datasets such as the Federal Reserve’s interest rate forecasts, regional employment growth, and housing supply fluctuations to anticipate shifts in lending conditions. For instance, a surge in employment within Nashville’s tech sector could drive housing demand, tightening mortgage availability and nudging rates upward. Conversely, economic deceleration might create a window of opportunity with more competitive refinance rates.

Advanced financial instruments, including yield curve analysis and forward rate agreements, serve as nuanced barometers for interest rate trajectories. Yield curve inversions, often harbingers of recession, influence lender risk assessments and subsequently refinance offers. Armed with these insights, Tennessee homeowners can strategically time refinancing to capitalize on favorable rate dips before inevitable market corrections.

How Can Tennessee Homeowners Leverage Loan-to-Value (LTV) Ratios for Optimal Refinance Outcomes?

Understanding and optimizing the Loan-to-Value (LTV) ratio is pivotal in securing advantageous refinancing terms in Tennessee’s diverse housing markets. Maintaining an LTV below 80% typically exempts borrowers from Private Mortgage Insurance (PMI), drastically reducing monthly expenses. Homeowners can improve their LTV by accelerating principal repayments or enhancing property value through strategic renovations, thereby unlocking superior refinance rates and expanding eligibility for cash-out refinancing options.

Nonetheless, caution is essential to prevent overleveraging, which may jeopardize financial stability. Balancing equity utilization against long-term fiscal health requires meticulous planning and, often, consultation with mortgage professionals experienced in Tennessee’s local market nuances.

Innovative Refinancing Products Tailored for Tennessee Homeowners: Beyond Conventional Loans

The evolution of refinancing instruments caters to complex homeowner needs in Tennessee. “Blend-and-extend” loans—merging existing mortgage terms with new conditions—offer a buffer against abrupt rate increases, preserving favorable payment structures. Incorporating bi-weekly payment schemes accelerates principal reduction, yielding substantial interest savings over time.

Moreover, emerging Home Equity Investment (HEI) products present alternative liquidity avenues by exchanging cash infusions for future appreciation shares. This innovative approach can complement or substitute traditional cash-out refinancing, especially for homeowners intent on avoiding additional debt burden.

Psychological and Behavioral Considerations in Refinancing Decisions

Refinancing transcends numerical analysis; behavioral economics profoundly shape borrower outcomes. Tennessee homeowners frequently grapple with decision fatigue, cognitive biases like anchoring to legacy rates, or disproportionate emphasis on short-term savings versus long-term costs. By recognizing and mitigating these biases, borrowers can make more balanced, strategic refinancing decisions.

Engagement with financial planners or mortgage consultants versed in behavioral finance can yield personalized frameworks that align refinancing decisions with overarching life goals—be it retirement planning or educational funding—thereby fostering sustainable financial well-being.

Consulting with Tennessee Mortgage Experts: When and Why It Matters Most

In a market as nuanced as Tennessee’s, partnering with seasoned mortgage advisors is indispensable. Experts adept in local economic trends and lender landscapes can unravel complex loan structures, forecast rate movements, and tailor refinancing strategies to individual financial circumstances. Their expertise uncovers latent costs or advantages often overlooked by the average borrower, optimizing refinancing outcomes.

For authoritative guidance, the Mortgage Bankers Association (MBA) provides extensive resources and a directory of certified professionals. Collaborating with such experts enhances process efficiency and financial optimization amid competitive lending environments.

Ready to harness advanced refinancing strategies tailored for Tennessee’s dynamic market? Connect with our expert advisors today and elevate your home financing journey.

Frequently Asked Questions (FAQ)

What is the ideal interest rate drop to consider refinancing in Tennessee?

Experts generally suggest refinancing when mortgage rates decline by at least 0.75% to 1% compared to your existing loan rate. This threshold usually offsets closing costs and yields meaningful monthly savings, making refinancing financially beneficial in the Tennessee market.

How does my credit score impact refinancing options in Tennessee?

Your credit score significantly affects the refinance rates and terms you qualify for. Higher scores typically grant access to lower interest rates and reduced fees. Improving your credit before refinancing can unlock better deals and increase your negotiating power with Tennessee lenders.

Should I refinance early or late in my mortgage term?

Refinancing early in your loan term maximizes interest savings over time, while late-term refinancing primarily helps reduce monthly payments or adjust loan features. Your decision should align with your financial goals and how long you plan to remain in your Tennessee home.

What role do closing costs play in my refinancing decision?

Closing costs can significantly affect the net benefit of refinancing. Calculating the break-even point—the time it takes for monthly savings to exceed these upfront costs—is crucial. If you plan to move before reaching this point, refinancing might not be financially advantageous.

How can I leverage my Loan-to-Value (LTV) ratio to get better refinance terms?

Maintaining an LTV below 80% in Tennessee typically eliminates the need for private mortgage insurance (PMI), lowering monthly expenses. You can improve your LTV by paying down principal or increasing your home’s appraised value through renovations, thereby qualifying for better refinance rates.

Are there innovative refinancing products available for Tennessee homeowners?

Yes, options like “blend-and-extend” loans, bi-weekly payment plans, and Home Equity Investment (HEI) products provide tailored solutions beyond traditional refinancing. These products can help manage payment stability, accelerate equity building, or access liquidity without conventional debt increases.

How do economic indicators affect refinancing timing in Tennessee?

Macroeconomic signals such as Federal Reserve interest rate decisions, regional employment data, and housing inventory shifts influence mortgage rates. Monitoring these indicators helps Tennessee homeowners anticipate rate movements and time their refinance to capitalize on market dips.

Why is partnering with a local Tennessee mortgage broker advantageous?

Local brokers possess in-depth knowledge of Tennessee lending landscapes, lender specials, and paperwork nuances. Their expertise streamlines the process, uncovers competitive products, and provides personalized advice tailored to your financial profile and regional market conditions.

How do psychological factors influence refinancing decisions?

Behavioral biases like decision fatigue, anchoring to previous rates, and loss aversion can lead to suboptimal refinancing choices. Awareness and guidance from behavioral finance experts can help align refinancing decisions with long-term goals, avoiding impulsive or emotionally driven actions.

What should I consider if planning to move soon after refinancing?

If you anticipate relocating within a few years, carefully evaluate the break-even period for your refinancing costs. Refinancing might not be cost-effective if you won’t remain in your Tennessee home long enough to recoup upfront expenses through monthly savings.

Trusted External Sources

- Mortgage Bankers Association (MBA) – Provides authoritative insights on mortgage market trends, regulatory updates, and certified professional directories relevant to Tennessee refinancing strategies.

- Federal Reserve Economic Data (FRED) – Offers comprehensive macroeconomic data including interest rate forecasts and employment statistics crucial for predictive analysis in Tennessee’s mortgage market.

- Tennessee Housing Development Agency (THDA) – Supplies localized housing market data, programs, and resources that help homeowners understand state-specific refinance options and assistance.

- Consumer Financial Protection Bureau (CFPB) – Delivers expert guidance on mortgage disclosures, closing costs, and consumer protections essential for informed refinancing decisions.

- National Association of Realtors (NAR) – Provides housing market analytics and reports that contextualize regional real estate trends impacting refinancing opportunities in Tennessee.

Conclusion

Refinancing your Tennessee home is a multifaceted decision that extends beyond simply chasing lower interest rates. By integrating local market understanding, credit optimization, and advanced predictive analytics, homeowners can strategically time and tailor refinancing to maximize financial benefits. Evaluating key factors such as closing costs, Loan-to-Value ratios, and behavioral influences ensures a balanced approach that aligns with both immediate needs and long-term goals. Partnering with Tennessee mortgage experts further enhances your ability to navigate complex options and secure the best possible terms. Embrace refinancing as a dynamic tool to recalibrate your mortgage in tune with evolving market conditions and personal circumstances.

Ready to optimize your Tennessee refinancing journey? Share your experiences, ask questions, or explore related expert content to empower your home financing decisions today.