Mastering the Art of Timing: When to Lock Your Refinance Mortgage Rate in Tennessee

Refinancing your mortgage in Tennessee can be a powerful tool to reduce monthly payments and save thousands over the life of your loan. However, the key to maximizing these benefits lies in knowing precisely when to lock your refinance mortgage rates in Tennessee. In 2025, market volatility, economic signals, and regional lending trends all intersect, making timing more critical than ever.

Decoding Tennessee’s 2025 Refinance Rate Landscape: More Than Just Numbers

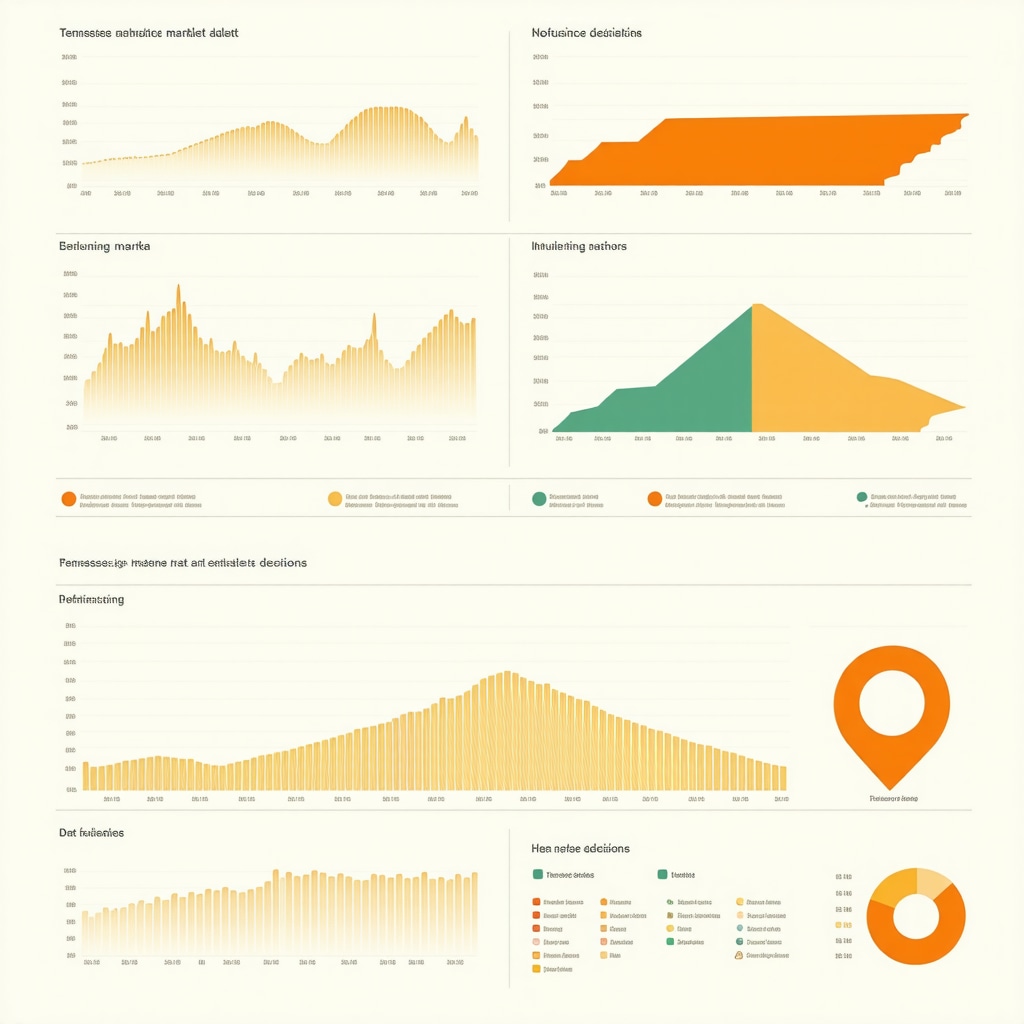

Mortgage rates don’t move in isolation; they respond to broader economic factors such as inflation, Federal Reserve policies, and housing demand. Tennessee’s unique market dynamics — including localized employment growth and housing inventory shifts — also shape refinance rates. For instance, a sudden uptick in Nashville’s housing market can subtly influence lender risk assessments statewide, nudging rates upward.

Experienced homeowners in Tennessee have noticed how regional nuances, like Memphis’s competitive lending environment, can present unexpected refinancing windows. Staying attuned to these shifts means you don’t just chase rates blindly but understand the underlying market forces.

Is It Ever Too Early or Too Late to Lock Your Tennessee Refinance Rate?

One common question is whether locking too early might cause missed savings if rates drop further, or if waiting too long risks higher costs. While no crystal ball exists, expert lenders advise a strategic “float-down” approach: lock when rates dip to a competitive level, but ensure your lender offers a float-down option allowing you to capitalize on future declines. This tactic blends security with flexibility — vital in Tennessee’s fluctuating market.

Practical Tips to Maximize Savings: From Credit Scores to Loan Types

Your creditworthiness significantly influences the refinance mortgage rates available to you. Improving your credit score before refinancing can lower your rate by notable fractions of a percent, translating into substantial savings. Additionally, choosing between fixed and adjustable refinance mortgage rates affects timing decisions; fixed rates provide stability, while adjustable rates might offer initial savings but carry risk if rates rise.

For a deeper dive on choosing between fixed and adjustable mortgages in Tennessee, explore our expert guide here. Furthermore, understanding FHA or conventional refinance options tailored to Tennessee’s market can open doors to better rates and terms.

Leveraging Local Expertise: Partnering with Tennessee Mortgage Professionals

Refinancing is not just about numbers; it’s also about relationships and insights. Tennessee mortgage brokers and lenders often have proprietary data and forecasts that can guide your lock timing more precisely. Engaging with local experts, especially those familiar with your city’s market nuances, can mean the difference between a good refinance and a great one.

Consider consulting trusted Tennessee mortgage brokers who specialize in refinancing strategies to lower your mortgage rate in 2025 for personalized advice tailored to your financial goals.

Real-Life Scenario: How Timing Saved a Memphis Homeowner Thousands

Take the example of Sarah, a Memphis homeowner who monitored refinance mortgage rates closely in early 2025. By locking her rate just before a Federal Reserve announcement that pushed rates higher, she secured a 0.5% lower rate than she would have otherwise. This strategic decision saved her over $20,000 across her loan term, demonstrating the tangible impact of well-timed locks.

If you’re intrigued by how such strategies apply to your situation, our comprehensive resource on when to lock refinance rates in Tennessee covers these insights in detail.

Stay Ahead with Authoritative Insights and Market Updates

For the most accurate, up-to-date information on Tennessee refinance mortgage rates, regularly consult authoritative financial news sources and Federal Reserve communications. Websites like Federal Reserve Monetary Policy Reports provide direct insight into factors influencing mortgage rates nationwide, including Tennessee.

Understanding these macroeconomic indicators alongside local Tennessee market trends equips you to make informed, expert decisions about locking your refinance mortgage rate in 2025.

Have you recently navigated refinancing in Tennessee or have questions about locking strategies? Reach out to our mortgage experts or share your experience in the comments below. Your insights could help fellow Tennessee homeowners save big!

Understanding the Role of Economic Signals in Your Refinance Timing

When I first started considering refinancing my home in Tennessee, I quickly realized it wasn’t just about the current interest rate number flashing on my screen. It was about interpreting the economic signals behind those numbers. For instance, inflation rates and Federal Reserve policy shifts often foreshadow mortgage rate movements. Back in early 2025, I closely watched inflation reports and the Fed’s monetary policy updates. These gave a real-time pulse on whether rates were likely to climb or dip. The Federal Reserve Monetary Policy Reports became my go-to resource for credible information that helped me avoid premature locking when rates briefly spiked but were expected to settle back down.

How Local Market Trends Influenced My Mortgage Refinance Decision

Beyond national indicators, I found Tennessee’s local real estate trends to be just as crucial. Nashville’s booming housing market, for example, tends to put upward pressure on mortgage rates statewide. On the flip side, slower markets in some rural areas offered occasional refinancing opportunities at lower rates. Memphis, with its competitive lending environment, provided unique windows where savvy borrowers could lock exceptionally favorable rates — as Sarah’s story earlier illustrated.

What’s Your Biggest Concern When Deciding to Lock a Refinance Rate?

Many homeowners I’ve spoken with worry about missing out on lower rates if they lock too early or getting caught with higher payments if they wait too long. It’s a balancing act, for sure. Are you more concerned about potential rate drops after locking, or the risk that rates might rise unexpectedly? Sharing your thoughts can help create a community of informed Tennessee homeowners making smarter refinance choices.

Personal Credit Score Improvements: A Game Changer in Rate Negotiation

One practical tip I can’t stress enough is how enhancing your credit score before refinancing can unlock significantly better mortgage rates. Even a modest boost can translate into thousands saved over the loan term. I worked on paying down credit card balances and resolving minor errors on my credit report before applying for refinancing. This effort made a tangible difference in the rates lenders offered me, reinforcing the advice from trusted mortgage brokers in Tennessee.

Choosing the Right Loan Type for Your Refinance Goals

Deciding between fixed and adjustable refinance mortgage rates is another key factor that shaped my refinancing experience. Fixed rates offered me peace of mind with predictable payments, while adjustable rates presented tempting initial savings but carried uncertainty. Depending on your financial goals and market outlook, your choice might differ. For an in-depth exploration, I recommend checking out our detailed guide on fixed vs adjustable mortgage rates in Tennessee.

How Working With Local Tennessee Mortgage Experts Made a Difference

Partnering with knowledgeable local mortgage brokers was invaluable. They provided insider insights on lender trends and timing strategies that I wouldn’t have found on my own. Their expertise helped me navigate nuances unique to Tennessee’s housing markets, ultimately guiding me to lock at the right moment. If refinancing is on your radar, I encourage you to connect with trusted Tennessee mortgage professionals who can tailor strategies to your needs.

If you’ve had experiences with refinancing or locking mortgage rates in Tennessee, please share your story in the comments below. Your input might just be the insight another homeowner needs. And for more tips on refinancing strategies, explore our comprehensive resource on when to lock refinance rates in Tennessee.

Dynamic Hedging Techniques: Protecting Your Tennessee Refinance Rate Against Market Fluctuations

In the ever-evolving landscape of Tennessee’s mortgage refinance market, savvy borrowers and financial experts are turning to dynamic hedging strategies to manage the inherent uncertainties of interest rate movements. Unlike a simple rate lock, dynamic hedging involves using financial derivatives or layered lock options to mitigate risk exposure while preserving flexibility. This approach is particularly beneficial in 2025’s unpredictable environment, where Federal Reserve signals and local market volatility converge.

For instance, some lenders now offer customized rate lock agreements combined with rate lock extensions or float-down clauses that allow borrowers to adjust their locked rates if market conditions improve. Borrowers can also utilize interest rate caps or collars, tools more commonly seen in corporate finance, to set boundaries on their refinance costs. Although these instruments may seem complex, consulting with Tennessee mortgage professionals experienced in such strategies can unlock significant savings and peace of mind.

Harnessing Predictive Analytics and AI for Optimal Lock Timing in Tennessee Refinances

The integration of predictive analytics and artificial intelligence (AI) models into mortgage lending is revolutionizing how homeowners approach refinance rate locks. By analyzing vast datasets — including economic indicators, housing market trends, and lender behavior — these systems forecast rate movements with increasing accuracy.

Leading Tennessee lenders are beginning to adopt AI-driven tools that provide personalized recommendations on when to lock refinance mortgage rates, considering your credit profile, loan amount, and local market conditions. This technology moves beyond generic advice, instead delivering nuanced, data-backed timing strategies tailored to your unique refinancing goals.

Engaging with lenders who leverage these advanced analytical tools can offer a competitive edge, especially when timing the lock amidst 2025’s fluctuating mortgage rate environment.

How Can Advanced Rate Lock Products Like Float-Down and Re-Lock Options Minimize Refinancing Risks?

Many Tennessee homeowners grapple with the dilemma of locking in a refinance rate too early or too late, each carrying its risks. Advanced rate lock products such as float-down and re-lock options provide strategic solutions. A float-down allows borrowers to benefit if rates drop after locking, while a re-lock provides the opportunity to reset the rate under specific circumstances.

These options typically come at a premium or require specific lender qualifications but can be invaluable in volatile markets. It’s essential to compare terms and fees carefully. Consulting with Tennessee mortgage experts who understand these products can help tailor a refinancing strategy that balances cost with risk mitigation effectively.

Integrating Macroeconomic Indicators with Tennessee-Specific Housing Data for Refine Rate Insights

While national economic signals like the Consumer Price Index (CPI) and Federal Reserve rate decisions set the backdrop, integrating these with Tennessee’s localized housing data offers a richer, more actionable insight into refinance rate timing. For example, monitoring regional home price indices, housing starts, and employment rates in Tennessee’s metropolitan areas like Nashville, Memphis, and Knoxville can reveal early signs of mortgage rate shifts.

According to a recent National Association of Realtors report, Tennessee’s housing inventory tightness combined with rising construction costs suggests upward pressure on mortgage rates could persist. Recognizing such patterns empowers borrowers to anticipate rate trends rather than react to them.

Collaborative Refinancing: How Peer Networks and Local Forums Enhance Rate Lock Decisions

Beyond professional advice, engaging with peer networks—such as local Tennessee homeowner groups and online forums—can provide real-time insights and experiential knowledge about lender responsiveness and rate lock success stories. These communities often share nuanced details about lender-specific float-down policies or promotional refinance offers that aren’t widely advertised.

Participating in such dialogues can complement expert guidance, equipping you with a comprehensive understanding of your refinance landscape.

Ready to navigate Tennessee’s refinance mortgage rate locks with cutting-edge strategies? Connect with our seasoned mortgage advisors today to customize your approach and maximize your savings potential.

Exploring Sophisticated Financial Instruments to Enhance Your Refinance Strategy

Beyond conventional rate locks and float-down options, Tennessee homeowners increasingly consider sophisticated financial instruments such as interest rate swaps and caps to hedge refinancing risk. These tools, typically reserved for institutional borrowers, are now accessible through specialized mortgage brokerage services, allowing homeowners to tailor exposure to interest rate fluctuations. By structuring a swap agreement, a borrower can effectively exchange a variable rate obligation for a fixed rate, insulating against potential hikes during the refinance process. Similarly, purchasing an interest rate cap sets a maximum borrowing cost, providing a safety net without foregoing the potential benefits of rate declines.

Utilizing Behavioral Economics Insights to Optimize Lock Timing Decisions

Understanding the psychological biases that influence borrower decisions is an emerging frontier in refinance rate locking. Tennessee mortgage advisors are leveraging behavioral economics principles to guide clients away from common pitfalls such as loss aversion and overconfidence. For example, encouraging clients to commit to a lock rate within a predefined window rather than perpetually waiting for a better rate mitigates procrastination risks and market timing errors. This approach, combined with disciplined adherence to data-driven signals, enhances outcomes by aligning emotional impulses with rational financial planning.

What Are the Best Practices for Integrating AI Forecasts with Personal Financial Goals in Rate Lock Decisions?

Integrating AI-driven predictive analytics into refinancing decisions necessitates a nuanced approach. The best practices involve calibrating AI forecasts with individual financial objectives, such as acceptable risk tolerance, loan duration preferences, and cash flow constraints. Tennessee borrowers should request lenders to provide scenario analyses generated by AI platforms illustrating potential rate trajectories and corresponding payment impacts. This empowers homeowners to contextualize AI recommendations rather than accepting them at face value, ensuring that the timing of their rate lock harmonizes with their unique financial landscape.

Leveraging Authoritative Data: Insights from the Mortgage Bankers Association

The Mortgage Bankers Association (MBA) offers granular data and forecasts pivotal for Tennessee borrowers aiming to master rate lock timing. Their weekly Mortgage Finance Forecasts combine macroeconomic indicators with regional housing market analyses, providing unparalleled clarity on anticipated rate trends. Engaging with MBA resources equips homeowners and mortgage professionals alike to navigate the complexities of 2025’s refinance environment with foresight and confidence.

By adopting these advanced methodologies and data sources, Tennessee homeowners can convert refinancing from a transactional event into a strategic financial maneuver.

Ready to elevate your refinance strategy with cutting-edge insights and tailored solutions? Connect with our expert mortgage consultants today and secure your optimal rate lock with confidence.

Frequently Asked Questions (FAQ)

What factors should I consider before deciding when to lock my refinance mortgage rate in Tennessee?

When deciding on the timing to lock your refinance mortgage rate, consider macroeconomic indicators such as Federal Reserve policies and inflation trends, local market conditions like housing inventory and employment rates, your personal credit score, and the type of loan you are refinancing into. Combining these factors gives you a comprehensive view of the optimal locking moment.

How does a float-down option work, and is it beneficial for Tennessee homeowners?

A float-down option allows you to lock a refinance mortgage rate but still benefit if rates drop before closing. While this option often entails additional fees or lender qualifications, it offers flexibility in volatile markets like Tennessee’s, helping borrowers minimize refinancing risk without losing potential savings.

Can improving my credit score significantly impact the refinance rate offered?

Absolutely. Even a modest credit score improvement can lead to lower refinance mortgage rates, reducing your monthly payments and total loan cost substantially. Prioritize paying down debts and correcting credit report errors before applying to maximize your rate advantage.

Should I choose a fixed or adjustable refinance mortgage rate in Tennessee?

The choice depends on your financial goals and risk tolerance. Fixed rates provide payment stability and protection from rate increases, ideal for long-term planning. Adjustable rates might start lower but carry the risk of future rate hikes. Tennessee homeowners should assess local rate trends and consult expert guides when making this decision.

How do local Tennessee market trends affect refinance rate timing?

Regional dynamics such as Nashville’s booming housing market or Memphis’s competitive lending environment influence lender risk assessments and rate availability. Understanding these local trends helps identify optimal windows to lock rates before market shifts push rates higher.

What role do advanced financial instruments like interest rate swaps and caps play in refinancing?

These sophisticated tools allow homeowners to hedge against interest rate fluctuations during refinancing. While traditionally institutional, some Tennessee mortgage brokers now offer access to swaps and caps, providing customized risk management strategies beyond conventional rate locks.

How can AI and predictive analytics improve my refinance rate lock decisions?

AI models analyze vast economic and market data to forecast rate movements tailored to your financial profile. Tennessee lenders leveraging these tools offer personalized timing recommendations, helping you avoid premature locks or missed savings opportunities in 2025’s volatile environment.

What are the best practices for integrating AI forecasts with my personal financial goals?

Review AI-generated scenario analyses with your lender, focusing on your risk tolerance, loan duration, and cash flow needs. Use these insights as guidance rather than absolute predictions, ensuring your rate lock timing aligns with your unique financial situation and goals.

How do behavioral economics insights help in timing a refinance rate lock?

Understanding biases like loss aversion and overconfidence helps borrowers avoid procrastination and poor timing decisions. Setting predefined lock windows and adhering to disciplined, data-driven strategies ensures more rational and effective refinance timing.

Where can I find reliable, authoritative data to stay informed about Tennessee refinance rates?

Resources like the Federal Reserve Monetary Policy Reports, Mortgage Bankers Association forecasts, and National Association of Realtors regional housing data provide credible, up-to-date information essential for mastering refinance rate timing in Tennessee.

Trusted External Sources

- Federal Reserve Monetary Policy Reports – These reports offer comprehensive insights into national monetary policy decisions, inflation trends, and economic outlooks that directly influence mortgage rates nationwide, including Tennessee, helping borrowers anticipate rate movements.

- Mortgage Bankers Association (MBA) – The MBA provides detailed weekly Mortgage Finance Forecasts combining macroeconomic data with regional housing analyses, enabling Tennessee homeowners and professionals to forecast refinance rate trends with precision.

- National Association of Realtors (NAR) – NAR’s research on housing inventory, construction, and pricing trends in Tennessee’s metropolitan areas provides localized context crucial for understanding market-driven mortgage rate fluctuations.

- Tennessee Housing Development Agency (THDA) – THDA offers state-specific programs, refinancing options, and market insights tailored to Tennessee residents, serving as a valuable resource for refinancing strategies and rates.

- Consumer Financial Protection Bureau (CFPB) – The CFPB provides guidelines on mortgage products, rate lock options, and consumer protections, equipping borrowers to make informed decisions regarding refinance rate locking.

Conclusion

Mastering when to lock your refinance mortgage rate in Tennessee in 2025 requires a multi-faceted approach that blends awareness of macroeconomic signals, deep understanding of local housing market dynamics, and personal financial preparedness. Utilizing advanced tools like float-down options, AI-driven analytics, and sophisticated hedging instruments can significantly mitigate risks and enhance savings. Partnering with local mortgage experts and engaging with trusted data sources further empowers homeowners to navigate the complex refinance landscape with confidence. By synthesizing these expert strategies and insights, Tennessee homeowners can transform refinancing into a strategic financial opportunity rather than a reactive transaction. Share your experiences, ask questions, and explore our expert resources to refine your approach and secure the best possible mortgage rates today.