My Journey into Tennessee Mortgage Shopping: A Personal Perspective

When I first started exploring home buying in Tennessee, I was overwhelmed by the various mortgage options and fluctuating rates. I remember sitting at my kitchen table, surrounded by internet tabs, trying to decode the best time to lock in a rate. It felt like navigating a maze, but over time, I discovered practical strategies that truly made a difference. Today, I want to share my personal tips on mortgage rate shopping that can help Tennessee buyers save big in 2025.

Understanding Tennessee’s Mortgage Landscape: What I Learned

One of the first things I realized was that Tennessee’s mortgage market is dynamic, influenced by both local and national economic factors. For instance, I found that FHA loan trends are particularly relevant for first-time buyers like myself, offering lower down payment options. Staying informed about these trends helped me time my application better and negotiate more effectively.

How to Spot the Best Mortgage Deals in Tennessee

My secret weapon was daily monitoring of mortgage rates. I used reliable sources and set alerts to catch rate dips. The key is consistency and patience. I also learned that getting pre-approved early gave me leverage when negotiating with lenders. For those wondering about the best loan types, I recommend exploring fixed versus adjustable-rate mortgages and understanding their long-term implications. An insightful resource I found was this guide on fixed vs adjustable rates.

What Are the Biggest Myths About Tennessee Mortgage Rates?

Is it true that shopping around just wastes time, or can it really save money?

In my experience, shopping around is essential. I contacted multiple lenders—some online, some local—and discovered that rates can vary significantly. It’s worth investing time to compare offers. Also, understanding what influences your mortgage rate, such as your credit score, income stability, and debt-to-income ratio, is crucial. For example, I improved my credit score by paying down debt, which positively impacted my interest rate, as explained in this authoritative article.

If you’re like me, eager to secure the best deal, I encourage you to stay informed about market forecasts for 2025 and use daily rate updates to your advantage. Remember, the right timing and preparation can save thousands of dollars over the life of your loan.

Have you already started your mortgage shopping journey? Share your experiences or ask questions below—I love hearing from fellow Tennessee homebuyers!

How Can Tennessee Homebuyers Leverage Market Trends for Optimal Mortgage Rates?

Understanding the nuances of Tennessee’s mortgage market in 2025 requires a keen eye on both local and national economic indicators. Factors such as employment rates, housing inventory, and Federal Reserve policies directly influence mortgage rate fluctuations. Monitoring these trends allows buyers to identify the most advantageous times to lock in their rates. For instance, recent insights from this authoritative source highlight the importance of staying informed about market shifts to maximize savings.

What Are the Practical Steps to Lock in the Best Tennessee Mortgage Rates in 2025?

Locking in a favorable rate involves strategic planning and proactive engagement with lenders. Start by getting pre-approved early, which not only strengthens your bargaining position but also provides a clearer picture of your budget. Keep an eye on daily rate updates, as these can signal upcoming rate dips. When you spot a promising rate, consider locking it in to avoid potential increases. Additionally, working with a trusted mortgage broker can give you access to exclusive offers and expert advice tailored to Tennessee’s market conditions. For comprehensive guidance, explore this detailed guide.

How Do Local Tennessee Market Factors Impact Your Mortgage Rate Decisions?

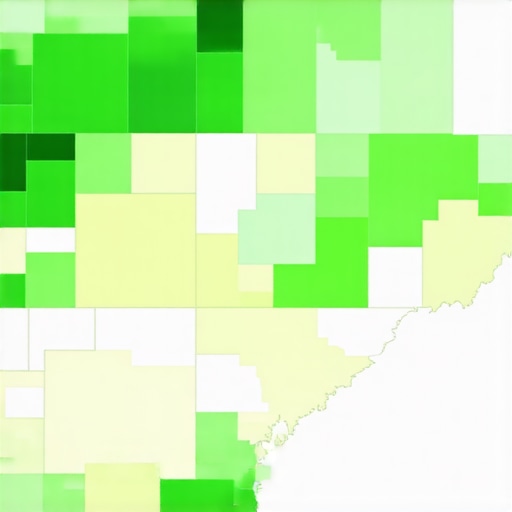

Local housing market dynamics significantly affect mortgage rates and loan availability. In areas with high demand, lenders may tighten lending criteria or offer less favorable terms, while regions with slower growth may present more competitive rates. Tennessee’s diverse markets—from Nashville’s booming suburbs to Memphis’s steady neighborhoods—require tailored strategies. Staying updated on regional trends through sources like this resource can help you time your purchase and financing optimally.

Image prompt: Tennessee housing market map showing regional trends and mortgage rate influences, illustrating local market diversity and its impact on homebuyers.

What Are the Top Mistakes to Avoid When Shopping for Tennessee Mortgage Rates?

One common mistake is failing to compare multiple lenders’ offers, which can lead to higher costs over the loan term. Another pitfall is neglecting to understand the long-term implications of fixed versus adjustable-rate mortgages—each has distinct advantages depending on your financial goals. Additionally, not maintaining or improving your credit score can result in less favorable rates. To avoid these pitfalls, consult trusted sources like this expert article and consider working with a knowledgeable mortgage professional.

If you’re eager to explore more about Tennessee mortgage options, I recommend visiting this resource for localized insights and tailored strategies.

Have you already started comparing mortgage offers? Share your experiences or ask questions below—I love hearing from fellow Tennessee homebuyers!

How Do I Navigate Tennessee’s Mortgage Market with Greater Confidence?

Reflecting on my journey, I realize that understanding the intricate factors influencing Tennessee’s mortgage rates requires more than just monitoring national trends. It involves a nuanced appreciation of regional economic shifts, local housing policies, and even seasonal market variations. For instance, I found that regions like Nashville and Memphis experience distinct mortgage dynamics, which can affect the timing and terms of your loan. Exploring detailed insights at this resource helped me craft a more tailored approach. The key is to stay proactive, continuously educate yourself, and leverage local market intelligence to make smarter decisions.

What Are the Hidden Nuances When Locking in a Mortgage Rate in Tennessee?

In my experience, the decision to lock in a rate isn’t just about current numbers but also about understanding the subtle signals that precede rate shifts. I learned to watch for economic indicators like employment reports, Federal Reserve statements, and regional housing inventory levels. Sometimes, a slight dip in rates can be a precursor to a more significant trend, which I could capitalize on by acting swiftly. Working with a knowledgeable broker who understands these nuances often gave me an edge. For comprehensive guidance, I recommend reviewing this detailed guide. It emphasizes the importance of timing and market awareness, empowering you to make confident decisions.

How Can I Use Market Data to Optimize My Mortgage Strategy?

Using trend data effectively requires a blend of analytical skills and intuition. I found that keeping a close eye on daily mortgage rate updates enabled me to identify patterns and predict potential shifts. For example, when I noticed rates stabilizing or slightly decreasing over a week, I would prepare to lock in my rate before an anticipated rise. Tools like rate alerts and market analysis reports became invaluable. Moreover, understanding external factors—such as regional employment trends or policy changes—added layers of confidence to my timing. For those interested, exploring market outlooks for 2025 can provide strategic foresight. My advice: stay informed, be patient, and act decisively when the opportunity aligns.

What Are the Most Overlooked Factors That Could Affect My Tennessee Mortgage Rate?

One overlooked aspect is your credit profile’s evolving impact during the mortgage process. I initially thought that my credit score was fixed, but I learned that even minor improvements—like reducing credit card balances or correcting errors—can lead to substantial rate discounts. Additionally, regional economic health, such as Tennessee’s employment rates and housing demand, subtly influences lender risk assessments. Sometimes, local developments like new industries or infrastructure projects can shift market conditions unexpectedly. To deepen my understanding, I turned to this authoritative article. Recognizing and adapting to these nuances can significantly enhance your mortgage strategy, ensuring you don’t miss out on savings.

If you’re actively comparing offers or considering refinances, I encourage you to share your experiences or ask questions below. Connecting with fellow Tennessee buyers who are navigating similar challenges can provide invaluable insights and moral support.

How Do Local Market Factors Shape My Long-term Mortgage Planning?

Understanding that local market conditions are dynamic is crucial for long-term planning. In some Tennessee regions, rapid economic growth can lead to rising property values and tighter lending criteria, while others remain more stable. This variability means your mortgage decisions should be flexible and adaptable. For example, locking in a favorable rate today might be beneficial if market forecasts predict a rise, but waiting could pay off if a downturn seems imminent. I found that staying engaged with regional economic reports, such as those available at this source, helped me align my strategy with evolving conditions. Ultimately, informed long-term planning is about balancing current opportunities with future risks, which requires ongoing vigilance and a willingness to adapt as the market shifts.

Leveraging Advanced Market Analytics for Optimal Rate Lock-In

One of the most sophisticated techniques I adopted involved integrating real-time market analytics with predictive modeling. By utilizing tools like market sentiment analysis and economic indicator tracking—such as regional employment trends and Federal Reserve monetary policies—I was able to anticipate when rates might dip or surge. For example, I monitored the latest insights on Tennessee’s housing market, which provided granular data on regional economic shifts. This approach moved beyond basic rate monitoring, allowing me to align my lock-in timing with statistically significant market movements, resulting in substantial savings and minimized risk.

How Can Deep Credit Profile Optimization Elevate Your Rate Negotiation?

Beyond standard credit score improvements, I found that conducting a comprehensive review of my credit report—disputing inaccuracies, reducing credit utilization ratios, and strategically timing credit inquiries—had a profound impact. According to this authoritative resource, even minor credit score boosts can unlock lower interest brackets. I also explored alternative credit-building strategies, such as secured credit cards and small installment loans, which further strengthened my profile. This meticulous credit management not only enhanced my eligibility but also empowered me to negotiate better terms directly with lenders, emphasizing the importance of a multi-faceted credit enhancement plan.

What Are the Nuances of Timing in Refinance Rate Opportunities?

Refinancing in Tennessee requires a nuanced understanding of market cycles. I learned that optimal refinancing opportunities often occur when rates are predictably declining due to macroeconomic factors, such as Federal Reserve rate cuts or regional economic slowdowns. For precise timing, I analyzed historical rate trends using the refinance rate forecasts and combined them with my personal financial goals. This strategic approach allowed me to lock in low rates before market reversals, ensuring long-term savings and manageable monthly payments. Staying vigilant to market signals and economic reports proved essential in executing successful refinances that aligned with my financial objectives.

How Do External Economic Indicators Shape My Long-Term Mortgage Planning in Tennessee?

Understanding external indicators—such as inflation rates, employment statistics, and regional development projects—became integral to my long-term strategy. I tracked Tennessee’s employment growth through sources like the economic reports, which revealed patterns influencing mortgage costs. For instance, a surge in new industry investments often correlates with increased housing demand and rising rates, prompting me to consider locking rates early. Conversely, signs of economic slowdown suggested potential rate declines, encouraging patience. This macroeconomic comprehension enabled me to craft a resilient mortgage plan, balancing immediate savings with future market flexibility, ultimately reducing the risk of unfavorable rate shifts.

If you’re interested in deepening your understanding of these advanced strategies, I invite you to connect through my contact page. Sharing insights and discussing personalized approaches can significantly enhance your mortgage success in 2025.

Things I Wish I Knew Earlier (or You Might Find Surprising)

Understanding the Power of Local Market Trends

When I first started my mortgage journey in Tennessee, I underestimated how regional economic factors could influence my rates. Discovering that Nashville’s booming economy and Memphis’s steady growth impacted local lending practices was a game-changer for me. It taught me to pay attention to regional news and housing reports, which helped me time my rate lock more effectively.

The Hidden Impact of Credit Profile Nuances

I used to think only my credit score mattered, but I learned that minor credit report details, like disputing errors or reducing balances, could significantly lower my interest rate. This insight motivated me to review my credit report meticulously and make small improvements that paid off in big savings.

Timing Is Everything—But How Do You Know When?

Market fluctuations can be unpredictable, but I found that monitoring daily rate updates and economic indicators helped me anticipate rate dips. Lock-in timing became less of a gamble, and I felt more confident making decisions about when to lock my rate.

Don’t Overlook Long-Term Planning

Thinking ahead about potential market shifts and regional developments allowed me to craft a flexible mortgage strategy. I kept an eye on industry growth, infrastructure projects, and employment data, which informed my decisions on whether to refinance or wait for better rates.

Resources I’ve Come to Trust Over Time

- Federal Reserve Economic Data (FRED): This comprehensive database helped me understand macroeconomic trends impacting mortgage rates. I recommend it for anyone wanting to grasp the bigger picture.

- Bankrate.com: Their detailed rate trend analysis and forecasts made it easier for me to spot opportunities and plan my moves.

- MyMortgageInsider: A trusted blog that offers insider tips and updates on Tennessee-specific market conditions, which proved invaluable for my decision-making process.

Parting Thoughts from My Perspective

Looking back, my key takeaway is that patience, research, and local market awareness can truly make a difference in securing the best Tennessee mortgage rates. I encourage anyone embarking on this journey to stay informed, be strategic, and don’t hesitate to seek expert advice. If this resonates with you, I’d love to hear your thoughts or experiences—feel free to drop a comment or reach out through my contact page. Remember, your mortgage journey is uniquely yours, and with a little effort, you can find the best deals in 2025 and beyond.