Navigating Tennessee’s Mortgage Rate Landscape: What 2025 Holds

As Tennessee’s housing market evolves, potential buyers and homeowners alike are keenly focused on the trajectory of mortgage rates in 2025. Understanding these predictions is not merely academic; it’s a practical necessity to make informed financing decisions amidst fluctuating economic tides. Drawing from current market analytics and expert commentary, this article offers a nuanced exploration of what influences mortgage rates in Tennessee and how savvy borrowers can position themselves advantageously.

Unpacking Key Drivers: Economic and Regional Forces Shaping Tennessee Mortgage Rates

Mortgage rates in Tennessee, much like the national averages, are intricately tied to macroeconomic indicators such as inflation, Federal Reserve policies, and bond market yields. However, local factors—such as Tennessee’s employment growth, housing demand, and state-specific lending trends—also play pivotal roles. For instance, with Tennessee’s expanding job market in cities like Nashville and Knoxville, increased demand for housing could exert upward pressure on rates due to competitive lending environments.

Moreover, mortgage offerings in Tennessee often reflect the balance between conventional loans and government-backed options like FHA loans, whose rates can differ based on federal policy adjustments. For deeper insight into FHA loan rate trends and opportunities specific to Tennessee, exploring resources like this detailed guide can be invaluable.

Strategic Borrowing: How to Lock in the Best Rates Amidst Volatility

Given the inherent volatility in mortgage markets, expert strategies emphasize the importance of timing and loan choice. Fixed-rate mortgages offer predictable payments and shield borrowers from potential rate hikes, whereas adjustable-rate mortgages (ARMs) might initially present lower rates but carry risks if rates climb later. For Tennessee buyers weighing these options, the comprehensive guide on fixed vs. adjustable rates provides a critical framework to decide which mortgage type aligns with one’s financial goals.

Additionally, creditworthiness remains a cornerstone in securing favorable mortgage terms. Borrowers with higher credit scores in Tennessee typically access lower interest rates, underscoring the merit of credit improvement efforts before applying for a mortgage. Insights on credit score impacts can be found in this expert resource.

What Are the Most Reliable Indicators for Predicting Mortgage Rate Trends in Tennessee for 2025?

Experts analyze a blend of leading economic indicators, including the Federal Reserve’s policy signals, Treasury bond yields, and regional housing market dynamics to forecast mortgage rates. In Tennessee, the interplay between local economic growth, housing inventory levels, and broader national monetary policy creates a complex mosaic that shapes rate movements. For example, an unexpected rise in inflation could prompt the Fed to tighten monetary policy, indirectly pushing mortgage rates higher. Conversely, a cooling housing market might ease rate pressures locally. Such multifactorial analysis helps lenders and borrowers anticipate shifts with greater precision.

For those interested in detailed market predictions and strategies tailored to Tennessee’s unique context, this authoritative forecast offers an in-depth look at upcoming trends.

Practical Experience: Case Study of Tennessee Homebuyers Navigating 2025 Rate Changes

Consider a Nashville couple planning to purchase their first home in mid-2025. By monitoring rate trends and locking in a fixed-rate mortgage during a temporary dip, they could secure payments significantly lower than waiting for potential rate increases later in the year. This strategic timing, informed by expert forecasts and a thorough credit review process, illustrates how practical application of these insights can lead to substantial long-term savings.

Such real-world scenarios emphasize that proactive engagement with mortgage forecasts and lender consultations is essential. Prospective Tennessee buyers should also explore local lending resources and broker comparisons to optimize their loan terms, as advised in this guide on mortgage lenders in Tennessee.

To stay ahead in Tennessee’s dynamic mortgage market, share your experiences or questions below and join a community dedicated to smart home financing decisions.

For further authoritative insights on mortgage rate determinants, the Federal Reserve’s official monetary policy updates remain a primary resource for understanding the macroeconomic context behind mortgage movements.

Learning from Local Experts: Tennessee Mortgage Brokers and Their Insider Tips

One of the biggest lessons I’ve learned while navigating Tennessee’s mortgage landscape is the value of tapping into local expertise. Mortgage brokers based right here in Tennessee often have their fingers on the pulse of subtle market shifts that national headlines might miss. For example, a trusted broker I connected with in Knoxville shared how seasonal employment trends and regional construction booms can temporarily influence lending rates. These insights helped me time my mortgage lock more strategically.

If you’re curious about how mortgage brokers differ from lenders and which might be best suited for your financial goals, consider reading this detailed comparison. It helped me decide to work with a broker, which ultimately saved me both time and money.

When Should You Consider Refinancing in Tennessee? My Personal Take

Refinancing can be a powerful tool to lower your monthly payments or shorten your loan term, but timing is everything. I recall a period in early 2025 when mortgage rates dipped unexpectedly. I took the opportunity to refinance my home loan, reducing my interest rate by nearly half a percentage point. The savings over the life of the loan were substantial.

However, it’s crucial to analyze closing costs and your long-term plans before jumping in. For a more comprehensive guide on timing a refinance in Tennessee, I recommend this resource on refinance rates and lock strategies. It gave me the confidence to make an informed decision that aligned perfectly with my financial goals.

How Can Understanding Tennessee’s Economic Trends Affect Your Mortgage Strategy?

This question really got me thinking during my mortgage journey. It turns out that staying informed about Tennessee’s economic indicators—like employment growth, inflation trends, and housing supply—can offer a strategic advantage. For instance, a report from the Federal Reserve Bank of Atlanta highlights how regional economic strength tends to correlate with slight upticks in mortgage rates, due to increased demand and lending risk perceptions.

By keeping an eye on these trends, I could better anticipate rate movements and plan my mortgage applications accordingly. It’s a dynamic dance between macroeconomic forces and personal financial readiness.

Have you ever timed a mortgage or refinance based on economic news or local market changes? Share your experience in the comments below! I’d love to hear how others approach this complex but rewarding process.

For those wanting to dive deeper into Tennessee’s FHA loan options and their impact on mortgage rates, this guide offers clear, practical advice that I found incredibly helpful.

Decoding Complex Mortgage Rate Influences: Beyond Basics to Advanced Economic Indicators in Tennessee

While general economic factors like inflation and Federal Reserve policies undeniably impact mortgage rates, an expert-level analysis requires delving deeper into nuanced indicators that uniquely affect Tennessee’s market. For instance, the yield curve’s shape—specifically the spread between 2-year and 10-year Treasury notes—can provide forward-looking signals about interest rate trajectories. A flattening or inverted curve often hints at economic slowdowns, which might temporarily suppress mortgage rates. Conversely, a steepening curve signals growth expectations that may elevate rates.

Additionally, Tennessee’s regional fiscal policies, such as state tax incentives for real estate development and urban infrastructure investments, subtly influence lending risk profiles and mortgage pricing. Lenders factor in these variables when calibrating risk premiums, especially in rapidly expanding metropolitan areas like Chattanooga and Memphis. This sophisticated interplay means astute borrowers benefit from monitoring local government announcements alongside traditional economic data.

How Do Seasonal and Demographic Shifts in Tennessee Affect Mortgage Rate Fluctuations?

Seasonal labor market variations, particularly in industries dominant in Tennessee—such as manufacturing and tourism—can temporarily alter housing demand and subsequently mortgage rate offerings. For example, increased hiring during holiday seasons or summer peaks can boost homebuyer confidence and lending activity, nudging rates upward due to heightened demand. Conversely, off-peak slowdowns might create brief windows for rate negotiation.

Demographically, Tennessee’s growing population of millennials entering the housing market creates sustained demand pressure, encouraging lenders to innovate mortgage products tailored to this cohort’s preferences. These include hybrid adjustable-rate mortgages with initial fixed periods and flexible refinancing options. Understanding these demographic-driven market dynamics enables borrowers to strategically select loan products optimized for their life stage and financial plans.

Leveraging Predictive Analytics and AI in Tennessee Mortgage Rate Forecasting

The advent of advanced predictive analytics and artificial intelligence (AI) tools is revolutionizing mortgage rate forecasting. In Tennessee, several lenders and financial institutions are deploying machine learning models that integrate vast datasets—ranging from macroeconomic indicators to localized real estate trends—to generate more precise mortgage rate projections. These models can simulate various economic scenarios, helping borrowers and brokers anticipate rate movements beyond conventional wisdom.

Moreover, AI-powered chatbots and virtual advisors provide personalized mortgage guidance by analyzing individual credit profiles, debt-to-income ratios, and market timing, thus enabling borrowers to lock in rates strategically. Embracing these technological advancements can significantly enhance decision-making quality in Tennessee’s increasingly complex mortgage landscape.

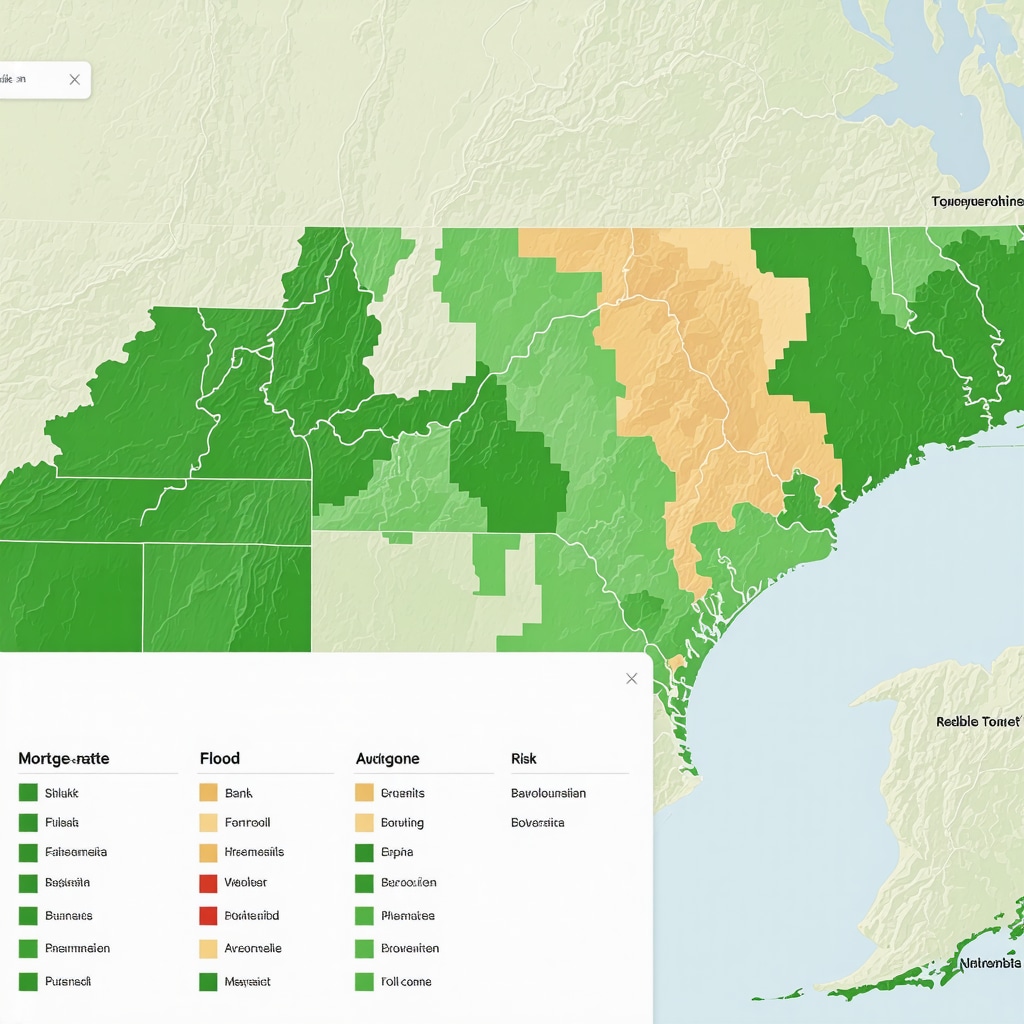

Incorporating Environmental and Climate Risk Assessments into Tennessee Mortgage Lending

Emerging research underscores the importance of environmental risk factors in mortgage underwriting. Tennessee, with its diverse geography encompassing flood-prone areas and variable climate zones, is witnessing lenders integrating climate resilience assessments into loan evaluations. Properties in higher-risk zones might face stricter lending criteria or higher interest rates to account for potential future losses.

This paradigm shift means that savvy Tennessee homebuyers must consider environmental risk data when selecting properties and negotiating mortgage terms. Accessing detailed flood zone maps, historical weather event data, and resilience certifications can empower borrowers to anticipate lender requirements and advocate for more favorable rates.

For a detailed exploration of how environmental factors are reshaping mortgage lending, the Freddie Mac Climate Risk Analysis Report offers cutting-edge insights.

What Role Do Local Credit Unions and Community Banks Play in Shaping Tennessee’s Mortgage Rate Environment?

Unlike national banks, local credit unions and community banks in Tennessee often exhibit greater flexibility in mortgage rate setting due to their intimate knowledge of community economic conditions and borrower profiles. These institutions may offer competitive rates or specialized programs reflecting localized risk assessments and community development goals. Engaging with these lenders can unlock unique opportunities, especially for first-time buyers or those seeking tailored loan structures.

Furthermore, these lenders frequently participate in state and federal housing initiatives aimed at increasing affordability, which can provide advantageous rate subsidies or reduced fees. Prospective borrowers should weigh these benefits against the broader market offerings to optimize their mortgage strategy.

Exploring local lenders’ offerings can be initiated through resources such as the Tennessee Credit Union League which provides up-to-date information on community-focused mortgage products.

Invitation to Engage: Share Your Advanced Mortgage Rate Strategies and Experiences in Tennessee

Understanding the multifaceted, evolving nature of mortgage rates in Tennessee requires continuous learning and community dialogue. Have you utilized predictive analytics or leveraged local lending nuances to secure favorable rates? Are you considering environmental risk factors in your home buying process? Your insights and questions enrich the conversation and help fellow Tennessee borrowers navigate these complexities.

Contribute your stories or seek expert advice by commenting below or connecting with mortgage professionals featured in our detailed guides. Together, we can master Tennessee’s mortgage market dynamics with confidence and strategic foresight.

Harnessing Cutting-Edge Technology: AI’s Role in Refining Tennessee Mortgage Forecasts

The integration of artificial intelligence (AI) and machine learning has ushered in a new era of precision in mortgage rate predictions. Within Tennessee’s diverse real estate market, AI models analyze multifaceted datasets—ranging from macroeconomic variables to county-level housing trends—to generate nuanced forecasts that surpass traditional methods. These predictive analytics enable lenders and borrowers to anticipate market fluctuations with heightened accuracy, optimizing mortgage lock timing and product selection.

Moreover, AI-driven virtual advisors personalize mortgage recommendations by synthesizing individual financial profiles, credit histories, and local market signals, empowering Tennessee homebuyers to make data-informed decisions tailored to their unique circumstances.

How Can AI and Predictive Analytics Transform Mortgage Decision-Making in Tennessee?

By leveraging AI, borrowers gain access to dynamic insights that account for both broad economic shifts and localized housing developments. Predictive models simulate various scenarios, such as Federal Reserve interest rate changes or regional employment fluctuations, offering actionable intelligence to mitigate risk and capitalize on favorable conditions. This technology is particularly valuable in Tennessee’s heterogeneous market, where urban and rural dynamics diverge significantly.

For a comprehensive understanding of AI applications in mortgage finance, the McKinsey & Company report on AI in mortgage lending provides authoritative analysis and case studies.

Environmental Risk Integration: Navigating Climate Challenges in Tennessee Mortgage Lending

As climate resilience becomes a critical factor in real estate financing, Tennessee’s mortgage landscape is adapting to incorporate environmental risk assessments. Properties situated in floodplains or susceptible to extreme weather events may encounter adjusted lending criteria or elevated interest rates to reflect increased risk exposure. This evolution necessitates that prospective borrowers proactively evaluate environmental data and engage with lenders knowledgeable about these considerations.

Utilizing resources such as FEMA flood zone maps and state climate resilience initiatives can inform property selection and mortgage negotiations. Awareness of these factors not only safeguards investment value but can also unlock potential incentives for energy-efficient or disaster-resilient home features.

Community-Centric Lending: The Strategic Advantage of Tennessee’s Local Credit Unions and Banks

Distinct from national financial institutions, Tennessee’s credit unions and community banks offer mortgage solutions deeply attuned to local economic realities. These entities often provide competitive interest rates, flexible underwriting standards, and specialized loan programs that reflect community development priorities. Engaging with these lenders can be particularly advantageous for first-time buyers, self-employed individuals, or those seeking customized financing arrangements.

Furthermore, participation in state and federal affordability initiatives frequently enhances the attractiveness of their mortgage offerings. Exploring options through the Tennessee Credit Union League is an excellent starting point for identifying such community-focused products.

Expert Engagement: Elevate Your Mortgage Strategy by Connecting with Tennessee Specialists

Given the increasing complexity of mortgage rate determinants—from AI analytics to environmental risks and localized lender nuances—collaborating with Tennessee mortgage experts is invaluable. These professionals can tailor strategies that integrate advanced data insights with regional market intelligence, enhancing your ability to secure optimal terms.

We invite you to engage with our community by sharing your experiences or posing questions below. Harness these advanced insights to navigate Tennessee’s evolving mortgage landscape with confidence and strategic foresight.

Frequently Asked Questions (FAQ)

What factors most influence mortgage rate fluctuations in Tennessee?

Mortgage rates in Tennessee are governed by a combination of national economic indicators—such as Federal Reserve policies, inflation rates, and Treasury bond yields—and localized factors including regional employment trends, housing demand, and state-specific lending practices. These variables interact dynamically, causing rates to vary based on both broad macroeconomic shifts and Tennessee’s unique market conditions.

How can first-time homebuyers in Tennessee secure the best mortgage rates?

First-time buyers should focus on improving their credit scores, comparing offers from local credit unions and community banks, and considering government-backed loan options like FHA loans. Utilizing expert resources and mortgage brokers familiar with Tennessee’s market nuances can also help identify special programs and timing opportunities to lock in favorable rates.

Is it better to choose a fixed-rate or adjustable-rate mortgage (ARM) in Tennessee’s 2025 market?

The decision depends on the buyer’s financial goals and risk tolerance. Fixed-rate mortgages provide predictable payments and protection against future rate hikes—ideal in a rising rate environment. ARMs may offer lower initial rates but carry uncertainty if rates increase. Evaluating personal circumstances alongside expert guidance can determine the optimal choice.

How do environmental risks impact mortgage lending in Tennessee?

Lenders increasingly integrate environmental risk assessments, especially for properties in flood-prone or climate-vulnerable areas. These assessments can result in stricter lending criteria or higher interest rates to mitigate potential losses. Borrowers should proactively review flood maps and climate data to understand possible impacts on loan terms.

What role do local credit unions and community banks play in Tennessee’s mortgage market?

Local lenders often offer more competitive rates and flexible underwriting tailored to Tennessee’s economic realities. Their intimate knowledge of regional conditions enables them to provide specialized programs, particularly benefiting first-time buyers and those requiring customized financing. Engaging with these institutions can uncover advantageous mortgage solutions.

How is AI transforming mortgage rate forecasting and decision-making in Tennessee?

Artificial intelligence and predictive analytics analyze vast datasets—from macroeconomic trends to localized housing data—to generate precise mortgage rate forecasts. This technology empowers borrowers with personalized advice and timing strategies, enhancing their ability to secure optimal loans in Tennessee’s diverse real estate market.

When should Tennessee homeowners consider refinancing their mortgage?

Refinancing becomes worthwhile when mortgage rates drop sufficiently to offset closing costs and align with the homeowner’s financial plans. Monitoring market trends and leveraging expert resources can help identify optimal refinancing windows to reduce payments or shorten loan terms.

How do seasonal and demographic shifts affect mortgage rates in Tennessee?

Seasonal employment fluctuations in industries like manufacturing and tourism can temporarily influence housing demand and mortgage rates. Additionally, demographic trends—such as millennials entering the market—sustain demand pressures, prompting lenders to innovate products tailored for evolving borrower profiles.

What advanced economic indicators should experts watch for Tennessee mortgage rate forecasts?

Beyond inflation and Fed policy, indicators like the Treasury yield curve shape and state fiscal policies provide nuanced insights. For example, an inverted yield curve may signal an economic slowdown that suppresses rates, while local tax incentives can affect lending risk premiums and pricing.

How can borrowers leverage local expert knowledge to improve mortgage outcomes in Tennessee?

Consulting local mortgage brokers and specialists provides access to real-time market intel, lender nuances, and strategic advice specific to Tennessee’s housing environment. This localized expertise aids in optimal loan selection, timing, and negotiation.

Trusted External Sources

- Federal Reserve Bank of Atlanta – Offers regional economic reports and monetary policy analysis relevant to Tennessee’s mortgage market dynamics.

- Freddie Mac Climate Risk Analysis Report – Provides cutting-edge research on environmental risk integration in mortgage lending, crucial for assessing Tennessee’s climate-related lending challenges.

- Tennessee Credit Union League – A comprehensive resource for exploring community-focused mortgage products and lender programs tailored to Tennessee residents.

- McKinsey & Company: AI in Mortgage Lending – Delivers authoritative insights on the application of artificial intelligence and predictive analytics in mortgage decision-making.

- U.S. Department of Housing and Urban Development (HUD) – Especially useful for FHA loan trends and federal housing policy impacts affecting Tennessee borrowers.

Conclusion: Mastering Tennessee Mortgage Rates in 2025 and Beyond

Understanding Tennessee’s mortgage rate landscape in 2025 requires a sophisticated grasp of intertwined macroeconomic forces, localized market dynamics, and emerging factors like environmental risks and AI-driven analytics. Savvy borrowers who monitor economic indicators, leverage local lending expertise, and strategically time their mortgage decisions stand to optimize financing costs amid an evolving environment.

From choosing between fixed and adjustable-rate loans to engaging with community lenders and assessing climate impacts, a holistic approach is essential. By integrating advanced data insights with personal financial goals, Tennessee homebuyers and homeowners can confidently navigate mortgage challenges and capitalize on opportunities.

We encourage you to share your experiences, ask questions, and explore our expert guides to deepen your knowledge and empower your mortgage journey in Tennessee’s dynamic 2025 market.

Ready to take the next step? Connect with local mortgage specialists, compare lender offerings, and stay informed to secure the best rates possible.