Decoding Tennessee’s Mortgage Rate Trajectory for 2025: An Expert Overview

As we approach 2025, the mortgage market in Tennessee is poised for nuanced shifts that demand sophisticated analysis. Understanding the forecasted mortgage rates requires dissecting macroeconomic signals, regional housing market dynamics, and federal monetary policy impacts. Buyers must evaluate not only headline rates but also embedded risk premiums influenced by local credit trends and lender competition. This article delivers a comprehensive examination rooted in professional financial analytics and Tennessee-specific market intelligence.

Interplay of National Economic Indicators and Tennessee Mortgage Rates

Mortgage rates in Tennessee are intricately linked to broader economic variables such as inflation trends, Federal Reserve policy adjustments, and Treasury bond yields. The anticipated Federal Open Market Committee stance in 2025 suggests a cautious approach toward interest rate normalization, potentially limiting aggressive hikes. However, Tennessee’s unique economic drivers—including employment rates, real estate demand, and state fiscal policies—modulate these effects, creating localized rate variations. The integration of these multi-layered factors necessitates a granular understanding for prospective buyers and investors.

How Will Credit Score Trends Influence Mortgage Rates for Tennessee Buyers in 2025?

Creditworthiness remains a pivotal determinant for mortgage rate qualification. In Tennessee, data indicates incremental improvements in average borrower credit scores, influenced by targeted financial education and credit repair initiatives. These enhancements may yield more favorable mortgage terms, but the variance across demographics and regions persists. Buyers with robust credit profiles can anticipate competitive fixed and adjustable rate options, whereas those with marginal scores might face elevated premiums or limited loan product availability. For detailed strategies on credit optimization, explore how credit scores impact Tennessee mortgage rates.

Fixed Versus Adjustable Rates: Strategic Considerations Amid Rate Fluctuations

The dichotomy between fixed and adjustable mortgage rates intensifies in 2025’s fluctuating environment. Fixed-rate loans offer predictability, shielding buyers from potential rate escalations, whereas adjustable-rate mortgages (ARMs) provide initial savings coupled with exposure to future market volatility. Tennessee buyers must assess time horizons, risk tolerance, and market forecasts. Expert analyses suggest that well-informed borrowers might leverage ARMs during anticipated rate stabilizations, while long-term homeowners may prioritize fixed options to secure financing certainty. Comprehensive guidance is available in the expert guide on fixed vs adjustable mortgage rates.

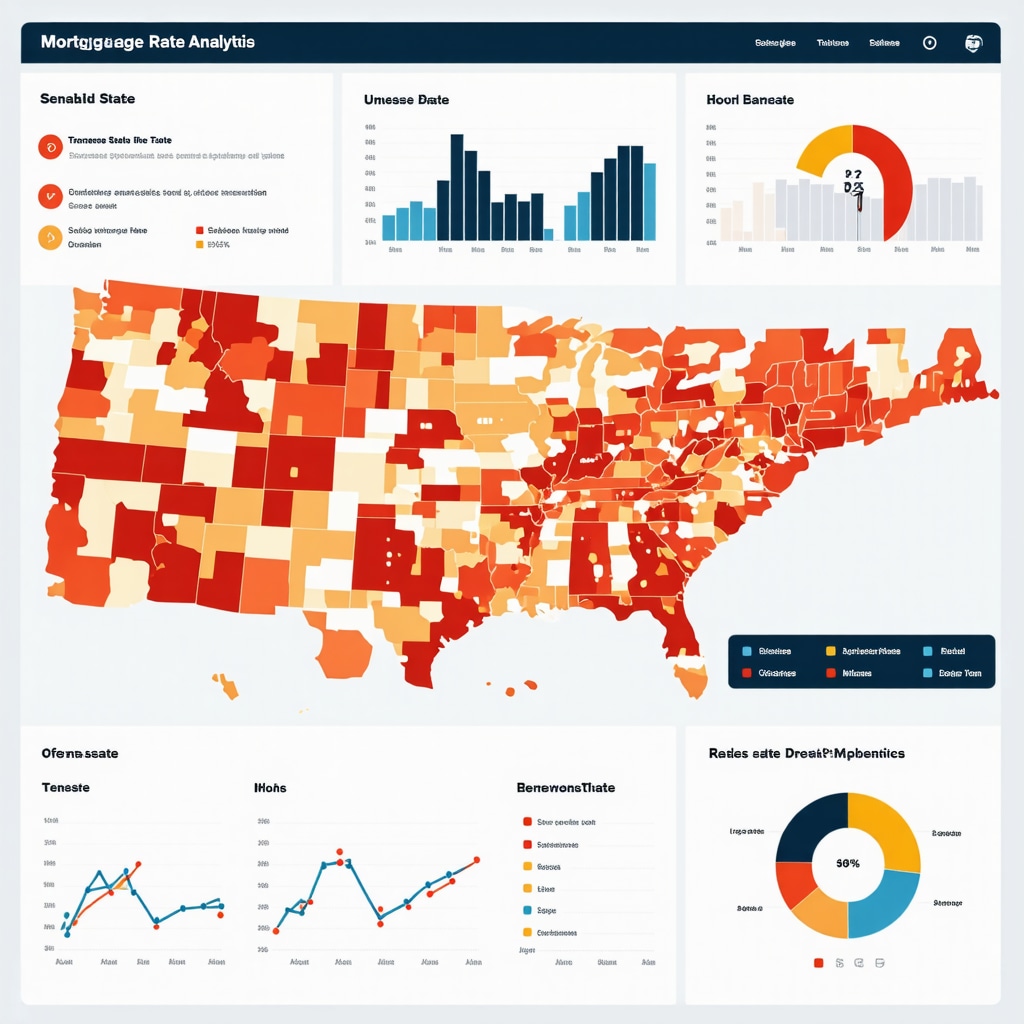

Regional Nuances: How Tennessee’s Local Markets Shape Mortgage Rate Realities

Tennessee’s diverse housing markets, from Nashville’s urban growth to Memphis’s revitalization efforts, induce differentiated mortgage rate behaviors. Local lender competition, housing inventory, and borrower demand create microeconomic environments that influence rate spreads beyond national benchmarks. For instance, Memphis buyers may encounter distinct mortgage opportunities compared to Knoxville residents due to lender density and regional economic stimuli. In-depth insights into these disparities can be found in our Memphis mortgage rates analysis.

Leveraging Mortgage Brokers to Navigate Tennessee’s 2025 Rate Landscape

Mortgage brokers serve as critical intermediaries, possessing nuanced market intelligence and lender relationships that can secure advantageous mortgage conditions. In Tennessee’s evolving 2025 environment, brokers can identify optimal timing for rate locks, tailor loan products to buyer profiles, and negotiate fees effectively. Their expertise is particularly valuable when confronting complex scenarios such as investment property financing or credit challenges. More on how Tennessee mortgage brokers add value is available at how Tennessee mortgage brokers help you secure lower rates.

What Are the Advanced Strategies for Timing Mortgage Rate Locks in Tennessee’s 2025 Market?

Timing mortgage rate locks demands sophisticated analysis of market volatility, economic forecasts, and personal financial readiness. Experts advise monitoring Treasury yield curves, Federal Reserve communications, and regional housing demand indicators to optimize lock-in moments. Tennessee buyers benefit from customized lock strategies that balance risk exposure and opportunity cost, especially amidst potential mid-year rate fluctuations. For actionable insights, consider reviewing our insider tips on locking mortgage rates.

Explore Further: Deepen Your Expertise on Tennessee Mortgage Dynamics

For professionals and sophisticated buyers alike, delving into the intricacies of mortgage refinancing and loan type selection remains essential. We encourage exploring our detailed resources on refinance timing and strategies and optimal loan types for first-time buyers to sharpen your strategic approach.

For expert perspectives or to share your insights on Tennessee mortgage forecasts, contact our team to engage with a community of seasoned professionals.

According to the Federal Reserve’s comprehensive economic analysis, mortgage rate movements are expected to remain sensitive to inflation expectations and fiscal policy shifts throughout 2025 (Federal Reserve Economic Projections 2024).

Integrating Inflation Expectations with Tennessee Mortgage Rate Decisions

Inflation forecasts remain a critical pivot point for mortgage rate behaviors nationwide, and Tennessee is no exception. Buyers must interpret inflation signals not only through headline Consumer Price Index data but also through localized cost-of-living adjustments and wage growth patterns. This granular approach enables borrowers to anticipate rate movements more accurately, balancing the Federal Reserve’s tightening or easing cycles with Tennessee’s economic idiosyncrasies. For example, rising housing costs in metropolitan areas like Nashville may exert upward pressure on mortgage premiums despite broader inflation moderation.

Understanding the Impact of Investment Property Financing on Tennessee Mortgage Rates

Investment property loans in Tennessee typically carry higher interest rates than primary residence mortgages due to increased risk factors. Lenders evaluate variables such as borrower credit quality, loan-to-value ratios, and property location, which collectively shape the rate offered. Additionally, specialized loan products such as FHA and VA loans have limited applicability for investment properties, often leading investors to conventional financing routes. Strategically, investors should consider diverse mortgage options for investment properties to optimize their financing costs in 2025.

How Can Sophisticated Buyers Leverage Market Timing to Maximize Savings on Tennessee Mortgages?

Timing mortgage rate locks and loan applications requires a comprehensive understanding of market indicators and Tennessee’s real estate cycles. Sophisticated buyers analyze Treasury bond yield trends, Federal Reserve announcements, and regional housing inventory fluctuations to optimize their entry points. Moreover, aligning loan lock strategies with personal financial preparedness, such as credit score improvements and down payment readiness, enhances rate negotiation leverage. Consulting resources like insider tips on mortgage rate locks offers actionable frameworks for executing these strategies effectively.

Evaluating Risk Premiums: How Tennessee Lender Competition Influences Mortgage Pricing

The competitive landscape among Tennessee lenders significantly affects the risk premiums embedded in mortgage rates. In markets with dense lender presence, such as Knoxville and Memphis, borrowers often benefit from narrower rate spreads and more flexible underwriting criteria. Conversely, less competitive regions may see elevated premiums reflecting reduced market pressure. Understanding these dynamics empowers buyers to select lenders strategically, potentially securing better terms by leveraging competitive offers. For a deeper dive into lender competition and rate variability, see local mortgage market insights.

Engage with us: Share your experiences or questions about Tennessee mortgage rates in 2025 in the comments section below, and consider sharing this article with peers seeking expert insights on navigating the complex mortgage landscape.

According to the Mortgage Bankers Association’s 2025 forecast, mortgage rates are expected to exhibit moderate volatility influenced by Federal Reserve policies and housing market adjustments, underscoring the importance of strategic timing and lender selection (MBA Mortgage Forecast 2025).

Inflation Hedging Techniques: Navigating Tennessee Mortgage Rate Responses with Precision

In the complex matrix of mortgage rate determinants, inflation hedging emerges as a nuanced strategy, particularly relevant for Tennessee’s 2025 market participants. Beyond traditional inflation tracking via the Consumer Price Index (CPI), advanced borrowers and lenders incorporate forward-looking inflation expectations derived from Treasury Inflation-Protected Securities (TIPS) spreads and regional wage growth trajectories. This multidimensional inflation insight enables more sophisticated mortgage structuring, such as embedding inflation-adjusted rate floors or caps in adjustable-rate mortgages (ARMs), thereby mitigating unexpected rate escalations attributable to localized economic inflation pressures.

For instance, metropolitan hubs like Chattanooga and Nashville exhibit wage growth patterns that outpace national averages, exerting upward pressure on housing expenses and, consequently, mortgage pricing. Borrowers employing inflation hedging can negotiate terms that buffer against such localized economic expansions, maintaining payment stability over time.

Deconstructing Risk Premium Variability: Tennessee’s Lender Ecosystem and Its Strategic Implications

The embedded risk premiums within Tennessee mortgage rates reflect a sophisticated interplay of lender competition intensity, borrower credit heterogeneity, and localized economic risk assessments. Particularly in markets with high lender density such as Knoxville, risk premiums compress owing to aggressive pricing strategies and technological innovations in underwriting that enhance credit risk precision. This contrasts with rural or less-competitive counties where lenders maintain wider spreads to compensate for credit risk uncertainty and limited market liquidity.

Moreover, Tennessee lenders increasingly integrate alternative data sources—such as utility payment histories and rental payment records—into credit evaluations. This integration reduces default risk mispricing and enables risk premiums to more accurately correspond to borrower creditworthiness. Advanced borrowers leveraging these innovations may benefit from rate reductions previously inaccessible with conventional credit metrics.

What Advanced Financing Structures Can Tennessee Investors Utilize to Optimize Mortgage Rates on Multi-Unit Properties?

Investors targeting multi-unit residential properties in Tennessee face distinct mortgage rate considerations influenced by property classification, loan-to-value ratio caps, and income capitalization rates. Sophisticated financing structures such as blanket mortgages, portfolio loans, and syndication financing offer pathways to optimize rates and terms by aggregating collateral and diversifying lender risk exposure.

For example, a blanket mortgage allows investors to finance multiple properties under a single loan, potentially securing better overall rates due to increased collateral base and streamlined underwriting. Portfolio loans, retained by lenders rather than sold on secondary markets, grant flexibility in underwriting standards, often benefiting borrowers with unique credit profiles or requiring customized amortization schedules.

Investors should also consider the impact of property income stability on mortgage pricing. Lenders apply capitalization rates to projected net operating income to assess risk; properties with higher and more stable income streams typically attract lower risk premiums, translating to more favorable mortgage rates. Detailed guidance on these structures and their applicability to Tennessee’s market can be explored at investment property mortgage options.

Harnessing Predictive Analytics for Mortgage Rate Optimization: Tennessee’s Emerging Frontier

Leading-edge mortgage lenders and brokers in Tennessee are increasingly deploying predictive analytics powered by machine learning algorithms to anticipate rate movements and borrower risk profiles. These technologies analyze vast datasets encompassing macroeconomic indicators, borrower behavior patterns, and local real estate market signals to fine-tune mortgage pricing dynamically.

Borrowers engaging with brokers who utilize these advanced analytics gain access to personalized rate forecasts and tailored lock strategies that align with their financial timelines and risk appetites. This approach transcends traditional static rate locking, enabling more agile responses to market volatility and unique borrower circumstances.

Integrating these insights with human expertise forms a hybrid advisory model that optimizes mortgage outcomes in Tennessee’s 2025 environment.

CTA: Elevate Your Tennessee Mortgage Strategy with Expert Analytics and Customized Financing

To master the complexities of Tennessee’s mortgage rate landscape in 2025, engaging with professionals who combine deep market intelligence, advanced analytics, and creative financing solutions is essential. Connect with our expert team to receive personalized guidance that leverages the latest economic insights and innovative loan products tailored to your unique home buying or investment objectives.

Innovative Financing Models Tailored for Tennessee’s Sophisticated Real Estate Investors

As Tennessee’s real estate market evolves, investors seeking to optimize mortgage rates on multi-unit and commercial properties must navigate beyond conventional financing. Structures such as syndicated loans and portfolio financing present unique advantages, allowing investors to aggregate assets and negotiate bespoke terms that reflect their risk profiles and growth strategies. These arrangements often involve intricate underwriting processes and require adept understanding of lender risk appetites and regulatory frameworks, especially pertinent in markets like Nashville and Chattanooga with burgeoning multi-family housing demands.

Harnessing Machine Learning: Predictive Analytics Revolutionizing Tennessee Mortgage Pricing

Mortgage lenders and brokers in Tennessee increasingly leverage machine learning algorithms to synthesize macroeconomic data, borrower credit behavior, and localized housing market fluctuations. This predictive analytic approach facilitates dynamic mortgage pricing models that adapt in near real-time, empowering borrowers with tailored rate forecasts and enabling strategic rate locks aligned with individual financial goals. Such advanced analytics also enhance risk stratification, reducing unnecessary risk premiums for well-qualified borrowers and fostering more competitive mortgage offerings.

How Can Predictive Analytics Be Applied to Optimize Rate Locks and Loan Terms in Tennessee’s Variable 2025 Mortgage Environment?

Applying predictive analytics involves integrating multifactorial data streams—such as Treasury yield curve shifts, Federal Reserve policy signals, and Tennessee’s regional economic indicators—to generate probabilistic models forecasting mortgage rate trends. Borrowers and brokers can utilize these insights to time rate locks optimally, balancing the trade-off between locking early to avoid upward rate movements and waiting for potential declines. Furthermore, this technology supports customization of loan structures, including adjustable-rate mortgage caps and prepayment penalty adjustments, enhancing borrower flexibility amid uncertainty. For technical elaboration, explore research from the Mortgage Bankers Association on analytics-driven mortgage pricing (MBA Mortgage Forecast 2025).

Strategic Implications of Lender Ecosystem Evolution: Embracing Technological Innovations and Competitive Dynamics

Technological advancements in underwriting and data integration have reshaped Tennessee’s lender landscape, compressing risk premiums and fostering innovative loan products. Particularly in urban centers with heightened lender competition, such as Memphis and Knoxville, these innovations translate into enhanced borrower options with more granular credit evaluations. This evolution demands that borrowers engage with lenders and brokers who possess not only market insight but also technological acumen to leverage these tools effectively, optimizing mortgage outcomes in a fluctuating rate environment.

Elevate your mortgage strategy by connecting with Tennessee’s leading experts who integrate predictive analytics and advanced financing solutions. Reach out today for personalized consultation tailored to your investment or home buying goals.

Expert Insights & Advanced Considerations

Integrating Predictive Analytics Enhances Mortgage Rate Timing and Customization

Advanced mortgage strategies in Tennessee leverage machine learning-driven predictive analytics that synthesize macroeconomic indicators, regional housing trends, and borrower profiles. This enables precise timing of mortgage rate locks and tailoring of loan terms, mitigating risk amidst 2025’s volatility. Borrowers and brokers who adopt these tools gain a decisive edge in optimizing financing outcomes.

Localized Economic Conditions Dictate Nuanced Rate Variability Across Tennessee Markets

Mortgages in Tennessee are not monolithic; urban centers like Nashville, Memphis, and Knoxville exhibit distinct demand, lender competition, and inflation pressures that influence embedded risk premiums. Recognizing these microeconomic differentials allows buyers to strategize lender selection and negotiate rates that reflect local market dynamics rather than broad national trends.

Innovative Financing Structures Offer Strategic Advantages for Sophisticated Investors

Multi-unit and investment property financing in Tennessee benefit from specialized approaches such as blanket mortgages, portfolio loans, and syndication financing. These structures optimize collateral aggregation and underwriting flexibility, often yielding more favorable rates and terms compared to conventional loans. Investors equipped with knowledge of these options can significantly enhance capital efficiency and risk management.

Credit Quality Enhancements Remain a Cornerstone for Rate Optimization

Incremental improvements in borrower credit scores, fostered by targeted financial education and alternative credit data integration, continue to compress risk premiums. Tennessee buyers and investors who proactively improve their credit profiles gain access to a broader spectrum of competitive mortgage products, underscoring credit management as an essential component of rate strategy.

Curated Expert Resources

- Mortgage Bankers Association – Mortgage Forecast 2025: Offers authoritative projections on mortgage rate trends influenced by Federal Reserve policy and housing market shifts, providing foundational insight for strategic planning (MBA Mortgage Forecast 2025).

- Tennessee Mortgage Rates – Insider Tips on Locking Rates: A practical guide to timing mortgage rate locks specific to Tennessee’s market conditions, essential for maximizing savings (When to Lock Your Tennessee Mortgage Rate).

- Investment Property Mortgage Options in Tennessee: Comprehensive analysis of FHA, VA, and conventional loan products tailored for Tennessee investors, illuminating pathways to optimized financing (Investment Property Mortgage Options).

- Navigating Fixed vs Adjustable Mortgage Rates Expert Guide: Detailed examination of the strategic merits of fixed and adjustable rates in Tennessee’s 2025 market, assisting buyers in aligning mortgage products with financial goals (Navigating Fixed vs Adjustable Mortgage Rates).

- Unlocking Memphis Mortgage Rates for 2025: An in-depth look at local market influences and lender competition in Memphis, enabling buyers to capitalize on regional rate advantages (Unlocking Memphis Mortgage Rates).

Final Expert Perspective

In 2025, Tennessee’s mortgage rate environment demands a sophisticated, multidimensional approach that transcends simplistic national narratives. The interplay of predictive analytics, localized economic factors, innovative financing structures, and credit quality advancements collectively define the strategic landscape. Buyers and investors who harness these insights position themselves to navigate rate volatility with agility and precision, securing financing that aligns with their nuanced objectives.

For those committed to deepening their expertise and optimizing mortgage outcomes, engaging with Tennessee’s leading professionals and specialized resources is indispensable. Connect with our expert team to explore tailored strategies that reflect the cutting edge of Tennessee mortgage rate dynamics.

Explore further to refine your approach with insights from our comprehensive guides on refinance timing and strategies and understand how credit scores shape your mortgage interest rates to unlock further financial advantages.