Decoding Tennessee’s Mortgage Landscape: Fixed and Adjustable Rates in 2025

As Tennessee’s real estate market evolves in 2025, understanding the nuances between fixed and adjustable mortgage rates has never been more crucial. For homebuyers and refinancers alike, this knowledge can spell the difference between long-term financial security and unexpected cost fluctuations. Tennessee’s unique economic factors and local market trends shape these mortgage options differently than in other states, demanding a keen, informed perspective.

Why Fixed-Rate Mortgages Offer Predictability Amid Market Shifts

Fixed-rate mortgages lock in a consistent interest rate for the entire loan term, providing Tennessee borrowers with the comfort of predictable monthly payments. In a year marked by fluctuating inflation and Federal Reserve policy shifts, this stability can be invaluable. Consider a Knoxville family securing a 30-year fixed mortgage; their ability to budget housing costs precisely over decades safeguards against Tennessee’s variable market pressures. However, this certainty often comes at a slightly higher initial rate compared to adjustable options, reflecting the lender’s risk mitigation.

The Dynamic Appeal of Adjustable-Rate Mortgages (ARMs) for Tennessee Buyers

Adjustable-rate mortgages typically start with lower interest rates that adjust periodically based on market indices. For Tennessee residents planning to move or refinance within a few years, ARMs can offer substantial short-term savings. Imagine a Memphis professional anticipating a job relocation in five years opting for a 5/1 ARM: they benefit from lower initial payments, hedging against short-term financial demands. Yet, the inherent uncertainty requires savvy risk assessment, especially as Tennessee’s mortgage rates can be influenced by national economic shifts and local lending competition.

How Do Tennessee’s Economic Trends Influence the Choice Between Fixed and Adjustable Rates?

Economic indicators such as employment growth, housing demand, and inflation in Tennessee directly affect mortgage rate trajectories. For example, steady job growth in Nashville may push demand—and consequently rates—higher. Borrowers must consider these dynamics when choosing mortgage types. Rising local inflation favors fixed rates for budget certainty, whereas a cooling market might make adjustable rates more attractive. The interplay of these factors requires buyers to stay informed and possibly consult experts to tailor the mortgage product to their financial horizon.

Expert Tip: Balancing Rate Security and Flexibility

Seasoned Tennessee mortgage advisors recommend assessing your long-term plans alongside current market analytics. Fixed-rate mortgages suit those valuing stability and long-term residence, while adjustable rates favor flexibility and short-term occupancy. Exploring resources like the Navigating Fixed vs Adjustable Mortgage Rates Expert Guide 2025 can provide deeper insights tailored to Tennessee’s unique market.

Trustworthy Sources Backing Tennessee Mortgage Decisions

According to the Consumer Financial Protection Bureau, understanding the total cost implications—including potential rate hikes on ARMs—is essential before committing. Their expert guidance underscores the importance of informed decision-making, particularly in regional markets like Tennessee where economic volatility can impact mortgage affordability.

Ready to Make an Informed Mortgage Choice in Tennessee?

Engage with local experts and leverage detailed market analyses to align your mortgage choice with your financial goals. For more nuanced strategies and the latest Tennessee mortgage rate updates, explore our comprehensive resources and connect with professionals here. Your smart mortgage decision in 2025 begins with expert knowledge and careful planning.

Deep Dive Into Tennessee Mortgage Rate Volatility: What Homebuyers Must Anticipate

Tennessee’s mortgage rates in 2025 are subject to a complex interplay of national monetary policy, local housing supply constraints, and evolving borrower profiles. Homebuyers and refinancers must be prepared for potential short-term fluctuations driven by Federal Reserve interest rate adjustments and shifts in Tennessee’s economic indicators such as wage growth and unemployment rates. This dynamic environment calls for strategic timing and a thorough understanding of market signals to optimize mortgage costs.

Leveraging Credit Scores to Secure Optimal Tennessee Mortgage Rates

Borrowers in Tennessee can substantially influence their mortgage interest rates by maintaining strong credit profiles. Credit scores remain a primary determinant in lender risk assessment and pricing. For instance, a score above 740 typically unlocks access to the most competitive fixed and adjustable rate mortgage products. Conversely, lower scores may result in higher premiums or restricted loan options. Prospective Tennessee homeowners should actively monitor their credit health and consider credit-improving strategies before applying.

For more detailed guidance on credit score impacts, visit How Credit Scores Shape Your Mortgage Interest Rates Today.

Innovative Mortgage Products Gaining Traction in Tennessee’s 2025 Market

Beyond traditional fixed and adjustable-rate mortgages, Tennessee lenders are increasingly offering hybrid products that blend the benefits of both. These include ARMs with extended fixed-rate periods or stepped-rate loans that start low and increase gradually. Such products can offer Tennessee borrowers tailored payment structures aligning with anticipated income growth or planned property tenure. Understanding these options requires consultation with mortgage professionals familiar with Tennessee’s lending landscape.

From an Expert Perspective: How Should Tennessee Buyers Weigh Fixed versus Adjustable Options Amid Economic Uncertainty?

Industry experts emphasize that the decision between fixed and adjustable mortgage rates in Tennessee hinges on individual financial goals and market forecasts. Fixed rates provide budget stability crucial for long-term homeowners, especially in regions experiencing rising living costs like Nashville and Chattanooga. However, adjustable rates may benefit buyers with short-term plans or those confident in declining interest rate trends. Consulting localized mortgage rate forecasts, such as those provided by Mortgage Rate Forecast 2025: Tennessee Market Guide, can provide actionable insights for making informed choices.

Integrating Local Market Conditions with Mortgage Rate Strategies

Tennessee’s diverse housing markets—from the urban vibrancy of Memphis to the suburban growth of Franklin—demand tailored mortgage approaches. Factors such as property type, loan size, and intended occupancy influence the suitability of fixed or adjustable rates. For example, investment property mortgages in Tennessee often carry higher rates and different risk profiles, requiring specialized strategies outlined in resources like Investment Property Mortgages in Tennessee: What You Need to Know.

Seasoned Tennessee buyers and investors should actively engage with local mortgage brokers who can navigate these nuances for optimal outcomes. To explore how to find the best local mortgage experts, see Tennessee Mortgage Broker Guide: Finding the Best Local Experts.

Strategic Mortgage Rate Locking: Timing Your Tennessee Loan for Maximum Savings

Locking in mortgage rates at the right time is critical amid Tennessee’s fluctuating market conditions. Homebuyers should monitor economic announcements and lender rate movements closely. Early locking can protect against upward swings, while delayed decisions might capitalize on falling rates. Understanding when and how to lock requires careful market analysis and lender communication, topics extensively covered in How to Lock the Best Mortgage Rate in Tennessee Quickly.

Engage with our community by sharing your experiences or questions about mortgage rate strategies in Tennessee. Your insights could help fellow homebuyers navigate this complex market more confidently.

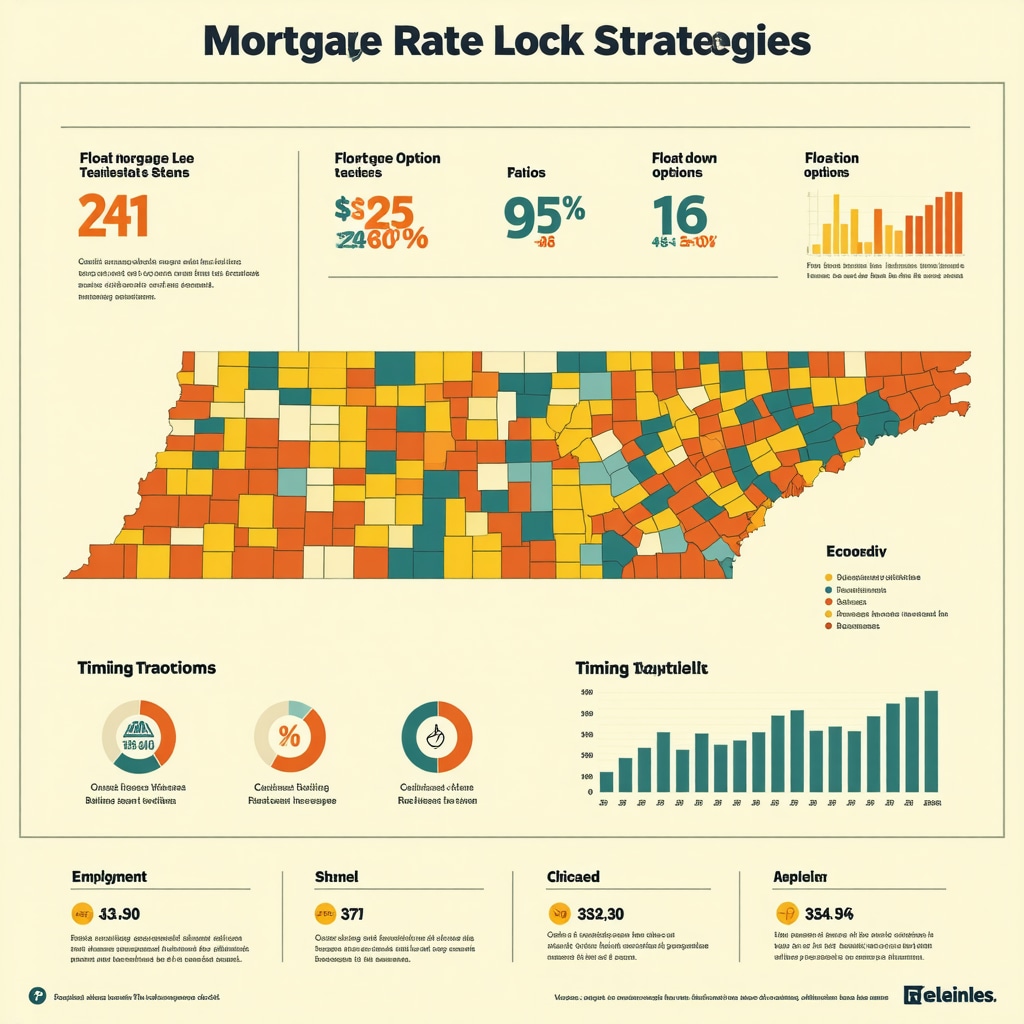

Advanced Strategies for Optimal Mortgage Rate Locking in Tennessee’s Volatile Market

In the nuanced landscape of Tennessee’s 2025 mortgage market, the timing of locking in your mortgage rate can significantly affect your long-term financial outcome. Beyond simply choosing when to lock, advanced strategies involve understanding market signals, lender behaviors, and macroeconomic indicators that influence rate trajectories. Savvy Tennessee borrowers are increasingly adopting dynamic rate lock tactics, such as float-down options and rate lock extensions, to hedge against unpredictable Federal Reserve policy moves and regional economic shifts.

For example, float-down provisions allow borrowers to benefit if rates decline after locking, a feature gaining traction among Tennessee lenders aiming to attract risk-conscious buyers. However, these often come with upfront fees or stricter qualification criteria, necessitating a thorough cost-benefit analysis. Additionally, rate lock extensions can provide breathing room during prolonged loan processing periods, but they may increase the overall cost if market rates rise. Understanding these mechanisms requires close collaboration with knowledgeable Tennessee mortgage brokers who can tailor strategies to individual borrower profiles and market forecasts.

What Are the Risks and Rewards of Using Float-Down Options in Tennessee’s 2025 Mortgage Market?

Float-down options offer a compelling balance between rate security and flexibility by allowing borrowers to re-lock at a lower rate if market conditions improve before closing. In Tennessee’s fluctuating 2025 market, this can translate into substantial savings, especially amid volatile inflation and employment data releases. However, these options typically involve trade-offs such as non-refundable fees or limited windows during which the float-down can be exercised. Borrowers must assess whether their anticipated loan processing timeline and market outlook justify these additional costs.

Moreover, lender policies vary widely, and some float-down offers may be more restrictive, requiring borrowers to maintain strong credit standings and consistent financial documentation. Engaging with local mortgage experts who understand Tennessee’s lender landscape can demystify these complexities and optimize your locking strategy.

For in-depth guidance on navigating these advanced rate lock features, consult resources like the Mortgage Bankers Association’s research on rate lock products, which offers authoritative insights into evolving lender offerings and borrower protections.

Integrating Macroeconomic Indicators and Tennessee-Specific Data for Rate Lock Timing

Expert mortgage advisors emphasize the importance of synthesizing national economic indicators—such as Federal Reserve announcements, inflation reports, and employment statistics—with localized data from Tennessee’s housing market. For instance, a sudden uptick in Tennessee’s housing demand due to corporate relocations or regional infrastructure projects can signal impending rate increases, making early locking advantageous.

Conversely, signals like slowing home sales in Nashville or Chattanooga might suggest a window to delay locking and potentially capture lower rates. This analytical approach requires borrowers to monitor financial news and market trends actively or to collaborate closely with mortgage professionals who provide real-time, region-specific forecasts.

Customizing Rate Lock Strategies Based on Loan Type and Borrower Profile

Different loan products and borrower circumstances necessitate tailored rate lock decisions. Jumbo loans or investment property mortgages in Tennessee often have more volatile rates and stricter lock policies, demanding heightened vigilance. Similarly, borrowers with fluctuating incomes or those pursuing first-time homebuyer programs may benefit from flexible rate locks that accommodate extended processing timelines.

Understanding these nuances ensures that your mortgage rate lock strategy aligns precisely with your financial situation and housing goals. Partnering with Tennessee mortgage brokers who specialize in your loan category can provide a competitive edge in securing favorable terms.

Ready to Optimize Your Tennessee Mortgage Rate Lock Strategy?

Engage with experienced local mortgage professionals to craft a personalized locking plan that leverages both market intelligence and borrower-specific factors. Explore our specialized guides and connect with experts to navigate Tennessee’s complex mortgage rate environment confidently. Your optimal mortgage rate lock is not just about timing—it’s about strategic alignment with your broader financial journey.

Decoding Tennessee’s Mortgage Landscape: Fixed and Adjustable Rates in 2025

As Tennessee’s real estate market evolves in 2025, understanding the nuances between fixed and adjustable mortgage rates has never been more crucial. For homebuyers and refinancers alike, this knowledge can spell the difference between long-term financial security and unexpected cost fluctuations. Tennessee’s unique economic factors and local market trends shape these mortgage options differently than in other states, demanding a keen, informed perspective.

Why Fixed-Rate Mortgages Offer Predictability Amid Market Shifts

Fixed-rate mortgages lock in a consistent interest rate for the entire loan term, providing Tennessee borrowers with the comfort of predictable monthly payments. In a year marked by fluctuating inflation and Federal Reserve policy shifts, this stability can be invaluable. Consider a Knoxville family securing a 30-year fixed mortgage; their ability to budget housing costs precisely over decades safeguards against Tennessee’s variable market pressures. However, this certainty often comes at a slightly higher initial rate compared to adjustable options, reflecting the lender’s risk mitigation.

The Dynamic Appeal of Adjustable-Rate Mortgages (ARMs) for Tennessee Buyers

Adjustable-rate mortgages typically start with lower interest rates that adjust periodically based on market indices. For Tennessee residents planning to move or refinance within a few years, ARMs can offer substantial short-term savings. Imagine a Memphis professional anticipating a job relocation in five years opting for a 5/1 ARM: they benefit from lower initial payments, hedging against short-term financial demands. Yet, the inherent uncertainty requires savvy risk assessment, especially as Tennessee’s mortgage rates can be influenced by national economic shifts and local lending competition.

How Do Tennessee’s Economic Trends Influence the Choice Between Fixed and Adjustable Rates?

Economic indicators such as employment growth, housing demand, and inflation in Tennessee directly affect mortgage rate trajectories. For example, steady job growth in Nashville may push demand—and consequently rates—higher. Borrowers must consider these dynamics when choosing mortgage types. Rising local inflation favors fixed rates for budget certainty, whereas a cooling market might make adjustable rates more attractive. The interplay of these factors requires buyers to stay informed and possibly consult experts to tailor the mortgage product to their financial horizon.

Expert Tip: Balancing Rate Security and Flexibility

Seasoned Tennessee mortgage advisors recommend assessing your long-term plans alongside current market analytics. Fixed-rate mortgages suit those valuing stability and long-term residence, while adjustable rates favor flexibility and short-term occupancy. Exploring resources like the Navigating Fixed vs Adjustable Mortgage Rates Expert Guide 2025 can provide deeper insights tailored to Tennessee’s unique market.

Trustworthy Sources Backing Tennessee Mortgage Decisions

According to the Consumer Financial Protection Bureau, understanding the total cost implications—including potential rate hikes on ARMs—is essential before committing. Their expert guidance underscores the importance of informed decision-making, particularly in regional markets like Tennessee where economic volatility can impact mortgage affordability.

Ready to Make an Informed Mortgage Choice in Tennessee?

Engage with local experts and leverage detailed market analyses to align your mortgage choice with your financial goals. For more nuanced strategies and the latest Tennessee mortgage rate updates, explore our comprehensive resources and connect with professionals here. Your smart mortgage decision in 2025 begins with expert knowledge and careful planning.

Deep Dive Into Tennessee Mortgage Rate Volatility: What Homebuyers Must Anticipate

Tennessee’s mortgage rates in 2025 are subject to a complex interplay of national monetary policy, local housing supply constraints, and evolving borrower profiles. Homebuyers and refinancers must be prepared for potential short-term fluctuations driven by Federal Reserve interest rate adjustments and shifts in Tennessee’s economic indicators such as wage growth and unemployment rates. This dynamic environment calls for strategic timing and a thorough understanding of market signals to optimize mortgage costs.

Leveraging Credit Scores to Secure Optimal Tennessee Mortgage Rates

Borrowers in Tennessee can substantially influence their mortgage interest rates by maintaining strong credit profiles. Credit scores remain a primary determinant in lender risk assessment and pricing. For instance, a score above 740 typically unlocks access to the most competitive fixed and adjustable rate mortgage products. Conversely, lower scores may result in higher premiums or restricted loan options. Prospective Tennessee homeowners should actively monitor their credit health and consider credit-improving strategies before applying.

For more detailed guidance on credit score impacts, visit How Credit Scores Shape Your Mortgage Interest Rates Today.

Innovative Mortgage Products Gaining Traction in Tennessee’s 2025 Market

Beyond traditional fixed and adjustable-rate mortgages, Tennessee lenders are increasingly offering hybrid products that blend the benefits of both. These include ARMs with extended fixed-rate periods or stepped-rate loans that start low and increase gradually. Such products can offer Tennessee borrowers tailored payment structures aligning with anticipated income growth or planned property tenure. Understanding these options requires consultation with mortgage professionals familiar with Tennessee’s lending landscape.

From an Expert Perspective: How Should Tennessee Buyers Weigh Fixed versus Adjustable Options Amid Economic Uncertainty?

Industry experts emphasize that the decision between fixed and adjustable mortgage rates in Tennessee hinges on individual financial goals and market forecasts. Fixed rates provide budget stability crucial for long-term homeowners, especially in regions experiencing rising living costs like Nashville and Chattanooga. However, adjustable rates may benefit buyers with short-term plans or those confident in declining interest rate trends. Consulting localized mortgage rate forecasts, such as those provided by Mortgage Rate Forecast 2025: Tennessee Market Guide, can provide actionable insights for making informed choices.

Integrating Local Market Conditions with Mortgage Rate Strategies

Tennessee’s diverse housing markets—from the urban vibrancy of Memphis to the suburban growth of Franklin—demand tailored mortgage approaches. Factors such as property type, loan size, and intended occupancy influence the suitability of fixed or adjustable rates. For example, investment property mortgages in Tennessee often carry higher rates and different risk profiles, requiring specialized strategies outlined in resources like Investment Property Mortgages in Tennessee: What You Need to Know.

Seasoned Tennessee buyers and investors should actively engage with local mortgage brokers who can navigate these nuances for optimal outcomes. To explore how to find the best local mortgage experts, see Tennessee Mortgage Broker Guide: Finding the Best Local Experts.

Strategic Mortgage Rate Locking: Timing Your Tennessee Loan for Maximum Savings

Locking in mortgage rates at the right time is critical amid Tennessee’s fluctuating market conditions. Homebuyers should monitor economic announcements and lender rate movements closely. Early locking can protect against upward swings, while delayed decisions might capitalize on falling rates. Understanding when and how to lock requires careful market analysis and lender communication, topics extensively covered in How to Lock the Best Mortgage Rate in Tennessee Quickly.

Engage with our community by sharing your experiences or questions about mortgage rate strategies in Tennessee. Your insights could help fellow homebuyers navigate this complex market more confidently.

Advanced Strategies for Optimal Mortgage Rate Locking in Tennessee’s Volatile Market

In the nuanced landscape of Tennessee’s 2025 mortgage market, the timing of locking in your mortgage rate can significantly affect your long-term financial outcome. Beyond simply choosing when to lock, advanced strategies involve understanding market signals, lender behaviors, and macroeconomic indicators that influence rate trajectories. Savvy Tennessee borrowers are increasingly adopting dynamic rate lock tactics, such as float-down options and rate lock extensions, to hedge against unpredictable Federal Reserve policy moves and regional economic shifts.

For example, float-down provisions allow borrowers to benefit if rates decline after locking, a feature gaining traction among Tennessee lenders aiming to attract risk-conscious buyers. However, these often come with upfront fees or stricter qualification criteria, necessitating a thorough cost-benefit analysis. Additionally, rate lock extensions can provide breathing room during prolonged loan processing periods, but they may increase the overall cost if market rates rise. Understanding these mechanisms requires close collaboration with knowledgeable Tennessee mortgage brokers who can tailor strategies to individual borrower profiles and market forecasts.

What Are the Risks and Rewards of Using Float-Down Options in Tennessee’s 2025 Mortgage Market?

Float-down options offer a compelling balance between rate security and flexibility by allowing borrowers to re-lock at a lower rate if market conditions improve before closing. In Tennessee’s fluctuating 2025 market, this can translate into substantial savings, especially amid volatile inflation and employment data releases. However, these options typically involve trade-offs such as non-refundable fees or limited windows during which the float-down can be exercised. Borrowers must assess whether their anticipated loan processing timeline and market outlook justify these additional costs.

Moreover, lender policies vary widely, and some float-down offers may be more restrictive, requiring borrowers to maintain strong credit standings and consistent financial documentation. Engaging with local mortgage experts who understand Tennessee’s lender landscape can demystify these complexities and optimize your locking strategy.

For in-depth guidance on navigating these advanced rate lock features, consult resources like the Mortgage Bankers Association’s research on rate lock products, which offers authoritative insights into evolving lender offerings and borrower protections.

Integrating Macroeconomic Indicators and Tennessee-Specific Data for Rate Lock Timing

Expert mortgage advisors emphasize the importance of synthesizing national economic indicators—such as Federal Reserve announcements, inflation reports, and employment statistics—with localized data from Tennessee’s housing market. For instance, a sudden uptick in Tennessee’s housing demand due to corporate relocations or regional infrastructure projects can signal impending rate increases, making early locking advantageous.

Conversely, signals like slowing home sales in Nashville or Chattanooga might suggest a window to delay locking and potentially capture lower rates. This analytical approach requires borrowers to monitor financial news and market trends actively or to collaborate closely with mortgage professionals who provide real-time, region-specific forecasts.

Customizing Rate Lock Strategies Based on Loan Type and Borrower Profile

Different loan products and borrower circumstances necessitate tailored rate lock decisions. Jumbo loans or investment property mortgages in Tennessee often have more volatile rates and stricter lock policies, demanding heightened vigilance. Similarly, borrowers with fluctuating incomes or those pursuing first-time homebuyer programs may benefit from flexible rate locks that accommodate extended processing timelines.

Understanding these nuances ensures that your mortgage rate lock strategy aligns precisely with your financial situation and housing goals. Partnering with Tennessee mortgage brokers who specialize in your loan category can provide a competitive edge in securing favorable terms.

Ready to Optimize Your Tennessee Mortgage Rate Lock Strategy?

Engage with experienced local mortgage professionals to craft a personalized locking plan that leverages both market intelligence and borrower-specific factors. Explore our specialized guides and connect with experts to navigate Tennessee’s complex mortgage rate environment confidently. Your optimal mortgage rate lock is not just about timing—it’s about strategic alignment with your broader financial journey.

Unlocking the Power of Predictive Analytics in Tennessee Mortgage Rate Decisions

Emerging technologies now empower Tennessee homebuyers and lenders to harness predictive analytics for mortgage rate forecasting. By integrating machine learning models with regional economic data, including employment trends and housing inventory fluctuations, borrowers can gain unprecedented foresight into likely interest rate movements. This advanced approach facilitates more informed rate lock timing and mortgage product selection, potentially saving thousands over the loan term.

However, leveraging predictive analytics demands access to sophisticated tools and expertise often available through specialized mortgage brokers or financial advisors versed in Tennessee’s market intricacies. Adopting these innovations represents a frontier in mortgage strategy, positioning Tennessee borrowers at the cutting edge of financial decision-making.

How Can Predictive Analytics Transform Mortgage Rate Locking Strategies in Tennessee?

Predictive analytics can analyze vast datasets, from macroeconomic indicators to micro-level housing trends, to model probable interest rate trajectories specific to Tennessee’s market. This enables borrowers to anticipate rate shifts with greater accuracy than traditional forecasting methods. For example, predictive insights might indicate a narrowing window before rates rise due to upcoming Federal Reserve policy changes or local economic developments such as major corporate expansions in Nashville.

Integrating these insights with personal financial timelines allows for dynamic, data-driven locking strategies—balancing risk and opportunity more effectively. Borrowers can proactively negotiate with lenders or time their applications to coincide with favorable market conditions.

To explore the practical applications of predictive analytics in mortgage planning, visit the National Association of Realtors’ research on technology in home buying, a trusted source highlighting cutting-edge industry trends and tools.

Engage with Tennessee Mortgage Experts to Elevate Your Home Financing Strategy

Harnessing advanced mortgage rate strategies and predictive insights requires collaboration with seasoned Tennessee professionals. These experts offer personalized assessments that consider your unique financial profile, loan goals, and local market conditions. Partnering with knowledgeable brokers and advisors ensures you capitalize on every opportunity, minimizing costs and maximizing financial security in a volatile 2025 market.

Ready to elevate your mortgage strategy? Connect with Tennessee mortgage professionals today to unlock tailored solutions and stay ahead in a rapidly evolving lending landscape.

Frequently Asked Questions (FAQ)

What are the main differences between fixed-rate and adjustable-rate mortgages in Tennessee?

Fixed-rate mortgages offer a consistent interest rate and monthly payment throughout the loan term, providing Tennessee borrowers stability against market fluctuations. Adjustable-rate mortgages (ARMs) start with lower initial rates that adjust periodically based on market indices, offering potential short-term savings but with payment uncertainty over time.

How do Tennessee’s local economic conditions affect mortgage rate choices?

Tennessee’s employment growth, inflation trends, and housing demand influence mortgage rates. Rising local inflation and strong job markets typically favor fixed rates for budget certainty, while cooling markets or short-term residency plans may make adjustable rates more appealing.

Can improving my credit score really impact my mortgage interest rate in Tennessee?

Yes. Credit scores above 740 generally unlock the most competitive mortgage rates, while lower scores may lead to higher premiums or limited loan options. Maintaining strong credit health is crucial for securing favorable Tennessee mortgage terms.

What are float-down options and should Tennessee borrowers consider them?

Float-down options allow borrowers to reduce their locked-in mortgage rate if market rates fall before closing, balancing security and flexibility. Tennessee borrowers should weigh upfront fees, qualification criteria, and market volatility to determine if float-downs align with their financial strategy.

How can predictive analytics enhance mortgage rate lock timing in Tennessee?

Predictive analytics integrate macroeconomic data and local market trends to forecast interest rate movements more accurately. Tennessee borrowers using these insights can optimize the timing of their rate locks, potentially saving thousands over the loan term by anticipating rate increases or decreases.

Are hybrid mortgage products beneficial in Tennessee’s 2025 market?

Hybrid products, such as ARMs with extended fixed periods or stepped-rate loans, can offer tailored payment structures suited to Tennessee borrowers’ income growth or property tenure plans. Evaluating these options with mortgage professionals helps align product features with financial goals.

When is the best time to lock a mortgage rate in Tennessee?

The optimal timing depends on monitoring Federal Reserve announcements, local economic signals, and lender movements. Early locking protects against rising rates, while delaying may capture lower rates when market conditions soften. A strategic approach requires active market analysis or professional guidance.

How do loan types affect mortgage rate locking strategies in Tennessee?

Loan types like jumbo loans or investment property mortgages often have more volatile rates and stricter lock policies. Borrower profiles, including income stability and first-time buyer status, also influence lock flexibility needs, necessitating customized strategies with expert consultation.

What role do local mortgage brokers play in navigating Tennessee’s mortgage market?

Local brokers provide specialized knowledge of Tennessee’s lender landscape, loan products, and market nuances. They can tailor mortgage and rate lock strategies to individual borrower profiles, enhancing access to competitive rates and suitable loan options.

How can I stay updated on Tennessee mortgage rate trends and strategies?

Regularly consult reputable local market guides, financial news sources, and engage with Tennessee mortgage professionals. Utilizing expert resources and predictive analytics platforms ensures informed, timely decisions in a dynamic 2025 market.

Trusted External Sources

Consumer Financial Protection Bureau (CFPB): Offers authoritative guidance on mortgage costs, risks of adjustable-rate mortgages, and consumer protections, emphasizing the importance of informed decisions in regional markets like Tennessee.

Mortgage Bankers Association (MBA): Provides in-depth research on mortgage rate lock products, float-down options, and lender behaviors, crucial for understanding advanced rate locking strategies in Tennessee’s volatile market.

National Association of Realtors (NAR): Delivers cutting-edge research on technology in home buying, including predictive analytics applications that enhance mortgage rate forecasting and decision-making tailored to local markets.

Tennessee Housing Development Agency (THDA): A key resource for local housing market data, first-time buyer programs, and regional mortgage assistance, supporting Tennessee-specific mortgage planning.

Federal Reserve Economic Data (FRED): Provides comprehensive national and regional economic indicators such as interest rates, inflation, and employment statistics that influence Tennessee mortgage rate trends.

Conclusion

Understanding the complex interplay of fixed and adjustable mortgage rates, local economic conditions, borrower credit profiles, and advanced rate locking strategies is essential for Tennessee homebuyers and refinancers in 2025. Fixed-rate mortgages deliver budget certainty amid inflation and market shifts, while adjustable-rate options offer flexibility and potential short-term savings for those with specific timelines. Leveraging predictive analytics, consulting local mortgage experts, and customizing approaches based on loan type and personal financial goals empower Tennessee borrowers to navigate volatility strategically.

As Tennessee’s housing landscape continues to evolve, staying informed and proactive in mortgage decisions ensures long-term financial stability. Engage with trusted professionals, explore advanced tools, and apply these expert insights to secure the best mortgage outcomes. Share your experiences, ask questions, and explore related expert content to deepen your understanding and confidence in Tennessee’s mortgage market.