My Personal Experience with the Tennessee Mortgage Application Process in 2025

When I first decided to purchase my dream home in Tennessee, I knew the mortgage application process would be a crucial step. As someone who’s navigated this path recently, I want to share my personal journey to help others understand what to expect in 2025. From gathering documents to closing, every step was a learning experience that I hope will make your home buying journey smoother.

Understanding the Basics of Mortgage Pre-Approval in Tennessee

The first thing I did was get pre-approved. This step gave me a clear idea of my budget and strengthened my position when making offers. I learned that Tennessee lenders often require proof of income, credit scores, and assets. For more detailed insights, I recommend reading this comprehensive guide on Tennessee mortgage pre-approval.

Collecting Documents: The Foundation of a Smooth Application

I gathered my recent pay stubs, tax returns, bank statements, and proof of assets. This documentation process was meticulous, but essential. Having all my paperwork organized saved me time and stress during the application. It’s also wise to check your credit score beforehand; a higher score can lead to better rates. To understand how credit scores impact your mortgage, see this article on credit scores and mortgage rates.

Choosing the Right Mortgage Type for Tennessee Buyers in 2025

Deciding between fixed and adjustable rates was a pivotal choice. I personally opted for a fixed-rate mortgage because of the stability it offered. However, I also explored adjustable-rate options, especially given the current trends in Tennessee’s housing market. If you’re unsure which is best, I highly recommend reviewing this detailed comparison of mortgage types.

Applying for the Loan: My Step-by-Step Experience

The application process was straightforward but required attention to detail. I submitted my documents through my lender’s online portal, and they reviewed everything thoroughly. Communication was key—always ask questions if something isn’t clear. Once approved, I received my loan commitment letter, which was an exciting milestone. For a step-by-step breakdown, check out this detailed guide.

How to Maximize Your Chances for Mortgage Approval in Tennessee

One tip I found invaluable was maintaining a good credit score and reducing existing debt. Also, getting pre-approved early helped me understand my limits and avoid falling in love with homes out of my budget. Remember, market fluctuations in Tennessee can influence your mortgage rates, so staying informed is vital. You might find this article on local market trends quite helpful.

What are the biggest surprises you faced during your mortgage journey in Tennessee?

Honestly, the most surprising part was how quickly the market can change. Staying flexible and informed about current Tennessee mortgage rate trends made all the difference. I also found that working with a trusted local lender simplified the process significantly. If you’re considering your options, check out this resource on Tennessee mortgage options.

Are you ready to start your mortgage application? Feel free to comment below or reach out through this contact page for personalized assistance. Remember, understanding each step of the Tennessee mortgage process in 2025 can make your homeownership dreams a reality.

How Do Local Tennessee Market Fluctuations Impact Your Mortgage Strategy in 2025?

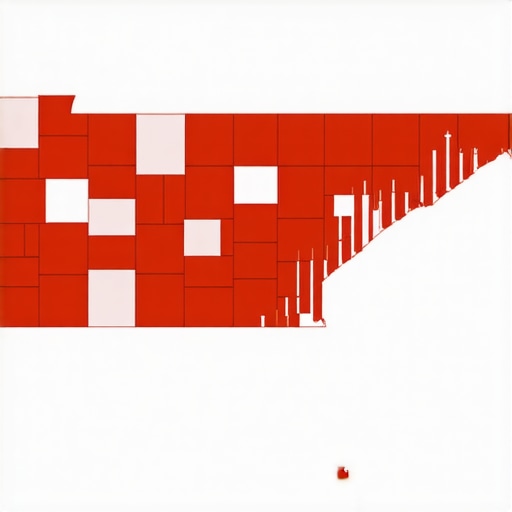

Understanding the dynamic nature of Tennessee’s housing market is crucial for homeowners and buyers alike. Market fluctuations—driven by economic indicators, employment rates, and regional development—can significantly influence mortgage rates and loan approval chances. For instance, areas experiencing rapid growth may see rising property values, prompting lenders to tighten lending criteria or adjust interest rates accordingly. Keeping abreast of these trends through trusted sources like this guide on Tennessee mortgage market trends can help you time your mortgage application strategically.

What Are the Most Effective Ways to Lock in Favorable Tennessee Mortgage Rates in 2025?

One of the most effective strategies is to monitor daily mortgage rate updates diligently, enabling you to lock in low rates before market shifts occur. Additionally, working with a local lender who understands regional market nuances can provide personalized advice and potential rate locks. Consider exploring options like adjustable-rate mortgages (ARMs) if you anticipate rates falling or remaining stable, but always weigh the risks involved. For comprehensive guidance, see this expert article on rate locking strategies.

How Do Economic Factors and Federal Policies Shape Tennessee Mortgage Rates in 2025?

The broader economic environment, including inflation rates and Federal Reserve policies, play a pivotal role in mortgage rate movements. For example, if inflation remains high, lenders may increase interest rates to offset potential losses. Conversely, if the Fed signals rate cuts, mortgage rates could decline, making it an opportune moment for refinancing or purchasing. Staying informed through reputable financial news and analysis—like this detailed report—is essential for making educated decisions.

Are There Specific Tennessee Regions That Offer Better Mortgage Rates for Investors in 2025?

Yes, certain Tennessee regions, particularly those experiencing rapid development or with thriving local economies, often provide more favorable mortgage conditions for investors. Memphis and Nashville, for example, are hotbeds for investment properties, with lenders offering competitive rates to attract real estate investors. To identify the best local options, explore this resource on investment property loans. Understanding regional market trends can help investors optimize their financing strategies and maximize returns.

If you’re considering a property purchase or refinance in Tennessee, staying informed about current mortgage rate trends and regional differences is vital. Feel free to comment below or reach out through this contact page for tailored advice. Empowered with the right knowledge, you can navigate 2025’s mortgage landscape confidently and secure the best possible terms for your homeownership journey.

Deepening My Understanding of Tennessee Mortgage Nuances in 2025

Over the past few months, as I continued exploring Tennessee’s mortgage environment, I realized there’s much more beneath the surface than just interest rates and loan types. The regional nuances, economic shifts, and borrower behaviors all weave into a complex tapestry that demands a more refined approach. For instance, I found that in Nashville, a booming hub for tech startups and urban development, lenders are increasingly tailoring their offerings to attract young professionals and first-time buyers. This shift not only affects rates but also influences the eligibility criteria and down payment requirements. To truly capitalize on these trends, staying connected with local market reports and expert analyses, like this detailed report on economic impacts, has become essential.

The Complexity of Choosing Between Fixed and Adjustable-Rate Mortgages in 2025

My personal experience has shown that the decision between fixed and adjustable-rate mortgages (ARMs) isn’t just about current rates but also about understanding future market trajectories. Tennessee’s economic resilience and regional development trends suggest that in some areas, fixed rates might be more advantageous for stability, especially if interest rates are expected to rise. Conversely, in regions like Memphis, where recent analyses like this comparison guide indicate potential rate drops, ARMs could offer savings. But the real key lies in aligning these choices with personal financial goals and risk tolerance.

What Are Some Advanced Tactics for Locking in Favorable Rates in a Volatile Market?

Beyond basic rate monitoring, I found that engaging with lenders early and exploring options like rate locks and float-downs can significantly impact savings. In 2025, with Tennessee’s market showing signs of volatility driven by economic policies and regional development, locking in a rate during a dip can be a game changer. I personally worked with a lender who offered a 60-day rate lock with a float-down option—this flexibility allowed me to benefit from market improvements without risking rate increases. For those interested in mastering this strategy, this comprehensive guide provides invaluable insights.

How Do Personal Credit Strategies Influence Mortgage Success in 2025?

From my perspective, maintaining an impeccable credit profile is more crucial than ever. I discovered that small, consistent actions—like reducing credit card balances, disputing inaccuracies, and avoiding new inquiries—can make a noticeable difference. Tennessee lenders are increasingly leveraging sophisticated credit evaluation models, as highlighted in this expert article, to determine not just eligibility but also the specific interest rates offered. Personal credit management thus becomes a strategic tool, especially as market competition intensifies.

Invitation for Shared Experiences and Further Exploration

Having navigated these complexities myself, I believe that sharing our experiences can illuminate paths for others. If you’ve faced similar decisions or have insights into Tennessee’s evolving mortgage scene, I invite you to comment below. Additionally, exploring related topics, like the latest regional market trends or innovative loan products, can further empower your homeownership journey. Remember, in 2025, being informed and adaptable is your best asset—so keep learning and connecting with trusted sources like this contact page for personalized guidance.

Refining My Approach: Leveraging Regional Economic Shifts for Optimal Mortgage Outcomes

As I delved deeper into Tennessee’s mortgage landscape in 2025, I realized that understanding regional economic shifts is paramount for tailoring my financing strategies. For instance, Nashville’s burgeoning tech sector and Memphis’s revitalization efforts have created unique lending environments. These regional nuances influence not just interest rates but also eligibility criteria and down payment expectations. Staying informed through in-depth analyses like this comprehensive report has enabled me to anticipate market movements and position myself advantageously.

Advanced Tactics for Rate Lock Optimization Amid Market Volatility

In volatile markets, timing your rate lock is crucial. I adopted proactive measures such as engaging with lenders early and negotiating for float-down options—these allowed me to capitalize on dips in mortgage rates without risking adverse hikes. For example, a 60-day rate lock with a float-down feature proved invaluable when Tennessee’s market showed signs of fluctuation. To master these tactics, I recommend exploring this detailed guide on rate lock strategies, which has significantly improved my refinancing outcomes.

The Strategic Role of Credit Management in Securing Competitive Mortgage Terms

My ongoing commitment to maintaining impeccable credit has paid dividends. I discovered that even minor credit improvements—such as reducing credit utilization or disputing inaccuracies—can substantially lower mortgage interest rates, especially in a competitive Tennessee market. Lenders increasingly rely on sophisticated credit modeling, as highlighted in this authoritative article. Therefore, strategic credit management isn’t just a preparatory step but a continuous process that can unlock substantial savings over the life of the loan.

Harnessing Data Trends for Predictive Mortgage Rate Movements

Analyzing trend data has become a cornerstone of my decision-making toolkit. By monitoring daily rate fluctuations and regional economic indicators, I can anticipate potential shifts. For example, observing Tennessee’s employment growth and regional development reports allows me to identify optimal windows for refinancing or entering the market. I suggest visiting this insightful guide to enhance your predictive capabilities and align your actions with market cycles.

Things I Wish I Knew Earlier (or You Might Find Surprising)

Unexpected Market Fluctuations

One thing that caught me off guard was how quickly Tennessee mortgage rates can change within a short period. Staying flexible and keeping an eye on daily updates helped me seize opportunities when rates dipped unexpectedly. This taught me the importance of being prepared to act swiftly.

The Power of Local Lenders

I initially thought big banks were the only option, but working with a trusted local lender made a huge difference. They understood regional trends better and often offered more competitive rates. Building that relationship was a game-changer for my home financing experience.

Timing Your Refinance

Timing is everything. I learned that monitoring Tennessee market trends and economic indicators allowed me to refinance at the perfect moment, saving thousands over the life of my loan. Using data insights from trusted sources helped me make smarter decisions.

Pre-Approval Advantages

Getting pre-approved early gave me a clear budget and made the home buying process smoother. It also strengthened my offer when competing in a hot market. I recommend securing pre-approval before house hunting to avoid surprises later.

Credit Management as a Strategy

Maintaining a good credit score was more crucial than I realized. Small actions like paying down debt and disputing inaccuracies helped me qualify for better rates. Good credit management continues to be a key factor in securing favorable mortgage terms.

Resources I’ve Come to Trust Over Time

- Official Tennessee Housing Authority Website: This site provides up-to-date information on state-specific programs and market conditions, which I found incredibly helpful for understanding regional dynamics.

- Mortgage Expert Blogs (like Bankrate and NerdWallet): These sites offer detailed analyses and forecasts that helped me anticipate rate movements and plan accordingly.

- Local Tennessee Real Estate Agents: Their insights into neighborhood trends and lender options made my decision-making process more informed and confident.

- Financial News Outlets (Bloomberg, CNBC): Staying updated on macroeconomic factors influenced my understanding of how federal policies impacted rates locally.

Parting Thoughts from My Perspective

Looking back, navigating Tennessee mortgage rates in 2025 was both challenging and rewarding. The key takeaway is that staying informed, working with trusted local experts, and being flexible with timing can lead to significant savings and a smoother homeownership journey. If this resonates with you, I’d love to hear your experiences or questions—feel free to share below or reach out through the contact page. Remember, being proactive and educated is your best strategy in today’s dynamic mortgage landscape.