Decoding Tennessee’s Mortgage Landscape: Expert Perspectives on Rate Dynamics for 2025

The Tennessee mortgage market stands at a critical juncture as 2025 approaches, with nuanced economic indicators and localized market forces intertwining to influence interest rate trajectories. Understanding these complex drivers requires an expert lens that discerns how regional housing demand, federal monetary policy, and credit market fluctuations converge to shape mortgage rates uniquely across Tennessee’s diverse localities.

Regional Variability in Mortgage Rate Trends: Beyond the Statewide Averages

While national mortgage trends provide a macroeconomic backdrop, Tennessee’s local markets exhibit distinct rate behaviors influenced by urbanization levels, economic growth patterns, and lender competition. For instance, areas like Memphis and Nashville experience differential rate pressures due to varying housing inventories and borrower profiles. This heterogeneity demands tailored analysis beyond aggregate state data, highlighting the importance of localized mortgage market intelligence for homebuyers and investors alike.

What are the key economic indicators affecting Tennessee mortgage rates in 2025?

Several critical metrics underpin mortgage rate movements in Tennessee for 2025. Inflation rates, as measured by the Consumer Price Index (CPI), influence Federal Reserve policy decisions affecting benchmark interest rates. Additionally, employment growth within Tennessee’s key sectors, such as manufacturing and healthcare, impacts borrower creditworthiness and demand for home financing. Regional housing supply constraints and new construction rates also modulate mortgage pricing dynamics. Monitoring these indicators offers predictive insights into rate fluctuations and helps stakeholders strategize effectively.

Strategic Implications of Fixed vs. Adjustable Mortgage Rates Amid Market Volatility

Given the prospect of rate volatility in 2025, Tennessee homebuyers must weigh the trade-offs between fixed and adjustable-rate mortgages (ARMs) with heightened sophistication. Fixed rates provide long-term payment stability but may carry a premium during tightening cycles, whereas ARMs offer lower initial rates with exposure to future increases. Expert guidance, such as that found in this comprehensive analysis of fixed vs. adjustable mortgage rates in Tennessee, is essential to align loan choices with individual risk tolerance and market forecasts.

Leveraging Local Mortgage Brokers to Secure Competitive Rates and Terms

Mortgage brokers with deep expertise in Tennessee’s local markets serve as invaluable resources to navigate lender options and rate negotiations. Their established relationships and nuanced understanding of regional underwriting standards can often translate into more favorable loan terms. Homebuyers and investors should consider engaging with reputable brokers, as outlined in guides to finding local Tennessee mortgage brokers, to optimize financing outcomes in a competitive environment.

How do credit scores and borrower profiles uniquely influence Tennessee mortgage rates?

Borrower credit health remains a pivotal determinant of mortgage pricing. In Tennessee, regional economic disparities mean that credit score distributions vary, impacting average mortgage rates offered by lenders. Higher credit scores correlate with access to the lowest rates, while subprime profiles face steeper premiums. Detailed insights into credit score impacts on Tennessee mortgage rates are available in this specialized resource, empowering borrowers to enhance their financing prospects through credit management.

Incorporating Macroeconomic and Local Market Insights for Mortgage Rate Forecasting

Integrating macroeconomic analysis with Tennessee’s localized market data creates a robust framework to anticipate mortgage rate trends in 2025. For example, Federal Reserve statements on interest rate policy combined with state-level housing starts and employment reports offer a multi-layered perspective. This synthesis enables lenders and borrowers to make informed decisions amid uncertainty, mitigating risk by understanding both broad economic cycles and Tennessee’s unique mortgage market mechanics.

Explore further expert insights on Tennessee mortgage markets and contribute your professional perspectives by visiting our contact page.

According to the Mortgage Bankers Association’s latest report, mortgage rates have shown sensitivity to inflationary pressures and monetary policy shifts, underscoring the importance of continuous market monitoring for Tennessee borrowers (MBA Mortgage Finance Outlook).

Innovative Approaches to Mortgage Rate Risk Management in Tennessee

With increasing unpredictability in the economic landscape, Tennessee borrowers are seeking sophisticated strategies to manage mortgage rate risks effectively. Beyond the traditional fixed and adjustable rate choices, hybrid mortgage products and rate-locking mechanisms provide nuanced options that can be tailored to individual financial goals and market conditions. For instance, hybrid ARMs that combine fixed-rate periods with adjustments later can offer a balance between initial affordability and long-term flexibility. Additionally, understanding the timing and conditions for rate locks can protect borrowers from adverse rate movements, a tactic explored further in this expert guide on locking mortgage rates in Tennessee.

Evaluating the Impact of Tennessee’s Housing Supply Chain on Mortgage Rates

The interplay between local housing supply constraints and mortgage pricing is a critical dimension often overlooked by homebuyers. In Tennessee, factors such as material costs, labor shortages, and regulatory environments contribute to fluctuating construction rates, which in turn influence mortgage demand and lender risk assessments. Areas experiencing limited new construction often face higher demand-driven price pressures, translating into upward rate adjustments. Mortgage professionals must integrate these supply chain insights to better forecast rate trends and advise clients accordingly.

How can Tennessee homebuyers leverage credit optimization to secure the best mortgage rates in 2025?

Credit optimization remains one of the most powerful levers for lowering mortgage rates. Tennessee borrowers can undertake targeted actions such as reducing credit utilization, eliminating outstanding debts, and correcting credit report inaccuracies to improve their credit profiles swiftly. Furthermore, understanding the nuances of credit scoring models used by lenders in Tennessee allows borrowers to prioritize impactful credit behaviors. Comprehensive strategies for credit enhancement are detailed in this specialized resource on credit tips for Tennessee mortgage rates.

Harnessing Technology and Data Analytics for Smarter Mortgage Decisions

The digital transformation of mortgage lending in Tennessee is empowering borrowers with real-time data and predictive analytics tools. Online platforms now offer personalized rate comparisons, prequalification assessments, and scenario analyses that factor in localized economic indicators. These technological advancements enable borrowers to make more informed decisions aligned with their financial timelines and risk tolerance. Additionally, mortgage brokers are increasingly leveraging data analytics to negotiate better terms, as discussed in this expert insight on Memphis mortgage brokers.

According to the Federal Reserve Bank of St. Louis, regional economic data combined with advanced analytics significantly enhances the accuracy of mortgage rate forecasts, underscoring the value of integrating diverse data sources for market strategy (Federal Reserve Economic Data – Mortgage Rates).

We invite experienced Tennessee homebuyers and mortgage professionals to share their strategies and insights in the comments below or connect with us through our contact page to enrich this ongoing conversation.

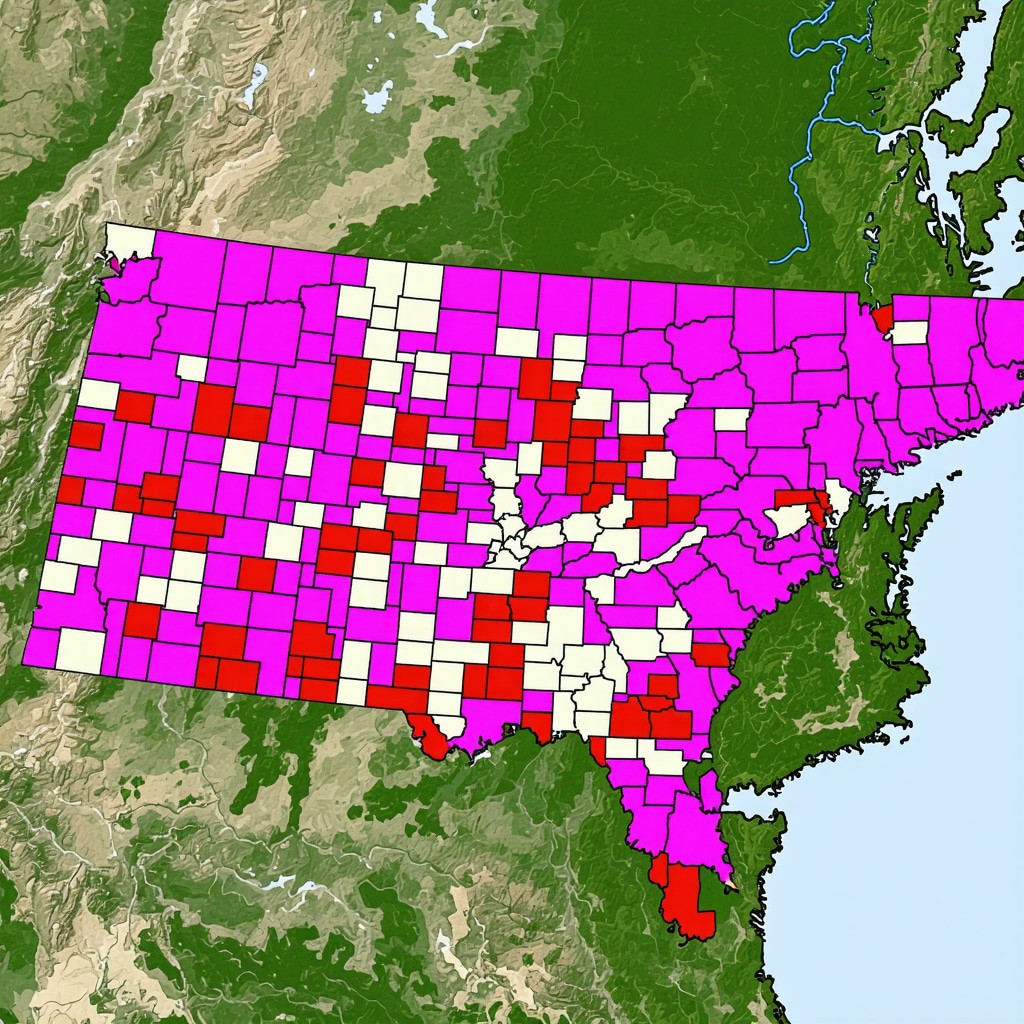

Decoding the Influence of Tennessee’s Economic Microclimates on Mortgage Rate Variability

The granularity of Tennessee’s economic microclimates plays a pivotal role in shaping mortgage rate dispersion across its counties. Metropolitan hubs such as Nashville and Chattanooga exhibit divergent rate trends compared to rural counties, influenced by localized employment sectors, income distributions, and real estate market saturation. Advanced mortgage lenders incorporate these microeconomic variables into their risk assessments, often resulting in tailored rate offerings that reflect regional credit risk profiles and housing demand elasticity. This level of market segmentation demands sophisticated data modeling techniques and underscores the necessity for borrowers to seek region-specific mortgage advice to optimize their financing terms.

How do regional economic microclimates in Tennessee affect mortgage rate disparities in 2025?

Regional microclimates in Tennessee manifest through variations in industry concentration, wage growth, and demographic shifts — all factors that inform lender risk models and pricing strategies. For example, counties with burgeoning tech and healthcare sectors typically demonstrate stronger borrower credit profiles and stable housing markets, enabling lenders to offer more competitive rates. Conversely, areas with slower economic growth or higher unemployment may experience elevated risk premiums embedded in mortgage rates. Understanding these nuances equips borrowers and investors with a strategic vantage point to navigate Tennessee’s heterogeneous mortgage landscape effectively (Federal Reserve Economic Data – Tennessee Employment).

Integrating Hybrid Mortgage Products and Rate Lock Strategies for Optimal Financing

Hybrid mortgage products, such as 5/1 or 7/1 adjustable-rate mortgages, have gained traction among Tennessee borrowers seeking a balance between initial affordability and future rate risk mitigation. These products offer fixed interest periods before adjustments commence, providing a tactical window to capitalize on lower initial rates while planning for potential rate hikes. Coupled with strategic rate lock mechanisms—where borrowers secure prevailing rates during the loan approval process—these tools can substantially shield against market volatility. Expert consultation is indispensable to tailor these options in alignment with individual financial timelines and market outlooks, as explained in this detailed guide on hybrid mortgages in Tennessee.

Leveraging Predictive Analytics and Machine Learning to Forecast Tennessee Mortgage Rates

Mortgage lenders and financial analysts increasingly employ predictive analytics and machine learning algorithms to refine mortgage rate forecasting models. By assimilating vast datasets—ranging from macroeconomic indicators to localized housing market metrics—these tools detect subtle patterns and correlations often imperceptible to traditional analysis. In Tennessee, integrating data on housing starts, regional employment, credit score distributions, and Federal Reserve policy signals enhances the precision of rate predictions. This technological evolution not only benefits lenders in risk management but also empowers borrowers to make proactive and informed financing decisions.

According to a recent study published in the Journal of Real Estate Finance and Economics, machine learning models significantly outperform conventional econometric models in predicting short-term mortgage rate movements, particularly when incorporating localized economic variables (Springer Journal – Advanced Mortgage Rate Forecasting).

What are the advanced risk management techniques Tennessee borrowers can implement amid rising mortgage rate uncertainty?

In the face of rising and unpredictable mortgage rates, Tennessee borrowers can adopt several advanced risk management techniques beyond traditional rate locks. These include:

- Mortgage rate buydowns: Paying upfront points to reduce interest rates over the loan term.

- Escalating payment structures: Starting with lower payments that increase over time as borrower income grows.

- Incorporation of interest rate caps: Particularly in ARMs, limiting the extent of rate increases.

- Portfolio diversification: For investors, diversifying mortgage types and geographic exposure to mitigate localized rate shocks.

Implementing these strategies requires a nuanced understanding of both personal financial capacity and market dynamics, often necessitating collaboration with seasoned mortgage advisors well-versed in Tennessee’s lending environment.

Exploring the Role of Regulatory Changes and Their Impact on Tennessee Mortgage Rates

Recent regulatory shifts at both federal and state levels have introduced complexities affecting mortgage underwriting and pricing in Tennessee. For instance, amendments to credit reporting standards and disclosure requirements influence lender risk assessments and operational costs, which can indirectly affect mortgage rates. Additionally, Tennessee’s state-specific housing policies aimed at increasing affordable housing supply may alter lender appetite and competition, thereby impacting rate structures. Staying abreast of these regulatory developments is critical for borrowers and professionals seeking to anticipate and respond to evolving market conditions effectively.

Engage with our expert network to delve deeper into Tennessee’s mortgage market intricacies and discover tailored strategies to navigate 2025’s challenges by visiting our contact page.

Deciphering the Impact of Inflation Expectations on Tennessee Mortgage Pricing

In 2025, inflation expectations continue to exert a profound influence on mortgage rate determinations within Tennessee’s diverse markets. Lenders incorporate forward-looking inflation forecasts into their yield curves, affecting the baseline costs of borrowing. Notably, when investors anticipate persistent inflationary pressures, mortgage-backed securities (MBS) yields rise, pressuring lenders to adjust rates upward to maintain profit margins. Sophisticated borrowers must therefore monitor not only current inflation indices but also market-based measures such as breakeven inflation rates embedded in Treasury Inflation-Protected Securities (TIPS) to anticipate mortgage rate movements.

Utilizing Geographic Information Systems (GIS) for Precision Mortgage Risk Profiling

Advanced lenders in Tennessee increasingly harness Geographic Information Systems (GIS) to overlay demographic, economic, and real estate data, creating granular risk profiles that inform mortgage pricing. This technology allows for hyper-localized assessment of factors such as neighborhood credit default rates, employment volatility, and property value trends. The result is a stratified mortgage rate landscape where borrowers in economically resilient micro-regions benefit from preferential pricing, while those in higher-risk pockets face adjusted premiums. This nuanced approach demands that borrowers understand their property’s microeconomic context to negotiate optimal terms.

How can Tennessee mortgage professionals leverage machine learning to optimize borrower risk assessment and rate setting?

Mortgage professionals are increasingly integrating machine learning algorithms to refine borrower risk assessment models tailored specifically for Tennessee’s heterogeneous market. These models analyze multifaceted data streams—including credit history nuances, employment sector dynamics, and housing market trends—to predict default probability with greater accuracy. By leveraging supervised learning techniques and ensemble methods, lenders can dynamically adjust mortgage rates to reflect real-time risk profiles, enhancing portfolio performance while offering competitive rates to low-risk borrowers. Such technological integration requires continuous data curation and expert oversight to ensure model validity and regulatory compliance.

Examining the Influence of Tennessee’s Emerging Tech and Healthcare Sectors on Local Mortgage Demand

The rapid expansion of technology and healthcare industries in Tennessee’s metropolitan areas, such as Nashville and Chattanooga, significantly shapes local mortgage demand and rate dynamics. These sectors attract a highly skilled workforce with robust income prospects, augmenting credit profiles and elevating housing market activity. Consequently, lenders perceive reduced default risk and increased loan demand, enabling tighter spreads and more attractive mortgage rates for qualified borrowers. Investors and homebuyers should closely track sectoral employment growth as a leading indicator of favorable mortgage conditions.

Incorporating Behavioral Economics into Mortgage Product Design and Borrower Engagement

Emerging insights from behavioral economics are influencing mortgage product innovation and borrower engagement strategies in Tennessee. By understanding cognitive biases and decision-making heuristics, lenders design tailored communication and product options that align with borrower preferences and risk tolerance. For example, framing hybrid ARM products with clear visualization of payment trajectories can increase borrower confidence and uptake. Additionally, behavioral nudges—such as reminders for credit optimization steps—enhance borrower preparedness, indirectly improving mortgage pricing outcomes. This interdisciplinary approach represents a frontier in mortgage market sophistication.

According to the Federal Reserve’s 2023 report on Behavioral Economics in Finance, integrating behavioral insights into lending practices improves borrower outcomes and lender risk management, underscoring its relevance for Tennessee mortgage markets.

To capitalize on these advanced insights and elevate your mortgage strategy in Tennessee’s evolving market, connect with our team of experts today through our contact page for personalized consultations.

Expert Insights & Advanced Considerations

Regional Economic Microclimates Demand Tailored Mortgage Strategies

Tennessee’s diverse economic microclimates, from thriving metropolitan hubs like Nashville to more rural counties, create distinct risk and rate profiles that lenders factor into mortgage pricing. Borrowers benefit significantly from localized market intelligence to align financing options with their region’s economic realities, optimizing rate outcomes.

Hybrid Mortgage Products and Rate Locks Enhance Risk Management

In a market marked by rate volatility, combining hybrid adjustable-rate mortgages with strategic rate locks offers Tennessee borrowers a sophisticated approach to balance initial affordability and future rate risk. Expert guidance is crucial to tailor these options effectively within personal financial plans and market forecasts.

Leveraging Predictive Analytics and Machine Learning Elevates Forecast Accuracy

The integration of advanced data analytics and machine learning models enables lenders and borrowers in Tennessee to anticipate mortgage rate movements with greater precision. This technological edge supports proactive decision-making, risk mitigation, and customized rate offerings based on real-time economic and credit data.

Behavioral Economics Innovations Improve Borrower Engagement and Product Design

Incorporating behavioral economics insights allows Tennessee lenders to design mortgage products and borrower communications that resonate with cognitive patterns, improving uptake, credit preparedness, and ultimately, mortgage pricing outcomes. This interdisciplinary approach represents a significant advancement in mortgage market sophistication.

Regulatory Changes and Housing Supply Dynamics Shape Rate Trends

Federal and state regulatory shifts alongside local housing supply chain factors profoundly influence mortgage underwriting standards and lender competition in Tennessee. Staying informed of these evolving frameworks is essential for borrowers and professionals aiming to anticipate rate adjustments and capitalize on emerging opportunities.

Curated Expert Resources

- Mortgage Bankers Association (MBA) Mortgage Finance Outlook: Provides in-depth analysis of national and regional mortgage market trends, critical for understanding inflation and monetary policy impacts on Tennessee rates (MBA Mortgage Finance Outlook).

- Federal Reserve Economic Data (FRED): Offers comprehensive datasets on Tennessee employment, mortgage rates, and inflation expectations, essential for nuanced market analysis (FRED Mortgage Rates, Tennessee Employment Data).

- Springer Journal of Real Estate Finance and Economics: Publishes cutting-edge studies on machine learning applications in mortgage rate forecasting, relevant for advanced market participants (Advanced Mortgage Rate Forecasting).

- Federal Reserve 2023 Report on Behavioral Economics in Finance: Explores how cognitive insights improve lending practices and borrower outcomes, pertinent to Tennessee mortgage innovation (Behavioral Economics in Finance).

- TennesseeMortgage-Rates.com Expert Guides: A series of specialized resources including Navigating Fixed vs. Adjustable Mortgage Rates and Locking in a Mortgage Rate in Tennessee offer actionable strategies tailored to the 2025 market.

Final Expert Perspective

The Tennessee mortgage landscape in 2025 demands a confluence of localized economic understanding, advanced financial products, and technological sophistication. Borrowers and professionals equipped with insights into regional microclimates, regulatory developments, and behavioral economics stand poised to navigate rate volatility with greater confidence and efficacy. Embracing hybrid mortgage structures and leveraging predictive analytics further refines risk management and financing optimization. For a deeper engagement with Tennessee mortgage strategies and to contribute your expertise, we invite you to explore our comprehensive guides and connect with industry specialists via our contact page. Staying informed and proactive remains the cornerstone of success in Tennessee’s dynamic mortgage market.