Unlocking Competitive Investment Property Mortgages in Tennessee

Securing investment property mortgages in Tennessee demands more than a cursory glance at headline interest rates; it requires a strategic approach that integrates market timing, credit optimization, and lender selection. As the Tennessee real estate sector gains momentum, investors face a nuanced mortgage landscape shaped by variable rate trends and tightening underwriting standards. Understanding how to lock the lowest rates now—amid evolving market dynamics—is paramount for maximizing long-term returns and mitigating financing costs.

Advanced Considerations for Investment Mortgage Rate Optimization

Investment properties typically attract higher mortgage rates than primary residences due to increased lender risk. However, expertise in leveraging credit profiles, loan-to-value ratios, and property types can materially influence available rates. Utilizing local Tennessee mortgage brokers familiar with regional market fluctuations offers an advantage, enabling access to tailored loan products and competitive terms not broadly advertised. Moreover, discerning investors should explore fixed versus adjustable-rate options, weighing interest rate forecasts and portfolio cash flow strategies.

What Are the Most Effective Techniques to Secure Lowest Investment Property Mortgage Rates in Tennessee?

Achieving optimal mortgage rates hinges on multifactorial strategies. Primarily, maintaining a strong credit score directly correlates with reduced interest rates, as detailed in this expert analysis. Additionally, making a substantial down payment—typically 20% or more—lowers lender risk, translating into better pricing. Timing the rate lock is critical; investors should monitor market indicators and consider locking when rates show upward trends, as emphasized in locking strategies guidance. Collaborating with licensed Tennessee mortgage brokers can facilitate access to exclusive lender networks, improving rate negotiation leverage.

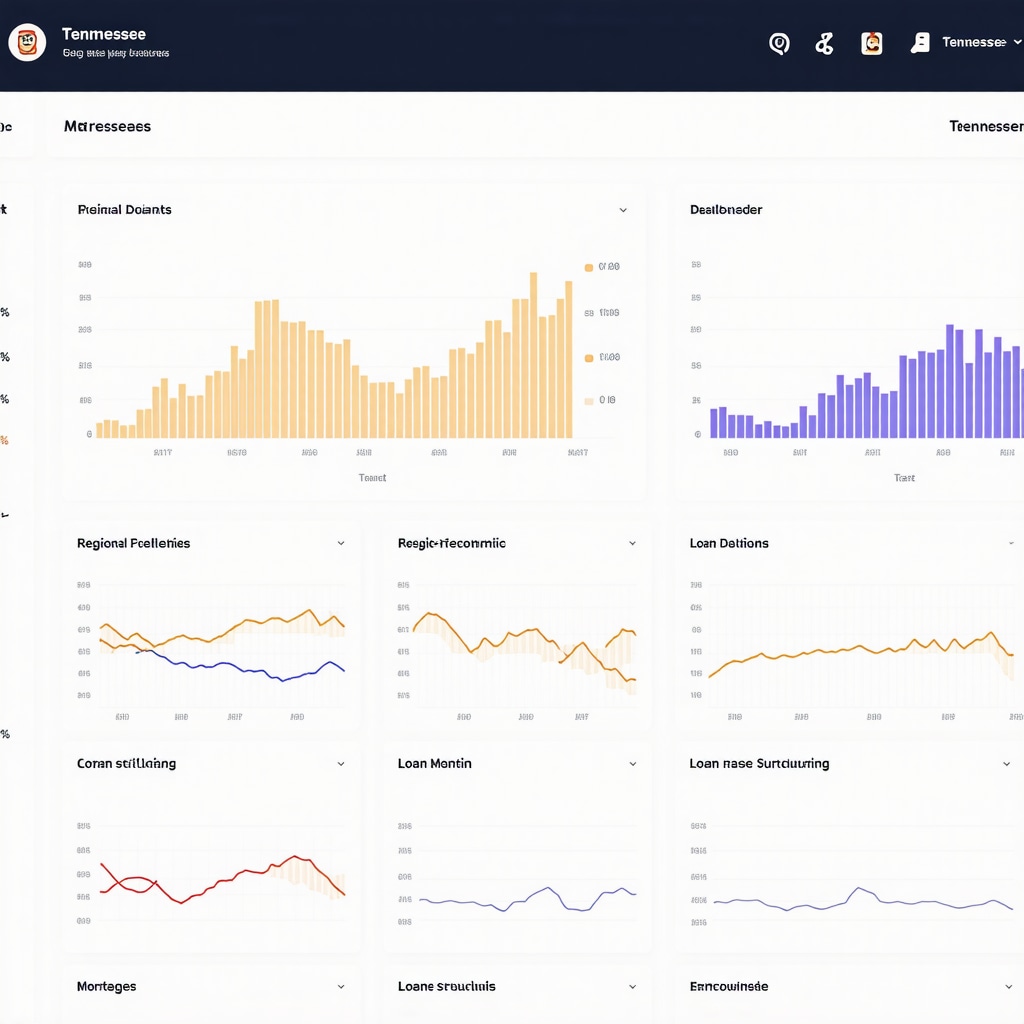

Integrating Market Insights: Tennessee Mortgage Rate Trends and Projections

Recent analyses from the Freddie Mac Mortgage Market Survey underscore that Tennessee’s mortgage rates for investment properties are influenced by national economic conditions and localized demand surges. Investors must remain vigilant to shifts in Federal Reserve policies and regional housing inventory changes, which directly affect mortgage availability and pricing. Employing predictive analytics tools and engaging with local mortgage experts can provide a competitive edge in rate locking decisions.

Holistic Mortgage Planning: Beyond Rates to Long-Term Investment Viability

While locking the lowest rate is crucial, comprehensive mortgage planning involves evaluating loan terms, prepayment penalties, and refinancing flexibility. An investment-focused mortgage strategy anticipates potential market volatility and incorporates contingencies for refinancing opportunities to capitalize on future rate drops. For deeper insights into Tennessee’s mortgage market dynamics, readers may consult investment property mortgage rate tips, which offer granular recommendations based on 2025 projections.

Explore Further: How Can Experienced Investors Share Their Mortgage Strategies in Tennessee?

We encourage seasoned investors and mortgage professionals to contribute their insights on securing advantageous investment property mortgages in Tennessee by engaging with our expert community through the contact page. Sharing nuanced experiences enriches collective understanding and aids others in navigating complex financing landscapes.

Leveraging Localized Economic Indicators for Smarter Mortgage Decisions

Investors aiming to maximize returns on Tennessee investment properties must consider localized economic indicators beyond national trends. Employment rates, population growth, and commercial development within key Tennessee markets such as Nashville, Memphis, and Knoxville significantly influence mortgage risk premiums. Mortgage lenders adjust rates in response to these factors, affecting the cost of borrowing. Staying abreast of these subtle market signals enables investors to anticipate rate shifts and strategically time their financing commitments.

For example, strong job growth in Nashville’s tech sector may reduce perceived lending risk, resulting in more favorable mortgage terms. Conversely, markets facing economic slowdown might see lenders impose higher rates to mitigate risk exposure. Thus, integrating local economic intelligence into mortgage planning is an indispensable practice for discerning investors.

Optimizing Loan Structures: Beyond Rate to Terms and Conditions

While securing competitive interest rates is critical, expert investors recognize that the structure of the loan—terms, covenants, and flexibility—significantly impacts long-term profitability. Adjustable-rate mortgages (ARMs) can offer lower initial rates but carry refinancing risks. Fixed-rate loans provide stability but might involve higher upfront costs. Customizing loan-to-value ratios and amortization schedules to match investment horizons and cash flow forecasts can improve financial efficiency.

Moreover, understanding lender-specific underwriting nuances, such as the treatment of rental income and reserves, can unveil opportunities for rate negotiation. Engaging experienced mortgage brokers familiar with Tennessee’s lending landscape, as outlined in this detailed guide, can provide access to specialized loan products and personalized financing solutions.

How Can Investors Effectively Balance Risk and Rate When Choosing Fixed vs. Adjustable Mortgages in Tennessee?

This pivotal question frames a nuanced decision-making process. Fixed mortgages offer predictability, insulating investors from rate hikes but potentially locking them into higher initial costs. Adjustable mortgages, by contrast, provide short-term savings but expose borrowers to market volatility. Analyzing investment duration, market forecasts, and cash flow flexibility is essential. Resources like our comprehensive expert guide assist in evaluating these trade-offs with Tennessee-specific data.

Mitigating Refinancing Risks Through Strategic Lock-In and Rate Watch

Refinancing remains a powerful tool for Tennessee investors aiming to reduce mortgage costs over time. However, timing the lock-in of refinance rates requires vigilance. Sudden economic shifts or policy changes can drastically affect rates. Employing analytics platforms that track real-time mortgage rate movements and forecasting Federal Reserve actions adds a layer of proactive risk management.

Additionally, locking rates at opportune moments can prevent costly rate spikes. Investors should adopt a disciplined monitoring approach and collaborate with mortgage professionals who provide up-to-the-minute guidance, as emphasized in these refinancing strategies. This approach safeguards investment returns against unnecessary financing costs.

Expert Insights: The Role of Credit Enhancement in Reducing Mortgage Rates

Credit enhancement techniques, including debt consolidation and timely payment history improvement, directly influence mortgage rate eligibility. According to the Consumer Financial Protection Bureau’s research, higher credit scores can reduce mortgage interest rates by significant margins, particularly for investment property loans where lender risk tolerance is lower.

Investors in Tennessee should prioritize credit score optimization as part of their mortgage preparation. Strategies such as disputing inaccuracies on credit reports, minimizing revolving debt, and maintaining consistent credit utilization are proven to enhance rate offers. Detailed credit improvement plans tailored to Tennessee borrowers are available to streamline this process.

Engage with the Tennessee Mortgage Community: Share Your Investment Mortgage Strategies

Your expertise can empower fellow investors navigating Tennessee’s complex mortgage landscape. We invite seasoned investors and mortgage professionals to share insights, experiences, and innovative strategies via our contact page. Collaborative knowledge exchange enhances decision-making and strengthens Tennessee’s investment community.

Decoding Complex Risk Assessment Models for Tennessee Investment Mortgages

In the increasingly sophisticated landscape of investment property financing, understanding advanced risk assessment models can unlock unprecedented mortgage savings. Lenders now utilize multifactor risk algorithms that incorporate borrower financial behavior, local market volatility indices, and macroeconomic stress tests to assign risk premiums. Investors who grasp these frameworks can proactively tailor their financial profiles to achieve more favorable mortgage terms.

For instance, integrating predictive credit behavior analytics alongside property-level risk assessments allows investors to present a compelling risk profile. This approach goes beyond the traditional credit score, encompassing cash flow stability, debt service coverage ratios (DSCR), and even localized economic resilience factors such as employment diversification. As detailed in the Mortgage News Daily analysis on risk modeling, lenders increasingly reward borrowers who demonstrate comprehensive risk mitigation, thereby reducing offered interest rates.

Harnessing Tax Strategy Integration to Optimize Mortgage Returns on Tennessee Investment Properties

Mortgage rate optimization is intrinsically linked to the broader financial strategy, particularly tax planning. Tennessee investors can leverage depreciation schedules, interest deductibility, and 1031 like-kind exchanges to enhance after-tax cash flows and indirectly influence mortgage affordability.

For example, strategically accelerating depreciation via cost segregation studies can bolster cash flow, allowing investors to handle higher mortgage payments comfortably or qualify for larger loans at better rates. Furthermore, understanding how mortgage interest deduction phases interact with Tennessee’s state tax policies can guide structuring loan amounts and amortization schedules.

How Can Strategic Tax Planning Influence Mortgage Financing Decisions for Tennessee Investment Properties?

Strategic tax planning can markedly alter the mortgage financing landscape. By aligning loan structures with tax advantages, investors reduce effective borrowing costs and enhance portfolio resilience. Engaging with tax professionals who specialize in real estate investment ensures nuanced application of federal and state tax codes, optimizing mortgage terms and investment returns simultaneously. Resources such as the IRS Real Estate Tax Center provide authoritative guidance on applicable deductions and compliance.

Innovative Financing Vehicles: Exploring Hybrid Loan Structures and Private Lending in Tennessee

Beyond conventional mortgages, experienced Tennessee investors are increasingly exploring hybrid loan arrangements that blend traditional bank financing with private or hard money lending. These hybrid structures can provide flexibility in rate negotiation, loan-to-value ratios, and repayment terms, mitigating rigid underwriting constraints.

Private lenders often assess risk differently, focusing more on property value and cash flow than borrower credit scores, which can translate into lower rates for well-positioned investors. Combining a conventional mortgage with a secondary private loan can optimize leverage while controlling overall financing costs.

Advanced Due Diligence: Utilizing Predictive Analytics and AI in Mortgage Decision-Making

Cutting-edge investors are now incorporating predictive analytics and artificial intelligence (AI) tools to refine mortgage decision-making. These technologies analyze vast datasets including local economic indicators, interest rate trajectories, borrower credit behavior patterns, and lender-specific underwriting tendencies to forecast optimal loan timing and structure.

By leveraging AI-driven mortgage advisory platforms, Tennessee investors can personalize rate lock timing and loan product selection with unprecedented precision, mitigating refinancing risks and enhancing portfolio cash flow. This proactive, data-driven approach is becoming a hallmark of next-generation investment strategies.

Exploring these technologies can be initiated through platforms such as Mortgage Bankers Association’s 2024 Technology Survey, which highlights industry adoption trends and vendor capabilities.

What Role Does AI Play in Enhancing Mortgage Rate Forecasting and Loan Structuring for Tennessee Investors?

AI enables dynamic scenario modeling that accounts for multifaceted variables impacting mortgage costs, such as Federal Reserve policy shifts, regional economic shocks, and borrower liquidity changes. This empowers investors to structure loans that balance risk and return optimally, adapt to market changes proactively, and secure financing at the most advantageous moments.

For Tennessee investors committed to sophisticated mortgage strategies, embracing AI and predictive analytics represents an evolution from reactive to anticipatory financing.

Deconstructing Multifaceted Mortgage Pricing Models in Tennessee

Investment property mortgage rates in Tennessee are no longer solely the result of basic risk metrics; they reflect an intricate interplay of macroeconomic variables, borrower-specific credit nuances, and lender portfolio strategies. Advanced lenders deploy multifactor pricing engines integrating credit risk, property valuation volatility, and local economic health indicators such as employment diversity and regional GDP growth. Investors aware of these complexities can tailor their loan applications to emphasize strengths like strong debt service coverage ratios (DSCR), low vacancy rates, and diversified income streams, thus unlocking premium mortgage pricing that rivals primary residence loans.

Dynamic Loan Portfolio Structuring: Leveraging Hybrid Financing and Private Capital

For high-net-worth Tennessee investors, conventional mortgage products can be complemented or partially supplanted by hybrid financing structures. These combine institutional bank financing with private lending or hard money loans to optimize capital deployment and rate efficiency. Private lenders often underwrite based on property cash flow and market potential rather than stringent credit thresholds, enabling lower effective interest costs for seasoned investors with solid asset backing. This hybrid approach also provides negotiation leverage and flexibility in amortization and prepayment terms, vital for adapting to evolving market cycles.

How Can Hybrid Financing Synergize with Traditional Mortgages to Optimize Tennessee Investment Property Costs?

Hybrid financing strategies enable investors to balance the low-cost benefits of traditional mortgages with the flexible terms of private lenders. By structuring loans with a primary conventional mortgage covering a significant portion of the property value and supplementing it with private capital for the remainder, investors can mitigate rate exposure and maintain liquidity for portfolio expansion. Detailed case studies and structuring examples can be found through specialized financial advisory services focused on real estate investment, such as those highlighted by NAREIT’s finance and capital markets resources.

Harnessing AI-Powered Predictive Analytics for Mortgage Timing and Structuring

The integration of artificial intelligence and machine learning models has transformed the mortgage decision-making landscape for Tennessee investment properties. AI platforms assimilate vast datasets—ranging from Federal Reserve policy signals, real-time local economic metrics, to borrower credit behavior trends—to generate precise rate forecasts and optimal lock-in windows. This granular insight allows investors to proactively hedge against market volatility, select loans with bespoke risk-return profiles, and dynamically adjust their portfolio financing strategies. Early adopters of these technologies report enhanced cash flow stability and improved refinancing outcomes.

What Are the Key AI-Driven Metrics That Influence Mortgage Rate Forecasting for Investment Properties in Tennessee?

AI-driven mortgage analytics prioritize variables such as forward-looking regional employment indices, consumer credit utilization trends, and lender-specific underwriting flexibility. By modeling these alongside macroeconomic indicators like inflation trajectories and bond yield curves, AI tools deliver scenario planning that refines timing and loan structure selection. Leveraging these insights, investors can anticipate rate inflection points, optimize loan-to-value ratios, and negotiate terms with greater confidence. For an in-depth exploration, see the Mortgage Bankers Association’s 2024 Mortgage Technology Survey.

Strategic Tax Planning: Amplifying Mortgage Efficiency Through Advanced Techniques

In Tennessee’s investment property arena, sophisticated tax strategy integration can substantially affect mortgage affordability and portfolio cash flow. Cost segregation studies, accelerated depreciation, and strategic utilization of 1031 exchanges allow investors to defer tax liabilities and enhance net operating income, thereby easing debt service burdens. Moreover, a nuanced understanding of the interplay between federal mortgage interest deductions and Tennessee’s tax frameworks enables investors to optimize loan sizing and amortization schedules effectively.

How Do Advanced Tax Strategies Influence Mortgage Structuring and Long-Term Investment Returns in Tennessee?

Tax planning not only reduces immediate tax liabilities but also reshapes cash flow profiles, influencing loan qualification criteria and mortgage pricing. By collaborating with tax professionals specializing in real estate, investors can align financing structures with tax-advantaged cash flows, optimizing both debt capacity and cost. The IRS Real Estate Tax Center remains an authoritative resource for compliance and strategic tax considerations.

Engage with Tennessee’s Elite Investment Mortgage Network

We invite discerning Tennessee investors and mortgage professionals to contribute their expert insights and pioneering strategies through our contact page. Collaborative discourse fosters elevated decision-making capabilities and propels the community toward innovative financing solutions.

Expert Insights & Advanced Considerations

Integrate Local Economic Indicators to Anticipate Rate Movements

Understanding the interplay between Tennessee’s localized economic factors—such as employment growth in Nashville’s tech sector or commercial development in Memphis—and lender mortgage risk premiums can provide investors with a predictive advantage. This nuanced insight enables strategic timing of mortgage commitments, often unlocking more favorable rates before broader market adjustments occur.

Leverage Hybrid Financing to Optimize Capital Structure and Cost

Combining traditional bank mortgages with private lending or hard money loans offers flexible underwriting terms and can reduce overall borrowing costs. This hybrid approach allows experienced investors to negotiate better loan-to-value ratios, amortization schedules, and prepayment terms, adapting financing structures to portfolio growth cycles and market volatility effectively.

Employ AI-Powered Predictive Analytics for Precision Rate Locking

Artificial intelligence tools analyzing Federal Reserve signals, regional economic data, and borrower credit behavior empower investors to pinpoint optimal moments to lock in rates or select loan products. This anticipatory methodology enhances refinancing outcomes and stabilizes cash flows by mitigating unforeseen market shifts, a critical edge in Tennessee’s evolving mortgage environment.

Prioritize Credit Enhancement as a Core Mortgage Rate Optimization Strategy

Beyond traditional credit scores, adopting advanced credit improvement techniques—such as debt consolidation, dispute resolution on credit reports, and maintaining low revolving balances—can significantly lower investment property mortgage rates. Tennessee investors benefit from tailored credit strategies that translate into tangible cost savings over the life of the loan.

Integrate Strategic Tax Planning to Amplify Mortgage Affordability

Sophisticated tax strategies, including accelerated depreciation and 1031 exchanges, directly influence effective mortgage costs by improving after-tax cash flow. Aligning loan structuring with these tax advantages enhances borrowing capacity and supports sustainable portfolio growth, underscoring the importance of collaboration with tax professionals versed in Tennessee real estate investment.

Curated Expert Resources

- Freddie Mac Mortgage Market Survey: Offers comprehensive data and analysis on national and regional mortgage rate trends critical for understanding Tennessee’s investment property financing landscape.

- IRS Real Estate Tax Center: An authoritative hub for the latest guidance on tax strategies affecting mortgage structuring and investment returns.

- Mortgage Bankers Association 2024 Technology Survey: Provides insights into cutting-edge AI and predictive analytics tools transforming mortgage decision-making.

- Mortgage News Daily on Advanced Risk Assessment Techniques: A detailed exploration of multifactor risk models lenders use, invaluable for tailoring loan applications.

- NAREIT Finance and Capital Markets Resources: Essential reading for understanding hybrid financing structures and evolving capital strategies in real estate investment.

Final Expert Perspective

In the dynamic realm of investment property mortgages in Tennessee, success hinges on embracing complexity—from local economic subtleties and hybrid loan structuring to AI-enhanced forecasting and integrated tax planning. These advanced strategies collectively empower investors to secure competitive mortgage rates and robust financing terms that support sustainable portfolio growth. For those ready to deepen their expertise or contribute pioneering insights, engaging with our expert community via the contact page offers a valuable platform to share, learn, and lead in Tennessee’s sophisticated mortgage market.