Understanding the Fluid Nature of Tennessee Mortgage Rates

When navigating the Tennessee real estate market, one of the most pressing questions for prospective homebuyers and refinancers alike is: how often do mortgage rates change? Unlike fixed prices on consumer goods, mortgage rates are dynamic, influenced by a complex array of economic factors. Grasping their volatility is crucial for making informed financial decisions in Tennessee’s unique housing landscape.

Daily Shifts: The Pulse of Mortgage Rate Movements

Mortgage rates can fluctuate daily, sometimes even multiple times within a single day, depending on economic news, bond market trends, and Federal Reserve policy signals. For example, changes in the 10-year Treasury yield often directly impact mortgage interest rates, as lenders adjust their offerings to maintain profitability while remaining competitive.

In Tennessee’s diverse markets—from Nashville’s booming urban areas to more rural counties—these shifts can influence buying power significantly. Experienced mortgage brokers in Tennessee closely monitor these trends to advise clients on the optimal timing for locking in rates, as detailed in this guide on refinancing and rate locks.

The Tennessee Market’s Seasonal and Economic Influences

Beyond daily fluctuations, mortgage rates in Tennessee are also affected by broader economic cycles and seasonal patterns. Economic indicators such as inflation rates, employment reports, and consumer spending habits ripple through the housing finance ecosystem, often causing noticeable rate adjustments over weeks or months.

Moreover, Tennessee’s housing market shows seasonal trends—spring and summer often see heightened buyer activity, which can tighten lending conditions and momentarily push rates higher. Conversely, winter months may offer more favorable rates due to lower demand. Understanding these temporal nuances empowers buyers to strategize effectively.

How Do Local Factors in Tennessee Influence Mortgage Rate Changes?

Local economic conditions, including job growth in metropolitan hubs like Memphis and Knoxville, significantly influence lenders’ risk assessments and thus mortgage rates. Additionally, Tennessee-specific loan programs, such as FHA loans, have their own rate trends and opportunities, which are explored comprehensively in this FHA loan rates overview.

Credit scores also play a pivotal role in determining individual mortgage rates in Tennessee. Borrowers with higher credit ratings typically secure lower interest rates, highlighting the importance of credit score management in Tennessee’s mortgage landscape.

Expert Strategies to Navigate Rate Changes in Tennessee

Given the fluidity of mortgage rates, Tennessee homebuyers benefit from proactive strategies: monitoring national economic news, consulting local mortgage experts, and understanding the timing nuances unique to Tennessee’s market. This approach helps in deciding when to lock a rate or float, maximizing savings over the life of a loan.

For those interested in deeper insights on locking strategies and timing, this resource on when to lock mortgage rates in Tennessee is highly recommended.

Stay Ahead in Tennessee’s Mortgage Rate Game

Mortgage rates in Tennessee are a reflection of an intricate dance between global economic forces and local market dynamics. Staying informed with expert guidance and timely data is essential for securing the best possible mortgage terms.

Curious about how mortgage rates might evolve in your Tennessee locality? Share your experiences or questions below to join a community of savvy homebuyers and mortgage professionals.

For authoritative insights on how economic factors shape mortgage rates nationwide and their local impact, the Federal Reserve’s monetary policy updates are an invaluable resource.

Microeconomic Triggers Behind Tennessee Mortgage Rate Volatility

While national economic factors set the broad stage for mortgage rate trends, microeconomic events within Tennessee can lead to nuanced rate shifts that savvy buyers should watch closely. For instance, local government bond issuances, changes in property tax policies, or infrastructural developments in areas like Chattanooga or Franklin can subtly influence lender risk assessments and, consequently, mortgage pricing.

Mortgage lenders in Tennessee meticulously analyze these local economic signals to adjust their rate offerings, ensuring they remain competitive yet profitable. This localized approach underscores why prospective borrowers should consult local mortgage brokers in Tennessee who possess on-the-ground insights beyond generic national data.

How Can Tennessee Homebuyers Leverage Timing and Market Dynamics to Secure Optimal Mortgage Rates?

Timing your mortgage lock-in decision is a sophisticated dance between anticipating market movements and understanding personal financial readiness. Experts recommend that Tennessee homebuyers align their mortgage applications with periods of relative economic calm and favorable seasonal trends, such as late fall or early winter, when competition among buyers typically softens.

Moreover, leveraging tools like rate alerts and consulting mortgage professionals familiar with fixed vs adjustable mortgage rates in Tennessee can help buyers tailor their borrowing strategy for both immediate affordability and long-term savings.

Impact of Credit Trends and Lending Policies on Tennessee Mortgage Rates

Credit score trends in Tennessee have shown a gradual improvement over recent years, largely driven by enhanced financial literacy and credit management tools available to consumers. This positive trajectory has enabled more borrowers to qualify for lower mortgage interest rates, fostering increased homeownership opportunities.

However, lending policies also evolve in response to regulatory changes and economic outlooks. For example, shifts in FHA loan underwriting guidelines or changes in debt-to-income ratio thresholds can alter the mortgage rate landscape significantly. Staying informed on these policy updates is crucial, as detailed in the comprehensive FHA loan rates trends and opportunities guide.

Integrating Data-Driven Mortgage Decisions with Tennessee Market Realities

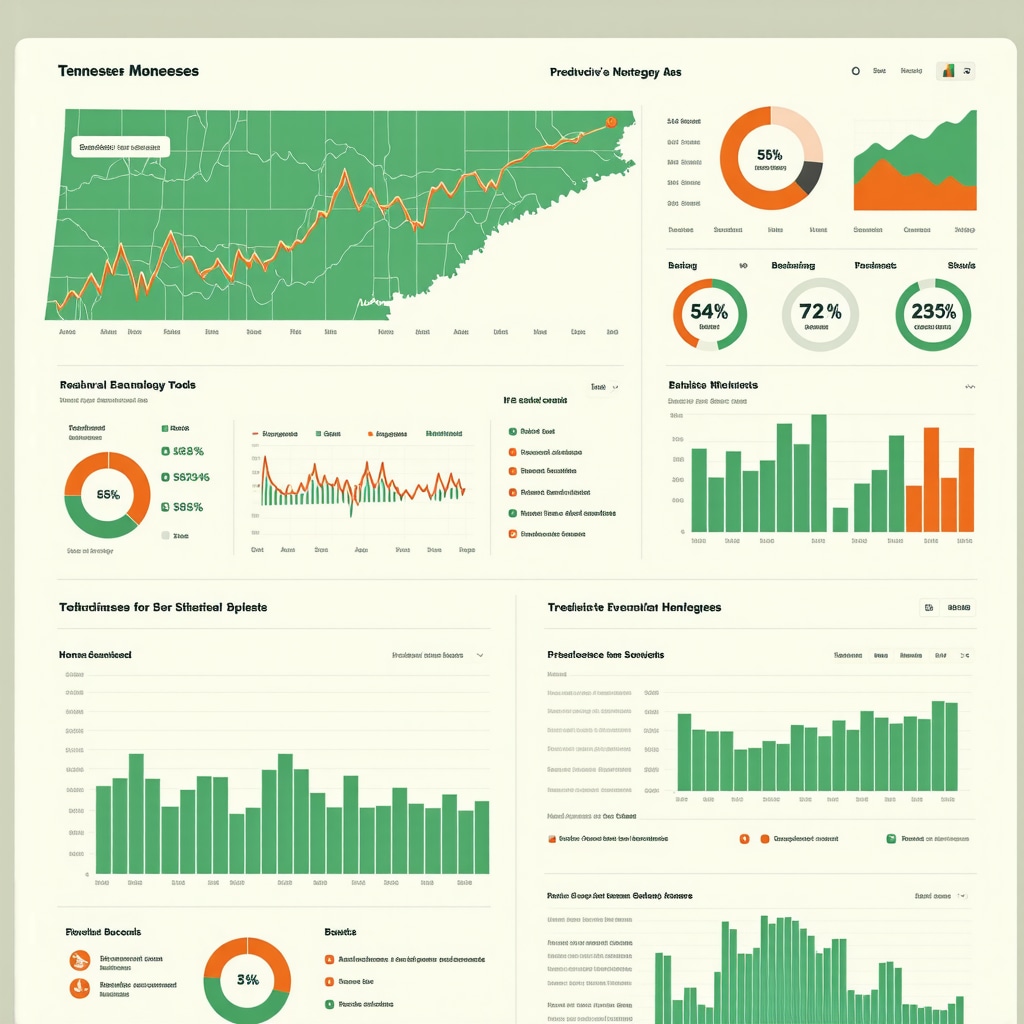

Data analytics have become indispensable tools for mortgage brokers and buyers alike. Tennessee’s growing adoption of AI-driven platforms and real-time market data feeds allows for more precise forecasting of mortgage rate movements, enabling proactive decision-making.

For example, predictive models that incorporate Tennessee-specific economic indicators such as regional employment rates and housing inventory levels can highlight optimal windows for mortgage rate locks. This advanced approach minimizes risk and maximizes financial efficiency in home financing.

Integrating these data-driven insights with personalized consultations from trusted licensed mortgage brokers in Tennessee ensures a well-rounded strategy tailored to individual needs.

Interested in mastering the art of mortgage timing in Tennessee? Share your questions or experiences below to engage with a community of experts and homebuyers.

For authoritative national context, the Investopedia guide on mortgage rate influences offers comprehensive insights into the multifaceted drivers of mortgage rates, complementing localized Tennessee expertise.

Decoding the Interplay Between Global Economic Indicators and Tennessee Mortgage Rates

While Tennessee’s mortgage rates are directly influenced by local market dynamics, their fluctuations are also tethered to the broader global economic environment. International trade tensions, geopolitical uncertainties, and shifts in foreign central bank policies can indirectly pressure U.S. Treasury yields, subsequently rippling into Tennessee’s mortgage market. For instance, when global investors seek safer assets amid turmoil, demand for U.S. Treasury bonds surges, pushing yields down and often leading to lower mortgage rates locally.

Understanding this global-local nexus is paramount for Tennessee borrowers aiming to anticipate rate movements beyond conventional domestic economic reports. Incorporating this macroeconomic perspective allows for more nuanced borrowing strategies that can capitalize on favorable global financial climates.

What Role Do Federal Reserve Forward Guidance and Market Expectations Play in Shaping Tennessee Mortgage Rates?

Federal Reserve communications, particularly forward guidance regarding interest rate trajectories and quantitative easing, wield substantial influence over mortgage rates nationwide, including Tennessee. Market participants closely analyze Fed statements for clues on monetary policy shifts, which affect bond markets and investor sentiment. When the Fed signals tightening policy, mortgage rates tend to rise in anticipation of higher benchmark rates; conversely, dovish tones often precipitate rate declines.

For Tennessee homebuyers and refinancers, interpreting these signals with expert insight can mean the difference between securing an optimal mortgage rate or facing higher borrowing costs. Engaging with local mortgage professionals who integrate Fed analysis with Tennessee-specific data ensures well-timed decisions aligned with both national and regional market realities.

Harnessing Predictive Analytics to Anticipate Tennessee Mortgage Rate Trends

The rise of machine learning and AI-powered predictive analytics has revolutionized mortgage rate forecasting. In Tennessee, sophisticated models integrate vast datasets—ranging from regional employment figures and housing inventory fluctuations to national economic indicators—to generate probabilistic forecasts of rate trends. This granular, data-driven approach transcends traditional heuristics, offering borrowers a competitive edge in timing their mortgage commitments.

These technologies empower mortgage brokers and buyers alike to simulate various economic scenarios, evaluate risk-adjusted costs, and optimize rate locks or float decisions. As such, the integration of AI analytics represents a paradigm shift in Tennessee’s mortgage market, fostering transparency and strategic foresight.

How Can Tennessee Borrowers Effectively Combine AI Forecasts with Traditional Market Knowledge?

While AI models provide powerful insights, their efficacy is maximized when complemented by seasoned human expertise. Tennessee borrowers should leverage predictive analytics as a decision-support tool rather than a sole determinant. Experienced mortgage brokers contextualize AI predictions within local market nuances—such as upcoming municipal developments or shifts in state lending policies—that algorithms might not fully capture.

This hybrid approach ensures a holistic understanding of mortgage rate drivers, balancing quantitative forecasts with qualitative intelligence. Collaborating with licensed Tennessee mortgage professionals who embrace technological innovation enhances the precision and reliability of mortgage rate timing strategies.

Policy Developments and Their Subtle Yet Significant Impact on Tennessee Mortgage Pricing

Recent federal and state policy shifts, including changes to mortgage insurance premiums, tax incentives, and lending regulations, subtly recalibrate the mortgage pricing landscape in Tennessee. For example, adjustments in conforming loan limits or updates to the Qualified Mortgage rule may alter lender risk assessments, resulting in marginal rate modifications.

Keeping abreast of these evolving policies is essential for Tennessee borrowers seeking to understand and anticipate changes in their mortgage cost structures. Comprehensive policy analysis paired with personalized mortgage consultations ensures borrowers do not overlook these pivotal factors.

For an authoritative exploration of these regulatory influences, the Consumer Financial Protection Bureau’s regulations on mortgage lending provide detailed guidance.

Ready to elevate your mortgage strategy with cutting-edge insights and expert guidance tailored to Tennessee’s unique market? Connect with licensed mortgage professionals today to navigate the complexities of rate fluctuations confidently.

Leveraging Behavioral Economics to Decode Mortgage Rate Movements in Tennessee

The interplay between borrower psychology and mortgage rate trends in Tennessee reveals subtle behavioral economics principles at work. Market sentiment, often shaped by collective expectations of future economic conditions, can amplify or dampen mortgage rate movements beyond fundamental data. Understanding how Tennessee buyers’ risk tolerance and decision-making heuristics influence demand can provide lenders with predictive signals for rate adjustments.

For example, heightened buyer optimism during periods of economic recovery may prompt lenders to tighten rates marginally to balance increased loan demand, while risk-averse sentiments during economic uncertainty might lead to more conservative pricing. Thus, discerning these behavioral nuances affords borrowers and brokers an advanced vantage point to anticipate and navigate rate changes effectively.

How Do Behavioral Biases Affect Mortgage Rate Timing Decisions for Tennessee Borrowers?

Tennessee borrowers often grapple with cognitive biases such as anchoring, where initial rate quotes disproportionately influence their lock-in timing, or herd behavior, where decisions are swayed by perceived market consensus rather than data-driven analysis. These biases can result in premature rate locks or missed opportunities to capitalize on favorable market dips.

Mitigating these biases requires a disciplined approach that integrates objective market analytics with expert consultation. Utilizing tools that provide real-time mortgage rate trends and scenario-based forecasts helps counteract emotional decision-making, ensuring Tennessee homebuyers optimize their borrowing costs.

Harnessing Tennessee’s Real Estate Tech Ecosystem for Mortgage Rate Intelligence

The burgeoning proptech scene in Tennessee, particularly in innovation hubs like Nashville, empowers mortgage participants with sophisticated platforms that aggregate hyperlocal market data and predictive analytics. These technologies enable granular tracking of microtrends in mortgage rate fluctuations, borrower profiles, and lending institution behaviors, offering unparalleled transparency.

Mortgage brokers and borrowers can tap into these platforms for tailored alerts, competitive rate benchmarking, and scenario modeling that incorporate Tennessee’s unique economic indicators. This technological leverage transforms traditional mortgage shopping into a strategic data-driven endeavor.

Institutional Lender Strategies and Their Impact on Tennessee Mortgage Pricing

Institutional lenders operating within Tennessee deploy advanced risk-based pricing models that consider multifaceted borrower and market variables. These models dynamically adjust mortgage rates in response to shifts in portfolio risk, capital costs, and regulatory requirements.

Understanding the mechanics behind these institutional strategies equips Tennessee borrowers with insights into why rates may diverge between lenders and how targeted improvements in creditworthiness or loan structure can yield more favorable terms. Engaging with lenders who transparently communicate their pricing frameworks can enhance negotiating power and mortgage outcomes.

For further expert analysis on risk-based pricing in mortgage lending, refer to the Mortgage Bankers Association’s research on credit risk and pricing.

CTA: Elevate Your Tennessee Mortgage Strategy with Cutting-Edge Expertise

Unlock sophisticated mortgage rate navigation strategies tailored to Tennessee’s dynamic market. Collaborate with licensed mortgage professionals leveraging behavioral insights, proptech innovations, and institutional pricing knowledge to secure optimal loan terms. Contact a Tennessee mortgage expert today to transform uncertainty into opportunity.

Frequently Asked Questions (FAQ)

How often do mortgage rates change in Tennessee?

Mortgage rates in Tennessee can fluctuate daily and sometimes multiple times within a day, driven by national economic data, Federal Reserve policies, bond market movements, and local market conditions. Staying informed daily is crucial for optimal timing.

What local factors uniquely influence mortgage rates in Tennessee?

Local economic growth, property tax policies, infrastructure projects, and regional employment trends impact lender risk perceptions and mortgage pricing. Metropolitan hubs such as Nashville, Memphis, and Knoxville have distinct dynamics affecting rates.

When is the best time to lock a mortgage rate in Tennessee?

Expert advice suggests timing rate locks during periods of economic stability and lower seasonal demand, such as late fall or early winter, when competition among buyers wanes. However, individual financial readiness and market forecasts should guide the decision.

How do credit scores affect mortgage rates in Tennessee?

Borrowers with higher credit scores generally qualify for lower interest rates due to reduced lending risk. Tennessee’s improving credit trends have expanded access to favorable rates, but maintaining a strong credit profile remains vital.

Can AI and predictive analytics improve mortgage rate timing?

Yes, integrating AI-driven forecasts with traditional market expertise helps anticipate rate movements more accurately. In Tennessee, combining data analytics with local insights offers borrowers a strategic advantage in locking or floating rates.

What role do Federal Reserve policies play in Tennessee mortgage rates?

Federal Reserve forward guidance influences national bond yields, which in turn affect Tennessee mortgage rates. Fed signals regarding interest rate hikes or cuts are closely monitored by lenders and borrowers to anticipate rate shifts.

How do behavioral economics impact mortgage decisions in Tennessee?

Borrowers may be influenced by cognitive biases such as anchoring or herd behavior, potentially leading to suboptimal timing of rate locks. Awareness and disciplined decision-making supported by data help mitigate these effects.

Are there Tennessee-specific loan programs affecting mortgage rates?

Yes, programs like FHA loans have particular rate trends and underwriting guidelines in Tennessee. Understanding these can open opportunities for advantageous mortgage terms tailored to local borrower profiles.

How do institutional lenders determine mortgage rates differently in Tennessee?

Institutional lenders use advanced risk-based pricing models that factor in borrower creditworthiness, loan structure, portfolio risk, and local market conditions, resulting in varying rates across lenders.

How can Tennessee homebuyers leverage technology for better mortgage deals?

The state’s growing proptech ecosystem offers platforms that provide real-time local market data, predictive analytics, and personalized alerts, empowering buyers and brokers to make informed, data-driven mortgage decisions.

Trusted External Sources

- Federal Reserve Board (https://www.federalreserve.gov/monetarypolicy.htm): Provides authoritative updates on monetary policy and interest rate guidance affecting mortgage rates nationwide, essential for understanding macroeconomic influences on Tennessee rates.

- Mortgage Bankers Association (https://www.mortgagebankers.org/news-research-and-resources/research/mortgage-credit-risk): Offers in-depth research on credit risk management and pricing strategies utilized by institutional lenders, illuminating the dynamics behind mortgage rate variations in Tennessee.

- Consumer Financial Protection Bureau (https://www.consumerfinance.gov/rules-policy/regulations/1026/): Details regulatory frameworks and lending policies that shape mortgage pricing and borrower protections relevant to Tennessee homebuyers.

- Investopedia – Mortgage Rate Influences (https://www.investopedia.com/articles/personal-finance/082615/what-affects-mortgage-rates.asp): Delivers comprehensive explanations of the multifactorial drivers of mortgage rates, complementing localized Tennessee market insights.

- Tennessee Housing Development Agency (https://thda.org): Provides localized data, loan programs, and housing market analysis specific to Tennessee, crucial for understanding regional mortgage rate impacts and borrower assistance.

Conclusion

Understanding the fluid and multifaceted nature of mortgage rates in Tennessee is essential for homebuyers and refinancers seeking optimal loan terms. Daily fluctuations influenced by national economic signals, combined with local market dynamics such as employment trends and seasonal demand, create a complex rate environment. Leveraging expert guidance, integrating predictive analytics with behavioral insights, and staying attuned to policy developments empower Tennessee borrowers to navigate this landscape strategically. By collaborating with licensed mortgage professionals and utilizing Tennessee’s proptech innovations, borrowers can transform uncertainties into opportunities for substantial financial savings. Embrace these expert-informed strategies today—share your experiences, ask questions, and explore further expert resources to master the art of mortgage rate timing in Tennessee’s dynamic housing market.