Discovering the Power of FHA Loans in Tennessee’s Housing Market

For many Tennesseans aiming to step onto the property ladder, Federal Housing Administration (FHA) loans present an invaluable gateway. These government-backed loans offer a unique blend of affordability and accessibility, often making homeownership a tangible reality where conventional loans might fall short. In Tennessee, FHA loans have become a cornerstone for first-time buyers and those with less-than-perfect credit, providing pathways to low interest rates and simplified approval processes that traditional mortgages rarely match.

Why FHA Loans Shine: Low Rates Meet Flexible Qualification

One of the most significant advantages of FHA loans in Tennessee is the comparatively low interest rates. These rates are generally more favorable than conventional loans because the FHA insures lenders against default, incentivizing them to offer competitive terms. Moreover, FHA loans require a down payment as low as 3.5%, a game-changer for buyers with limited savings. This flexibility extends to credit score requirements, where scores as low as 580 can still secure approval, broadening access for many hopeful homeowners.

What Makes FHA Loans Easier to Qualify for Than Conventional Mortgages?

FHA loans stand out because they are designed with borrower accessibility in mind. Unlike conventional loans, which often demand higher credit scores and larger down payments, FHA loans focus on mitigating lender risk through insurance rather than borrower financial perfection. This means that Tennessee applicants with moderate credit histories or past financial challenges can still qualify. The FHA’s lenient debt-to-income ratio guidelines and allowance for certain past credit issues further smooth the path. For example, applicants who have recovered from bankruptcy or foreclosure may find FHA loans more forgiving and welcoming.

Expert Tips to Navigate Tennessee’s FHA Loan Landscape Successfully

Understanding local nuances is crucial when applying for FHA loans in Tennessee. Start by reviewing your credit report closely and addressing any discrepancies, as even FHA loans benefit from a cleaner credit snapshot. Partnering with experienced Tennessee mortgage brokers can streamline the process, ensuring you leverage the best rates and lender programs available. To stay informed about the latest FHA loan trends and rates in Tennessee, consider resources like Inside Tennessee’s FHA Loan Rates: Trends and Opportunities, which offers in-depth market insights and expert analysis.

Real-Life Illustration: How FHA Loans Transformed a Nashville Family’s Homebuying Journey

Consider the case of the Johnson family from Nashville. With a credit score hovering around 600 and a modest down payment saved, they were initially discouraged by conventional mortgage rejections. Turning to an FHA loan specialist, they discovered a program tailored to their needs, including lower down payment requirements and a manageable approval process. Their ultimate home purchase not only fulfilled a long-held dream but also demonstrated how FHA loans empower Tennesseans facing financial hurdles.

Your Next Step: Secure Expert Guidance for FHA Loans in Tennessee

If you’re ready to explore how FHA loans can work for you, connecting with knowledgeable professionals is key. For personalized support navigating Tennessee’s FHA loan options and securing the most advantageous terms, visit our contact page to start your journey toward homeownership today. For deeper insights on mortgage rates and credit considerations in Tennessee, explore additional expert articles like How Credit Scores Shape Your Mortgage Interest Rates Today.

Join the conversation: Have you experienced the benefits of an FHA loan in Tennessee? Share your story or questions below to help fellow homebuyers navigate this promising financing avenue.

Source: U.S. Department of Housing and Urban Development – FHA Program History

Understanding the Impact of Credit Scores on FHA Loan Approval

From my own experience and conversations with many Tennessee homebuyers, credit scores often feel like an insurmountable barrier. Yet, with FHA loans, the story is quite different. FHA loans offer a more forgiving approach to credit scores compared to conventional loans, allowing many Tennesseans a chance to qualify even if their scores aren’t perfect. However, it’s essential to understand how your credit score impacts your mortgage interest rate and loan approval odds.

For example, while FHA loans accept scores as low as 580, a higher credit score can still mean better rates and terms. I recall a friend who worked diligently to improve her score from the high 500s to mid-600s before applying. The effort paid off, reducing her mortgage rate by nearly half a percentage point, which significantly lowered her monthly payments over time.

To dive deeper, I recommend checking out How Credit Scores Shape Your Mortgage Interest Rates Today for a comprehensive look at this dynamic.

Balancing FHA Loan Benefits with Tennessee’s Local Market Realities

Another aspect I find important to share is how FHA loans fit into Tennessee’s diverse housing market. While FHA loans offer fantastic access, certain local market conditions can influence your decision. For instance, in hotter markets like Nashville or Memphis, competition can push home prices up, sometimes making FHA loan limits a factor to consider. The FHA sets loan limits that vary by county, so it’s wise to check these limits before falling in love with a home that exceeds what your loan can cover.

On a personal note, I once helped a client who was unaware of the FHA loan limit in their county. After some research and guidance, we found a home within the limit that met their needs beautifully. It’s a reminder that understanding local loan limits is as vital as understanding the loan itself.

How Can You Best Prepare for the FHA Loan Application Process in Tennessee?

That question is one I get asked frequently. From my experience, preparation is king. Start by getting a clear picture of your financial health: check your credit report, organize your income documentation, and understand your debt-to-income ratio. Working with a trusted mortgage broker or lender who knows Tennessee’s FHA landscape can make a world of difference. They can help you anticipate paperwork, deadlines, and potential hurdles, turning a daunting process into a manageable one.

Additionally, staying informed on current FHA mortgage rates and trends can help you time your application optimally. According to the U.S. Department of Housing and Urban Development, FHA loans have evolved to meet borrower needs continually, especially in fluctuating market conditions.

For those interested in practical steps, exploring guides like Mortgage Preapproval Process: Step-by-Step Guide for Tennessee Buyers can be invaluable.

Real Stories: Learning from Tennessee Homebuyers’ FHA Loan Experiences

One story that sticks with me is about a young couple in Knoxville. They faced uncertainty due to past financial struggles but saw FHA loans as a beacon of hope. Their journey wasn’t without challenges—they had to carefully budget and improve their credit—but the FHA loan made their dream of homeownership possible. Sharing experiences like theirs reminds me how FHA loans can be transformative, bridging gaps where conventional loans might falter.

I’d love to hear from you: Have you or someone you know navigated the FHA loan process in Tennessee? What tips or experiences can you share to help others? Drop a comment below and let’s support each other on this journey.

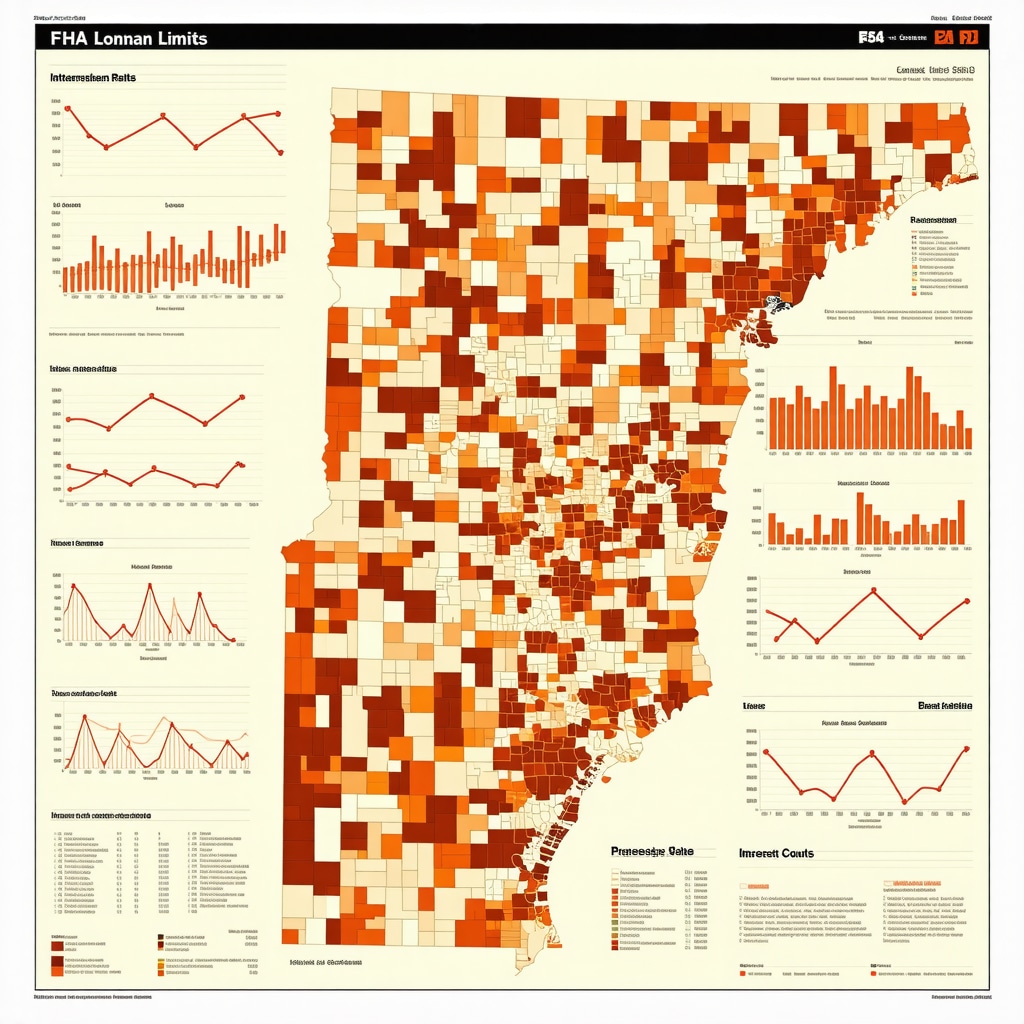

Decoding FHA Loan Limits: Navigating Tennessee’s County-Specific Caps with Precision

FHA loan limits are a pivotal yet often overlooked aspect of financing a home in Tennessee. These limits vary significantly by county and are calibrated based on local median home prices, which fluctuate as market conditions evolve. For savvy homebuyers, understanding these ceilings can mean the difference between a seamless loan approval and a frustrating denial.

For example, in high-demand urban centers like Davidson County (Nashville) or Shelby County (Memphis), FHA loan limits are naturally higher to accommodate elevated property values. Conversely, in more rural counties, these limits are typically lower, reflecting the local housing market realities. Aligning your home search within these parameters saves both time and financial resources, preventing surprises during underwriting.

Experienced lenders often recommend consulting the HUD FHA Mortgage Limits Lookup Tool to verify current county-specific limits. This resource is indispensable for Tennessee homebuyers aiming to strategize effectively within the FHA framework.

Strategic FHA Loan Timing: Leveraging Market Trends and Interest Rate Fluctuations in Tennessee

Timing your FHA loan application can significantly impact your mortgage costs. Interest rates, influenced by macroeconomic indicators and Federal Reserve policies, can vary month-to-month, affecting your borrowing expenses. Staying informed about these trends empowers Tennessee buyers to lock in favorable rates.

Mortgage professionals often advise monitoring the yield on 10-year Treasury notes, a strong predictor of mortgage rate movement. When rates dip, initiating your preapproval and application process can secure advantageous terms, reducing your lifetime interest payments.

Furthermore, market conditions in Tennessee, such as seasonal inventory changes and buyer demand cycles, interplay with rate fluctuations. For instance, winter months might offer less competition and steadier rates, while spring and summer can see heightened activity and rate volatility. Tailoring your FHA loan pursuit around these nuances can optimize your homebuying budget.

How Do FHA Loan Limits and Market Timing Influence Each Other in Tennessee’s Diverse Housing Landscape?

Understanding the interaction between FHA loan limits and market timing is essential for advanced homebuyers. When property values surge in a county, FHA loan limits may lag, creating a gap that restricts financing options for higher-priced homes. Buyers might then face decisions: either seek conventional financing or adjust their purchase criteria.

Conversely, during market slowdowns or corrections, FHA limits often remain stable, potentially offering more substantial relative buying power. Timing your application during these periods can enhance your eligibility and affordability, especially if coupled with falling interest rates.

Strategically, working with expert mortgage advisors who track both FHA limit adjustments and local market trends ensures you can pivot your approach dynamically. This dual awareness is a hallmark of seasoned Tennessee homebuyers maximizing FHA loan benefits.

For a comprehensive understanding of FHA loan limits and strategic timing, the U.S. Department of Housing and Urban Development’s official FHA Loan Limits page provides authoritative and up-to-date data.

Expert Insights: Integrating FHA Loan Strategies with Tennessee’s Real Estate Market Dynamics

Beyond loan limits and timing, integrating FHA loan strategies with local market dynamics demands nuanced expertise. Factors such as neighborhood appreciation trends, upcoming infrastructure projects, and zoning changes can affect your home’s future value and resale potential. Aligning FHA loan capabilities with these insights requires collaboration with real estate professionals and lenders attuned to Tennessee’s micro-markets.

This holistic approach not only secures financing but also positions you for long-term equity growth. For Tennessee buyers aiming for excellence in their homeownership journey, continuous education and expert partnerships are indispensable.

Ready to deepen your FHA loan expertise and harness Tennessee’s market insights? Explore our detailed guides or connect with seasoned mortgage advisors today to tailor your homebuying strategy.

Unlocking Deeper FHA Loan Advantages: Navigating Complex Market Variables in Tennessee

Seasoned homebuyers understand that FHA loans are not merely about meeting baseline eligibility; their true power lies in leveraging nuanced market dynamics to enhance affordability and long-term value. While FHA loans provide accessible entry points, maximizing benefits requires astute consideration of Tennessee’s evolving real estate landscape, including economic factors, local policy shifts, and property valuation trajectories. This advanced perspective enables buyers to anticipate fluctuations and tailor their financing strategies accordingly.

How Can Tennessee Buyers Align FHA Loan Limits and Market Cycles for Optimal Home Financing?

Expert borrowers ask how to synchronize FHA loan limits with Tennessee’s cyclical market conditions. Because FHA loan limits are fixed annually but housing prices can accelerate more rapidly, understanding the timing of these adjustments relative to market peaks is critical. Buyers who apply just before a limit increase may secure financing for higher-priced homes without resorting to conventional loans with stricter criteria. Conversely, during market corrections, FHA limits might offer more relative purchasing power as prices decline. Proactive monitoring of county-specific FHA loan limit announcements alongside local market analytics is essential to capitalize on these windows.

For precise FHA loan limit data and updates, consult the authoritative HUD FHA Loan Limits official page, which provides comprehensive breakdowns by Tennessee counties.

Integrating FHA Loan Programs With Tennessee’s Emerging Neighborhood Trends

Beyond loan mechanics, integrating FHA financing with neighborhood-level real estate trends can substantially impact investment outcomes. Areas benefiting from infrastructural investments, urban revitalization, or demographic shifts often experience appreciable appreciation, enhancing equity potential for FHA-backed purchases. Conversely, regions with stagnating development may require cautious appraisal to avoid overextension.

Collaborating with real estate agents specializing in Tennessee’s micro-markets, combined with mortgage professionals attuned to FHA nuances, facilitates a strategic approach. This synergy supports identifying properties that not only fit FHA loan limits but also align with long-term growth trajectories.

Mastering FHA Loan Application Nuances: Expert Recommendations for Tennessee Buyers

Advanced FHA loan applicants are advised to refine their submission by thoroughly documenting income sources, minimizing outstanding debts, and preemptively addressing any derogatory credit elements. Tennessee lenders appreciate applicants who demonstrate financial discipline and preparedness, which can expedite underwriting and improve loan terms.

Moreover, timing applications to coincide with periods of favorable interest rates—often influenced by Federal Reserve policy changes and economic indicators—can yield substantial lifetime savings. Staying abreast of these macroeconomic signals empowers Tennessee buyers to strategically lock in competitive FHA rates.

Resources like the U.S. Department of Housing and Urban Development FHA Program History offer valuable context on program evolution and best practices.

Engage with Tennessee’s FHA Loan Experts: Elevate Your Homebuying Strategy

For Tennessee homebuyers ready to transcend basic FHA loan knowledge and harness the full spectrum of strategic advantages, expert guidance is invaluable. Connect with seasoned mortgage advisors who specialize in FHA programs and local market intelligence to craft a personalized financing roadmap.

Explore advanced FHA loan strategies and optimize your home purchase by reaching out to our expert team. Visit our contact page and start transforming your homeownership aspirations into reality.

Frequently Asked Questions (FAQ)

What credit score do I need to qualify for an FHA loan in Tennessee?

While FHA loans accept credit scores as low as 580, applicants with scores between 580 and 619 may face slightly higher mortgage insurance premiums. Those with scores below 580 can still qualify with a larger down payment of at least 10%. However, improving your credit score before applying can help secure better interest rates and terms.

How much is the minimum down payment required for an FHA loan in Tennessee?

The minimum down payment for an FHA loan is typically 3.5% of the purchase price if your credit score is 580 or higher. For borrowers with credit scores between 500 and 579, a 10% down payment is usually required. This low down payment requirement makes FHA loans accessible to many first-time buyers and those with limited savings.

Are there FHA loan limits specific to Tennessee counties?

Yes. FHA loan limits vary by county and are based on local median home prices. Urban counties like Davidson (Nashville) and Shelby (Memphis) have higher limits reflecting their real estate market, while rural counties have lower caps. It’s essential to verify your county’s FHA loan limit using the HUD FHA Mortgage Limits Lookup Tool before house hunting.

Can I use an FHA loan if I have a previous bankruptcy or foreclosure?

Yes, FHA loans are more forgiving toward past financial hardships. Typically, you must wait two years after a bankruptcy discharge and three years after a foreclosure before applying. Additionally, you should demonstrate improved credit and stable income. FHA’s flexible guidelines often make homeownership possible sooner than conventional loans.

How do FHA loans compare to conventional loans in Tennessee?

FHA loans generally offer lower credit score requirements, smaller down payments, and easier qualification criteria compared to conventional loans. However, FHA loans require mortgage insurance premiums for the life of the loan, while conventional loans may allow mortgage insurance removal after reaching certain equity thresholds. Choosing between them depends on your financial profile and homebuying goals.

What are the typical FHA mortgage insurance premium (MIP) costs in Tennessee?

FHA loans require an upfront mortgage insurance premium (usually 1.75% of the loan amount) plus annual premiums divided into monthly payments. The annual premium ranges from 0.45% to 1.05%, depending on loan terms and down payment size. These costs add to your monthly payment but enable lenders to offer more flexible credit and down payment options.

How can I find a reputable FHA-approved lender in Tennessee?

Start by seeking mortgage brokers or lenders with extensive experience in Tennessee FHA loans. Look for transparent terms, competitive rates, and positive customer reviews. Many local brokers specialize in FHA programs and understand Tennessee’s specific market nuances, which can streamline your loan process and optimize your financing options.

Does timing my FHA loan application affect the interest rate I receive?

Yes. FHA loan interest rates fluctuate with broader economic factors such as Federal Reserve policies and Treasury yields. Monitoring market trends and applying during periods of lower rates can reduce your borrowing costs significantly. Working with knowledgeable local mortgage professionals can help you identify optimal timing.

Can FHA loans be used for investment properties in Tennessee?

FHA loans are intended for primary residences only. You must occupy the home as your principal residence within 60 days of closing. They cannot be used to finance second homes or investment properties, but they are excellent tools for owner-occupants entering Tennessee’s housing market.

What documents will I need to prepare when applying for an FHA loan in Tennessee?

Common documentation includes proof of income (pay stubs, tax returns), employment verification, credit reports, identification, bank statements, and details on debts. Preparing these in advance and working with a Tennessee lender familiar with FHA requirements can expedite your approval process.

Trusted External Sources

- U.S. Department of Housing and Urban Development (HUD) FHA Program History – Offers authoritative background on FHA loan programs, eligibility guidelines, and historical context essential for understanding FHA benefits nationwide and in Tennessee. https://www.hud.gov/program_offices/housing/fhahistory

- HUD FHA Mortgage Limits Lookup Tool – Provides up-to-date, county-specific FHA loan limits for Tennessee, critical for buyers to align property searches with financing eligibility. https://entp.hud.gov/idapp/html/hicostlook.cfm

- Tennessee Housing Development Agency (THDA) – Offers resources, programs, and counseling tailored to Tennessee buyers, including FHA loan assistance and market insights. https://thda.org

- National Association of Realtors (NAR) – Tennessee Market Reports – Provides analyses of Tennessee housing market trends, helping buyers understand local dynamics affecting FHA loan usage. https://www.nar.realtor/research-and-statistics

- Federal Reserve Economic Data (FRED) – Supplies economic indicators such as interest rates and mortgage trends influencing FHA loan timing and rates in Tennessee. https://fred.stlouisfed.org

Conclusion: Mastering FHA Loans for Tennessee Homeownership Success

Understanding FHA loans within Tennessee’s varied housing landscape unlocks powerful opportunities for both new and experienced homebuyers. These loans combine accessible credit qualifications, low down payments, and government-backed security to facilitate homeownership where conventional financing may not reach. However, mastering FHA loan benefits requires awareness of county-specific limits, credit score impacts, timing strategies, and local market subtleties.

By integrating expert guidance, thorough preparation, and strategic timing, Tennessee buyers can optimize FHA loan advantages, transforming aspirations into lasting homeownership. Whether navigating urban centers or rural communities, FHA loans remain a cornerstone of affordable housing solutions across the state.

Ready to take the next step? Share your experiences, ask questions, or explore our expert guides to deepen your FHA loan knowledge and confidently embark on your Tennessee homebuying journey.

Join the conversation and empower your path to homeownership today!