My Journey into Tennessee Mortgage Rates: A Personal Perspective

When I first started exploring the Tennessee housing market, I was overwhelmed by the fluctuating mortgage rates. I remember sitting at my desk late at night, pouring over charts and articles, trying to decode what the experts predicted for 2025. It was a daunting task, but I realized that understanding these trends is crucial for anyone looking to buy or refinance in Tennessee.

Deciphering the Future: What Do Experts Say About Tennessee Mortgage Rate Trends?

Based on my research and personal experience, expert predictions for 2025 suggest that mortgage rates in Tennessee might experience moderate fluctuations. According to the latest expert predictions, rates could stabilize or slightly increase due to market adjustments. Understanding these forecasts helps me plan my financial moves better.

How Can I Prepare for the Expected Rate Movements?

Preparation is key. I learned that improving my credit score significantly impacts the interest rates I could qualify for. For example, exploring effective credit improvement strategies can make a big difference. Additionally, locking in a rate early, especially if predictions favor rising rates, can save thousands over the loan term.

What Are the Best Strategies to Lock in Low Tennessee Mortgage Rates in 2025?

From my experience, working with a local lender who offers flexible lock-in options is invaluable. Also, considering fixed-rate mortgages might provide more stability if rates are expected to climb. Remember, timing and professional guidance are essential to navigating these changes successfully.

If you’re like me, trying to make sense of all the market signals, I encourage you to share your thoughts or experiences below. It’s always helpful to learn from each other as we prepare for the evolving Tennessee mortgage landscape.

For more detailed insights, I recommend checking out local market trends and consulting with trusted mortgage professionals. Staying informed and proactive is the best way to secure favorable mortgage terms in 2025.

Understanding the Nuances of Tennessee Mortgage Rate Fluctuations in 2025

As the Tennessee housing market continues to evolve, mortgage rates are influenced by a complex interplay of economic indicators, policy changes, and regional market dynamics. Experts forecast that in 2025, rates may experience subtle shifts rather than dramatic swings, emphasizing the importance of staying informed and agile. For those planning to buy or refinance, grasping these nuances can make a significant difference in securing favorable terms.

How Do Regional Economic Factors Shape Tennessee Mortgage Rates?

Regional economic health plays a pivotal role in shaping mortgage rates. Tennessee’s robust job growth, especially in cities like Nashville and Memphis, contributes to a stable economic environment that can support moderate rate increases. Conversely, if inflationary pressures persist nationally, lenders might tighten lending standards or adjust rates accordingly. By monitoring local employment trends and broader economic policies, buyers can better anticipate rate movements. A helpful resource is local market trend analysis.

What Are the Key Indicators Experts Are Watching for 2025?

Experts are particularly attentive to inflation rates, Federal Reserve policies, and global economic stability. An increase in inflation often leads to higher mortgage rates, while rate hikes by the Fed can signal borrowing costs will rise. Conversely, if inflation remains controlled, rates might stay steady or decline. Staying ahead requires diligent attention to these signals, which are often discussed in financial news and expert forecasts.

Strategies to Minimize the Impact of Rate Volatility

Proactively, prospective homeowners and refinancing clients should consider locking in rates early if indications point to rising trends. Consulting with experienced local lenders who offer flexible lock-in options can provide a tactical advantage. Additionally, exploring different loan types, such as fixed-rate mortgages, can offer stability amidst fluctuating rates. For more insights on choosing the best loan options, visit this comprehensive guide.

How Can Personal Financial Health Influence Your Mortgage Rate in 2025?

Your credit score remains one of the most influential factors in determining mortgage interest rates. Improving your credit through strategic actions can unlock lower rates, saving thousands over the life of your loan. Resources like effective credit improvement methods provide practical steps. Remember, the better your financial profile, the more leverage you have in negotiating favorable terms, especially if rates trend upward.

If you’re eager to deepen your understanding of the Tennessee mortgage landscape, I encourage you to share your experiences or questions below. Connecting with others navigating this market can offer valuable insights. For tailored advice, consider reaching out to trusted mortgage professionals through our contact page.

My Evolving Perspective on Tennessee Mortgage Rate Nuances

Over the years, as I’ve immersed myself in the Tennessee housing market, I’ve come to realize that understanding mortgage rates isn’t just about reading charts or listening to forecasts. It’s a complex dance of economic indicators, regional dynamics, and personal financial health. For instance, I’ve seen how Nashville’s booming job market subtly pushes mortgage rates upward, yet local lenders often offer competitive deals that can defy broader trends.

How Do Regional Economic Shifts Deepen Your Mortgage Strategy?

Regional economic factors are a fascinating puzzle piece. When I tracked Nashville’s employment trends, I noticed a correlation with slight rate increases. But more intriguing was how local initiatives, like infrastructure investments or tech sector growth, sometimes create unexpected opportunities for buyers and refinancers. This prompted me to dig deeper into local market analysis for more nuanced insights.

What Advanced Questions Do I Ask as a Homebuyer in 2025?

How Much Does My Personal Financial Profile Really Influence My Mortgage Rate?

Beyond the usual credit score, I’ve learned that factors like debt-to-income ratio, recent credit activity, and even regional economic resilience can influence my interest rate. For example, I discovered that improving my credit score through targeted actions—like paying down credit card balances—could shave off significant points from my rate, especially if the market is trending upward. Resources such as effective credit strategies became invaluable in this journey.

Furthermore, I’ve found that locking in a rate early, when forecasts suggest a rise, can be a game-changer. Working closely with a local lender who offers flexible lock-in options made me feel more confident in my decision-making process, especially amid market fluctuations.

How Can I Leverage Advanced Strategies to Maximize Savings?

One tactic I’ve adopted is to explore different loan types, particularly fixed-rate versus adjustable-rate mortgages. The expert guide helped me understand the long-term stability of fixed-rate loans, which can be comforting if rates are predicted to climb. Conversely, adjustable-rate mortgages might offer lower initial rates but require careful timing and risk management, especially in a volatile market.

Additionally, I’ve been attentive to regional policies and economic signals. Monitoring inflation rates, Federal Reserve policies, and local employment data provides an edge in timing my refinancing or home purchase. Staying informed through authoritative sources helps me navigate the unpredictable landscape of mortgage rates in Tennessee.

What Personal Reflection Ties It All Together?

As I reflect on my journey, I realize that the most powerful tool is education combined with proactive engagement. The process of understanding and adapting to market shifts is ongoing. Sharing insights and experiences with others—whether through comments or community forums—has enriched my perspective. I encourage anyone venturing into the Tennessee mortgage scene to stay curious, ask tough questions, and leverage expert resources.

If you’re interested in exploring more personalized strategies or have questions about your specific situation, don’t hesitate to reach out through our contact page. The landscape is complex, but with the right knowledge and tools, you can confidently navigate your home financing journey in 2025 and beyond.

Decoding the Impact of Federal Policies on Tennessee Mortgage Rates

One of the most intricate aspects of my mortgage journey has been understanding how federal policies directly influence regional rates. When the Federal Reserve adjusts interest rates or implements quantitative easing measures, the ripple effects are felt profoundly in Tennessee’s housing market. I recall analyzing how the Fed’s decision to pause rate hikes in early 2025 provided a temporary reprieve, stabilizing mortgage rates just long enough for me to lock in a favorable deal. For those interested in how national monetary policy shapes local lending, I recommend reviewing detailed analyses like those found at this resource.

How Can Regional Economic Indicators Foretell Mortgage Rate Trends?

Beyond federal policies, regional economic health serves as a barometer for mortgage rate fluctuations. During my research, I observed Nashville’s booming tech sector and Memphis’s expanding logistics hubs correlating with slight upticks in mortgage rates, driven by increased demand and higher employment figures. Tracking indicators like regional employment growth, new industry investments, and infrastructure developments has become essential in my strategic planning. For a comprehensive view of local economic conditions and their influence on mortgage rates, I found local market trend analysis particularly insightful.

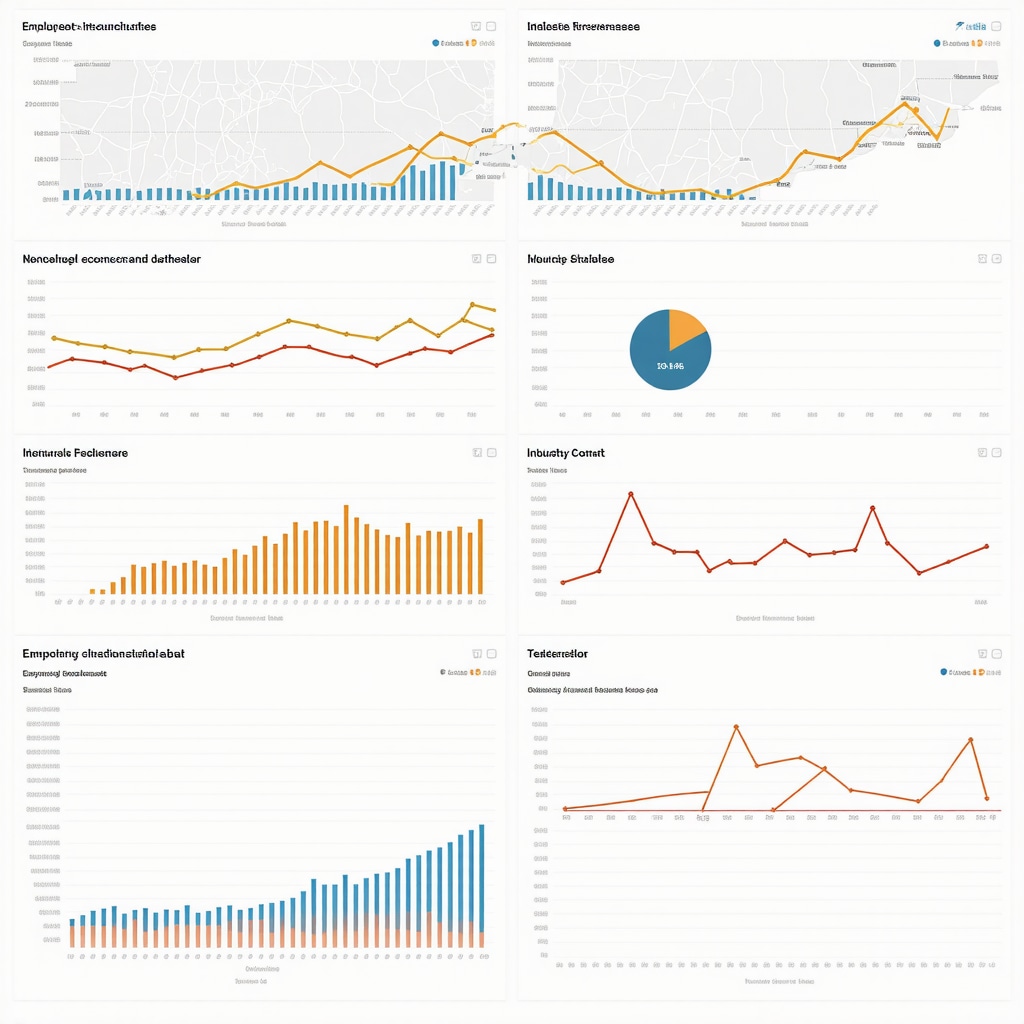

This image depicts a regional economic dashboard highlighting employment trends, infrastructural projects, and industry growth, illustrating how local economic strength influences mortgage rates in Tennessee.

What Are the Advanced Tactics for Locking in Favorable Rates Amid Market Volatility?

My experience has shown that timing and flexibility are crucial. Engaging with lenders who offer customizable lock-in options, such as extended lock periods or float-down features, can be game-changers. Additionally, diversifying loan types—considering hybrid adjustable-rate mortgages with caps—has allowed me to hedge against rate hikes while maintaining some initial savings. To deepen my understanding of these strategies, I frequently consult authoritative guides like this expert resource. Remember, proactive engagement and comprehensive knowledge are your best tools in navigating a volatile rate environment.

How Does Personal Financial Health Shape Your Mortgage Rate in 2025?

Improving my credit score through strategic debt management—such as paying down high-interest credit cards and avoiding new debt—significantly lowered my interest rates. I learned that regional lenders are increasingly factoring in nuanced credit profiles, including recent credit activity and debt-to-income ratios, when determining rates. For a detailed approach to enhancing your financial profile, I recommend exploring this comprehensive guide. Strengthening your financial standing not only improves your loan terms but also grants you greater leverage in negotiations, especially if market conditions tilt towards rising rates.

Engage and Share Your Insights

If you’ve navigated similar challenges or have insights into Tennessee’s mortgage landscape, I invite you to share your experiences below. Connecting with a community of informed homebuyers can open doors to new strategies and perspectives. For tailored advice or specific questions, reach out through our contact page. Remember, in the complex world of mortgage rates, knowledge and proactive planning are your most powerful allies.

Things I Wish I Knew Earlier (or You Might Find Surprising)

1. The Power of Personal Financial Health

When I first started exploring mortgage options, I underestimated how much my credit score and debt-to-income ratio could influence the rates I’d get. Improving my credit through targeted actions, like paying down credit cards, made a noticeable difference. Now I realize that a healthy financial profile can unlock lower rates and more favorable loan terms, often making the difference between a good deal and a great one.

2. Regional Economic Indicators Are More Than Just Numbers

Tracking Nashville’s job growth and Memphis’s industry expansions helped me anticipate rate movements. It’s fascinating how local economic strength can subtly push mortgage rates up or down. Realizing this early on allowed me to time my buying or refinancing decisions better, and I encourage others to keep an eye on local trends to stay ahead.

3. The Value of Locking in Rates Early

Market volatility in 2025 made me appreciate the importance of locking in a rate sooner rather than later. Working with a lender who offers flexible lock options gave me peace of mind, especially when forecasts indicated rising rates. Sometimes, a strategic lock can save you thousands over the life of your loan.

4. Fixed-Rate Mortgages Offer Stability in Uncertain Times

During my research, I found that fixed-rate options provided a sense of security amid fluctuating market conditions. While adjustable-rate mortgages can be tempting with lower initial rates, fixed-rate loans give predictability, which is invaluable if you plan to stay in your home for several years.

5. Regional Policies and National Trends Intersect

Understanding how federal policies impact Tennessee mortgage rates was eye-opening. For example, Fed rate pauses temporarily stabilized rates, giving me a window to lock in a good deal. Staying informed through trusted sources like expert predictions helped me time my decisions better.

6. The Role of Community and Shared Experiences

Connecting with other homebuyers and sharing insights has been incredibly valuable. Reading about others’ experiences with Tennessee mortgage rates helped me understand the nuances and build confidence in my choices. I encourage you to engage with local forums or reach out to professionals who can offer personalized guidance.

Resources I’ve Come to Trust Over Time

- Tenessee Mortgage Rate Blog: A real treasure trove of up-to-date market insights and expert forecasts. I check it regularly to stay informed.

- Local Tennessee Market Reports: These reports, available at this link, helped me understand regional economic conditions that influence mortgage rates.

- Financial News Outlets: Trusted sources like CNBC and Bloomberg provide macroeconomic updates that affect interest rates nationwide and locally.

Parting Thoughts from My Perspective

Navigating Tennessee mortgage rates in 2025 has been a journey of learning and adaptation. The key takeaway for me has been the importance of proactive financial health, staying informed about local economic trends, and working closely with experienced lenders. These insights have empowered me to make smarter decisions and secure favorable mortgage terms. If this resonates with you, I’d love to hear your experiences or questions. Feel free to share your story or reach out through our contact page. Remember, understanding the landscape and acting strategically can make all the difference in your homeownership journey.