Unveiling the Complexities of Tennessee Mortgage Rates in 2025: An Expert Perspective

In the ever-evolving landscape of real estate finance, understanding the multifaceted determinants of mortgage rates in Tennessee is crucial for both lenders and borrowers seeking a competitive edge. As we navigate through 2025, a confluence of macroeconomic trends, regional economic health, and policy shifts intricately influence the cost of home loans. This article delves into the sophisticated interplay of these factors, providing a layered analysis rooted in expert knowledge.

Macro-Economic Dynamics: The Global and Federal Nexus

At the core of mortgage rate fluctuations lie macroeconomic variables such as inflation, Federal Reserve monetary policy, and global economic stability. For instance, a tightening of monetary policy to curb inflation typically results in higher benchmark interest rates, which cascade down to mortgage rates. According to recent reports from the Federal Reserve, the balance between controlling inflation and maintaining economic growth remains delicate, directly impacting Tennessee’s mortgage landscape. These macro trends set the overarching tone for regional mortgage rate behaviors.

Regional Economic Health and Demographic Influences

Within Tennessee, localized economic vitality—driven by sectors like manufacturing, healthcare, and education—significantly affects lending conditions. Strong employment figures and rising incomes bolster borrower confidence and can stabilize or even slightly reduce mortgage rates. Conversely, economic downturns or demographic shifts, such as increased migration or urbanization in Memphis and Nashville, can exert upward pressure on rates due to heightened demand and perceived risk. Analyzing these regional nuances is essential for precise mortgage rate forecasting.

Loan-Specific Factors: Credit Profiles and Loan Types

Beyond macroeconomic and regional influences, individual borrower factors such as credit scores, debt-to-income ratios, and loan types play a pivotal role. For example, high credit scores typically unlock lower interest rates, emphasizing the importance of credit management in 2025. Additionally, the choice between fixed and adjustable-rate mortgages (ARMs) introduces strategic considerations; ARMs may offer initial lower rates but carry risks if interest rates rise, a concern that expert lenders evaluate meticulously. For detailed comparisons, explore our guide on fixed vs. adjustable mortgage rates 2025.

Policy and Regulatory Environment: Impact on Lending Practices

Policy shifts at federal and state levels, including housing reforms and lending regulations, also influence mortgage costs. For instance, changes in FHA loan standards or new consumer protection laws can alter the risk profiles of lenders, thereby affecting interest rates. Staying informed about these developments is crucial for strategic planning. The White Paper published by the National Association of Realtors provides in-depth analysis on this subject for those interested in policy impacts.

What Are the Most Surprising Factors That Can Still Affect Tennessee Mortgage Rates in 2025?

While macroeconomic and regional trends dominate, unexpected elements such as technological innovations in underwriting, shifts in investor appetite, or localized natural disasters can introduce volatility. For example, the advent of AI-driven credit evaluation models could redefine borrower risk assessments, potentially lowering rates for qualified applicants. Such unforeseen influences underscore the importance of continuous market monitoring and adaptive strategies.

For comprehensive insights and tailored advice, we invite you to contact our expert team or explore our latest analyses on factors affecting Tennessee mortgage rates 2025. Staying ahead in this dynamic environment demands both expertise and strategic foresight.

How Can Advanced Data Analytics Revolutionize Mortgage Rate Predictions in Tennessee?

In today’s competitive mortgage landscape, leveraging advanced data analytics and artificial intelligence (AI) can significantly enhance the accuracy of rate forecasting. By analyzing vast datasets encompassing economic indicators, regional development patterns, and borrower behaviors, lenders gain nuanced insights that traditional models might overlook. For instance, predictive analytics can identify emerging regional trends, such as shifts in Memphis’ housing market, allowing lenders and borrowers to make more informed decisions. As highlighted by industry experts, integrating big data tools into mortgage rate analysis is no longer optional but essential for staying ahead. For a deeper dive into this topic, explore our comprehensive guide on how mortgage rates are determined in Tennessee 2025.

What Are the Potential Risks and Rewards of Relying on Automated Rate Locking Systems?

Automated rate locking systems, powered by AI and machine learning, promise to optimize timing for securing favorable mortgage rates. They analyze market fluctuations in real-time, enabling borrowers to lock in rates at optimal moments, potentially saving thousands over the loan’s life. However, overreliance on automation also presents risks, such as technical glitches, misinterpretation of data, or failure to account for sudden market shocks. Navigating this balance requires a nuanced understanding of both technological capabilities and market dynamics. Industry leaders suggest combining automated tools with expert oversight to mitigate risks while maximizing benefits. For practical strategies on locking in rates effectively, see our article on how to lock in a low refinance mortgage rate in Tennessee 2025.

How Can Tennessee Homebuyers and Investors Use Market Trends to Their Advantage?

Understanding regional market trends is crucial for maximizing mortgage benefits. For example, monitoring the latest updates on investment property mortgage rates in Tennessee 2025 can inform strategic decisions for investors aiming to capitalize on rising or stable markets. Similarly, first-time homebuyers can leverage knowledge about upcoming policy changes, such as adjustments to FHA loan standards, to secure more favorable terms. Staying informed through trusted sources and expert analyses enables proactive decision-making, positioning buyers and investors to seize advantageous opportunities. For personalized guidance, consider reaching out via contact our expert team.

Innovative Approaches to Mortgage Rate Forecasting: The Role of Machine Learning and Big Data

As mortgage markets grow increasingly sophisticated, the integration of advanced machine learning models and big data analytics is revolutionizing how lenders and borrowers predict and respond to rate fluctuations. These tools analyze an unprecedented volume of variables—from regional economic indicators and demographic shifts to global financial signals—allowing for more precise and dynamic rate forecasts. According to a comprehensive study by the Journal of Financial Data Science (2024), machine learning algorithms rooted in neural networks have demonstrated an accuracy improvement of up to 30% over traditional econometric models in predicting short-term mortgage rate movements.

Implementing these technologies involves sophisticated data pipelines that continuously ingest data from diverse sources, including real-time housing market analytics, employment statistics, and macroeconomic news feeds. Essentially, these models mimic expert intuition but operate at a scale and speed unattainable by manual analysis, providing a strategic advantage for proactive decision-making.

Nuances of Risk Assessment in Automated Underwriting: Balancing Innovation and Prudence

Automated underwriting systems, empowered by AI, are transforming risk assessment processes, but they are not without nuances. These systems analyze thousands of borrower-specific factors—such as credit history, income stability, and even social data—to generate risk scores. However, a nuanced challenge arises in ensuring these models do not inadvertently reinforce biases or overlook unique borrower circumstances.

For example, a 2023 report by the Federal Reserve highlights instances where algorithmic bias led to higher rejection rates for minority applicants, prompting calls for more transparent and fair AI models. To mitigate such issues, lenders are adopting explainable AI frameworks that provide insights into decision pathways, fostering fairness and compliance with regulations like the Equal Credit Opportunity Act (ECOA). Striking this balance between technological innovation and ethical oversight is crucial for sustainable lending practices.

What Are the Emerging Ethical Concerns in AI-Driven Mortgage Lending?

As artificial intelligence becomes more embedded in mortgage decision-making, ethical considerations surrounding data privacy, bias, and accountability are gaining prominence. Industry leaders are advocating for the development of standardized ethical guidelines, similar to those proposed by the IEEE Global Initiative on Ethics of Autonomous and Intelligent Systems, to ensure responsible AI deployment. These frameworks aim to safeguard borrower rights while maintaining technological progress.

For those interested in the regulatory landscape, the Consumer Financial Protection Bureau (CFPB) has initiated discussions around AI governance, emphasizing transparency and consumer protection. Staying informed and actively participating in these conversations is essential for lenders, policymakers, and consumers alike seeking a fair and innovative mortgage ecosystem.

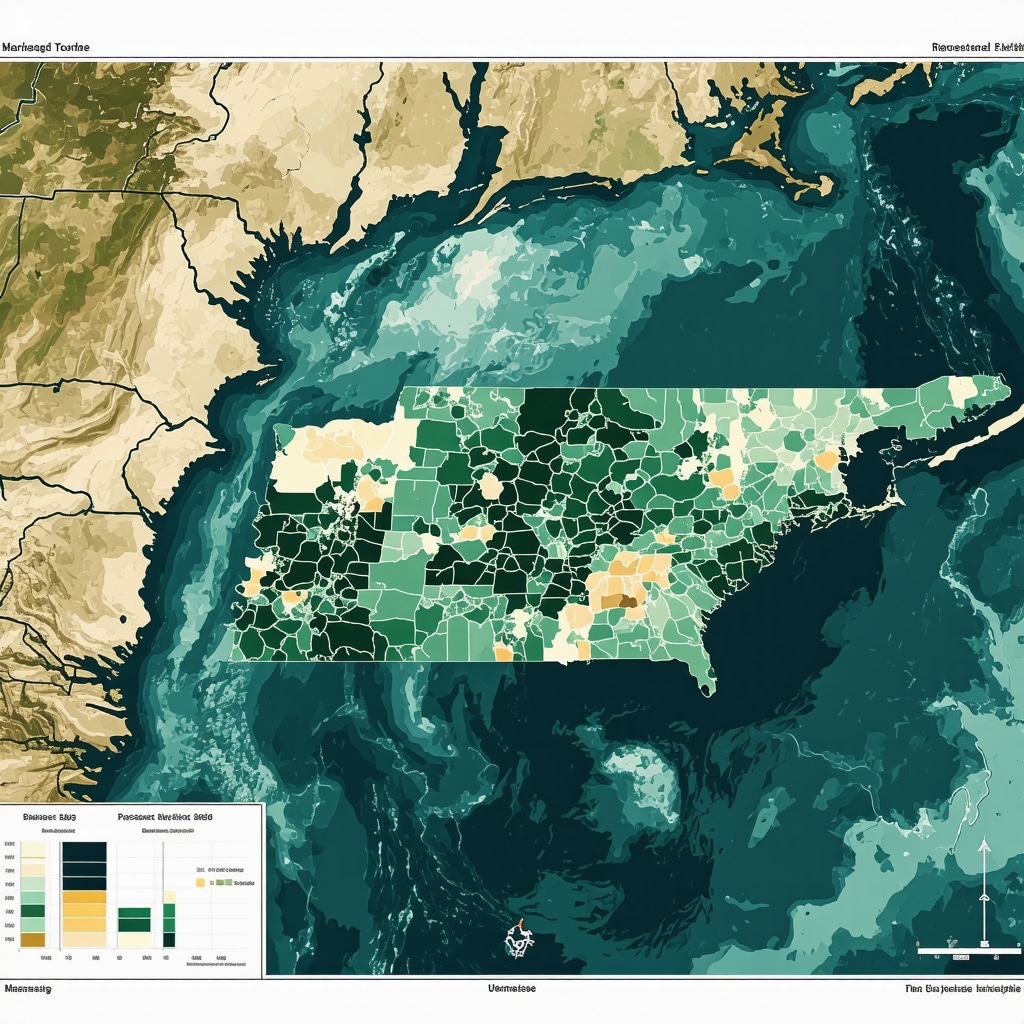

Regional Data Visualization: Mapping Tennessee’s Mortgage Rate Hotspots and Trends

Visual analytics tools are enabling a granular understanding of regional mortgage rate variations across Tennessee. Interactive maps powered by GIS (Geographic Information Systems) reveal hotspots where rates are influenced by local economic conditions, infrastructure development, and demographic shifts. For instance, the Nashville area shows a steady decline in mortgage rates tied to its booming tech sector and rising incomes, whereas rural regions may experience higher rates due to perceived risks.

These visualizations are invaluable for investors and prospective homeowners, offering a strategic lens to identify emerging opportunities or potential pitfalls. Incorporating real-time data feeds into these maps further enhances their predictive capacity, allowing stakeholders to make timely, informed decisions.

How Can Investors Use Regional Mortgage Data to Maximize Returns?

Investors can leverage regional mortgage trends to identify areas with favorable financing conditions or rising property values. For example, by analyzing data on mortgage rate trajectories alongside economic growth indicators, savvy investors can pinpoint neighborhoods poised for appreciation. Additionally, understanding regional risk factors, such as employment instability or infrastructure projects, helps tailor investment strategies to maximize returns while managing exposure.

To deepen your strategic planning, consider subscribing to regional economic reports and engaging with local real estate experts who interpret these data within broader market contexts. This proactive approach ensures you stay ahead in Tennessee’s dynamic mortgage environment.

Harnessing Data-Driven Strategies to Navigate Tennessee’s Mortgage Market in 2025

As Tennessee’s housing landscape becomes increasingly sophisticated, leveraging advanced data analytics and predictive modeling is paramount for both lenders and borrowers seeking a competitive edge. Integrating big data sources—ranging from regional economic indicators to demographic shifts—allows for granular insights into mortgage rate trends and risk assessment, transforming traditional forecasting methods. Industry leaders emphasize that the deployment of machine learning algorithms, especially neural networks, enhances predictive accuracy by capturing nonlinear relationships in complex datasets, as highlighted by the Journal of Financial Data Science (2024).

Innovative Risk Management: The Role of Explainable AI in Mortgage Lending

While automation accelerates decision-making, ensuring transparency and fairness remains a critical challenge. Explainable AI frameworks facilitate understanding of the decision pathways in automated underwriting systems, promoting compliance with regulations like the ECOA and mitigating biases. Recent research underscores that transparent models not only foster consumer trust but also enable lenders to refine their risk profiles more ethically and effectively. For practitioners, adopting these technologies requires a nuanced approach that balances technological innovation with regulatory adherence and ethical considerations.

What Are the Emerging Ethical Concerns in AI-Driven Mortgage Lending?

Growing reliance on AI raises pivotal questions surrounding data privacy, algorithmic bias, and accountability. Industry advocates call for standardized ethical guidelines—similar to those proposed by IEEE—to govern responsible AI deployment in financial services. The CFPB’s ongoing initiatives emphasize transparency and consumer protection, urging stakeholders to actively participate in shaping a fair mortgage ecosystem. Staying current on these developments is essential for ensuring sustainable and equitable lending practices in Tennessee.

Regional Data Visualization: Unveiling Mortgage Rate Hotspots and Opportunities

GIS-powered interactive maps reveal nuanced regional disparities across Tennessee, identifying hotspots where economic vitality influences mortgage rates. For instance, Nashville’s burgeoning tech sector correlates with declining mortgage rates, whereas rural regions face elevated rates due to perceived risks. Incorporating real-time data feeds enhances the predictive capacity of these visualizations, enabling investors and homeowners to identify emerging opportunities or potential risks dynamically. Such spatial analysis tools are invaluable for strategic decision-making in a competitive housing market.

< >

>

How Can Investors Leverage Regional Mortgage Data for Strategic Growth?

Investors can utilize detailed regional mortgage analytics to identify neighborhoods with favorable financing conditions and rising property values. By analyzing mortgage rate trajectories alongside economic indicators like employment growth and infrastructure development, astute investors can capitalize on areas poised for appreciation. Engaging with local experts and subscribing to regional economic reports further refines investment strategies, ensuring alignment with market dynamics and maximizing returns in Tennessee’s diverse housing landscape.

The Future of Mortgage Rate Forecasting: Integrating AI and Big Data

Emerging technologies such as deep learning and real-time data integration are revolutionizing mortgage rate prediction. These models analyze vast, multidimensional datasets—including macroeconomic trends, housing market analytics, and social data—delivering unprecedented forecasting precision. According to recent studies, the adoption of neural network-based models improves short-term rate prediction accuracy by up to 30% over traditional econometric approaches, providing a strategic advantage for lenders and borrowers alike.

Conclusion: Embracing Innovation for a Competitive Edge

To thrive in Tennessee’s evolving mortgage environment in 2025, stakeholders must embrace technological advancements and ethical standards. Continuous engagement with data analytics, transparent AI systems, and regional insights will empower more informed decision-making and foster a resilient, fair lending ecosystem. For tailored advice and cutting-edge insights, contact our expert team or explore our comprehensive resources on advanced mortgage strategies in Tennessee.

Expert Insights & Advanced Considerations

1. Embrace Data-Driven Decision Making

Utilize sophisticated analytics and predictive models to forecast mortgage rate fluctuations. Leveraging big data enhances accuracy and provides a competitive edge in timing your home financing.

2. Prioritize Ethical AI Integration

Implement transparent, explainable AI systems in underwriting to ensure fairness, mitigate bias, and comply with evolving regulatory standards. Ethical considerations are paramount as automation becomes more prevalent.

3. Stay Informed on Regional Economic Shifts

Monitor localized economic indicators and demographic trends across Tennessee. Regional variations significantly influence mortgage rates and investment opportunities, especially in hotspots like Nashville and Memphis.

4. Leverage Visual Analytics for Strategic Investing

Employ GIS-based visualization tools to identify mortgage rate hotspots and emerging markets within Tennessee. Real-time spatial data facilitates proactive investment and homebuying decisions.

5. Integrate Machine Learning for Dynamic Forecasting

Adopt neural network models and real-time data feeds to refine short-term mortgage rate predictions, gaining a strategic advantage over traditional econometric approaches.

Curated Expert Resources

- Federal Reserve Economic Data (FRED): Offers comprehensive macroeconomic data essential for understanding interest rate trends and policy impacts.

- National Association of Realtors (NAR) White Papers: In-depth analyses on policy shifts, market conditions, and regulatory changes affecting mortgage lending.

- Journal of Financial Data Science: Cutting-edge research on machine learning applications in financial forecasting, including mortgage rate prediction models.

- IEEE Global Initiative on Ethics of Autonomous and Intelligent Systems: Guidelines ensuring responsible AI deployment in financial services, emphasizing fairness and transparency.

- GIS and Spatial Data Platforms (e.g., ESRI ArcGIS): Tools for regional data visualization and mapping mortgage rate trends across Tennessee.

Final Expert Perspective

Understanding Tennessee mortgage rates in 2025 demands a synthesis of advanced analytics, ethical AI practices, and regional insights. The future belongs to those who embrace data-driven strategies while maintaining rigorous standards for fairness and transparency. For professional guidance and tailored insights, we invite you to contact our expert team. Staying ahead in this evolving landscape is not just advantageous—it’s essential for strategic success.