Understanding the Nuances of Credit Scores in Tennessee Mortgage Rate Determination

In the intricate landscape of Tennessee mortgage lending, credit scores play a pivotal role in influencing interest rates and loan eligibility. Beyond the simplistic view of creditworthiness, lenders analyze credit history depth, recent credit activity, and debt-to-income ratios to calibrate risk. This multifaceted evaluation directly affects the mortgage rates offered, underscoring the importance of a robust credit profile for prospective Tennessee homebuyers.

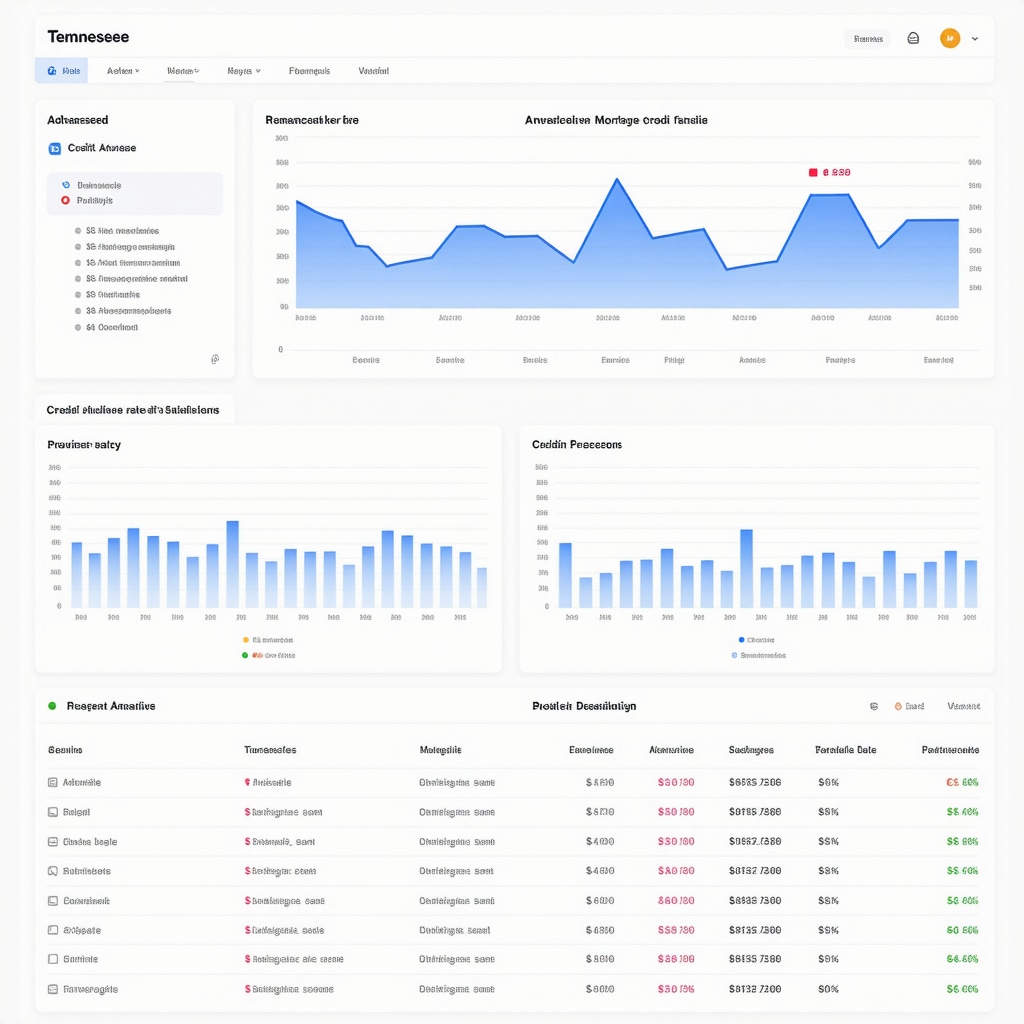

How Do Credit Profiles Affect Mortgage Rate Tiers in Tennessee?

Mortgage lenders in Tennessee typically segment applicants into rate tiers based on their credit scores. Borrowers with scores above 740 often access the most competitive rates, reflecting lower perceived risk. Conversely, scores below 620 may trigger higher interest rates or necessitate additional underwriting scrutiny. The gradient between these tiers can translate into significant cost differences over the life of a mortgage, emphasizing strategic credit management as a cost-saving tactic.

Advanced Credit Optimization Tactics to Secure Lower Tennessee Mortgage Rates

Experienced mortgage brokers recommend targeted credit improvements, such as reducing revolving debt balances, rectifying credit report inaccuracies, and avoiding new credit inquiries in the months preceding application. These actions can enhance credit scores measurably within a short timeframe. Additionally, understanding the specific scoring models utilized by Tennessee lenders, such as FICO 9 vs. VantageScore 3.0, can further refine credit optimization strategies.

What Are the Best Practices for Rapid Credit Score Improvement Before Applying for Tennessee Mortgages?

Rapid credit enhancement requires a disciplined approach: prioritize payment of high-utilization credit cards to reduce utilization ratios below 30%, dispute any errors promptly with credit bureaus, and refrain from opening new lines of credit that could trigger hard inquiries. Furthermore, maintaining a mix of credit types and showing a consistent payment history over time adds qualitative weight to a borrower’s profile. These nuanced practices can boost approval odds and secure favorable mortgage terms.

Integrating Credit Impact Knowledge into Tennessee Mortgage Rate Shopping

Leveraging detailed credit insights empowers Tennessee homebuyers to negotiate better loan conditions and identify mortgage products aligned with their credit tier. Collaborating with seasoned Tennessee mortgage brokers who understand local market dynamics and credit considerations can yield optimized loan structures. For a comprehensive understanding of how credit scores shape your mortgage interest rates today, consult authoritative resources like this expert guide.

Call to Action: Elevate Your Mortgage Strategy with Expert Credit Insights

Explore our in-depth analysis on simple yet effective credit improvement steps tailored for Tennessee buyers. Share your experience or consult with local mortgage brokers to harness credit as a strategic lever in securing the best mortgage rates.

For further authoritative insight, see the comprehensive research on credit risk and mortgage pricing published by the Federal Reserve Board, which elucidates the empirical relationship between credit scores and mortgage rate spreads.

Decoding the Influence of Credit Mix and Payment History on Tennessee Mortgage Offers

While credit scores provide a quantifiable metric, lenders in Tennessee delve deeper into the qualitative aspects of a borrower’s credit profile. The diversity of credit types—such as revolving credit, installment loans, and mortgage history—demonstrates credit management skills and influences mortgage rate offers. Moreover, a consistent and timely payment history reduces perceived risk, often translating to preferential loan terms. Understanding these subtleties allows prospective borrowers to strategically cultivate their credit profiles for advantageous mortgage conditions.

How Can Tennessee Homebuyers Strategically Time Their Mortgage Applications to Maximize Credit Score Benefits?

Mortgage seekers often overlook the timing of their application relative to credit activity. Experts recommend initiating mortgage applications shortly after positive credit events such as debt payoff or credit limit increases, as these can enhance credit scores and lower debt-to-income ratios. Conversely, avoid applying immediately after hard inquiries or recent credit utilization spikes. This timing strategy can optimize credit presentation to lenders, sharpening the borrower’s competitive edge in rate negotiations.

What Advanced Credit Monitoring Tools and Practices Should Tennessee Buyers Employ to Navigate Mortgage Rate Fluctuations Effectively?

Proactive credit monitoring equips Tennessee homebuyers with real-time insights into credit changes impacting mortgage rates. Utilizing sophisticated tools that track credit score variations, alert to potential inaccuracies, and forecast the impact of financial moves can empower informed decision-making. Additionally, collaborating with mortgage professionals who leverage data analytics can uncover personalized strategies to lock in favorable rates amidst market volatility.

For a deeper dive into effective credit and mortgage rate strategies, explore resources like how credit scores shape mortgage interest rates in Tennessee to tailor your approach.

Expert Insights: The Role of Credit Score Segmentation in Mortgage Rate Customization

Lenders increasingly use granular credit score segmentation beyond traditional bands to customize mortgage pricing. This nuanced approach allows for more precise risk assessment and competitive rate offers to borrowers who demonstrate incremental credit improvements. Tennessee homebuyers who understand this segmentation can better position themselves during loan negotiations by presenting a polished credit profile that aligns with lender-specific scoring models.

Call to Action: Share Your Credit Optimization Success or Challenges to Enhance Tennessee Homebuyer Knowledge

Have you successfully improved your credit profile to secure better mortgage rates in Tennessee? Or are you navigating challenges in credit optimization? Join the conversation by commenting below or sharing this article with fellow buyers. For personalized guidance, consider consulting experienced Tennessee mortgage brokers who specialize in credit-savvy loan solutions.

Additionally, authoritative research such as the Federal Reserve Board’s analysis on credit risk and mortgage pricing offers empirical evidence supporting the strategic importance of credit in mortgage rate determination.

Leveraging Behavioral Credit Data: The Next Frontier in Tennessee Mortgage Pricing

Beyond traditional credit scores, lenders are increasingly incorporating behavioral credit data—such as payment consistency patterns, credit utilization volatility, and even alternative data sources like utility payments—to refine mortgage risk profiles. This emergent trend, often powered by machine learning algorithms, allows Tennessee lenders to identify high-quality borrowers who might be underserved by conventional scoring methods. Homebuyers who proactively manage behavioral signals can position themselves favorably to access competitive mortgage rates that reflect their true creditworthiness.

How Does Behavioral Credit Data Enhance Mortgage Rate Precision in Tennessee?

Behavioral credit data enhances precision by evaluating dynamic credit behaviors rather than static snapshot scores. For example, a borrower with stable, low credit utilization and punctual payments—even if their overall score is moderate—may be offered better rates than a borrower with a higher score but irregular credit patterns. Tennessee lenders leveraging this data use sophisticated risk models validated by empirical studies, such as those published by the Consumer Financial Protection Bureau, which demonstrates improved default prediction accuracy through alternative data inclusion.

Strategically, Tennessee homebuyers can enhance their behavioral credit profile by maintaining consistent payment timing, minimizing credit utilization fluctuations, and integrating positive payment histories from non-traditional credit sources. This approach requires meticulous credit monitoring and disciplined financial management but can yield mortgage rate advantages in competitive markets.

Harnessing Predictive Analytics for Optimal Mortgage Rate Timing in Tennessee

Predictive analytics tools are revolutionizing mortgage rate shopping by forecasting interest rate movements and lender behavior based on macroeconomic indicators and borrower-specific credit trends. Tennessee homebuyers utilizing these advanced platforms can time their mortgage applications to coincide with anticipated rate dips or lender credit policy adjustments. This strategic timing can translate into substantial savings over the loan term, especially when combined with credit profile enhancements.

What Predictive Models Should Tennessee Borrowers Use to Align Credit Improvements with Market Timing?

Borrowers should consider models that integrate real-time credit bureau data, Federal Reserve interest rate projections, and Tennessee-specific housing market trends. Examples include AI-driven mortgage rate forecasting tools and credit score simulators that quantify the impact of financial actions on mortgage offers. Collaborations with mortgage brokers adept in data analytics can further refine application timing strategies. Such integrative approaches are supported by research from the National Bureau of Economic Research, which highlights the efficacy of data-driven mortgage timing in cost reduction.

Advanced Credit Repair Strategies: Beyond the Basics for Tennessee Homebuyers

While conventional credit repair focuses on disputing inaccuracies and reducing debt, advanced strategies include negotiating with creditors for goodwill adjustments, strategically timing debt repayments to optimize credit utilization reporting, and leveraging secured credit cards to rebuild credit mix. Tennessee borrowers who engage credit counselors with expertise in mortgage lending nuances can tailor these tactics to their unique profiles, accelerating credit score improvements and unlocking lower mortgage rates.

Call to Action: Elevate Your Tennessee Mortgage Journey with Data-Driven Credit Mastery

Ready to harness cutting-edge credit insights and predictive analytics to secure the best mortgage rates in Tennessee? Engage with our expert mortgage advisors who specialize in behavioral credit data and market timing strategies. Share your experiences or questions below to foster a community of savvy Tennessee homebuyers driving mortgage innovation forward.

Unlocking the Power of Behavioral Credit Data: A Paradigm Shift in Mortgage Risk Assessment

Traditional credit scoring models offer a snapshot of creditworthiness, but behavioral credit data unveils a dynamic portrait of borrower reliability. By analyzing payment consistency, credit utilization volatility, and alternative data streams such as utility and rent payments, Tennessee lenders can harness machine learning algorithms to identify low-risk applicants more accurately. This shift not only enhances risk stratification but also democratizes access to competitive mortgage rates for borrowers with non-traditional credit profiles.

How Can Tennessee Homebuyers Leverage Behavioral Credit Data to Secure More Favorable Mortgage Rates?

Homebuyers should prioritize consistent on-time payments and maintain low, stable credit utilization ratios to positively influence behavioral credit metrics. Incorporating positive data from alternative sources, like timely utility or rental payments, further strengthens credit profiles. Employing advanced credit monitoring platforms that track these behavioral indicators enables borrowers to proactively manage their credit narrative. Collaboration with mortgage professionals versed in interpreting behavioral data can optimize loan structuring and pricing, turning nuanced credit behaviors into tangible rate advantages.

Harnessing Predictive Analytics: Timing Your Tennessee Mortgage Application for Maximum Savings

Predictive analytics meld macroeconomic trends, lender risk appetite, and individual credit trajectories to forecast mortgage rate fluctuations with remarkable precision. Tennessee borrowers equipped with AI-powered tools can anticipate rate dips and lender policy shifts, strategically aligning their application timing to capitalize on favorable conditions. Integrating real-time credit bureau updates with Federal Reserve interest rate forecasts and localized housing market dynamics yields a holistic decision-making framework.

What Advanced Predictive Models Are Most Effective for Tennessee Borrowers Navigating Mortgage Rate Volatility?

Models combining artificial intelligence with big data analytics, such as machine learning-based mortgage price simulators, offer granular insights into how credit changes and market movements interact. These predictive tools, supported by research from the National Bureau of Economic Research, enable borrowers to forecast optimal application windows and quantify the impact of credit profile adjustments on interest rates. Partnering with data-savvy mortgage advisors can further refine these models to individual borrower circumstances.

Beyond Basics: Advanced Credit Repair Strategies Tailored for Tennessee’s Mortgage Market

Elevating credit repair efforts involves negotiating goodwill deletions with creditors, timing repayments to influence credit utilization reporting cycles, and strategically employing secured credit cards to diversify credit mix. Such sophisticated maneuvers require deep understanding of lender-specific credit evaluation nuances prevalent in Tennessee’s mortgage landscape. Engaging credit counselors with specialized mortgage lending expertise can accelerate credit score improvement trajectories, unlocking lower mortgage rates more efficiently.

Call to Action: Engage with Tennessee’s Mortgage Innovation Frontier Today

Are you ready to transcend conventional credit strategies and leverage behavioral data alongside predictive analytics to secure optimal mortgage terms in Tennessee? Connect with our expert mortgage advisors who specialize in cutting-edge credit optimization and market timing techniques. Share your experiences or questions below to build a community of forward-thinking Tennessee homebuyers who are reshaping mortgage success through data-driven insights.

Expert Insights & Advanced Considerations

Nuanced Credit Segmentation Enables Tailored Mortgage Pricing

Understanding that Tennessee lenders employ granular credit score segmentation beyond traditional bands allows borrowers to strategically improve their profiles and access bespoke mortgage rates. Incremental credit improvements, even within sub-tiers, can translate to meaningful savings over the mortgage term.

Behavioral Credit Data is Reshaping Borrower Risk Profiles

Incorporating behavioral metrics such as payment consistency and credit utilization volatility provides lenders with a dynamic assessment of borrower reliability. Tennessee homebuyers who manage these indicators proactively can secure competitive mortgage rates despite conventional credit score limitations.

Predictive Analytics Facilitates Optimal Mortgage Timing

Leveraging AI-driven predictive models that integrate macroeconomic factors and individual credit trajectories empowers Tennessee borrowers to time applications strategically. This data-driven approach can maximize interest rate savings and optimize loan terms in a fluctuating market.

Advanced Credit Repair Techniques Accelerate Score Enhancement

Beyond disputing errors and lowering debt, techniques like negotiating goodwill adjustments and timing repayments to influence credit reporting cycles offer Tennessee borrowers sophisticated avenues to improve creditworthiness swiftly and effectively.

Collaboration with Specialized Mortgage Brokers Enhances Outcomes

Engaging Tennessee mortgage brokers who understand local market nuances and credit optimization strategies can unlock personalized loan solutions, ensuring borrowers navigate complex lending landscapes with expert guidance.

Curated Expert Resources

- Federal Reserve Board’s Research on Credit Risk and Mortgage Pricing: Offers empirical data validating the impact of credit scores on mortgage rate spreads, providing foundational knowledge for strategic credit management (link).

- Consumer Financial Protection Bureau’s Reports on Alternative Data: Explores the integration of behavioral and alternative credit data in lending decisions, highlighting emerging trends relevant to Tennessee borrowers (link).

- National Bureau of Economic Research on Mortgage Rate Forecasting: Provides insights into AI and big data applications for mortgage rate prediction, enabling informed application timing (link).

- Tennessee Mortgage Rates – How Credit Scores Shape Your Mortgage Interest Rates Today: A local expert guide that breaks down scoring models and credit impact on mortgage rates specific to Tennessee (link).

- Working with a Tennessee Mortgage Broker: Benefits and What to Expect: An essential resource for understanding broker advantages in credit-savvy mortgage solutions (link).

Final Expert Perspective

The intricate interplay between credit nuances, behavioral data, and market timing underscores a sophisticated landscape for Tennessee mortgage rates. Borrowers who transcend basic credit knowledge to embrace advanced credit segmentation, behavioral insights, and predictive analytics position themselves advantageously in negotiating superior mortgage terms. Collaborating with specialized mortgage professionals familiar with Tennessee’s lending environment further refines these strategies into actionable outcomes. To deepen your mastery and tailor your mortgage approach effectively, explore resources like how credit scores shape your mortgage interest rates today and consider connecting with expert advisors at Tennessee Mortgage Rates contact. Elevate your mortgage strategy by integrating these advanced insights and become a discerning participant in Tennessee’s home financing arena.