Unlocking the Tennessee Mortgage Mystery: Fixed or Adjustable?

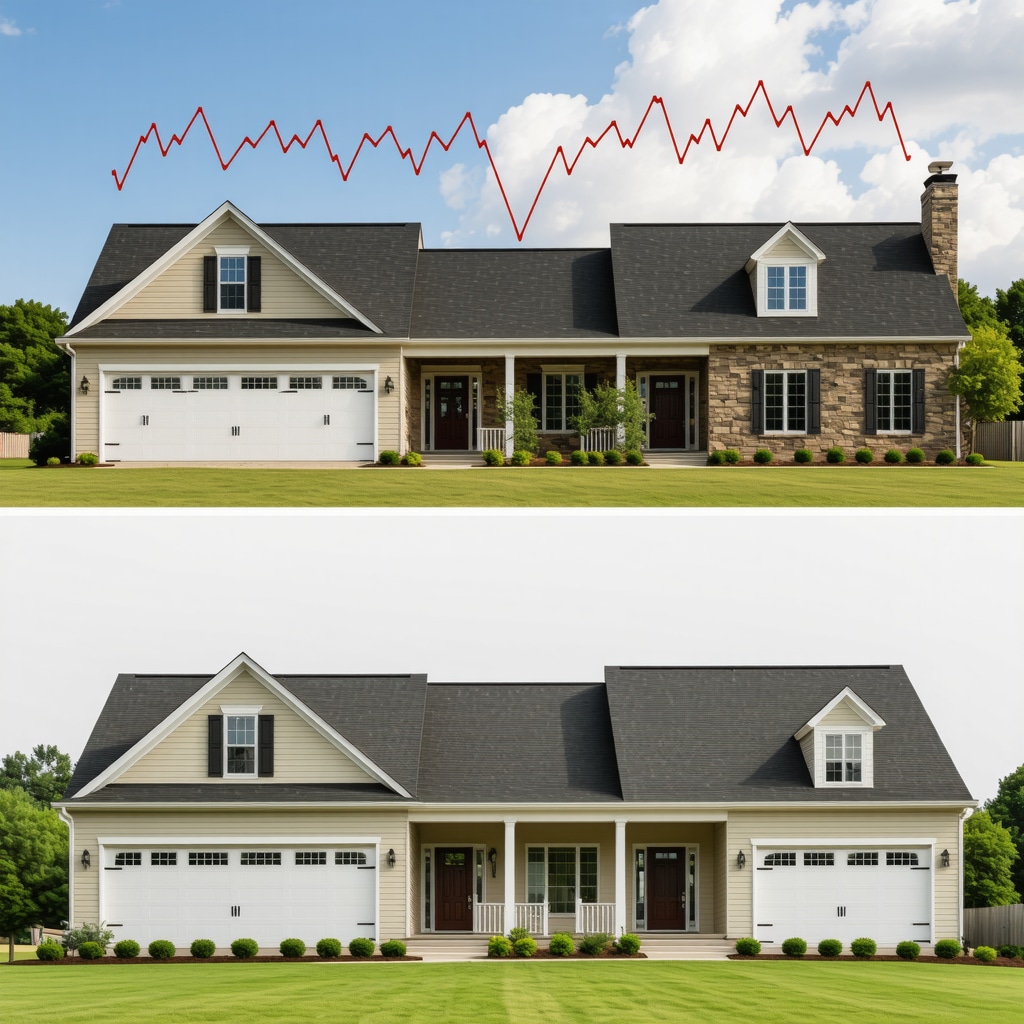

Choosing between fixed and adjustable mortgage rates is a pivotal decision for Tennessee homebuyers. Each option carries distinct financial implications shaped by individual circumstances and market trends. This article dives deep into the nuances of fixed vs adjustable rates in Tennessee, uncovering which mortgage option can truly save you more over the long haul.

When Stability Meets Savings: The Fixed Rate Advantage

Fixed-rate mortgages in Tennessee offer predictability — the interest rate remains constant throughout the loan term, shielding borrowers from market fluctuations. This stability appeals especially to buyers planning to stay long-term in their homes, providing peace of mind and consistent monthly payments. For example, a homeowner in Knoxville opting for a 30-year fixed mortgage locks in today’s rate, avoiding the risk of rising rates in the future.

Moreover, fixed rates tend to be slightly higher at origination compared to adjustable rates, reflecting the lender’s premium for risk protection. However, this upfront premium can pay off if interest rates rise over time. According to recent analyses by the Mortgage Bankers Association, fixed rates provide a hedge against inflation-driven rate increases, which have been notably volatile in the past decade.

The Adjustable Rate Gamble: Flexibility and Potential Savings

Adjustable-rate mortgages (ARMs) start with a lower initial interest rate, often enticing Tennessee buyers with tighter budgets or plans to refinance or sell within a few years. For instance, a Memphis buyer anticipating relocation within five years might benefit from an ARM’s initial lower payments, potentially saving thousands in early years compared to a fixed loan.

However, ARMs come with inherent uncertainty. After the initial fixed period (often 5, 7, or 10 years), rates adjust periodically based on market indexes plus a margin. Rising rates can lead to payment shocks, straining budgets if not anticipated. It’s crucial to analyze Tennessee’s local mortgage rate trends and economic forecasts to gauge the risk of rate hikes.

How Do Tennessee’s Market Trends Influence Your Choice Between Fixed and Adjustable Rates?

Understanding the local market dynamics is essential. Tennessee’s mortgage rates have been influenced by factors like the Federal Reserve’s policy shifts, inflation patterns, and regional housing demand. For instance, insights into Tennessee mortgage rate determinants reveal that periods of economic uncertainty often lead to fluctuating adjustable rates, making fixed loans more attractive for risk-averse buyers.

Moreover, with Tennessee’s housing market showing steady appreciation, locking in a low fixed rate can safeguard against future cost escalations. Yet, savvy buyers with strong credit and flexible plans might find ARMs beneficial, especially when combined with strategies like refinancing at favorable times. Resources such as refinancing strategies for Tennessee homeowners provide valuable guidance on optimizing mortgage costs.

Practical Wisdom: Real-World Scenarios from Tennessee Borrowers

Consider Sarah from Nashville, who chose a fixed-rate mortgage for her first home, valuing the stability amid a rising rate environment. Conversely, Mike in Chattanooga opted for a 7/1 ARM, anticipating a job transfer in five years, allowing him to capitalize on lower initial payments and plan a refinance later.

These examples underscore that the best mortgage choice hinges on personal timelines, financial goals, and risk tolerance. Engaging with a licensed mortgage broker can provide tailored advice — check out guidance on choosing between brokers and lenders in Tennessee for expert insights.

Take the Next Step: Empower Your Tennessee Mortgage Decision

Ready to navigate the complex landscape of Tennessee mortgage rates? Explore detailed comparisons between fixed and adjustable options in our expert guide: Navigating Fixed vs Adjustable Mortgage Rates: Expert Guide 2025. Understanding these choices can unlock significant savings and financial security in your home journey.

If you found these insights helpful, share your thoughts below or share this post to help others make informed mortgage decisions in Tennessee.

Authoritative source: Mortgage Bankers Association – mba.org

When Life Throws Curveballs: Adjusting Your Mortgage Strategy

One of the most eye-opening lessons I’ve learned from friends and family in Tennessee is how quickly life circumstances can change, making flexibility in mortgage plans invaluable. Take my cousin Lisa in Memphis, for example. She initially locked in a fixed-rate mortgage because she loved the idea of stability. But a few years in, she faced an unexpected job relocation. Thankfully, she had built equity and maintained a good credit score, which allowed her to refinance her mortgage at a lower rate, easing her transition. This personal experience echoes the advice found in refinancing strategies for Tennessee homeowners, emphasizing the importance of timing and credit health when considering refinancing.

Credit Scores: The Unsung Hero in Mortgage Rate Decisions

Speaking of credit, I can’t stress enough how much your credit score impacts the type of mortgage rates you can secure. When I was shopping for a home in Nashville, I was surprised to find that a modest improvement in my credit score lowered my mortgage interest rate by nearly half a percentage point. That difference translated into significant savings over the life of the loan. For anyone wondering how to boost their credit to snag better rates, resources like credit score tips to lower your Tennessee mortgage interest rates are pure gold. It’s a journey well worth the effort.

Is an Adjustable Rate Mortgage Too Much of a Gamble?

That question came up repeatedly during my conversations with fellow Tennessee homebuyers. The truth is, ARMs can be both a smart move and a risk, depending on your personal situation. For instance, my friend James in Knoxville chose a 5/1 ARM because he planned to sell his house within seven years. The lower initial rate gave him breathing room to invest in home renovations and save aggressively. However, I also know buyers who faced rate adjustments that stretched their budgets unexpectedly, reminding me that an ARM demands careful planning and a keen eye on market trends. The Mortgage Bankers Association notes that understanding these dynamics is key to making an informed choice (mba.org).

How Can You Best Prepare Yourself for Tennessee’s Mortgage Rate Fluctuations?

It’s a question that I often reflect on, especially given how dynamic the market has been. My approach has been to stay informed continuously—subscribing to updates from trusted sources and working closely with mortgage professionals who know the Tennessee market intimately. You might also want to explore tools that compare current rates, such as mortgage rate trends in Tennessee. By understanding what drives rate changes—whether it’s Federal Reserve moves, inflation, or local housing demand—you can time your decisions more wisely.

Of course, no two journeys are the same. That’s why I’m curious: What factors have influenced your mortgage decisions in Tennessee? Have you opted for fixed or adjustable rates, and how did it work out? Feel free to share your experiences or questions in the comments below. Your story might just help someone else make a more confident choice. And if you’re just starting your search, check out our detailed guide on navigating fixed vs adjustable mortgage rates for 2025—it’s packed with practical insights to help you decide.

Decoding the Impact of Economic Indicators on Tennessee Mortgage Rate Fluctuations

Understanding how macroeconomic indicators affect Tennessee mortgage rates is pivotal for buyers aiming to time their mortgage decisions optimally. Interest rates are not isolated; they respond dynamically to complex forces such as the Consumer Price Index (CPI), employment statistics, and Federal Reserve policy signals. For example, a rising CPI often signals inflationary pressure, which can prompt the Federal Reserve to increase benchmark rates, translating to higher mortgage rates.

In Tennessee, localized economic factors such as job growth in metropolitan areas like Nashville and Chattanooga also contribute to housing demand, influencing lenders’ risk assessments and ultimately the rates offered. According to the Federal Reserve’s Monetary Policy Overview, borrowers who monitor these indicators can better anticipate rate shifts, enabling proactive mortgage planning rather than reactive decisions.

How Do Inflation Trends Specifically Affect Fixed and Adjustable Mortgage Rates in Tennessee?

Inflation trends exert divergent effects on fixed and adjustable mortgage products. Fixed-rate mortgages lock in a rate that may seem high during low inflation periods but becomes advantageous as inflation rises by preserving payment stability. Conversely, ARMs’ initial low rates may rise sharply with inflation-driven increases in the underlying indexes, exposing borrowers to higher payments.

For Tennessee homeowners, especially in rapidly appreciating markets, this means that while ARMs might offer short-term savings, they carry the risk of escalating costs if inflation accelerates. Expert analyses from the Mortgage Bankers Association emphasize the necessity of aligning mortgage type with inflation outlooks and personal financial resilience (MBA Forecasts and Commentary).

Innovative Mortgage Products: Blending Fixed and Adjustable Features for Tennessee Buyers

The evolving mortgage landscape in Tennessee now includes hybrid products designed to offer borrowers the benefits of both fixed and adjustable rates. For instance, a 5/5 ARM might provide a fixed rate for the first five years, followed by adjustments every five years, allowing for greater predictability initially and flexibility later.

Moreover, lenders are increasingly offering options with caps on rate increases, protecting borrowers from steep payment shocks. These innovative products require a nuanced understanding of contract terms, local market conditions, and long-term financial planning. Engaging with mortgage advisors who specialize in Tennessee’s market nuances can unlock these tailored solutions, leveraging resources such as Innovative Mortgage Products for Tennessee Homebuyers.

Refinancing Nuances: Timing and Strategies to Maximize Tennessee Mortgage Savings

Refinancing remains a powerful tool to manage mortgage costs but demands strategic timing. Tennessee borrowers must watch for declining interest rates, improved credit scores, or changes in personal circumstances like increased income or home equity to capitalize on refinancing benefits.

However, refinancing comes with costs such as closing fees and potential prepayment penalties that must be weighed against long-term savings. Advanced strategies involve calculating the break-even point meticulously and considering adjustable rate resets in ARM contracts to decide optimal refinance windows. The Refinance Timing Strategies for Tennessee Homeowners guide offers comprehensive frameworks to navigate these decisions.

Can Refinancing an ARM into a Fixed Rate Mortgage Protect Tennessee Homeowners from Future Rate Volatility?

Absolutely. Refinancing an ARM into a fixed-rate mortgage can be a prudent move for Tennessee homeowners anticipating rate hikes or seeking budget certainty. This transition locks in a stable payment structure, insulating the borrower from future market-driven increases inherent in ARMs. However, this strategy hinges on current fixed rates being favorable and the borrower’s ability to meet refinancing costs.

Engaging with a mortgage professional to analyze your specific ARM terms, current market conditions, and financial goals is critical before undertaking such a move. Detailed scenario analyses and personalized projections can be found in expert resources like ARM to Fixed Refinancing: A Tennessee Homeowner’s Guide.

Embracing Expert Guidance: Your Path to Mortgage Mastery in Tennessee

Mortgage decisions in Tennessee are multifaceted, influenced by economic, personal, and market-specific variables. The most successful borrowers are those who combine up-to-date market intelligence with professional advice tailored to their unique circumstances.

We invite you to deepen your understanding by exploring our comprehensive expert resources and engaging with seasoned mortgage specialists who can craft strategies aligned with your financial aspirations and risk tolerance. Whether you lean toward fixed, adjustable, or hybrid products, mastering your mortgage choices today paves the way for financial stability tomorrow.

Authoritative source: Federal Reserve – federalreserve.gov

Deciphering Inflation’s Dual Role in Mortgage Dynamics

In Tennessee’s shifting economic terrain, inflation remains a potent force molding mortgage behaviors. Fixed-rate mortgages offer a sanctuary against inflation’s unpredictability by securing a consistent payment schedule, effectively insulating borrowers from escalating costs over time. Conversely, adjustable-rate mortgages (ARMs) expose homeowners to inflation-induced variability, as periodic adjustments tethered to economic indices can amplify monthly obligations. This dichotomy necessitates a sophisticated understanding of inflation trajectories and personal financial resilience when selecting a mortgage product.

Innovative Hybrid Mortgages: Merging Predictability with Flexibility

To reconcile the benefits of fixed and adjustable rates, Tennessee lenders increasingly propose hybrid mortgage instruments. Notably, products such as 5/5 ARMs provide an initial fixed interest term followed by scheduled adjustments, striking a balance between payment stability and adaptability. These offerings often incorporate caps on rate increases, affording borrowers protection against severe payment escalations while capitalizing on favorable market conditions. Expert consultation is vital to dissect contract nuances and align these products with individual fiscal strategies.

Strategic Refinancing: Timing and Tactical Considerations for Tennessee Homeowners

Refinancing emerges as a powerful lever in managing mortgage expenditure, yet it demands precision timing and a thorough cost-benefit analysis. Tennessee homeowners should vigilantly monitor interest rate trends, credit score improvements, and equity accumulation as indicators for optimal refinancing windows. Advanced calculations encompassing break-even points and ARM reset schedules can inform decisions that maximize long-term savings while mitigating transaction costs.

Can Refinancing an ARM into a Fixed Rate Mortgage Protect Tennessee Homeowners from Future Rate Volatility?

Indeed, transitioning from an ARM to a fixed-rate mortgage can safeguard against unpredictable rate hikes, delivering budgetary certainty amid volatile markets. This strategy hinges on prevailing fixed rates being advantageous and the borrower’s capacity to absorb refinancing fees. Collaborating with mortgage professionals to evaluate loan terms and market forecasts is essential to tailor this approach effectively.

Harnessing Economic Indicators for Proactive Mortgage Planning

Mastery of macroeconomic signals—such as the Consumer Price Index, employment data, and Federal Reserve policy shifts—empowers Tennessee borrowers to anticipate mortgage rate movements. Regional economic drivers, including metropolitan job growth, further influence lender risk assessments and rate offerings. A proactive stance informed by credible sources like the Federal Reserve’s Monetary Policy Overview facilitates strategic mortgage timing and optimizes financial outcomes.

Engage with Expert Insights to Elevate Your Tennessee Mortgage Strategy

Embarking on Tennessee’s mortgage journey equipped with nuanced market intelligence and innovative financial tools can significantly enhance decision-making efficacy. We encourage readers to explore specialized resources and engage with seasoned mortgage advisors who can personalize strategies aligning with your unique economic context and risk appetite. Your path to mortgage mastery begins with informed choices and expert collaboration.

Authoritative source: Federal Reserve – federalreserve.gov

Ready to refine your mortgage approach with advanced strategies tailored for Tennessee’s unique market? Connect with our expert advisors today and transform uncertainty into confident financial stewardship.

Frequently Asked Questions (FAQ)

What are the main differences between fixed and adjustable mortgage rates in Tennessee?

Fixed-rate mortgages maintain the same interest rate throughout the loan term, offering consistent monthly payments and protection against rising rates. Adjustable-rate mortgages (ARMs) start with a lower initial rate that adjusts periodically after a fixed period based on market indexes and margins, potentially leading to fluctuating payments. The choice depends on your financial goals, timeline, and risk tolerance.

How does Tennessee’s local economy affect mortgage rate decisions?

Tennessee’s economic indicators such as job growth, inflation trends, and Federal Reserve policies directly influence mortgage rate fluctuations. Metropolitan areas like Nashville and Chattanooga with robust employment growth tend to drive housing demand, affecting lenders’ risk assessments and interest rates. Monitoring these factors helps buyers anticipate market shifts and select appropriate mortgage products.

When is an adjustable-rate mortgage a good option for Tennessee homebuyers?

ARMs can be advantageous for buyers planning to sell or refinance within the initial fixed-rate period (often 5–10 years) or those with strong credit seeking lower initial payments. They offer flexibility but carry the risk of payment increases. Careful evaluation of your future plans and market forecasts is essential before choosing an ARM.

Can refinancing an ARM to a fixed-rate mortgage protect against future rate hikes?

Yes. Refinancing an ARM into a fixed-rate mortgage can provide payment stability and protect against rising interest rates. However, it depends on current fixed rates being favorable and the borrower’s financial readiness to cover refinancing costs. Professional assessment is recommended to determine if this strategy aligns with your goals.

How important is my credit score in securing favorable mortgage rates in Tennessee?

Your credit score significantly impacts the mortgage interest rate offered. Higher scores typically unlock lower rates, which can save thousands over the life of a loan. Improving your credit before applying is a worthwhile investment. Expert resources tailored to Tennessee borrowers provide actionable tips to enhance your credit profile.

What are hybrid mortgage products and how do they benefit Tennessee buyers?

Hybrid mortgages combine fixed and adjustable features, such as 5/5 ARMs that offer a fixed rate for five years followed by adjustable periods. These products provide initial payment stability with later flexibility and often include caps on rate increases, offering a balanced approach for borrowers seeking to optimize cost and risk.

How can I best time my mortgage or refinancing in Tennessee’s changing market?

Effective timing involves monitoring economic indicators, interest rate trends, and personal financial factors like credit score and home equity. Utilizing trusted market analytics and working with local mortgage professionals can help identify optimal windows to lock in rates or refinance, maximizing savings and minimizing costs.

What risks should Tennessee homeowners be aware of with adjustable-rate mortgages?

The primary risk with ARMs is potential payment shocks when rates adjust upward after the initial fixed period, which can strain budgets unexpectedly. Understanding adjustment indexes, caps, and your financial flexibility is vital. Preparing contingency plans or refinancing options can mitigate these risks.

Are there cost considerations when refinancing a mortgage in Tennessee?

Refinancing involves closing costs, appraisal fees, and possible prepayment penalties. Tennessee homeowners should calculate the break-even point — how long it takes for savings to offset refinancing expenses — to ensure refinancing is financially beneficial. Consulting detailed guides and mortgage experts can clarify these aspects.

How can working with mortgage advisors improve my decision-making in Tennessee’s market?

Mortgage advisors bring localized expertise, market insights, and personalized strategy development to help navigate complex options. They can tailor mortgage solutions, explain innovative products, and optimize timing strategies, empowering you to make well-informed, confident decisions aligned with your financial goals.

Trusted External Sources

- Mortgage Bankers Association (MBA) – mba.org: Offers authoritative research and forecasts on mortgage trends, rate analyses, and economic impacts essential for understanding Tennessee mortgage dynamics.

- Federal Reserve – federalreserve.gov: Provides comprehensive data on monetary policy, inflation, and economic indicators that influence mortgage interest rates nationally and regionally.

- Tennessee Housing Development Agency (THDA) – thda.org: Specializes in state-specific housing market information, mortgage assistance programs, and consumer education tailored to Tennessee borrowers.

- Consumer Financial Protection Bureau (CFPB) – consumerfinance.gov: Offers expert guidance on mortgage products, refinancing considerations, and consumer rights crucial for informed borrowing decisions.

- Zillow Research – zillow.com/research: Provides in-depth real estate market analytics and trends that help contextualize mortgage decisions within Tennessee’s housing market environment.

Conclusion

Deciding between fixed and adjustable mortgage rates in Tennessee requires a nuanced understanding of economic forces, personal financial goals, and market trends. Fixed-rate mortgages offer long-term stability and protection against inflation-driven rate increases, making them ideal for buyers prioritizing predictability. Conversely, adjustable-rate mortgages can provide initial savings and flexibility for those with shorter timelines or plans to refinance, though they come with inherent risks tied to market volatility.

Innovative hybrid products and strategic refinancing further expand the toolkit for Tennessee homeowners seeking optimized mortgage solutions. Staying informed through trusted external sources and engaging mortgage professionals ensures decisions are aligned with evolving economic conditions and individual circumstances.

Your journey to homeownership or mortgage mastery in Tennessee is empowered by knowledge, strategic planning, and expert collaboration. Share your experiences, ask questions, or explore our related expert content to deepen your understanding and make confident, financially sound mortgage choices today.