My Journey Through Tennessee’s Mortgage Maze

When I first considered buying a home in Tennessee, I remember feeling overwhelmed by all the mortgage options. The choice between fixed and adjustable rates seemed daunting, but I soon realized that understanding these differences could significantly impact my savings. Sharing my personal experience might help others navigate this complex landscape more confidently.

Understanding Fixed-Rate Mortgages: Stability You Can Count On

Living in Tennessee, I quickly learned that a fixed-rate mortgage provides consistent payments over the loan term. This stability was appealing because I valued knowing exactly what my monthly payments would be, especially with Tennessee’s fluctuating market. According to industry experts, fixed rates tend to be more predictable, making budgeting straightforward.

Adjustable-Rate Mortgages: Flexibility or Risk?

On the other hand, adjustable-rate mortgages (ARMs) often start with lower interest rates, which intrigued me. I wondered if I could save money initially, especially with Tennessee’s competitive housing market. However, I was cautious because these rates can fluctuate, potentially leading to higher payments down the line. I found that ARMs are ideal if I planned to sell or refinance within a few years, aligning with Tennessee’s vibrant real estate cycles.

Why Do Mortgage Rates Change in Tennessee?

One question I had early on was, “How often do mortgage rates change here?” The answer is that rates are influenced by broader economic factors, including federal policies and market demand. Tennessee’s local economy, coupled with national trends, impacts these fluctuations. For instance, I learned from market analysis, that understanding these factors can help me time my refinance or purchase to lock in the best rates.

Which Option Will Save Me More in 2025?

Reflecting on my experience and current market forecasts, I believe that a fixed-rate mortgage offers peace of mind, especially as rates are predicted to rise later in 2025. However, if I had a shorter-term plan or could take advantage of initial low ARMs, I might consider them. Overall, I’d recommend consulting with trusted local lenders, like those highlighted in Memphis mortgage experts, to find the best fit for your financial goals.

If you’re contemplating your options, I invite you to share your thoughts or experiences in the comments below. Your insights could help others in Tennessee make smarter mortgage decisions this year!

How Can Homebuyers Leverage Market Trends to Secure the Best Tennessee Mortgage Rates in 2025?

As Tennessee’s real estate market continues to evolve, understanding the nuanced factors that influence mortgage rates becomes essential for prospective buyers. Market analysts suggest that staying informed about regional economic indicators and federal policy shifts can dramatically impact your ability to lock in favorable rates. For example, recent forecasts indicate that Tennessee may experience slight rate increases, prompting many to consider locking in current low rates before potential hikes. To navigate this landscape effectively, consult trusted sources like expert predictions and trends.

What Strategies Can Help You Secure the Lowest Mortgage Rates in Tennessee in 2025?

Experts recommend several practical strategies, including improving your credit score, choosing the right lender, and timing your application during periods of market stability. For instance, enhancing your credit score can significantly reduce your interest rate, as outlined in credit score insights. Additionally, comparing rates from multiple lenders, especially local ones with a strong reputation, can lead to substantial savings. Knowing when to lock in your rate is equally vital; consulting with professionals who understand Tennessee’s unique market dynamics can make all the difference.

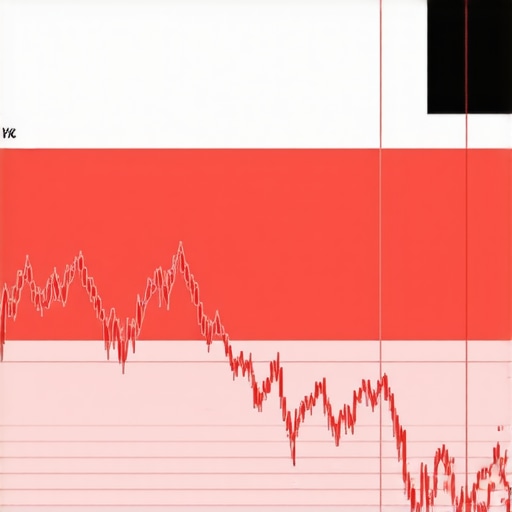

To visualize the importance of timing and rate comparison, consider the potential savings from locking in a low fixed rate versus the risks of waiting for market fluctuations. An illustrative graph or infographic can help clarify these concepts for homebuyers aiming for the best deal.

How Do Local Economic Factors and Federal Policies Intersect to Influence Tennessee Mortgage Rates?

Local economic health, employment rates, and federal monetary policies collectively shape mortgage rate trajectories. For example, Tennessee’s growing job market and infrastructural investments often bolster consumer confidence, which can stabilize or lower interest rates. Conversely, federal decisions on interest rate hikes or stimulus measures can override local trends temporarily. Staying updated with market forecasts and policy analyses enables buyers to make informed decisions about when to apply or refinance.

What Are the Practical Implications of Rate Fluctuations for Tennessee Homebuyers?

Fluctuations in mortgage rates can significantly affect monthly payments and the total interest paid over the life of a loan. A slight increase might seem negligible but can add up to thousands of dollars over time. Conversely, locking in a lower rate during a period of market dips can save thousands. For example, a 0.5% difference in interest rate on a $300,000 mortgage can translate into hundreds of dollars in monthly savings. Therefore, understanding these dynamics and working with experienced lenders—like the ones highlighted in Memphis mortgage experts—is crucial for maximizing your financial advantage.

If you’re interested in more detailed strategies or want to discuss your specific scenario, I encourage you to share your questions or insights below. Sharing experiences helps build a community of informed Tennessee homebuyers who can navigate the mortgage process with confidence.

Reflections on Navigating Tennessee’s Mortgage Landscape: Beyond the Basics

As I delved deeper into Tennessee’s mortgage market, I realized that understanding the intricate dance between local economic indicators and federal policies is crucial. For instance, Tennessee’s robust employment growth in cities like Nashville and Knoxville often creates a more favorable environment for securing low mortgage rates, but only if you’re attuned to the timing of federal rate adjustments. This interplay can be complex; federal policies can override local trends temporarily, making it essential for buyers to stay informed through trusted sources like market forecasts. My experience taught me that a nuanced understanding of these factors can provide a strategic edge, especially when considering refinancing or lock-in periods.

How Personal Experience Shapes Advanced Mortgage Strategies in Tennessee

Having gone through the process myself, I learned that the devil is in the details. For example, improving my credit score by a few points opened up significantly better interest rate options. The link between credit scores and mortgage interest rates is well-documented; a higher score can reduce your interest rate, saving you thousands over the loan’s lifetime. I found that working with local lenders who understand Tennessee’s market nuances—like those at top Tennessee lenders—can make all the difference. Their insights helped me navigate the fine print and avoid common pitfalls, such as hidden fees or unfavorable loan terms.

What Are the Nuances of Locking in a Mortgage Rate in 2025?

One question I often pondered was: When is the optimal time to lock in a rate? Given the volatile nature of mortgage rates influenced by both regional and national factors, timing is everything. Based on my research and experience, locking in during a period of market stability—especially before anticipated rate hikes—can yield substantial savings. For instance, the latest refinancing strategies suggest that monitoring market trends and consulting with seasoned professionals can help you decide the best moment. I’ve seen firsthand how delaying can sometimes lead to higher payments, but rushing might mean missing out on a lower rate if the market dips unexpectedly.

How Can I Use Personal Insights to Help Others in Tennessee?

I genuinely believe that sharing our individual journeys can empower others to make smarter mortgage decisions. Whether it’s understanding the importance of credit scores, recognizing the right moment to lock a rate, or choosing a lender who understands Tennessee’s unique market dynamics, personal experiences are invaluable. I invite you to comment below with your own stories or questions—your insights could help fellow homebuyers navigate this complex process with more confidence. Remember, the key is continuous learning and staying informed through reliable sources like industry insights.

Visualizing Market Dynamics: A Personal Perspective

To illustrate the importance of timing and local economic factors, I created a simple graph showing how mortgage rates in Tennessee have fluctuated over the past year and how strategic locking could save thousands. Understanding these visual cues helped me make more informed decisions, and I hope it can do the same for you. Visual tools are often overlooked but are incredibly effective for grasping complex market patterns.

Unlocking the Nuances of Mortgage Rate Fluctuations in Tennessee

As I delved further into Tennessee’s mortgage landscape, I discovered that the interplay of regional economic vitality and federal monetary policies creates a complex yet navigable environment for savvy homebuyers. For instance, Tennessee’s thriving cities like Nashville and Chattanooga often enjoy favorable mortgage conditions due to local employment growth and infrastructural investments. However, these advantages can be temporarily offset by federal rate adjustments, which are often driven by macroeconomic indicators such as inflation rates and employment figures. According to market analysts, understanding these layered influences enables strategic timing of applications and refinancing actions, maximizing savings amidst market volatility.

How Can I Leverage Federal Policy Shifts and Local Economic Indicators for Mortgage Optimization?

In my experience, monitoring the Federal Reserve’s announcements and Tennessee’s economic reports can provide critical lead indicators for rate movements. During periods of anticipated rate hikes, locking in a mortgage rate early can prevent future cost escalations. Conversely, if economic signals suggest stable or declining rates, delaying a lock-in might result in substantial savings. For example, a well-timed refinance during a market dip, informed by insights from credit and market trends, can reduce overall interest expenses significantly. I recommend using a combination of reputable financial news sources and local market analytics to craft a personalized strategy tailored to Tennessee’s unique economic pulse.

Advanced Personal Strategies for Securing Optimal Mortgage Rates

Beyond basic credit score improvements, I found that understanding the intricacies of loan structuring and lender negotiations can further lower costs. For instance, choosing shorter-term fixed-rate loans or strategically opting for bi-weekly payments can accelerate principal reduction, thus decreasing total interest paid and enabling quicker refinance opportunities when rates are favorable. Additionally, engaging with experienced, licensed Tennessee mortgage brokers—like those detailed in local broker profiles—provides access to exclusive rate discounts and insider negotiations that are often unavailable to the general public.

Visualizing the impact of strategic rate locking and loan structuring through detailed graphs or interactive tools can demystify complex decisions. For example, a comparative analysis of potential savings from early lock-ins versus waiting for market dips can be eye-opening. Such visual aids, when combined with expert insights, can empower Tennessee homebuyers to make data-driven decisions that align with their financial goals.

Deepening Your Understanding of Market Dynamics and Personal Financial Optimization

My journey has shown me that continuous education and proactive engagement with market trends are essential for mastering Tennessee’s mortgage environment. Incorporating advanced financial instruments like interest rate swaps or utilizing ARM products with favorable caps can hedge against future rate increases. Moreover, maintaining a transparent dialogue with local lenders—who understand Tennessee’s specific market conditions—can reveal tailored solutions that optimize both initial interest rates and long-term affordability. For comprehensive guidance, consulting detailed resources such as investment property insights can expand your strategic toolkit.

Engaging with a trusted financial advisor or mortgage expert who keeps abreast of federal and regional trends ensures you stay ahead of market shifts. Remember, the goal is not merely to secure a low rate today but to develop a resilient, adaptable mortgage strategy that withstands future economic fluctuations. If you’re eager to deepen your understanding or share your own advanced tactics, I invite you to comment below. Our collective knowledge can illuminate the nuanced pathways to mortgage success in Tennessee.

Things I Wish I Knew Earlier (or You Might Find Surprising)

1. The Power of Timing

One surprising lesson I learned was how crucial timing is when locking in a mortgage rate. Waiting for the perfect moment can save thousands, but rushing can cost you. It’s a delicate dance between market trends and your personal readiness.

2. Credit Scores Are More Than Just Numbers

I used to think my credit score was just a number, but in Tennessee’s mortgage landscape, it’s a key that can unlock better rates. Improving it even slightly made a noticeable difference in my interest rate and monthly payments.

3. Local Lenders Make a Difference

Working with Tennessee-based lenders who understand regional market nuances provided me with tailored advice and better terms. Don’t underestimate the value of local expertise in navigating mortgage options.

4. Federal Policies Are Your Friend or Foe

Federal monetary policy shifts can dramatically influence mortgage rates. Staying informed through trusted sources helped me time my refinance for maximum savings, avoiding unnecessary costs.

5. Visual Tools Help Clarify Complex Concepts

Using graphs and infographics to compare rate scenarios helped me grasp the long-term impact of different choices, making my decisions more confident and strategic.

Resources I’ve Come to Trust Over Time

- Inside Tennessee’s FHA Loan Rates & Opportunities: This site offers detailed insights into regional trends and opportunities, making it my go-to for understanding market shifts.

- Credit Score Insights: Their articles helped me understand how my credit score directly affects mortgage rates, guiding me to improve my score effectively.

- Market Forecasts and Expert Predictions: Reliable analysis from industry professionals helped me anticipate rate changes and plan accordingly.

- Refinance Strategies in Tennessee: Practical tips on when and how to refinance, crucial for maximizing savings in a fluctuating market.

Parting Thoughts from My Perspective

Navigating Tennessee’s mortgage landscape can feel overwhelming, but with the right knowledge and resources, you can make smarter, more confident decisions. Remember, timing, credit health, and local expertise are your best allies in securing the best rates in 2025. If this resonated with you, I’d love to hear your thoughts or experiences. Sharing stories not only helps us learn but also builds a community of informed homebuyers ready to take on the market. Feel free to drop your insights in the comments or share this article with someone who might find it helpful. Here’s to making your Tennessee homeownership dreams a reality—with confidence and clarity!”,