My Personal Journey into Tennessee Mortgage Rates: Fixed vs. Adjustable in 2025

When I first started exploring home financing options in Tennessee, I was overwhelmed by the choices between fixed and adjustable-rate mortgages. As someone who’s navigated the real estate market, I can attest that understanding these options can make a huge difference in your financial future. I remember sitting at my kitchen table, comparing rates and trying to decode the complex language of lenders, feeling both excited and a bit anxious about the decision ahead.

Why I Chose to Dive Deep into Mortgage Types

My curiosity about the nuances of mortgage rates led me to research thoroughly. I wanted to know which mortgage type—fixed or adjustable—would serve me best in 2025, considering Tennessee’s unique market trends. I learned that fixed-rate mortgages offer stability, locking in a consistent payment, which appeals to many homeowners seeking predictability. Conversely, adjustable-rate mortgages can offer lower initial rates, but come with the risk of future rate increases. This knowledge helped me craft a strategy aligned with my financial goals.

What Makes Tennessee’s Market Stand Out?

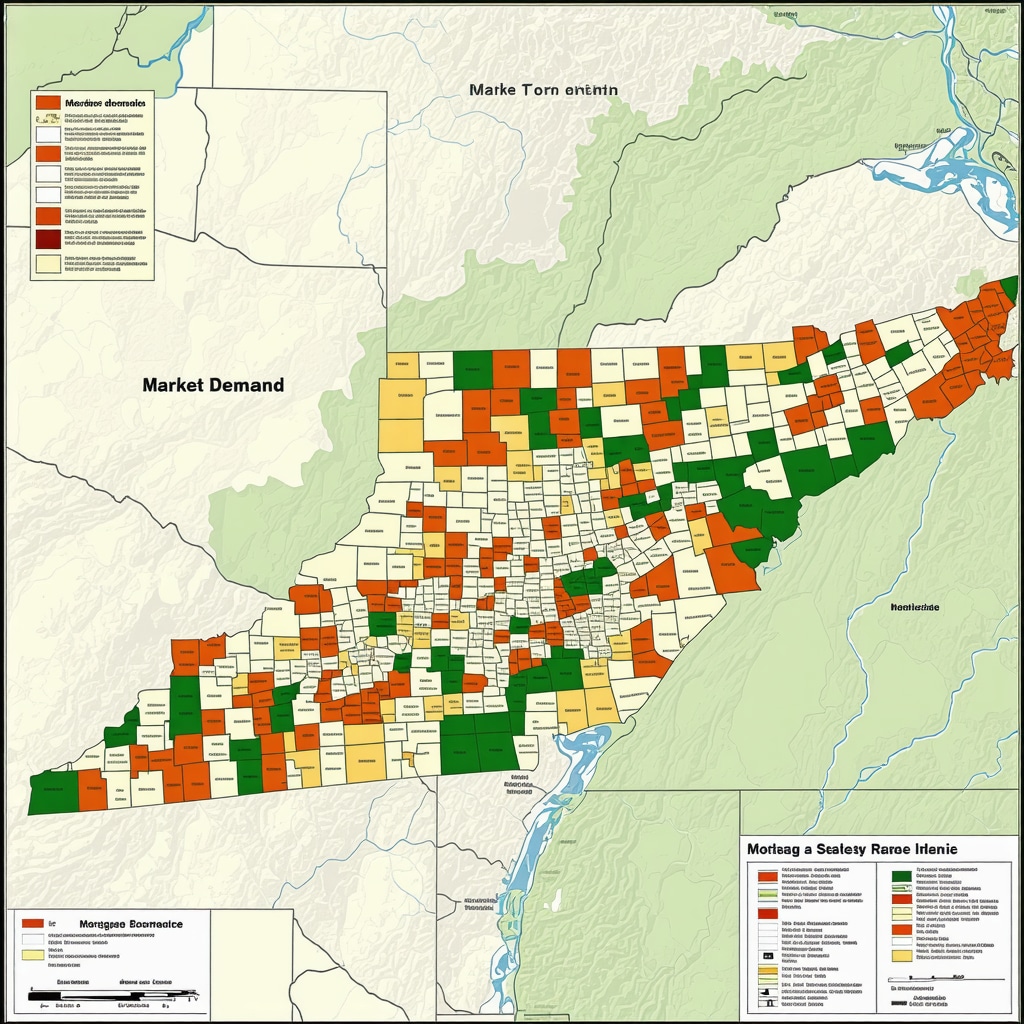

Tennessee’s housing market has been quite dynamic. According to recent insights from authoritative sources, local market trends significantly influence mortgage interest rates, making it crucial for buyers and refinancers to stay informed. I found that in areas like Nashville and Memphis, mortgage rates tend to fluctuate based on regional economic conditions, which can impact whether fixed or adjustable options are more advantageous.

Which Favors Me More? My Personal Reflection

As I weighed my options, I realized that in 2025, fixed-rate mortgages might be the safer choice for someone like me, who values stability and predictable payments. However, if you’re comfortable with some variability and aiming for lower initial rates, adjustable mortgages could be worth considering. I recommend discussing with a trusted local lender or mortgage broker—like those highlighted in this guide—to tailor the best plan for your situation.

How Do I Know Which Mortgage Rate Is Better for My Future?

This question is crucial because it depends on your financial stability, risk appetite, and long-term plans. I suggest evaluating your job security, savings, and how long you plan to stay in your home. If you prefer peace of mind, a fixed-rate mortgage might be your best bet. If you’re open to adjusting your plan later, an adjustable could save you money initially. Remember, the key is to stay informed about Tennessee’s evolving market conditions, which can be explored more at this resource.

If you’ve experienced navigating mortgage options in Tennessee or have insights to share, please comment below. Your experience could help others make smarter choices in 2025!

Decoding Tennessee’s Market Trends: What Influences Your Mortgage Rate?

Understanding the factors behind Tennessee mortgage rates is essential for making informed decisions. Local economic conditions, employment rates, and regional housing demand play pivotal roles in shaping mortgage interest rates, as detailed in this comprehensive guide. For example, in markets like Nashville, rising job opportunities tend to boost housing demand, which can influence lenders to adjust rates accordingly, impacting both purchase and refinance scenarios.

Fixed vs. Adjustable: Which Mortgage Fits Your Future?

Choosing between fixed and adjustable-rate mortgages (ARMs) hinges on your financial stability and long-term plans. Fixed-rate mortgages offer predictability, locking in a rate for the entire term, making them ideal for those prioritizing stability. In contrast, ARMs often feature lower initial rates that can adjust periodically, potentially saving money if market rates remain favorable. Analyzing your risk tolerance and future plans is crucial. For more nuanced strategies tailored to Tennessee’s evolving market, explore this expert guide.

How Can You Optimize Your Mortgage Strategy in 2025?

To maximize savings and ensure the best mortgage terms, consider timing your rate lock and understanding market trends. For instance, locking in a rate during a low-interest period can lead to significant savings, especially if Tennessee market conditions indicate a potential rise. Additionally, leveraging local lender insights, like those found in this detailed analysis, can give you an edge in negotiations and decision-making.

What Role Do Credit Scores Play in Your Mortgage Rate?

Your credit score remains a crucial determinant in the mortgage process. Higher scores typically qualify you for lower interest rates, saving thousands over the life of your loan. Improving your credit before applying can significantly impact your mortgage options. For tailored advice on boosting your credit score, visit this resource.

Are You Ready to Take the Next Step Toward Your Tennessee Home?

If you’re contemplating your mortgage options or need expert guidance, don’t hesitate to reach out. Working with a trusted local lender or mortgage broker can help you navigate complex choices and lock in favorable rates. For personalized assistance, visit our contact page. And if you’ve found this article helpful, share it with others planning their home financing journey in Tennessee!

Delving Deeper: The Nuances of Mortgage Rate Fluctuations in Tennessee

Reflecting on my journey through Tennessee’s real estate landscape, I realize that mortgage rates are not merely numbers; they are a reflection of broader economic currents and regional nuances. For instance, during my research, I discovered that Tennessee’s diverse markets, from the booming streets of Nashville to the quieter suburbs of Chattanooga, experience rate changes differently, influenced by local employment trends and housing demand. Understanding these regional variances is crucial for any serious homebuyer or investor aiming to optimize their mortgage strategy in 2025.

The Impact of Economic Indicators and Market Sentiment

One aspect that often goes underappreciated is how national economic indicators, like inflation rates and Federal Reserve policies, ripple into local mortgage rates. I recall analyzing data from this detailed report which highlighted how shifts in interest rate policies can influence Tennessee’s market unpredictability. This realization prompted me to consider how market sentiment and economic forecasts should inform my decision-making process, especially when choosing between fixed and adjustable options.

How Can Advanced Market Analytics Help You Make Smarter Mortgage Choices?

Leveraging sophisticated analytics tools, including regional economic models and predictive algorithms, can give buyers a competitive edge. For example, tools that analyze Tennessee’s housing demand trends and interest rate forecasts can help determine the optimal time to lock in a mortgage rate, potentially saving thousands over the loan term. Such insights are invaluable for those of us who seek not just stability, but also strategic financial positioning. Exploring these tools further, as discussed in this resource, can empower you to make nuanced, data-driven decisions.

Personal Strategies for Navigating Rate Variability

From my experience, one of the most effective strategies is to stay agile. While locking in a fixed rate offers peace of mind, I found that periodically reviewing market conditions and being ready to refinance or adjust your mortgage plan can lead to significant savings. Especially in a market like Tennessee’s, where rates can swing due to regional economic shifts, maintaining flexibility and staying informed is key. I also recommend cultivating relationships with local lenders who understand the intricacies of Tennessee’s market, as highlighted in this guide.

How Do You Balance Risk and Reward in Your Mortgage Strategy?

This question lies at the heart of mortgage decision-making. Personally, I weigh my financial stability, long-term plans, and risk tolerance carefully. For those comfortable with some variability, adjustable-rate mortgages can offer initial cost savings, but it’s essential to have a plan for potential future rate increases. Conversely, if stability is your priority, fixed-rate loans provide peace of mind but might come with slightly higher initial costs. Recognizing the regional economic signals discussed earlier can help refine this balance, ensuring your strategy aligns with Tennessee’s evolving market conditions.

As I continue to explore and adapt, I invite readers to share their experiences or ask questions in the comments. Your insights could illuminate new paths for others navigating the complex landscape of Tennessee mortgage rates in 2025!

Harnessing Regional Economic Indicators to Fine-Tune Your Mortgage Strategy in Tennessee

As I continue to refine my understanding of Tennessee’s mortgage landscape, I realize that staying attuned to regional economic indicators is crucial. For example, in Nashville, where job growth has been consistently strong, mortgage rates tend to reflect increased demand, which can lead to slight rate increases. Conversely, in markets like Chattanooga, where economic growth is steadier but less aggressive, rates often remain more stable. By analyzing data from this detailed report, I’ve learned that understanding these microeconomic factors enables me to anticipate rate movements more accurately, allowing for strategic timing of rate locks or refinancing opportunities.

Leveraging Advanced Analytics and Predictive Models for Smarter Mortgage Decisions

In my quest for optimal mortgage solutions, I’ve adopted sophisticated analytics tools that incorporate regional housing demand, employment trends, and macroeconomic forecasts. These models, as discussed in this comprehensive analysis, help predict potential fluctuations in Tennessee mortgage rates. For instance, if analytics suggest a downturn in interest rates due to national policy shifts, I can preemptively strategize refinancing or rate locking to maximize savings. This proactive approach has transformed my decision-making process from reactive to predictive, providing a significant edge in a competitive market.

What Are the Best Strategies for Utilizing Market Data to Lock in Low Rates?

Drawing from my experience, the key lies in continuous monitoring and timely action. I’ve found that setting up alerts for rate movements, combined with insights from local lenders who understand Tennessee’s nuanced market conditions, can facilitate swift decisions. For example, during a recent rate dip, I leveraged insights from this resource to lock in a favorable rate before the market rebounded. I encourage you to explore these advanced strategies, as they can significantly enhance your financial positioning in 2025 and beyond.

Things I Wish I Knew Earlier (or You Might Find Surprising)

The Power of Local Market Trends

When I first looked into Tennessee mortgage rates, I underestimated how much regional differences could impact my decision. Understanding that Nashville’s booming job market could push rates slightly higher helped me plan better, and I wish I had known this earlier. It’s fascinating how local economic conditions can sway mortgage interest rates, making research on regional trends so valuable.

The Hidden Impact of Credit Scores

Initially, I thought my credit score only affected my loan approval, but I discovered it also significantly influences the rate I could get. Improving my credit before applying made a real difference in the interest rate I secured. This taught me that small steps to boost credit scores are well worth the effort, especially when aiming for the best Tennessee mortgage rates in 2025.

The Nuance of Fixed vs. Adjustable Rates

I used to see fixed and adjustable-rate mortgages as just different options, but I learned they serve different financial strategies. Fixed rates offer predictability, perfect for stable plans, while ARMs can save money upfront but come with future rate risks. Knowing my long-term plans helped me choose wisely, and I recommend others to reflect on their comfort with rate variability.

The Timing of Rate Locks

One surprising insight was how critical timing can be. Locking in a rate during a low-interest period can save thousands, especially if Tennessee’s market shows signs of rising rates. I found that staying informed and acting swiftly when conditions are favorable is a smart move, and it’s something I wish I had prioritized earlier.

The Role of Advanced Analytics

Using predictive models and regional economic data can give you a strategic advantage. I started exploring tools that forecast Tennessee mortgage rate trends, which helped me decide when to lock or refinance. It’s like having a financial compass guiding your decisions—definitely worth considering if you want to optimize your mortgage strategy.

Final Reflection: The Joy of Informed Decisions

Looking back, I realize that understanding Tennessee mortgage rates in 2025 isn’t just about numbers—it’s about being aware of regional nuances, personal financial health, and timing. The more I learned, the more confident I felt making decisions that suited my long-term goals. If you’re navigating this process, remember that your knowledge and preparation can make all the difference. I recommend checking out some trusted resources I’ve come to rely on, like the comprehensive guides and expert analyses on this site.