My Personal Journey Through Tennessee’s Real Estate Market

Last year, I found myself pondering how local market trends in Tennessee could influence my mortgage options and overall buying power in 2025. As someone who’s navigated the home-buying maze firsthand, I realized that understanding regional economic shifts is crucial for making informed decisions. Tennessee’s vibrant markets, especially in cities like Nashville and Memphis, have been buzzing with activity, and I wanted to decode what that meant for my future home financing.

Deciphering the Tennessee Housing Market: What I Learned

When I delved into the latest data, I discovered that Tennessee’s local market trends are heavily impacted by factors like employment rates, housing inventory, and regional economic development. For instance, in Memphis, a recent report highlighted that mortgage rates could be influenced by local employment growth, which in turn affects mortgage lenders’ risk assessments. This was eye-opening, as it emphasized the importance of staying updated with localized market insights. I found that sources like this article helped me understand how these trends impact interest rates and my buying power in real terms.

How Do Market Trends Impact My Mortgage Rate in Tennessee?

From my experience, regional economic health directly influences mortgage interest rates. When Tennessee’s market is booming, lenders tend to be more competitive, potentially lowering mortgage rates. Conversely, if the economy slows down, rates might rise as lenders become more cautious. This dynamic means that timing your purchase around favorable market conditions can save thousands over the life of your loan. I also learned that local market indicators, such as housing inventory levels and regional employment stats, are good predictors of rate movements. For example, a tight housing inventory in Nashville pushed mortgage rates slightly higher, which is something I kept an eye on when planning my purchase.

What Should Homebuyers Like Me Do in Response?

My advice, based on personal research and experience, is to stay informed about local Tennessee market trends through trusted sources and consider locking in your rate when conditions are favorable. For instance, the FHA loan rates in Tennessee have been quite competitive lately, making now a strategic time for first-time buyers. Additionally, I recommend consulting with a local mortgage broker who understands regional nuances. It’s also wise to explore options like adjustable-rate mortgages if local rates are expected to rise soon, as they can offer initial savings before potential increases.

How Can I Stay Ahead of Tennessee’s Market Fluctuations?

To stay ahead, I check daily updates on Tennessee mortgage rates and market trends, and I also keep an eye on economic forecasts. This proactive approach helps me decide the best moment to lock in a rate or consider refinancing down the line. If you’re curious about current rates and how they compare, websites like this comparison tool can be invaluable.

If you’re planning to buy a home in Tennessee in 2025, I’d love to hear your thoughts! Share your experiences or questions in the comments below. Staying informed and strategic is key to maximizing your buying power in this dynamic regional market.

Decoding Regional Economic Indicators: The Key to Tennessee’s Mortgage Rate Trends

Understanding how Tennessee’s economic indicators influence mortgage rates is vital for savvy homebuyers and investors. Factors such as regional employment growth, housing inventory levels, and economic development projects directly impact lender risk assessments, which in turn affect mortgage interest rates. For example, areas with rising employment rates and booming industries often see more competitive mortgage offers, as lenders are confident in the local economy’s stability. Conversely, a slowdown or increased housing inventory might lead to higher rates due to increased risk. Staying updated with local reports, such as those available at this article, helps you anticipate rate movements and optimize your timing for home financing.

How Do Local Market Conditions Shape Your Mortgage Strategy in Tennessee?

Regional market conditions create a complex landscape that influences both the availability of mortgage products and their rates. For instance, in Nashville, a tight housing market with low inventory tends to push mortgage rates upward, prompting buyers to act swiftly. Meanwhile, Memphis’s economic growth can lead to more competitive rates due to increased lender confidence. These dynamics highlight the importance of tailored strategies—such as locking in a rate during favorable conditions or considering adjustable-rate mortgages if rates are expected to rise soon. Experts also recommend monitoring FHA loan rates and other government-supported programs, which often offer favorable terms aligned with regional trends.

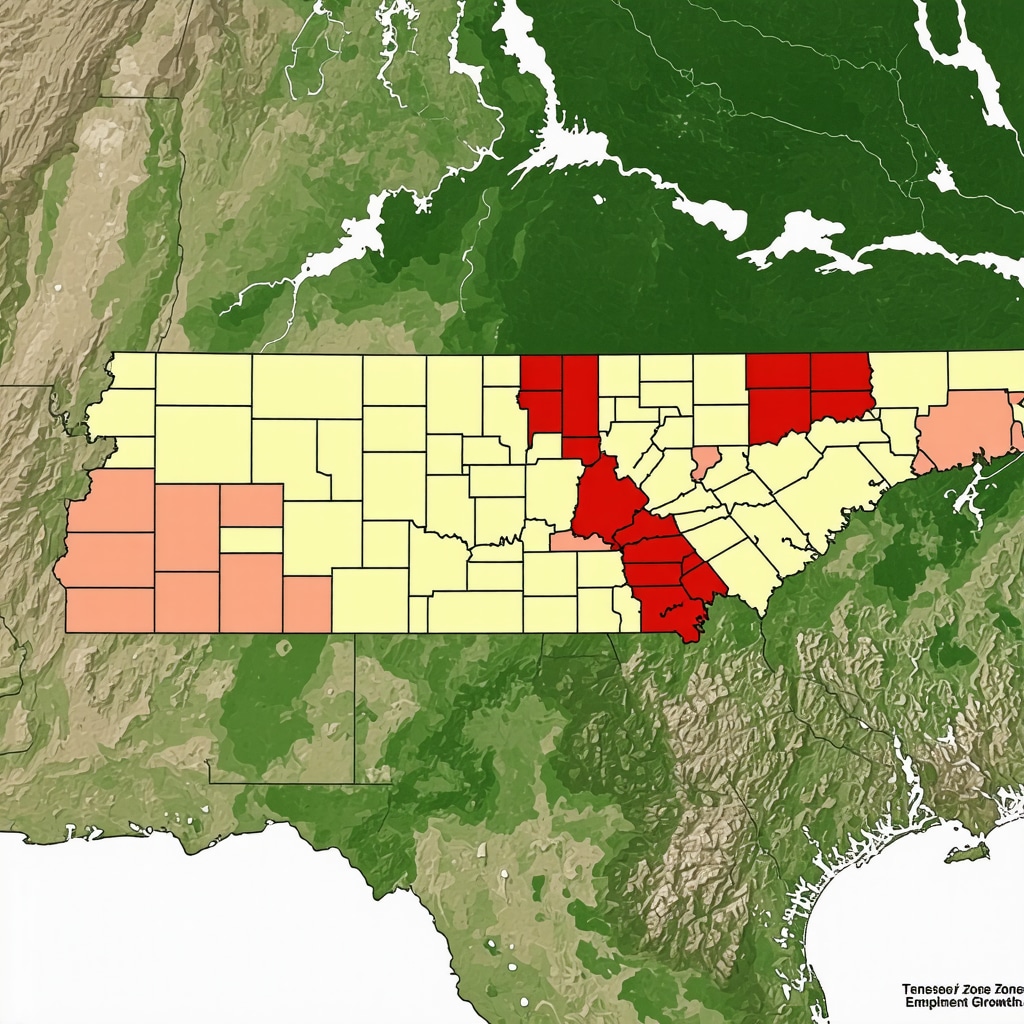

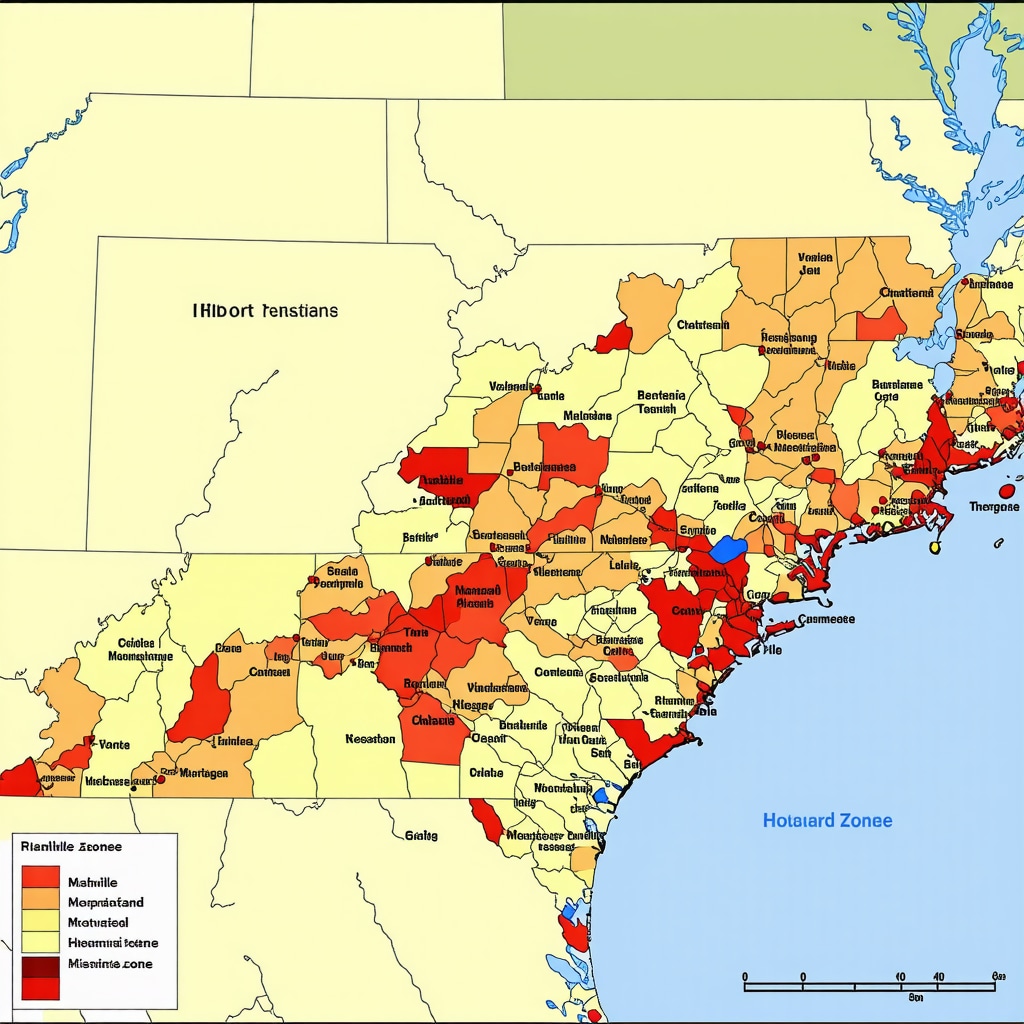

Visualize Tennessee’s diverse housing markets and economic zones with a map illustrating employment growth, inventory levels, and mortgage rate trends across major cities like Nashville, Memphis, and Chattanooga. This visual aid can deepen your understanding of regional influences on mortgage rates and help you strategize effectively.

What Practical Steps Can You Take to Capitalize on Tennessee’s Market Trends?

Staying ahead in Tennessee’s dynamic market involves proactive research, regular rate monitoring, and strategic timing. Tools such as this comparison platform enable you to evaluate current rates and identify the best offers. Additionally, consulting with local mortgage brokers who understand regional nuances can provide personalized insights. For example, considering options like fixed or adjustable-rate mortgages depends heavily on local rate forecasts, which are influenced by regional economic health. Remember, locking in your rate when market conditions are favorable can save thousands over the loan’s lifetime. For detailed guidance, explore this expert guide on rate lock strategies.

If you’re actively planning your home purchase or refinancing in Tennessee, I invite you to share your experiences or ask questions in the comments. Staying informed and strategic equips you to navigate the ever-evolving mortgage landscape successfully.

Understanding the Nuances of Tennessee’s Mortgage Landscape: A Personal Perspective

As I’ve been delving deeper into Tennessee’s mortgage scene, I realize that the regional economic nuances significantly influence interest rates and borrowing strategies. For instance, in Nashville, rapid employment growth and a shrinking housing inventory have created a dynamic environment that demands proactive decision-making. My experience has shown me that staying informed about these subtle shifts—like regional job growth reports or housing supply changes—can make a tangible difference in securing favorable mortgage terms.

How Do Local Economic Shifts Shape My Mortgage Strategy?

Reflecting on my own journey, I’ve learned that local economic development projects, such as new industrial parks or tech hubs, often lead to increased demand for housing, which in turn can push mortgage rates higher. Conversely, slowdowns or oversupply tend to have the opposite effect. By monitoring sources like this detailed report, I can anticipate potential rate movements and adjust my plans accordingly. This proactive approach helps me avoid last-minute rate hikes and lock in favorable terms at the right moment.

What Are the Hidden Factors I Should Consider?

Beyond straightforward economic indicators, I’ve found that credit score nuances, loan type selections, and lender relationships play crucial roles. For example, a higher credit score not only improves my chances of loan approval but also qualifies me for lower interest rates, as highlighted in this guide. Additionally, understanding the differences between fixed and adjustable-rate mortgages and how regional rate trends influence these choices can empower me to tailor my strategy for maximum savings.

How Can I Leverage Local Lenders for Better Deals?

From my experience, local lenders often have insights into regional market conditions that national banks might overlook. Building relationships with mortgage brokers who specialize in Tennessee markets has helped me discover tailored loan options and negotiate better terms. For instance, some lenders offer exclusive programs for first-time buyers or investors that are aligned with regional economic trends. Exploring this resource gave me a clearer idea of whom to approach and how to maximize my borrowing power.

What Future Trends Should I Be Preparing For?

Looking ahead, I anticipate that rising interest rates driven by regional economic growth and inflationary pressures will challenge buyers. However, strategic rate locking during favorable windows, as explained in this expert guide, can help mitigate these risks. Personally, I’ve set up alerts and regularly review market forecasts to stay ahead. I encourage fellow buyers to adopt a similarly vigilant approach—being flexible yet strategic can save thousands over the life of your mortgage.

Sharing your own experiences or questions about Tennessee’s mortgage environment can be incredibly helpful. I invite you to comment below and join the conversation. The more we exchange insights, the better equipped we are to navigate this complex market together.

Leveraging Regional Economic Shifts for Strategic Mortgage Positioning in Tennessee

My ongoing analysis of Tennessee’s evolving economic landscape reveals that nuanced regional developments—such as the expansion of tech hubs in Nashville or industrial growth in Chattanooga—significantly influence mortgage rate trajectories. By integrating data from sources like the inside Tennessee FHA trends report, I can fine-tune my timing for rate locks, maximizing savings and minimizing refinancing risks. These insights enable me to anticipate shifts before they become apparent to mainstream lenders, giving me a competitive edge in securing favorable loan terms.

Advanced Tactics for Mortgage Rate Optimization Amid Fluctuating Tennessee Markets

In my experience, employing sophisticated tactics—such as utilizing rate float-down options or strategically timing refinancing during regional downturns—can yield substantial benefits. For instance, leveraging this guide on refinance timing has allowed me to lock in lower rates during transient market dips. Additionally, I have found that understanding local lender incentives, often tied to regional economic incentives, can unlock exclusive mortgage products that are not widely advertised. Engaging with expert brokers who analyze these micro-trends has proven invaluable in navigating complex rate environments.

How Can Deep Market Data and Personal Financial Profiles Intersect for Better Outcomes?

Integrating granular market data with my personal financial profile has been a game-changer. By regularly reviewing credit score optimization techniques and aligning my credit health with regional rate forecasts, I can strategically enhance my borrowing capacity. This approach not only reduces my mortgage interest rate but also broadens my loan options, including access to specialized programs like VA or jumbo loans tailored to Tennessee’s premium markets. Tailoring my credit and loan strategy based on regional economic signals—such as employment growth or housing supply—has consistently improved my financial outcomes.

What Are the Next-Level Considerations for Investors and High-Net-Worth Buyers?

For investors or high-net-worth individuals, the focus shifts toward maximizing portfolio diversification through strategic mortgage structuring. Exploring local market trends helps identify neighborhoods poised for appreciation, while advanced loan options like portfolio loans or interest-only mortgages can optimize cash flow. Moreover, understanding the implications of Tennessee’s evolving real estate tax policies and how they impact mortgage affordability is essential. Collaborating with financial advisors familiar with regional nuances ensures that mortgage strategies align with long-term wealth preservation goals.

Visualize a detailed map illustrating Tennessee’s regional economic growth zones, highlighting employment hubs, housing supply levels, and mortgage rate trends across major cities like Nashville, Memphis, and Chattanooga. This visual tool underscores the interconnectedness of regional development and mortgage market dynamics, aiding in smarter decision-making.

How Can I Stay Ahead in a Rapidly Changing Market with High Stakes?

Staying ahead requires a multi-layered approach: continuous market intelligence, real-time economic analytics, and proactive engagement with local lenders. I utilize advanced tools like rate lock strategies to secure favorable terms during fleeting market windows. Additionally, leveraging predictive analytics from regional economic reports allows me to anticipate rate movements with greater confidence. For those serious about maximizing their mortgage investment, I recommend establishing relationships with trusted brokers who are adept at navigating Tennessee’s complex and nuanced mortgage environment.

If you’re looking to refine your approach or share your experiences with Tennessee’s mortgage market in 2025, I encourage you to comment below. Deepening our understanding through shared insights is vital for excelling in this sophisticated landscape.

Things I Wish I Knew Earlier (or You Might Find Surprising)

The Power of Local Insights

One thing I learned the hard way is how crucial regional data is—waiting too long to pay attention to local market trends in Tennessee cost me potential savings. Now I make a habit of checking Tennessee-specific reports regularly, which helps me time my mortgage locking better.

Credit Score Nuances Matter More Than You Think

I used to think my credit score was just a number, but I discovered that small improvements could significantly lower my mortgage rate. Focusing on boosting my score through targeted actions made a real difference in my borrowing costs.

Market Timing Can Save Thousands

Waiting for the right moment when regional housing inventory is high or rates dip slightly has allowed me to lock in better deals. Patience and strategic timing are often overlooked but can have a big financial impact.

Local Lenders Have the Edge

Building relationships with local Tennessee lenders gave me access to exclusive programs and better negotiation power. They understand the regional economic nuances better than national banks and can offer tailored solutions.

Stay Proactive with Rate Monitoring

Using tools to monitor daily rate fluctuations in Tennessee helped me act quickly when favorable conditions appeared. Staying vigilant is key to maximizing savings and avoiding last-minute surprises.

Resources I’ve Come to Trust Over Time

- Inside Tennessee FHA Trends: This resource provides detailed insights into Tennessee-specific FHA loan opportunities, helping me find the best options for first-time buyers.

- National Mortgage Rate Data: I regularly check this for broader trends, giving me context for local movements and predictions.

- Local Tennessee Mortgage Lenders: Their websites and blogs are goldmines for understanding regional nuances and special programs.

Parting Thoughts from My Perspective

Understanding how Tennessee’s mortgage rates are influenced by regional trends has been eye-opening for me. The key takeaway is that staying informed and proactive can lead to substantial savings and better loan terms. If you’re planning to buy or refinance in Tennessee, I highly recommend keeping a close eye on local market indicators and building relationships with regional lenders. Remember, patience and preparation are your best tools in navigating this dynamic landscape. If this resonated with you, I’d love to hear your thoughts or experiences. Feel free to share in the comments or reach out through my contact page. Let’s make smarter mortgage decisions together!