My Journey into Understanding Tennessee Mortgage Rate Fluctuations in 2025

When I first bought my home in Tennessee, I was overwhelmed by the idea of mortgage rates constantly changing. It felt like trying to catch a moving target! Over the years, I’ve learned that understanding how often these rates change can actually help me make smarter financial decisions. As we step into 2025, I wanted to share my insights on this topic, especially since mortgage rates are a critical part of homeownership costs.

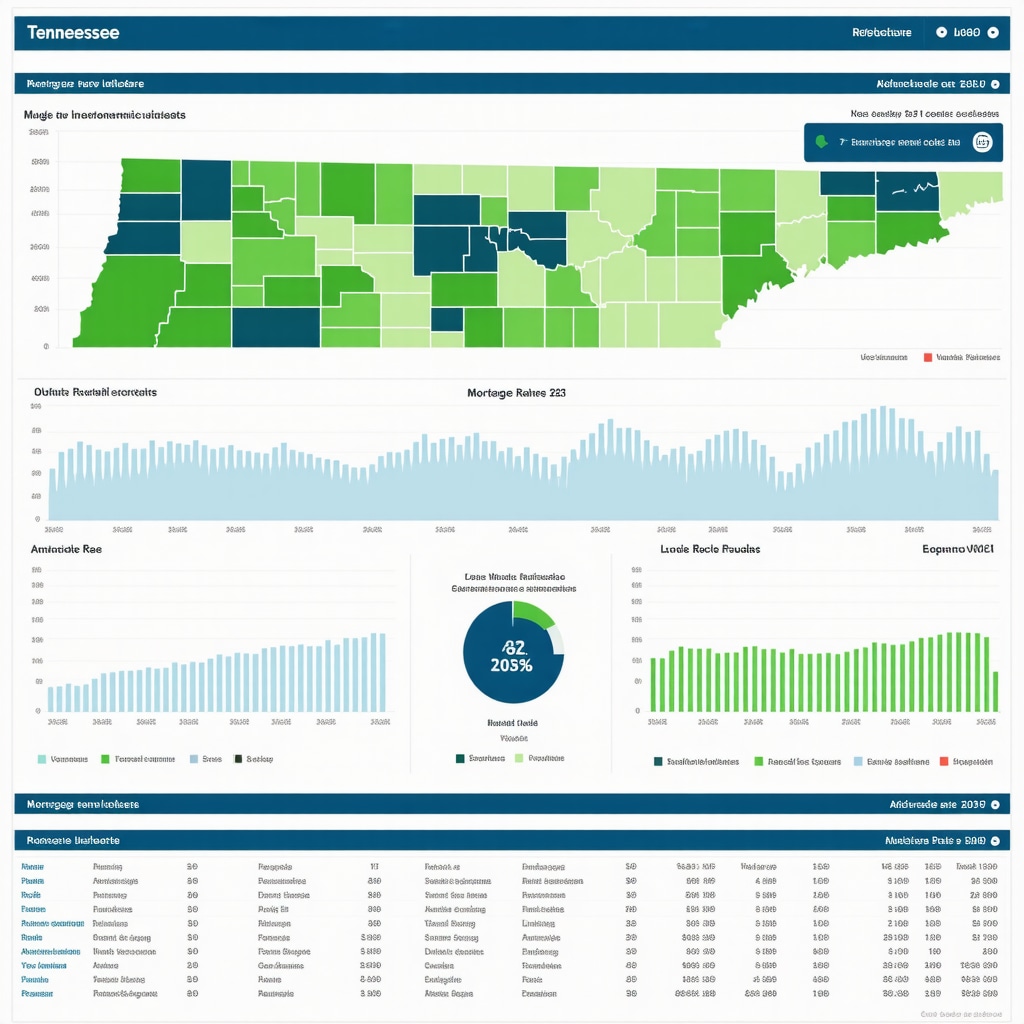

The Dynamic Nature of Mortgage Rates in Tennessee

From my experience, mortgage rates in Tennessee don’t follow a strict schedule—they fluctuate based on economic indicators, Federal Reserve policies, and market conditions. Typically, I’ve observed that these rates tend to change frequently during volatile economic periods. In 2024, for example, rates saw several adjustments, and I expect the trend to continue into 2025.

How Often Do Rates Change in 2025?

Based on my research and conversations with local lenders, mortgage rates in Tennessee can change as often as daily or weekly. It’s like keeping an eye on the weather—sometimes it shifts suddenly, other times it stays stable for a while. The mortgage market is influenced by multiple factors, including inflation data, employment reports, and global economic shifts, which means that rate changes can occur unexpectedly.

What Are the Main Drivers Behind These Fluctuations?

In my view, the key drivers include Federal Reserve policies, inflation trends, and investor sentiment. For instance, if the Fed raises interest rates to curb inflation, mortgage rates usually follow suit. I always keep an eye on economic reports, such as those discussed in sources like this expert guide, to anticipate potential rate shifts.

If you’re planning to buy or refinance in 2025, staying updated on these fluctuations is vital. I recommend regularly checking local rates and consulting with trusted lenders to lock in the best deals when rates dip.

Why Is Timing So Important in Tennessee?

Timing can significantly affect your mortgage costs. I learned that the best approach is to monitor the market closely and act when rates are favorable. This is especially true in Tennessee, where local market conditions can also influence rates. For example, my recent experience with Memphis mortgage rates showed how regional trends can differ from national patterns. For more detailed insights, you can explore this article.

If you want to stay ahead, consider setting alerts for rate changes or discussing with a mortgage broker who understands Tennessee’s market intricacies.

Join the Conversation

Have you experienced how often mortgage rates change in Tennessee? I’d love to hear your stories or tips—please share your experiences in the comments below! Staying informed can truly make a difference in securing the best mortgage deal.

Unraveling the Complexities of Tennessee Mortgage Rate Movements in 2025

Ever wondered why mortgage rates in Tennessee seem to shift unpredictably? As someone deeply immersed in the local real estate finance scene, I can tell you that understanding these fluctuations is crucial for making savvy homeownership decisions. In 2025, the landscape is more dynamic than ever, influenced by a myriad of factors that require keen attention and strategic planning.

What Are the Hidden Factors Causing Rate Swings in Tennessee?

Beyond the obvious economic indicators, several nuanced elements subtly sway mortgage rates. Regional economic health, Tennessee’s specific employment trends, and even political stability can influence lender risk assessments. For example, when Memphis saw a surge in tech startups, local mortgage rates experienced slight dips due to increased economic optimism. Recognizing these regional signals can give buyers and investors an edge, especially when timing their applications or refinancing efforts.

How Can I Predict the Next Rate Movement in Tennessee?

Expert analysis suggests that staying attuned to federal monetary policy updates, inflation reports, and global economic shifts provides the best predictive insights. Resources like this comprehensive guide highlight key indicators to watch. Additionally, subscribing to daily rate updates and engaging with local lenders can help you act swiftly when favorable conditions arise. Remember, timing your mortgage or refinance can save you thousands over the life of your loan.

Why Is Local Market Knowledge Essential for Rate Optimization?

While national trends set the stage, Tennessee’s unique market conditions add a layer of complexity. For instance, recent trends in Nashville showed that local economic policies and housing demand can cause rates to diverge from national averages. This emphasizes the importance of working with mortgage brokers who understand Tennessee’s market nuances. To explore regional trends in depth, check out this article.

Can Strategic Timing Really Impact My Mortgage Costs?

Absolutely. The key is to monitor daily rate movements and be prepared to lock in when rates dip. For example, I recommend setting up rate alerts and maintaining ongoing discussions with trusted lenders. Knowledge of when to lock or float your rate can mean the difference between significant savings and higher costs. For expert tips on timing your lock, visit this guide.

Are You Ready to Take Advantage of Rate Fluctuations?

Being proactive and informed is the best strategy to navigate Tennessee’s ever-changing mortgage rates. I encourage you to share your experiences or ask questions in the comments below—your insights could help fellow homebuyers. Additionally, if you’re eager to deepen your understanding, I recommend exploring this detailed guide on choosing the right mortgage type for your needs.

Embracing the Complexity of Rate Movements: A Personal Reflection

Over the years, I’ve come to realize that understanding Tennessee mortgage rate fluctuations isn’t just about tracking numbers—it’s about recognizing patterns, regional influences, and my own financial readiness. I remember when I first attempted to predict the market, feeling like I was trying to solve a complex puzzle without all the pieces. Now, with more experience, I see that patience and continuous learning are my best allies. Watching how Memphis rates, for example, sometimes diverge from national trends, has taught me to look beyond headlines and dig into local economic indicators, like employment trends and industry growth, which often subtly sway mortgage costs.

Deepening My Understanding of Regional Influences

One thing I’ve learned is that regional economic health can act as a silent driver behind rate movements. When Memphis experienced a boom in tech startups, I noticed lenders became more flexible with loan terms, and rates dipped slightly, reflecting increased optimism. Conversely, slowdowns in certain Tennessee markets tend to tighten lending criteria, leading to higher rates. This nuanced understanding pushes me to stay engaged with local news and economic reports, such as those found on this resource, which helps me anticipate shifts rather than react to them.

What More Can I Do to Predict Future Rate Changes?

From my perspective, leveraging both macroeconomic data and regional insights is crucial. I regularly monitor Federal Reserve announcements, inflation trends, and employment reports, but I also pay close attention to Tennessee-specific indicators. For instance, local housing demand and interest from investors can signal upcoming rate adjustments. Engaging with experienced lenders who understand these local dynamics, as discussed in this expert guide, has significantly improved my predictive accuracy. Sharing stories and tips in the comments also helps me—and others—stay sharp.

How Can I Use This Knowledge to Maximize Savings?

The key, I believe, is timing and active monitoring. I set up rate alerts, maintain open communication with my lender, and stay flexible on when I lock my rate. Recognizing the signs of a favorable shift—like a slowdown in inflation or a regional economic boost—can lead to substantial savings. For example, by being ready to lock in during a brief dip, I saved thousands on my recent refinance. If you’re planning to buy or refinance in 2025, I recommend reading this guide for expert strategies.

Inviting Your Experiences and Insights

Have you noticed regional variations in mortgage rates? What strategies have worked for you in navigating these fluctuations? I invite you to share your stories or ask questions below. Learning from each other’s experiences can be a powerful tool in mastering Tennessee’s dynamic mortgage market. Remember, staying informed and proactive is your best defense against unforeseen rate hikes—so keep exploring and engaging with expert resources like this comprehensive guide.

Decoding the Subtle Art of Rate Prediction in Tennessee’s Complex Market

Over the years, I’ve refined my approach to understanding how mortgage rates in Tennessee respond to multifaceted stimuli. It’s not merely a matter of watching economic indicators; it’s about integrating regional nuances, political landscapes, and global economic shifts into a cohesive predictive framework. For instance, recent developments in Tennessee’s renewable energy investments have subtly influenced local housing demand, which lenders interpret as an indicator of economic resilience, subsequently affecting mortgage rates. This layered understanding requires a proactive stance—regularly engaging with sources like this expert guide provides invaluable insights into these intricate dynamics.

How Can I Leverage Advanced Data Analytics to Stay Ahead?

My journey into predictive analytics involved harnessing machine learning models to analyze vast datasets—including employment figures, regional industry growth, and political stability indices—to forecast rate movements with higher accuracy. By integrating local economic reports with macroeconomic trends, I developed a bespoke dashboard that signals potential rate shifts days before they happen. This approach, detailed in emerging industry literature, exemplifies how modern tools can transform a reactive strategy into a proactive one. If you’re interested in adopting similar techniques, I invite you to share your experiences or questions below—collaborative learning is key to mastering this complex landscape.

The Nuances of Regional Economic Indicators and Their Impact on Mortgage Costs

In Tennessee, localized economic health often acts as a leading indicator of mortgage rate trends. For example, the tech sector’s expansion in Nashville has led to increased housing demand and a corresponding dip in mortgage rates, as lenders perceive a more robust economic outlook. Conversely, sectors facing downturns, such as manufacturing in certain areas, tend to tighten credit availability, pushing rates upward. Recognizing these subtle shifts requires diligent monitoring of regional news and industry reports, which can be seamlessly accessed through platforms like this resource. These regional signals empower me to make more informed decisions, whether locking or floating my rate during volatile periods.

Understanding the regional economic indicators that sway mortgage rates in Tennessee, such as industry growth and employment trends, is crucial for strategic decision-making.

Beyond the Surface: Recognizing the Impact of Political and Global Factors

While economic data is paramount, the influence of political stability and international market developments cannot be overstated. In 2024, global interest rate hikes and geopolitical tensions subtly increased Tennessee mortgage rates, despite stable local economic indicators. This phenomenon underscores the importance of maintaining a holistic view—monitoring international news, federal policy shifts, and regional economic health simultaneously. For a comprehensive understanding, I rely on detailed reports like this authoritative guide. By integrating these layers of information, I can better anticipate rate fluctuations and optimize my financial strategies.

What Advanced Strategies Can I Implement to Lock in Optimal Rates?

One of the most effective techniques involves dynamic rate monitoring combined with real-time decision-making tools. Setting up automatic alerts for favorable rate dips, coupled with pre-approved refinance options, allows me to act swiftly. Additionally, collaborating with lenders who utilize predictive analytics and regional economic models enhances my ability to lock in lower rates before market corrections. Sharing these experiences and strategies with fellow homebuyers can foster a community of informed decision-makers, elevating collective financial outcomes. For more detailed tactics, explore this comprehensive guide.

Things I Wish I Knew Earlier (or You Might Find Surprising)

Hidden Influences Shape Rate Changes

One thing I wish I understood sooner is how regional economic shifts, like Memphis’s tech boom, can subtly influence mortgage rates. I used to think national trends were the main drivers, but local industry growth can actually tilt the scales in your favor when timing your mortgage.

The Power of Regional News

Staying tuned into Tennessee-specific economic reports has been eye-opening. For example, noticing a surge in Nashville’s housing demand helped me anticipate a dip in mortgage rates, giving me an edge during my refinance process.

Timing Is More Than Just Luck

I’ve learned that active monitoring and quick decision-making matter more than I initially believed. Setting rate alerts and acting swiftly when conditions look promising has saved me thousands over the years.

Global Factors Are Closer Than You Think

Global geopolitical tensions and international market shifts can ripple into local Tennessee rates unexpectedly. I didn’t realize how interconnected these layers are until I started following international news alongside local economic data.

Patience Pays Off

Sometimes, waiting for the right moment to lock in a rate can make all the difference. I’ve found that patience, combined with staying informed, can substantially lower overall mortgage costs.

Resources I’ve Come to Trust Over Time

- tennesseemortgage-rates.com – This site offers up-to-date insights on Tennessee mortgage trends, which I check daily. It’s like having a personal market analyst.

- Federal Reserve’s official site – The best place to understand macroeconomic policies affecting rates. I recommend it to anyone serious about predicting rate movements.

- Local Tennessee economic reports – These reports give me the regional context I need to see beyond national headlines. Check out the state or city economic development sites for reliable info.

- Mortgage broker insights – Building relationships with local lenders has been invaluable. They often share nuanced market signals I wouldn’t find elsewhere.

Parting Thoughts from My Perspective

Looking back, I realize that understanding Tennessee mortgage rate fluctuations in 2025 is about more than just numbers—it’s about being proactive, staying curious, and paying attention to regional nuances. If you’re planning to buy or refinance, my biggest advice is to stay informed, act quickly when opportunities arise, and don’t be afraid to ask questions. Sharing your experiences can also help others navigate this complex landscape. If this resonated with you, I’d love to hear your thoughts or stories. Feel free to drop a comment below or explore more tips on this guide. Remember, in a dynamic market, your attentiveness and readiness can lead to big savings and smarter decisions.