Ready to Dive into Tennessee’s Housing Market? Let’s Talk FHA Loans!

Ah, Tennessee! Land of sweet tea, soulful music, and—more importantly—affordable homeownership opportunities. If you’re a first-time buyer feeling overwhelmed by the mortgage maze, fear not. FHA loans in Tennessee are your golden ticket to unlocking that front door without breaking the bank.

Why Are FHA Loans the Secret Sauce for Tennessee Homebuyers?

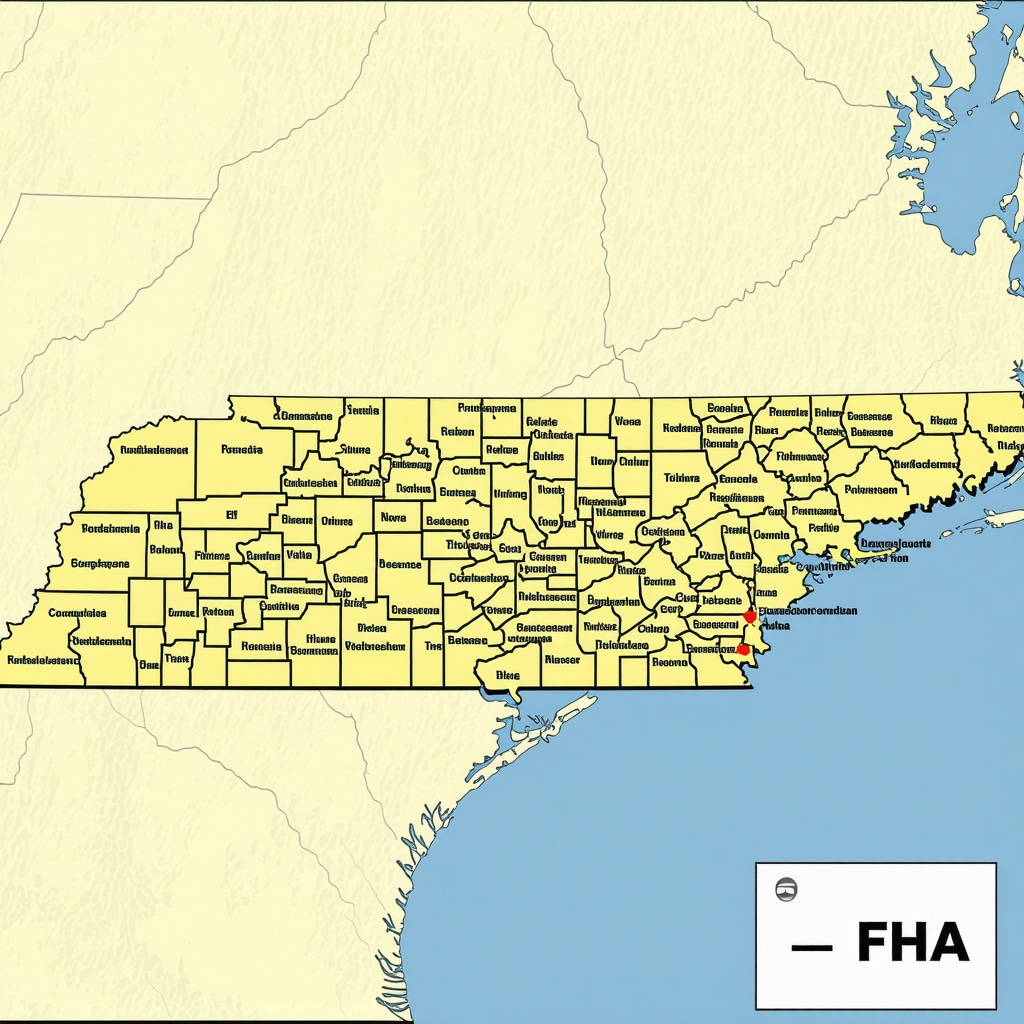

Federal Housing Administration (FHA) loans have been a game-changer for many aspiring homeowners, especially in Tennessee’s vibrant markets like Nashville, Memphis, and Knoxville. These loans offer lower down payments, more flexible credit requirements, and competitive interest rates — making homeownership more accessible than ever.

The Tennessee Twist: What Makes FHA Loans Special Here?

With Tennessee’s diverse real estate landscape, FHA loans adapt well to urban condos and sprawling rural homes alike. Plus, the state’s recent economic growth means more buyers are eyeing their first Tennessee property, and FHA loans are stepping in as the friendly guide through the mortgage jungle.

How Do You Qualify for an FHA Loan in Tennessee? The Checklist

Is Your Credit Score Ready for the Spotlight?

While conventional loans demand stellar credit, FHA loans in Tennessee are more forgiving. Typically, a credit score of 580 or higher secures you a low down payment, but don’t worry if yours is a bit lower — lenders often go the extra mile for genuine homebuyers.

For a deep dive into how credit scores shape your mortgage journey, check out this comprehensive guide.

Can You Afford the Down Payment? Spoiler: Yes!

One of the biggest perks of FHA loans? A down payment as low as 3.5%. For many Tennesseans, that’s less than the cost of a new car or a fancy vacation. Imagine putting that savings toward home improvements instead!

Wondering about other costs? Always consider property taxes, insurance, and closing fees. A trusted mortgage broker can help you navigate these waters smoothly.

What’s Next? Your Path to Savings and Success

Once you’re pre-approved, it’s time to hunt down that perfect Tennessee home. Remember, FHA loans often come with competitive interest rates, but shopping around is key. Revisit refinance options to keep your future finances in check.

If you’re eager to explore the latest FHA rate trends in Tennessee, check out this insightful report.

What About the Future? Is It a Good Time to Buy?

Absolutely! Tennessee’s housing market is dynamic, with rates fluctuating but generally trending favorably. Whether you’re eyeing a cozy bungalow in Chattanooga or a lakeside retreat in Smith County, FHA loans can make your dream more tangible.

Thinking of taking the plunge? Connect with a licensed Tennessee mortgage broker to get tailored advice and the best rates. They know the local market and can help you lock in savings.

And if you want to stay ahead of market trends, don’t forget to explore Knoxville’s mortgage landscape.

So, what are you waiting for? Your Tennessee home story begins with understanding FHA loans — and perhaps a little courage! Share your thoughts or questions below; I love hearing from future homeowners eager to make their mark in the Volunteer State.

What Hidden Opportunities Do Tennessee FHA Loans Offer That You Might Be Overlooking?

Many prospective homeowners in Tennessee are aware of the basic advantages of FHA loans, such as low down payments and flexible credit requirements. However, there are nuanced strategies and lesser-known benefits that can significantly impact your homeownership journey. For instance, some lenders in Tennessee offer special programs or incentives for FHA borrowers, including reduced mortgage insurance premiums or tailored assistance packages, especially in competitive markets like Nashville or Memphis. Exploring these options can lead to substantial savings and smoother approval processes.

How Can You Leverage Local Market Trends to Your Advantage?

Understanding Tennessee’s unique real estate landscape is crucial for FHA applicants. For example, the Memphis market is experiencing a surge in investment properties, which can influence FHA loan availability and terms. By staying informed about regional trends—such as rising property values or upcoming development projects—you can position yourself to negotiate better rates or find properties that qualify for special FHA programs. Keep an eye on local market reports and consult with experienced Tennessee mortgage brokers to stay ahead. Additionally, revisiting Knoxville’s mortgage landscape can provide insights into regional rate fluctuations.

Are You Asking the Right Questions to Your Mortgage Advisor?

One of the most overlooked aspects of securing an FHA loan in Tennessee is proactive communication. Buyers should ask their mortgage advisors about upcoming rate lock opportunities, potential discounts on mortgage insurance, or special local programs designed for first-time buyers. A well-informed buyer can time their loan application to benefit from favorable market conditions, especially considering that mortgage rates in Tennessee are influenced by national trends but also have local variations. To deepen your understanding, explore how credit scores impact your rates and strategies to enhance your credit profile.

Furthermore, don’t hesitate to seek guidance on the differences between fixed and adjustable FHA loans, as choosing the right mortgage type can save you thousands over the life of your loan. For an in-depth comparison, review this expert guide.

Thinking about the future? Now is a prime time to consider refinancing options if rates drop after your purchase. Visiting refinance strategies can help you maximize your savings over time.

If you’re eager to start your Tennessee homeownership story, connect with trusted local lenders or licensed mortgage brokers who understand the intricacies of FHA loans here. They can help tailor your mortgage plan to your unique financial situation, ensuring you get the best possible terms. Remember, the key to success lies in asking the right questions and staying informed about regional market movements. Want to share your experiences or ask a question? Drop a comment below or explore more tips on how your credit score influences your mortgage rates — knowledge is power in the Tennessee housing market.

Unlocking Hidden Benefits: Advanced Strategies for FHA Loan Success in Tennessee

While many prospective homeowners in Tennessee are familiar with the fundamentals of FHA loans, savvy buyers understand that there are nuanced strategies that can optimize their mortgage journey. For instance, negotiating with lenders for reduced mortgage insurance premiums or leveraging state-specific assistance programs can significantly lower overall costs. Tennessee’s unique economic zones and development incentives sometimes include tailored FHA loan programs designed to encourage first-time homeownership, especially in emerging markets.

How Can You Maximize FHA Loan Advantages with Innovative Approaches?

One cutting-edge tactic involves combining FHA loans with local down payment assistance programs, which can sometimes cover the entire down payment and closing costs. Tennessee offers several such programs, like the Tennessee Housing Development Agency’s (THDA) FirstHome Program, which can be layered with FHA financing to reduce upfront costs dramatically. Additionally, understanding the nuances of mortgage insurance premiums is crucial; some lenders offer options to refinance or modify MIP after certain periods, saving thousands in the long run.

Leveraging Tennessee Market Trends for Strategic Advantage

In-depth knowledge of regional real estate dynamics is vital. For example, Nashville’s booming condo market presents opportunities for FHA borrowers to secure properties in high-demand areas, but it requires careful navigation of property eligibility and appraisal standards. Conversely, rural Tennessee offers expansive land and homes that may qualify for special FHA programs aimed at rural development, such as the Section 502 Rural Housing Loan Program, which can be combined with FHA’s flexible credit requirements.

What Are the Best Practices for Timing Your FHA Loan Application in Tennessee?

Market timing can influence interest rates and approval chances. For instance, monitoring Federal Reserve rate announcements and local economic indicators can help determine optimal periods for applying or refinancing. Engaging with local mortgage brokers who are attuned to Tennessee’s economic cycles enables you to lock in favorable rates when conditions are optimal.

Furthermore, staying informed about upcoming regional developments—like new infrastructure projects or commercial hubs—can add future value to your property. Regional market reports from sources like the Tennessee Department of Economic and Community Development can serve as invaluable tools for strategic planning.

Deepening Your Understanding: The Role of Credit and Income Verification in Tennessee FHA Loans

Given Tennessee’s diverse economic landscape, lenders often employ sophisticated models to assess borrower stability. Beyond credit scores, factors such as employment history, income consistency, and local economic resilience are scrutinized. For example, in economically resilient cities like Chattanooga, lenders might be more flexible with self-employment income verification, recognizing the area’s entrepreneurial vibrancy.

To enhance your approval prospects, consider consulting with financial advisors familiar with Tennessee’s regional quirks. They can help you optimize documentation and present a compelling case to lenders, especially if your income fluctuates due to seasonal work or gig economy employment.

How Can You Prepare for Potential Challenges in the FHA Loan Process?

Anticipating hurdles such as appraisal delays or property condition issues is essential. Tennessee’s diverse housing stock means some properties may require extensive inspections or repairs. Understanding FHA’s repair escrow requirements and working with experienced local inspectors can streamline this process. Additionally, building a strong relationship with your lender and maintaining transparent communication can preempt many common pitfalls.

In conclusion, mastering Tennessee’s FHA loan landscape requires an expert-level understanding of regional market nuances, innovative financial strategies, and proactive planning. Dive deep into local resources, consult seasoned mortgage professionals, and stay adaptable to market shifts. Your journey toward homeownership in Tennessee can be both rewarding and strategically optimized — if armed with the right knowledge.

Unlocking Hidden Opportunities: Advanced Strategies for FHA Loan Success in Tennessee

While many prospective homeowners in Tennessee are familiar with the fundamentals of FHA loans, savvy buyers understand that there are nuanced strategies that can optimize their mortgage journey. For instance, negotiating with lenders for reduced mortgage insurance premiums or leveraging state-specific assistance programs can significantly lower overall costs. Tennessee’s unique economic zones and development incentives sometimes include tailored FHA loan programs designed to encourage first-time homeownership, especially in emerging markets.

How Can You Maximize FHA Loan Advantages with Innovative Approaches?

One cutting-edge tactic involves combining FHA loans with local down payment assistance programs, which can sometimes cover the entire down payment and closing costs. Tennessee offers several such programs, like the Tennessee Housing Development Agency’s (THDA) FirstHome Program, which can be layered with FHA financing to reduce upfront costs dramatically. Additionally, understanding the nuances of mortgage insurance premiums is crucial; some lenders offer options to refinance or modify MIP after certain periods, saving thousands in the long run.

Leveraging Tennessee Market Trends for Strategic Advantage

In-depth knowledge of regional real estate dynamics is vital. For example, Nashville’s booming condo market presents opportunities for FHA borrowers to secure properties in high-demand areas, but it requires careful navigation of property eligibility and appraisal standards. Conversely, rural Tennessee offers expansive land and homes that may qualify for special FHA programs aimed at rural development, such as the Section 502 Rural Housing Loan Program, which can be combined with FHA’s flexible credit requirements.

What Are the Best Practices for Timing Your FHA Loan Application in Tennessee?

Market timing can influence interest rates and approval chances. For instance, monitoring Federal Reserve rate announcements and local economic indicators can help determine optimal periods for applying or refinancing. Engaging with local mortgage brokers who are attuned to Tennessee’s economic cycles enables you to lock in favorable rates when conditions are optimal.

Furthermore, staying informed about upcoming regional developments—like new infrastructure projects or commercial hubs—can add future value to your property. Regional market reports from sources like the Tennessee Department of Economic and Community Development can serve as invaluable tools for strategic planning.

Deepening Your Understanding: The Role of Credit and Income Verification in Tennessee FHA Loans

Given Tennessee’s diverse economic landscape, lenders often employ sophisticated models to assess borrower stability. Beyond credit scores, factors such as employment history, income consistency, and local economic resilience are scrutinized. For example, in economically resilient cities like Chattanooga, lenders might be more flexible with self-employment income verification, recognizing the area’s entrepreneurial vibrancy.

To enhance your approval prospects, consider consulting with financial advisors familiar with Tennessee’s regional quirks. They can help you optimize documentation and present a compelling case to lenders, especially if your income fluctuates due to seasonal work or gig economy employment.

How Can You Prepare for Potential Challenges in the FHA Loan Process?

Anticipating hurdles such as appraisal delays or property condition issues is essential. Tennessee’s diverse housing stock means some properties may require extensive inspections or repairs. Understanding FHA’s repair escrow requirements and working with experienced local inspectors can streamline this process. Additionally, building a strong relationship with your lender and maintaining transparent communication can preempt many common pitfalls.

In conclusion, mastering Tennessee’s FHA loan landscape requires an expert-level understanding of regional market nuances, innovative financial strategies, and proactive planning. Dive deep into local resources, consult seasoned mortgage professionals, and stay adaptable to market shifts. Your journey toward homeownership in Tennessee can be both rewarding and strategically optimized — if armed with the right knowledge.

Expert Insights & Advanced Considerations

1. Tailored Local Programs Can Significantly Reduce Costs

In Tennessee, leveraging state-specific assistance programs such as the Tennessee Housing Development Agency’s FirstHome Program can be combined with FHA loans to dramatically lower upfront costs. Understanding eligibility and strategic layering of these programs ensures prospective buyers maximize their savings and streamline approval processes.

2. Regional Market Trends Offer Competitive Advantages

Monitoring development projects and regional economic indicators in areas like Nashville and Memphis enables savvy buyers to time their applications for optimal interest rates. Engaging with local mortgage brokers provides insights into when market conditions favor locking in favorable rates or refinancing.

3. Advanced Credit and Income Verification Strategies Enhance Approval Odds

In Tennessee’s diverse economy, preparing comprehensive documentation—especially for self-employed or gig economy workers—can improve approval chances. Consulting with financial advisors familiar with regional employment patterns helps optimize income verification and credit profiles.

4. Strategic Timing of Loan Application and Refinance is Crucial

Aligning your application with Federal Reserve rate announcements and regional economic cycles can lead to substantial savings. Regularly reviewing regional market reports from sources like the Tennessee Department of Economic and Community Development supports informed decision-making.

5. Proactive Communication with Lenders Mitigates Risks

Asking about upcoming rate lock opportunities, regional incentives, and mortgage insurance options can provide competitive edges. Building a transparent relationship with your lender ensures smoother processing and better terms.

Curated Expert Resources

- TN Housing Development Agency (THDA): Provides detailed information on down payment assistance programs tailored for Tennessee residents, essential for layered FHA strategies.

- National Association of Mortgage Brokers (NAMB): Offers comprehensive guides on regional market conditions and choosing qualified brokers familiar with Tennessee-specific programs.

- Federal Reserve Economic Data (FRED): Up-to-date economic indicators to assist in timing applications and refinancing opportunities based on regional and national trends.

- Regional Market Reports from Tennessee Department of Economic and Community Development: Critical for understanding local development, property value trends, and future investment potential.

- Credit Improvement Guides: Resources like https://tennesseemortgage-rates.com/how-credit-scores-shape-your-mortgage-interest-rates-today provide expert advice on boosting credit scores for better mortgage rates.

Final Expert Perspective

Mastering Tennessee’s FHA loan landscape means going beyond basic benefits. By integrating regional market insights, leveraging state-specific assistance programs, and honing your credit and income profile, you can unlock superior mortgage advantages. Think of your homeownership journey as a chess match—anticipate market shifts, strategize your moves, and consult seasoned professionals to stay ahead. Dive deep into trusted resources, stay informed about local trends, and don’t hesitate to ask your mortgage broker for personalized tips. Your expert approach today paves the way for a solid financial future in Tennessee’s vibrant housing market. Ready to elevate your mortgage strategy? Share your insights or questions below, and let’s navigate this complex terrain together.