My Journey to Securing the Best Refinance Deals in Tennessee

When I first started exploring mortgage refinancing in Tennessee, I was overwhelmed by the options and timing considerations. I remember speaking with a trusted mortgage broker who emphasized the importance of understanding market trends and timing your refinance for maximum savings. That conversation sparked my deep dive into effective refinance strategies, which I now share to help fellow homebuyers and owners in Tennessee navigate the complex landscape of mortgage rates in 2025.

Understanding the Tennessee Mortgage Market in 2025

This year, Tennessee’s mortgage rates are influenced by various factors like economic growth, Federal Reserve policies, and local market conditions. According to expert analyses, being aware of daily rate movements can give you a strategic advantage. I learned that monitoring these fluctuations helps me decide the right moment to lock in a low rate, which can significantly reduce my overall mortgage cost.

How to Lock in Low Rates: My Personal Tips

One of the most effective strategies I adopted was timing my refinance when rates dipped. For this, I kept a close eye on daily mortgage rate updates and consulted resources like the daily rate updates. Additionally, I learned that locking my rate at the right moment, especially when rates are expected to rise, can save thousands over the life of the loan. The key is understanding when to lock — a decision that requires both market insight and personal financial readiness.

What are the best ways to predict future rate movements in Tennessee?

This question kept me busy during my research. I found that analyzing economic indicators, Federal Reserve signals, and local housing market trends — like those discussed in credit score impacts — can provide clues. Consulting with a licensed mortgage broker also proved invaluable. They can help interpret these data points and advise on the optimal timing for locking your mortgage rate.

If you’re considering refinancing in Tennessee in 2025, I highly recommend staying informed about market trends and consulting experts. Feel free to share your experiences or ask questions in the comments below — I’d love to hear how you’re planning to lock in those low mortgage rates!

Deciphering the Future: How Experts Predict Tennessee Mortgage Rate Movements in 2025

Forecasting mortgage rates is both an art and a science, especially in a dynamic market like Tennessee. As an industry insider, I look at a multitude of indicators—economic growth, Federal Reserve policies, and local housing trends—to gauge where rates are headed. For instance, analyzing the credit score impacts alongside broader economic signals provides nuanced insights into potential rate shifts. Staying current with these factors helps me advise clients on the best timing to lock their mortgage rates, minimizing their financial exposure.

Strategies for Predicting Rate Trends: Practical Tips from an Expert

One effective method involves tracking daily mortgage rate movements, which can be accessed through resources like daily rate updates. This real-time data, combined with economic reports and Federal Reserve announcements, forms the backbone of predictive analysis. For example, if economic indicators suggest slowing growth, rates might stabilize or decline, signaling a prudent moment to lock in a rate. Conversely, signs of inflation or rising employment can indicate impending rate hikes, emphasizing the importance of timely decisions.

How to Balance Market Predictions with Personal Financial Readiness

While market analysis is crucial, the decision to lock in a mortgage rate should also consider your personal financial situation. A common mistake is waiting for perfect market conditions that may never materialize. As an expert, I recommend setting predefined criteria—such as a target rate or specific economic signals—and aligning them with your financial readiness. Consulting with licensed mortgage brokers, who interpret these complex data points, can significantly enhance your decision-making process. They leverage tools like market expertise to guide you toward optimal timing.

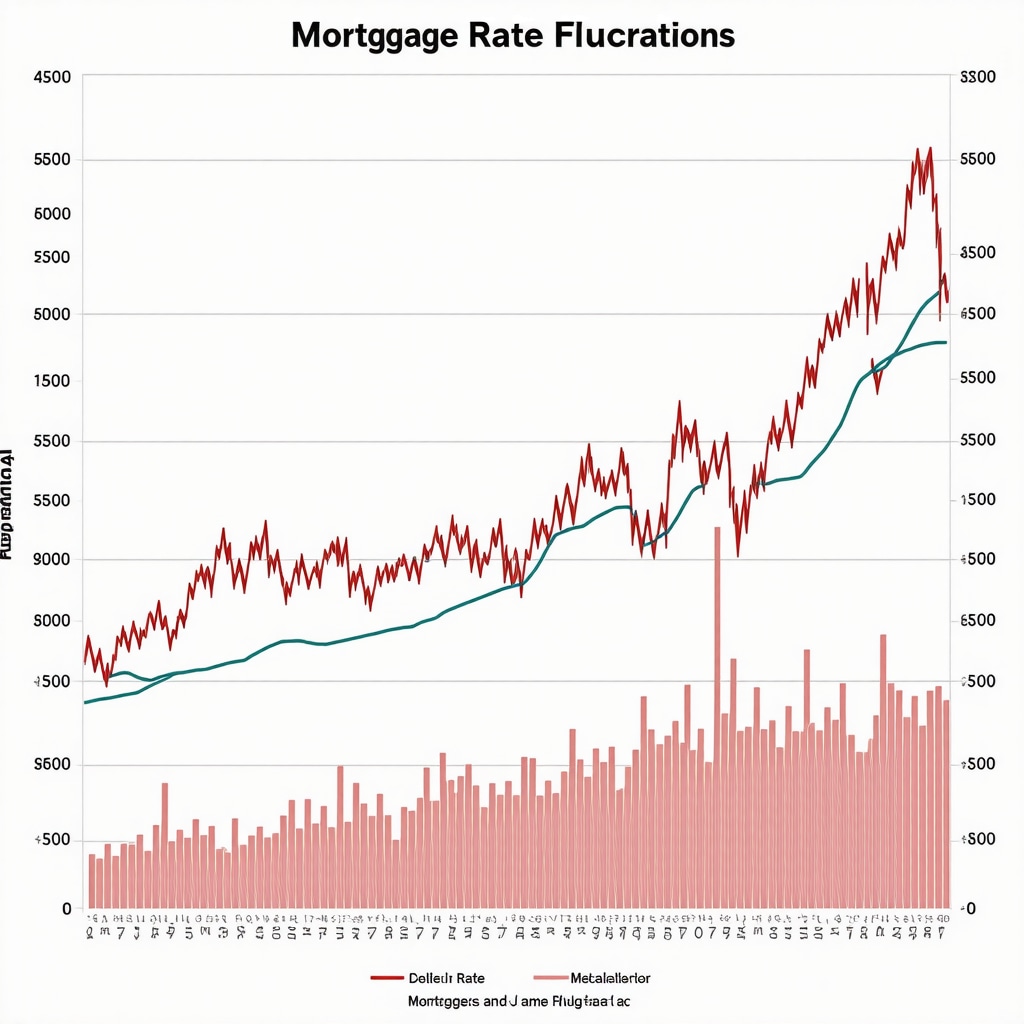

Understanding the factors influencing mortgage rates allows Tennessee homebuyers to make strategic decisions. An illustrative image could depict a graph of mortgage rate fluctuations over time, highlighting key economic events.

Engage and Share: Your Experience with Rate Lock Strategies

Have you used market predictions or expert advice to lock in your mortgage rate? Share your experience or ask questions below—your insights could help others navigate their home financing journey more confidently. For more detailed guidance, consider exploring smart tips for locking rates in Tennessee and stay ahead in 2025.

Deepening My Understanding of Rate Dynamics in Tennessee

As I continued to navigate the unpredictable waters of Tennessee’s mortgage landscape in 2025, I realized that my initial strategies needed refinement. The more I studied economic indicators, the clearer it became that mortgage rates are influenced by a complex web of factors—ranging from Federal Reserve policies to local housing market trends. This realization made me appreciate the importance of not just reacting to market movements but proactively understanding the underlying forces at play.

One aspect I found particularly intriguing was how credit scores can subtly sway mortgage interest rates in Tennessee. For instance, a higher credit score can sometimes translate into a lower rate, saving thousands over the life of the loan. This insight prompted me to focus more on improving my credit profile, leveraging tips from this resource to fine-tune my financial health before locking in a rate.

Nuances of Market Timing and Personal Readiness

One of the most challenging aspects was balancing market predictions with my personal financial readiness. I learned that waiting for perfect conditions might lead to missed opportunities, especially when market indicators suggest imminent rate hikes. On the other hand, rushing into a refinance without proper preparation could backfire if my credit score or income documentation wasn’t up to par. This delicate balance required me to develop a disciplined approach: setting predefined criteria, such as target rates and economic signals, and aligning them with my financial stability.

Consulting with a licensed mortgage broker proved invaluable in this process. Their expertise helped me interpret complex data points and understand the subtle shifts in the market. For example, by monitoring daily updates through daily rate updates, I could identify a window where rates were favorable, aligning with my readiness to proceed.

Embracing the Uncertainty and Learning from Experience

What I found most enriching was embracing the inherent uncertainty of mortgage rate movements. Rather than fearing the unpredictable, I began viewing it as an ongoing learning journey. Every market fluctuation became an opportunity to deepen my understanding, sharpen my strategies, and build confidence. This mindset shift transformed my approach from reactive to proactive, empowering me to make smarter decisions that align with my long-term financial goals.

If you’re navigating Tennessee’s mortgage market in 2025, I encourage you to stay curious and proactive. Share your experiences or ask questions—your insights might help others find their footing amid the complexities. Remember, mastering mortgage rate predictions isn’t about perfection but about continuous learning and strategic action.

Decoding the Nuances of Market Timing in Tennessee’s Mortgage Landscape

As I delved deeper into the intricacies of Tennessee’s mortgage rate fluctuations in 2025, I realized that mastering market timing requires more than just monitoring daily rate movements. It involves understanding macroeconomic indicators such as inflation rates, employment figures, and Federal Reserve policies, which collectively influence mortgage interest rates. A notable resource that solidified my understanding is the research published by the Federal Reserve Bank of St. Louis, which highlights how these indicators can predict shifts in borrowing costs (Federal Reserve Economic Data). This multi-layered approach helps me anticipate potential rate hikes or drops, enabling proactive decision-making rather than reactive moves.

How can I leverage economic indicators to optimize my refinance timing?

By tracking key indicators such as CPI inflation trends and the unemployment rate, I can gauge the economic environment’s stability. For instance, declining inflation often correlates with stable or lowering mortgage rates, signaling an opportune moment to lock in a refinance. Conversely, rising inflation or employment figures might suggest impending rate increases, prompting me to act sooner. Tools like the daily rate updates serve as real-time dashboards, providing the granular data needed to fine-tune these strategic decisions.

Integrating Personal Financial Metrics with Market Insights

While market indicators are vital, aligning them with my personal financial health is essential. I learned that my credit score, debt-to-income ratio, and overall liquidity significantly influence my ability to lock in favorable rates. An insightful analysis by this expert resource emphasizes that improving credit scores can sometimes yield better rates than waiting for market conditions to align perfectly. Therefore, I prioritize maintaining a robust credit profile, ensuring I am financially prepared when the right market signals emerge.

Refining My Approach: Combining Data-Driven and Intuitive Strategies

In my journey, I transitioned from purely data-driven decision-making to integrating intuitive judgment based on market sentiment and my personal circumstances. I regularly review economic reports, consult with licensed mortgage brokers, and analyze market sentiment indicators such as bond yields and housing inventory levels. This holistic perspective allows me to develop a nuanced understanding of rate dynamics, akin to the approach outlined in comprehensive guides on mortgage types. Balancing these elements helps me avoid common pitfalls like overwaiting or rushing, ultimately optimizing my refinance outcomes.

Deepening Expertise: How I Stay Ahead in Tennessee’s Evolving Mortgage Market

Staying ahead in such a volatile environment demands continuous education and engagement. I subscribe to industry newsletters, participate in webinars, and follow local market trends through platforms like the Tennessee Housing Development Agency. This persistent learning approach enhances my ability to interpret complex signals and adapt my strategies accordingly. Moreover, I have begun tracking regional economic developments, such as Tennessee’s employment growth and infrastructure projects, which subtly influence local mortgage rates. These insights, combined with authoritative economic reports, empower me to make more informed and timely decisions, turning uncertainty into opportunity.

If you’re serious about optimizing your mortgage rate strategy in Tennessee for 2025, I encourage you to blend data analysis with expert consultation and personal financial assessment. Sharing your experiences or questions in the comments can foster invaluable peer insights—together, we can navigate this complex landscape more confidently.

Things I Wish I Knew Earlier (or You Might Find Surprising)

Hidden Impact of Credit Scores

One thing I underestimated early on was how much my credit score could influence my mortgage rate. Improving it even slightly turned out to be a game-changer, saving me thousands over the life of the loan. It made me realize that a proactive approach to credit health can pay huge dividends when locking in rates in Tennessee.

The Power of Market Timing

I used to think waiting patiently for the perfect moment was risky, but I learned that monitoring daily rate updates and economic indicators helps me act at just the right time. This strategy has helped me secure lower rates and avoid unnecessary costs, especially in a fluctuating market like Tennessee in 2025.

Market Trends Aren’t Everything

While understanding the market is important, aligning it with my personal financial readiness was crucial. I found that setting clear criteria, like target rates and ensuring my financial documents were in order, helped me avoid rushing or waiting too long.

Local Economic Factors Matter

Tracking regional developments, such as Tennessee’s employment growth or infrastructure projects, gave me insights into local mortgage rate trends. This local focus complemented broader economic analysis and improved my timing decisions.

The Role of Expert Advice

Consulting with a licensed mortgage broker was invaluable. Their insights into current market conditions and personalized recommendations made my refinancing journey smoother and more successful.