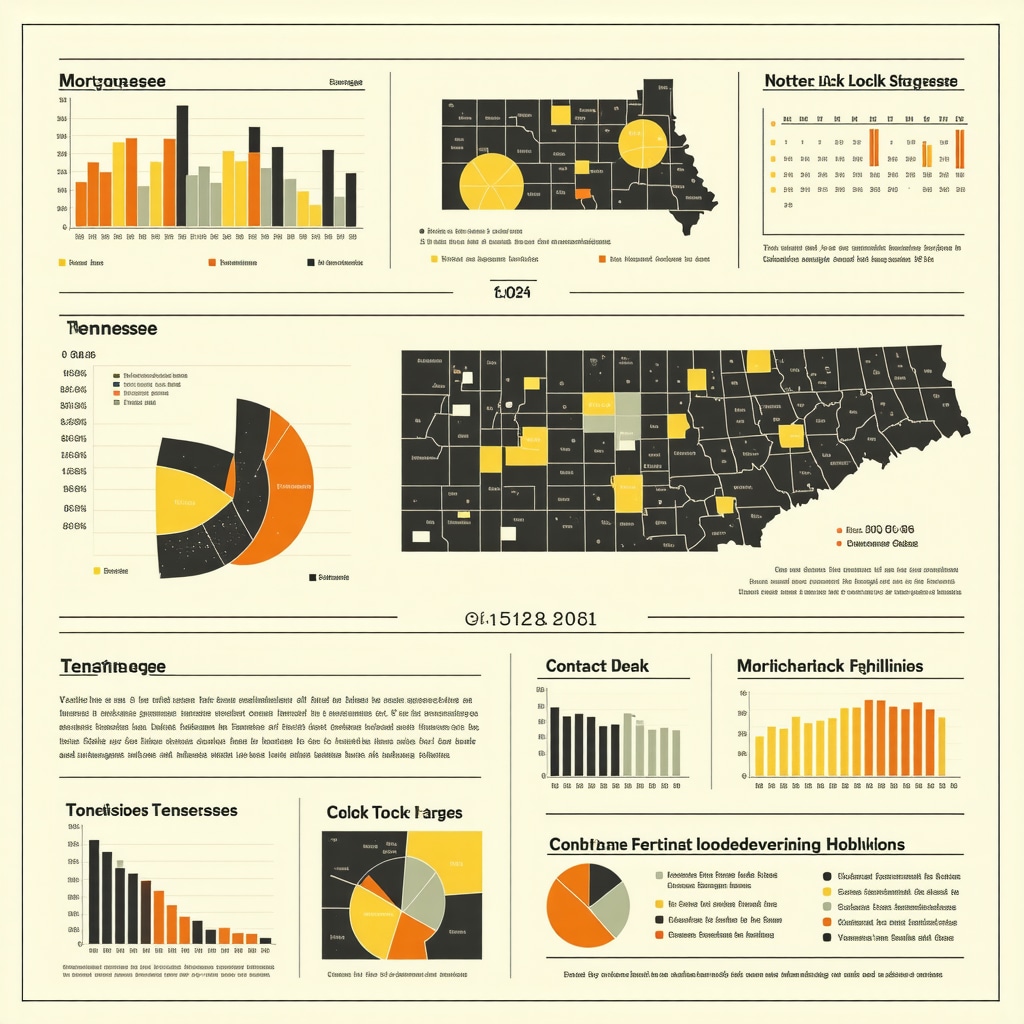

Locking In Your Mortgage Rate: Tennessee’s 2025 Dance with Destiny

Picture this: you’re standing at the crossroads of homeownership in Tennessee, 2025 edition. Mortgage rates are as unpredictable as a Tennessee thunderstorm, and you’re trying to avoid getting soaked by sudden hikes. How do you lock a mortgage rate without risking a financial drizzle—or worse, a downpour? Let’s unravel this knotty puzzle with the flair of a seasoned columnist who’s been through the mortgage maze and lived to tell the tale.

The Art and Science of Mortgage Rate Locking: More Than Just a Signature

Locking a mortgage rate might sound as simple as signing on the dotted line, but it’s a nuanced dance with the market. Tennessee’s mortgage terrain in 2025 is shaped by economic shifts, Federal Reserve signals, and local lending trends. By understanding these forces, you gain the upper hand. For example, locking early can shield you from rate hikes but might cost a premium if rates fall afterward. Conversely, waiting too long risks rates climbing beyond your dream budget.

Fun fact: a study by Investopedia highlights that most savvy borrowers lock rates for 30 to 60 days to balance risk and flexibility—a sweet spot Tennessee buyers should ponder.

Is It Ever Truly Risk-Free to Lock a Mortgage Rate?

Ah, the million-dollar question! Can you lock a mortgage rate in Tennessee in 2025 without any risk? The truth is, no financial move is completely risk-free. However, risk can be managed and minimized. Tools like floating locks or rate lock extensions provide a safety net for rate fluctuations, though sometimes at a cost. Partnering with informed Tennessee mortgage brokers who understand local market nuances can make your lock feel less like gambling and more like strategic chess.

Secrets to Locking Your Tennessee Mortgage Rate Without Losing Sleep

First, get pre-approved rather than just pre-qualified—this shows lenders you’re serious and locks in your financial profile. Next, keep an eye on market trends; websites offering daily updates on current Tennessee mortgage rates can be your best friend. Don’t forget credit scores—they wield tremendous influence on your rate options, so boost yours early (learn how here).

Lastly, consider the type of mortgage: fixed or adjustable? Our expert guide breaks down which fits your Tennessee lifestyle best.

Ready to Take the Plunge?

If you’re gearing up to lock in that mortgage rate in Tennessee, why not share your experiences or questions? Join the conversation and discover how others are navigating 2025’s mortgage rate rollercoaster. And if you want a personalized touch, don’t hesitate to reach out to Tennessee mortgage experts who can help tailor the perfect strategy for your unique situation.

When to Lock? Timing Strategies That Can Save You Thousands in Tennessee

Timing your mortgage rate lock in Tennessee’s 2025 market feels akin to predicting a lightning strike—risky, yet rewarding when done right. Economic indicators such as inflation reports, Federal Reserve announcements, and local housing demand shifts all play a starring role in this financial theater. Savvy buyers monitor these signals closely; for instance, locking just before a Fed rate hike announcement might secure a lower rate, while waiting could mean paying more.

But isn’t it daunting to interpret these signals alone? This is where partnering with seasoned mortgage brokers shines. They decode market rhythms and advise whether to lock immediately or float your rate. Such expertise can transform anxiety into opportunity.

How Do Market Volatility and Personal Financial Goals Influence Your Lock Decision?

Understanding the interplay between market volatility and your unique financial goals is essential. If your priority is stability—perhaps you’re buying your forever home—a fixed rate lock offers predictability. Conversely, if you’re an investor or planning to refinance soon, floating might be advantageous, capitalizing on potential rate drops.

Moreover, consider the lock period. While 30- to 60-day locks are common, longer durations might be necessary in a prolonged closing process but often come with added fees. Balancing these factors reflects a tailored approach rather than a one-size-fits-all solution.

Leveraging Technology: Tools That Empower Tennessee Homebuyers in 2025

Digital platforms have revolutionized how Tennessee buyers monitor and lock mortgage rates. Real-time rate trackers and alerts offer instantaneous updates, enabling proactive decisions. Some lenders even provide “float-down” options, allowing borrowers to benefit from lower rates discovered after locking.

Such technological advancements demystify the locking process and empower buyers to act with confidence rather than guesswork. For those seeking comprehensive guidance, exploring mortgage rate comparison tools tailored for Tennessee can be a game changer.

Expert Perspectives: Insights from the Mortgage Industry’s Front Lines

Industry veterans emphasize the importance of flexibility. According to a recent report by the Consumer Financial Protection Bureau, borrowers benefit from understanding their options, including lock extensions and float-down provisions, to mitigate unexpected market swings. Such knowledge, coupled with local market expertise, significantly enhances decision-making quality.

Join the Conversation and Elevate Your Mortgage Strategy

Have you recently locked a mortgage rate in Tennessee or are you considering when to do so? Share your experiences and questions in the comments below to help build a community of informed Tennessee homebuyers navigating the 2025 market. Don’t forget to explore more in-depth guides like our comprehensive fixed vs adjustable mortgage rates guide to fine-tune your financing approach.

Decoding the Fine Print: Hidden Costs and Clauses in Tennessee Mortgage Rate Locks

Locking in your mortgage rate may seem straightforward, but beneath the surface lies a labyrinth of terms and conditions that can significantly impact your final costs. In Tennessee’s 2025 housing market, understanding these hidden clauses can be the difference between a savvy financial move and an unexpected expense. For instance, some lenders incorporate lock extension fees if your closing delays beyond the lock period, which can escalate quickly. Additionally, float-down options—allowing borrowers to capitalize on rate drops after locking—often come with stipulations such as limited windows or additional upfront fees.

Another subtlety: some rate locks are non-refundable, meaning if you back out or your loan falls through, you might forfeit your lock fee. Awareness of these nuances empowers Tennessee homebuyers to negotiate more favorable terms or opt for lenders offering flexible, transparent policies.

Leveraging Economic Indicators: Predictive Analytics for Optimal Lock Timing in Tennessee

Beyond conventional wisdom, advanced homebuyers in Tennessee are turning to predictive analytics to time their rate locks with surgical precision. By integrating data from inflation trends, employment reports, and the Federal Reserve’s monetary policy signals, predictive models can forecast short-term rate movements with increasing accuracy. This approach transcends guesswork, offering actionable insights tailored to Tennessee’s unique market dynamics.

For example, an unexpected shift in Tennessee’s manufacturing sector employment or a surge in housing demand in Nashville might prelude rate adjustments. Sophisticated tools that aggregate such data enable buyers and brokers to make data-driven lock decisions, reducing exposure to market volatility.

What Are the Risks and Rewards of Using Predictive Analytics for Mortgage Rate Locks in Tennessee?

While predictive analytics offer an elevated edge, they are not infallible. Market anomalies, geopolitical events, or sudden policy changes can disrupt forecasts. The primary risk lies in over-reliance on data models without incorporating qualitative insights from local experts. Conversely, when combined with seasoned mortgage broker advice, predictive tools can optimize timing, potentially saving thousands by locking at the most opportune moments.

For Tennessee buyers willing to embrace this tech-forward approach, partnering with lenders and brokers equipped with these analytical capabilities is crucial. It’s a fusion of art and science, where data meets intuition.

Customizing Your Lock Strategy: Integrating Personal Financial Milestones with Market Conditions

Mortgage rate locking isn’t just about market timing—it’s also about aligning with your personal financial narrative. For Tennessee homebuyers, considering upcoming events like expected bonuses, tax refunds, or changes in debt load can influence the optimal lock window. For example, if a significant bonus is anticipated shortly after closing, locking early with a slightly higher rate might secure approval and peace of mind, while waiting for a better rate could risk financing delays.

Moreover, long-term plans such as anticipated refinancing or property upgrades should factor into your mortgage product choice and lock duration. A meticulous evaluation of these personal milestones against the backdrop of Tennessee’s evolving mortgage landscape ensures your strategy is not only market-savvy but personally sustainable.

Ready to Harness Expert Tools and Insights for Your Tennessee Mortgage?

Engaging with Tennessee’s mortgage market in 2025 demands more than cursory knowledge—it requires a strategic partnership with experts who meld data analytics, local market savvy, and personalized financial planning. Dive deeper into advanced mortgage strategies by consulting our tailored resources or connecting directly with seasoned Tennessee mortgage professionals ready to architect your ideal rate lock journey.

Beyond the Basics: Navigating Complex Mortgage Rate Lock Clauses in Tennessee

While locking your mortgage rate in Tennessee might seem straightforward, the devil is often in the details. In 2025’s dynamic market, understanding the minutiae of lock agreements can protect you from unexpected fees and pitfalls. For example, certain lenders implement non-refundable lock fees that vanish if you cancel the loan or your financing falls through—an expense many buyers overlook until it’s too late. Additionally, lock extension fees can escalate if your closing timeline extends beyond the agreed period, sometimes costing hundreds or even thousands of dollars. These hidden charges emphasize the importance of thoroughly reviewing your lock contract and negotiating terms that prioritize transparency and flexibility.

For Tennessee homebuyers seeking clarity, reading up on mortgage broker fees and hidden costs can illuminate what to expect and how to advocate effectively for your financial interests.

Harnessing Predictive Analytics: The Cutting-Edge Tool for Tennessee Mortgage Rate Timing

Amid fluctuating national and local economic signals, predictive analytics is emerging as a game-changer for Tennessee buyers aiming to time their mortgage locks with surgical precision. By synthesizing real-time data from inflation trends, employment shifts, and Federal Reserve policy signals, these models forecast short-term interest rate movements with increasing accuracy. For instance, an uptick in Nashville’s housing demand or unexpected changes in Tennessee’s manufacturing sector employment can signal imminent rate adjustments.

Integrating predictive analytics into your mortgage strategy allows you to move beyond guesswork and make data-driven decisions that could save thousands over the life of your loan. However, it’s crucial to pair these insights with seasoned local expertise to contextualize data within Tennessee’s unique market nuances.

According to a 2024 analysis by the National Association of Realtors, buyers who combine predictive tools with expert guidance experience more consistent success navigating volatile interest rate environments.

Can Predictive Analytics Replace the Human Touch in Tennessee Mortgage Decisions?

While predictive analytics offers unparalleled forecasting power, it cannot fully replace the experiential knowledge of Tennessee mortgage professionals who understand local market idiosyncrasies. Unexpected geopolitical events or policy shifts can disrupt even the most sophisticated models. Therefore, the optimal approach blends advanced analytics with personalized broker advice, ensuring your lock decision is both data-informed and strategically sound.

Aligning Rate Locks with Personal Financial Milestones: A Tennessee-Specific Playbook

Mortgage rate locks aren’t purely market-driven decisions—they must harmonize with your personal financial timeline. In Tennessee, where seasonal employment and tax cycles often influence cash flow, syncing your lock timing with anticipated income boosts like tax refunds or bonuses can enhance affordability and reduce stress.

Moreover, if you foresee refinancing or home improvements shortly after purchase, your lock strategy should reflect these plans. For example, opting for a shorter lock period with a flexible float-down feature might better suit buyers targeting refinancing within a few years. Our refinance timing guide offers tailored strategies to integrate these considerations effectively.

Have You Experienced a Mortgage Rate Lock Strategy That Worked Wonders in Tennessee?

Your real-world insights are invaluable. Whether you successfully timed a lock using predictive tools or navigated hidden fees with expert help, sharing your story enriches the Tennessee homebuying community. Drop your experiences or questions below to deepen the conversation, or explore our detailed guide on fixed vs adjustable mortgage rates to refine your financing approach. And when ready, don’t hesitate to connect with Tennessee mortgage experts for personalized guidance tailored to your 2025 journey.

Expert Insights & Advanced Considerations

Strategic Use of Float-Down Clauses Can Shield Against Volatility

In Tennessee’s fluctuating 2025 mortgage market, float-down options are more than just a safety net—they’re tactical instruments. Borrowers who negotiate these clauses gain the ability to capitalize on rate drops even after locking in, reducing risk without sacrificing commitment. However, understanding the fine print—such as limited windows and fees—is critical to leveraging this advantage effectively.

Integrating Predictive Analytics with Local Expertise Yields Superior Lock Timing

While predictive analytics provide a data-driven edge by forecasting short-term rate movements based on economic indicators like inflation and employment trends, pairing these insights with seasoned Tennessee mortgage brokers’ intuition creates a holistic strategy. This fusion mitigates blind spots that raw data alone might miss, such as sudden policy shifts or regional market nuances.

Personal Financial Milestones Must Guide Lock Decisions Beyond Market Signals

Locking a mortgage rate isn’t solely a market timing exercise. Tennessee buyers who align lock timing with personal financial events—like bonuses, tax refunds, or anticipated refinancing plans—position themselves for smoother approvals and optimized affordability. Customizing lock durations and mortgage products accordingly transforms the process into a personalized financial strategy.

Comprehensive Pre-Approval Accelerates Lock Eligibility and Negotiating Power

Securing a thorough pre-approval, distinct from mere pre-qualification, projects financial seriousness and readiness to lenders. This status not only streamlines lock acquisition but also enhances negotiating leverage on lock terms, potentially unlocking more flexible durations and fee waivers in Tennessee’s competitive 2025 lending environment.

Transparency in Lock Agreements Prevents Costly Surprises

Scrutinizing mortgage rate lock contracts to uncover hidden clauses—such as non-refundable fees, lock extension charges, and conditional float-down limitations—is paramount. Tennessee homebuyers who proactively negotiate clarity and flexibility safeguard themselves from unexpected expenses that could erode the financial benefits of a locked rate.

Curated Expert Resources

- Consumer Financial Protection Bureau Mortgage Rate Guidance: Offers authoritative insights on navigating rate fluctuations and understanding lock options, invaluable for Tennessee borrowers seeking federal-level clarity (CFPB Blog).

- National Association of Realtors Market Analytics: Provides up-to-date research and predictive analytics that help homebuyers anticipate market trends and make informed locking decisions tailored to Tennessee’s unique conditions (NAR Statistics).

- Tennessee Mortgage Rates Expert Guide 2025: An indispensable local resource detailing fixed versus adjustable rates, rate lock strategies, and credit score impacts, essential for nuanced understanding (Expert Guide).

- Tennessee Mortgage Broker Fee Transparency: This guide demystifies hidden costs and broker vs. lender fees, helping buyers negotiate better deals and avoid surprises (Broker Fee Guide).

- Refinance Timing Strategies in Tennessee: For those planning future refinancing, this resource outlines optimal lock timing to maximize savings and flexibility (Refinance Guide).

Final Expert Perspective

Locking a mortgage rate in Tennessee during 2025 demands an artful balance of market acuity, personal financial foresight, and contractual vigilance. By embracing advanced tools like predictive analytics alongside trusted local mortgage expertise, buyers can navigate rate volatility confidently. The nuanced integration of personal milestones ensures the lock strategy is sustainable and tailored, not just reactive. Understanding and negotiating lock agreements’ fine print prevents costly pitfalls and preserves the financial benefits of securing a favorable rate.

For Tennessee homebuyers ready to elevate their mortgage approach, exploring the comprehensive fixed vs adjustable mortgage rates guide offers deep insights. When questions or unique situations arise, connecting with seasoned Tennessee mortgage experts can transform uncertainty into opportunity. Your journey to mastering mortgage rate locks starts with informed action—take the next step today.