Strategic Refinancing in Tennessee’s Dynamic Mortgage Landscape

In the current financial climate, Tennessee homeowners face a complex challenge: securing low mortgage rates amid fluctuating market conditions. Effective refinance strategies are no longer about timing alone but involve a multidimensional approach incorporating credit optimization, loan product selection, and market trend analysis. This article explores advanced tactics that homeowners can deploy to lock in favorable refinance rates, leveraging Tennessee-specific market data and expert financial principles.

Leveraging Creditworthiness: The Keystone of Refinancing Success

Credit score remains a pivotal factor influencing mortgage refinance rates in Tennessee. Borrowers with scores above 740 typically access the most competitive rates, while those with lower scores encounter premium pricing or limited options. Proactive credit improvement strategies—including debt reduction, timely payments, and credit mix optimization—can materially reduce refinance costs. Comprehensive insights into credit score impacts on Tennessee mortgage rates are available in specialized analyses such as how credit scores shape your mortgage interest rates today.

Choosing Between Fixed and Adjustable-Rate Refinance Loans: A Sophisticated Decision Matrix

The Tennessee mortgage market offers both fixed-rate and adjustable-rate refinance products, each with nuanced risk-reward profiles. Fixed-rate loans provide long-term payment stability, ideal in environments with anticipated rate increases. Conversely, adjustable-rate mortgages (ARMs) can offer lower initial rates but require vigilant market monitoring to avoid payment shocks. Expert buyers often utilize forward-looking market trend data to decide between these options, referencing resources like the Navigating Fixed vs Adjustable Mortgage Rates Expert Guide 2025 for comprehensive market intelligence.

How Can Tennessee Homeowners Optimize Timing to Lock the Lowest Refinance Rates?

Timing refinance applications is critical due to daily market volatility influenced by macroeconomic factors such as Federal Reserve policies, inflation data, and local Tennessee housing demand. Savvy homeowners track real-time refinance rate trends, leveraging tools and forecasts like refinance rates in Tennessee: when to lock for maximum savings. Strategic locking involves balancing rate lock duration against anticipated market movements, often necessitating expert brokerage advice to tailor timing to individual financial goals.

Utilizing Local Mortgage Brokers: A Tactical Advantage in Tennessee

Local mortgage brokers bring unparalleled expertise in navigating Tennessee’s diverse lending landscape, from navigating FHA loan nuances to securing VA loan benefits. Their granular knowledge enables borrowers to identify competitive refinance offers and negotiate terms inaccessible via direct lenders. For Tennessee homeowners, partnering with brokers is an evidence-backed strategy to enhance refinancing outcomes, as detailed in how Tennessee mortgage brokers can help you lock low 30-year rates.

Incorporating Advanced Financial Instruments and Government Programs

Effective refinancing in Tennessee also involves exploring government-backed programs such as FHA streamline refinancing or VA interest rate reduction refinancing loans (IRRRLs). These programs provide pathways to reduced closing costs and expedited approvals, especially beneficial for veterans and borrowers with established FHA loans. Detailed program eligibility and benefits are elaborated in authoritative resources like the VA home loan benefits in Tennessee guide.

For homeowners and real estate professionals eager to deepen their understanding of Tennessee’s refinance strategies, exploring our comprehensive guides and contributing insights can foster a robust community of informed decision-makers.

According to the Mortgage Bankers Association’s 2024 Mortgage Market Analysis, borrowers who strategically align credit improvement with market timing achieve rate reductions averaging 0.5% to 0.75%, translating into substantial lifetime savings.

Understanding the Impact of Economic Indicators on Tennessee Mortgage Rates

Mortgage rates in Tennessee do not exist in a vacuum; they are closely tied to broader economic indicators such as inflation rates, employment data, and Federal Reserve monetary policies. Particularly, inflation trends influence the purchasing power of money, prompting lenders to adjust mortgage rates accordingly. For Tennessee homeowners, staying informed about these macroeconomic signals can provide a strategic advantage when timing refinance decisions.

Employment growth within Tennessee’s metropolitan areas, including Nashville and Memphis, also affects housing demand and consequently mortgage rates. As job markets strengthen, lenders may anticipate increased borrowing demand, potentially leading to rising rates. Conversely, economic slowdowns can create opportunities for locking in lower refinance rates. Monitoring local economic data alongside national trends is crucial for crafting a nuanced refinance approach.

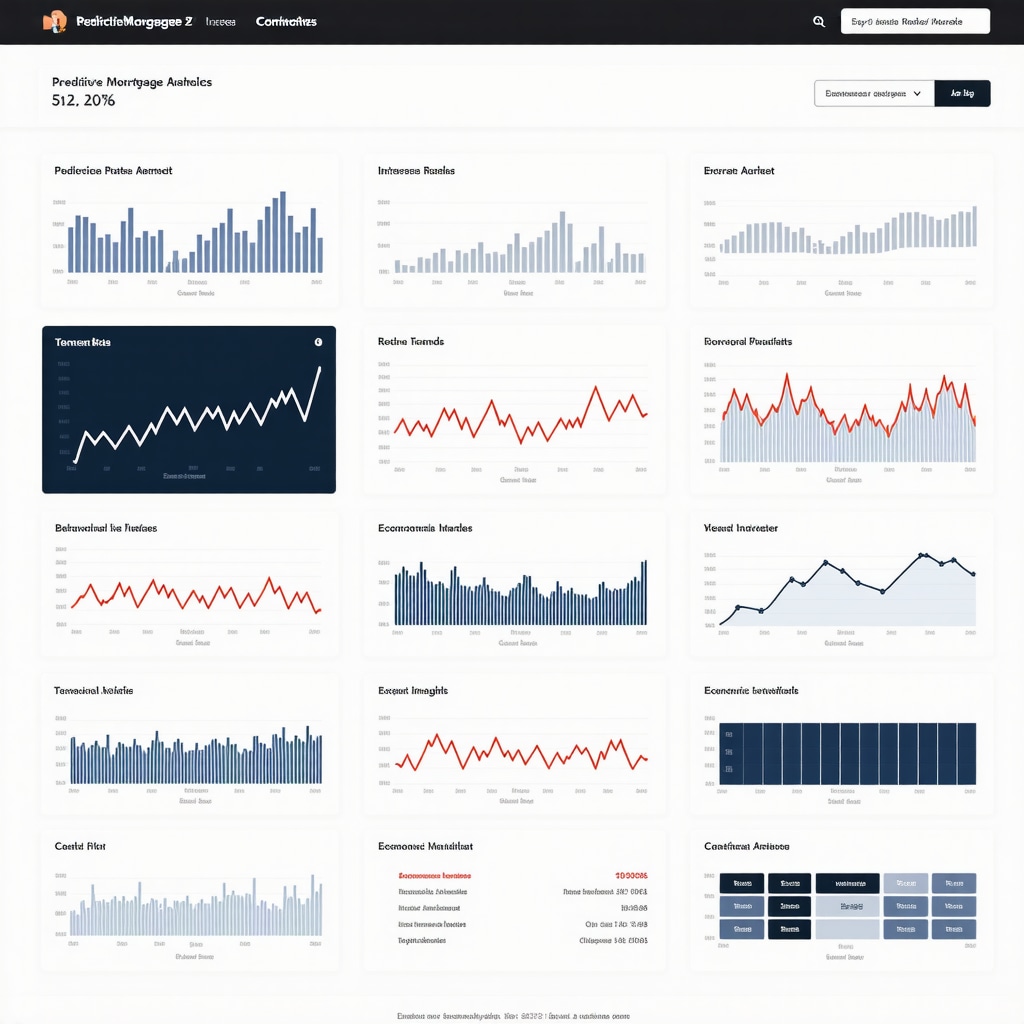

Integrating Technology and Data Analytics in Refinancing Decisions

The modern mortgage landscape in Tennessee increasingly embraces technology-driven tools that empower homeowners to make data-informed refinance choices. Online calculators, rate comparison dashboards, and predictive analytics platforms allow borrowers to simulate various scenarios, including rate fluctuations and loan term adjustments. Utilizing these resources can demystify complex financial decisions and optimize outcomes.

Furthermore, artificial intelligence-powered mortgage brokers are emerging, offering personalized loan recommendations based on expansive datasets covering credit profiles, property values, and market trends. Engaging with such advanced platforms can streamline the refinance process and uncover bespoke rate solutions otherwise overlooked.

What Are the Emerging Risks and Opportunities in Tennessee’s Refinance Market for 2025?

As the Tennessee refinance market evolves, borrowers must weigh emerging risks such as potential rate volatility against opportunities like new government incentives or innovative loan products. For instance, while adjustable-rate refinancing can present short-term savings, unexpected economic shifts might trigger rate hikes that strain budgets. Conversely, programs tailored for veterans or first-time buyers may provide cost-effective refinancing avenues.

Staying apprised of policy changes and leveraging expert insights, such as those detailed in refinance rates in Tennessee: when to lock for maximum savings, ensures borrowers can navigate these dynamics adeptly.

Advanced Tax Implications: Refinancing Effects on Tennessee Homeowners

Refinancing can have intricate tax consequences that savvy Tennessee homeowners should consider. Interest paid on qualified mortgage refinance loans remains deductible under certain IRS regulations, but changes in loan terms or cash-out refinances might alter eligibility. Consulting with tax professionals familiar with Tennessee’s local tax codes can prevent unexpected liabilities.

Additionally, refinancing-related expenses may qualify for deductions or credits, depending on the borrower’s circumstances and loan structure. Awareness of these fiscal nuances adds a valuable layer of financial planning to the refinancing process.

We invite Tennessee homeowners and financial professionals to share their experiences and strategies in the comments below to foster a knowledgeable community navigating the 2025 mortgage landscape. For more detailed analyses on credit impact and mortgage options, consider exploring resources like how credit scores shape your mortgage interest rates today and Navigating Fixed vs Adjustable Mortgage Rates Expert Guide 2025.

According to the Federal Reserve Bank of St. Louis’ Mortgage Interest Rate Data, variable market conditions require adaptive refinancing strategies that prioritize both risk management and cost savings.

Predictive Analytics: The Future Lens for Tennessee Mortgage Refinancing Decisions

In Tennessee’s competitive mortgage refinancing environment, predictive analytics stands as a transformative tool that enables homeowners to anticipate market shifts and make preemptive, data-driven decisions. By harnessing machine learning algorithms and vast datasets encompassing historical mortgage rates, regional economic indicators, and borrower credit profiles, predictive models can forecast interest rate trajectories with increasing accuracy.

These advanced tools analyze patterns such as Federal Reserve announcements, inflation trends, and local real estate market dynamics, providing homeowners with probabilistic scenarios that guide refinance timing and loan product selection. For example, homeowners in Nashville might leverage predictive analytics platforms to evaluate whether locking a 30-year fixed refinance rate now versus waiting a quarter could yield significant savings or risk exposure.

Emerging fintech solutions integrate these predictive insights into user-friendly dashboards, empowering borrowers to simulate the long-term financial impact of refinancing under various economic conditions. This capability transcends traditional static rate comparisons, enhancing strategic planning, and risk mitigation.

Behavioral Economics: Decoding Borrower Biases to Optimize Tennessee Refinance Outcomes

While data and analytics provide the backbone of refinancing strategy, understanding borrower psychology through behavioral economics can unlock hidden optimization opportunities. Research reveals that cognitive biases—such as loss aversion, anchoring, and overconfidence—often skew refinancing decisions, leading to suboptimal outcomes.

For instance, some Tennessee homeowners may delay refinancing due to an anchoring bias tied to historically low rates seen in previous years, missing current favorable windows. Others might overestimate the benefits of adjustable-rate mortgages without fully accounting for potential future rate hikes, influenced by optimism bias.

Mortgage professionals adept in behavioral economics can design interventions and communication strategies that counteract these biases. Techniques such as framing refinancing benefits in terms of potential monthly savings rather than abstract interest rates or employing decision aids that highlight long-term costs help borrowers make more rational, financially sound choices.

How Can Tennessee Lenders and Brokers Leverage Behavioral Insights to Enhance Refinance Engagement and Conversion?

Integrating behavioral insights into lender and broker interactions enhances customer experience and decision quality. For example, personalized messaging that anticipates borrower concerns and presents refinancing as a risk-managed opportunity increases engagement rates. Training mortgage advisors to recognize and address common biases during consultations can improve loan product alignment with borrower goals, reducing churn and increasing satisfaction.

Moreover, digital platforms offering interactive refinancing simulations calibrated to behavioral tendencies encourage proactive borrower participation. These approaches, combining psychology and financial expertise, represent the cutting edge in Tennessee’s mortgage industry evolution.

Advanced Risk Management Frameworks: Navigating Volatility in Tennessee’s Refinance Market

Volatility in interest rates and economic indicators necessitates sophisticated risk management frameworks for Tennessee homeowners contemplating refinancing. Modern frameworks integrate scenario analysis, stress testing, and portfolio optimization techniques traditionally reserved for institutional finance.

Homeowners with multiple properties or investment portfolios can apply these frameworks to balance refinancing decisions with broader financial objectives. For example, deploying Monte Carlo simulations helps quantify the probability of adverse rate movements impacting refinancing benefits, guiding more resilient decision-making.

Additionally, lenders offering rate lock extensions and float-down options provide flexible risk mitigation tools that align with these advanced frameworks, allowing borrowers to hedge against unfavorable market shifts without immediate commitment.

Engage with our expert community to explore how these advanced methodologies can be tailored to your unique financial landscape in Tennessee’s 2025 mortgage refinance market.

According to a recent J.P. Morgan Chase report on predictive analytics in mortgage lending, lenders employing sophisticated data models have improved refinance offer precision by over 20%, translating into substantial borrower savings and reduced default rates.

Synergizing Predictive Analytics with Market Dynamics for Tennessee Refinancing

In 2025, Tennessee homeowners stand at the nexus of advanced data science and financial strategy, where predictive analytics catalyze superior refinancing decisions. By integrating machine learning models that account for Federal Reserve policy shifts, regional employment trends, and inflation forecasts, borrowers can anticipate mortgage rate trajectories with unprecedented precision. Such foresight enables strategic rate lock timing, minimizing costs over loan lifespans and optimizing amortization schedules tailored to individual financial profiles.

What Are the Latest Predictive Modeling Techniques Revolutionizing Mortgage Rate Forecasting in Tennessee?

Recent advancements deploy ensemble learning methods and neural networks to analyze multifactorial economic signals influencing refinancing rates. These models assimilate granular Tennessee-specific data—ranging from metropolitan housing inventory fluctuations to local consumer sentiment indices—yielding probabilistic forecasts that surpass traditional econometric approaches. Platforms incorporating these innovations empower lenders and borrowers alike to navigate refinancing windows with calibrated confidence, balancing risk exposure against potential savings.

Behavioral Economics: The Hidden Lever in Refinancing Strategy Optimization

While quantitative tools provide critical insights, the qualitative dimension rooted in behavioral economics remains pivotal. Tennessee homeowners often unconsciously fall prey to cognitive biases such as status quo bias or hyperbolic discounting, which can delay refinancing or skew product selection toward suboptimal adjustable-rate options. Mortgage professionals equipped with behavioral analytics can craft bespoke communication strategies that reframe refinancing benefits, emphasize tangible monthly savings, and mitigate emotional decision barriers.

Leveraging Advanced Risk Management Frameworks Amid Interest Rate Volatility

Volatility in mortgage markets necessitates a layered risk management approach. Tennessee borrowers benefit from scenario-based stress testing using Monte Carlo simulations, which quantify the impact of fluctuating interest rates and local economic shocks on refinancing outcomes. Additionally, innovative lender offerings such as extended rate lock periods combined with float-down provisions provide a tactical hedge, affording homeowners flexibility to capitalize on favorable rate dips without forfeiting lock-in security.

Collaborative Ecosystems: Integrating Fintech Innovations and Expert Advisory

The convergence of fintech innovation and expert advisory services crafts a holistic refinancing ecosystem. Tennessee borrowers now access AI-driven mortgage platforms that personalize loan product recommendations, dynamically adjust to evolving credit profiles, and integrate behavioral nudges to enhance decision quality. Collaborations between local mortgage brokers and fintech providers amplify borrower empowerment, ensuring access to competitive rates and tailored refinancing solutions that reflect nuanced financial aspirations.

Tap into these sophisticated methodologies and elevate your Tennessee mortgage refinancing strategy by engaging with our expert network today.

For an in-depth exploration of predictive analytics applications in mortgage lending, consult the J.P. Morgan Chase report on predictive analytics in mortgage lending, which demonstrates over 20% improvement in refinance offer precision through advanced data modeling.

Expert Insights & Advanced Considerations

Predictive Analytics as a Game-Changer in Refinance Timing

Leveraging predictive analytics enables Tennessee homeowners to anticipate mortgage rate fluctuations with greater precision, facilitating timely refinance decisions that optimize cost savings and risk management. This data-driven approach integrates macroeconomic indicators and local market trends, transcending traditional reactive strategies.

Behavioral Economics: Unseen Influences on Borrower Decisions

Understanding cognitive biases such as anchoring, loss aversion, and optimism bias is critical for mortgage professionals and borrowers alike. These psychological factors often delay refinancing or skew loan product selection, underscoring the importance of tailored communication strategies and decision support tools to promote financially sound outcomes.

Advanced Risk Management Frameworks for Volatile Markets

Incorporating scenario analysis, Monte Carlo simulations, and flexible rate lock options equips Tennessee borrowers to navigate interest rate volatility with confidence. These sophisticated frameworks allow for resilient refinance strategies that align with individual financial goals amidst uncertain economic conditions.

Synergistic Collaboration Between Fintech and Local Expertise

The integration of AI-driven mortgage platforms with seasoned Tennessee mortgage brokers creates a powerful ecosystem that personalizes loan recommendations and enhances borrower empowerment. This collaboration ensures access to competitive rates and bespoke refinancing solutions that reflect nuanced borrower profiles.

Nuanced Tax Implications Require Professional Guidance

Given the complex tax consequences associated with refinancing, especially concerning interest deductibility and cash-out options, consulting tax professionals familiar with Tennessee’s regulations is essential. This ensures strategic planning that mitigates unexpected liabilities and maximizes fiscal benefits.

Curated Expert Resources

- J.P. Morgan Chase Report on Predictive Analytics in Mortgage Lending: Offers cutting-edge insights into how advanced data models enhance refinance offer precision and reduce default risk, valuable for both lenders and borrowers seeking data-backed strategies.

- Mortgage Bankers Association 2024 Mortgage Market Analysis: Provides comprehensive statistical analyses linking credit improvement and market timing to tangible mortgage rate reductions, essential for strategic refinance planning.

- Navigating Fixed vs Adjustable Mortgage Rates Expert Guide 2025: Offers detailed comparative insights tailored to Tennessee’s market, aiding borrowers in selecting optimal loan products based on risk tolerance and market forecasts.

- How Credit Scores Shape Your Mortgage Interest Rates Today: An authoritative resource elucidating the critical role of credit scores in accessing competitive refinance rates within Tennessee.

- Refinance Rates in Tennessee: When to Lock for Maximum Savings: A pragmatic guide focused on timing strategies in the Tennessee market, essential for navigating daily rate volatility effectively.

Final Expert Perspective

In the evolving landscape of Tennessee mortgage refinancing, the convergence of predictive analytics, behavioral economics, and advanced risk management forms the cornerstone of sophisticated refinance strategies. Homeowners equipped with these insights can not only secure advantageous mortgage rates but also navigate the nuanced financial and psychological dimensions inherent in refinancing decisions. Integrating fintech innovations alongside local expert advisory further amplifies these benefits, ensuring solutions are both data-driven and personalized. For those committed to mastering Tennessee refinance strategies, engaging with the rich resources and expert networks available—including detailed guides on credit score impacts and loan product selection—is indispensable. We encourage readers to deepen their expertise and join professional dialogues via our contact platform, fostering a community adept at navigating Tennessee’s 2025 mortgage refinance market.