Understanding the Dynamics Behind Daily Mortgage Rates in Tennessee for 2025

In the complex landscape of 2025, Tennessee’s mortgage rates fluctuate daily, influenced by multifaceted economic indicators and regional housing market conditions. For prospective buyers and refinancers, staying updated with these daily mortgage rate shifts is critical to securing optimal financing terms. This nuanced volatility is shaped not only by national monetary policies but also by local credit trends and property market dynamics specific to Tennessee.

Key Economic Drivers Affecting Tennessee Mortgage Rate Variability

Mortgage rates are inherently tethered to broader economic signals such as inflation expectations, Federal Reserve interest rate adjustments, and bond market yields. Tennessee’s unique economic environment—characterized by its growing yet regionally diverse housing markets—introduces additional layers of complexity. Localized employment rates, credit score distributions, and housing supply-demand balances significantly modulate how these macroeconomic factors translate into daily mortgage rate variations in the state.

How Do Credit Scores and Regional Market Conditions Interact to Influence Daily Mortgage Rates in Tennessee?

The interplay between individual credit profiles and Tennessee’s regional market conditions is a pivotal factor in daily mortgage rate determination. Borrowers with higher credit scores typically access more favorable rates; however, regional market dynamics such as buyer demand in metropolitan hubs like Memphis or Knoxville can cause fluctuations in available rates. Understanding this interaction can empower borrowers to time their mortgage applications strategically, leveraging insights from how credit scores shape mortgage interest rates and local market trends.

Advanced Strategies for Navigating Daily Mortgage Rate Changes in Tennessee

Seasoned homebuyers and investors often employ sophisticated approaches such as daily rate monitoring combined with predictive analytics to anticipate optimal lock-in moments. Utilizing mortgage rate comparison tools tailored for Tennessee can reveal subtle market shifts, enabling strategic decisions whether to pursue fixed or adjustable mortgage options. Resources like expert guides on fixed versus adjustable rates offer critical insights into selecting loan products aligned with market forecasts and individual financial goals.

Implications of Daily Rate Updates for Refinancing and Investment Property Loans

For homeowners considering refinancing or investors acquiring property in Tennessee, daily mortgage rate fluctuations necessitate an agile approach. Refinancing strategies must account for timing to maximize savings, as rates can shift materially within short windows. Similarly, investment property mortgage rates often exhibit distinct trends influenced by risk premiums and loan types. Exploring refinancing strategies and investment property mortgage insights is crucial for those aiming to capitalize on daily rate movements.

How Often Do Mortgage Rates Change in Tennessee and What Should Buyers Anticipate in 2025?

Mortgage rates in Tennessee can change multiple times daily due to bond market fluctuations, lender risk assessments, and competitive market forces. Buyers must anticipate this dynamic environment by staying informed through reliable daily rate updates and expert commentary. Understanding these patterns aligns with the guidance found in specialized analyses such as the comprehensive explanation of mortgage rate change frequency.

For a deeper dive into optimizing your mortgage strategy in Tennessee amidst fluctuating rates, explore our expert resources or connect with seasoned mortgage professionals who can tailor advice to your unique financial profile.

According to a 2024 report by the Mortgage Bankers Association, daily mortgage rate monitoring combined with credit score optimization significantly improves borrower outcomes, reinforcing the criticality of informed decision-making in today’s market (MBA Official Site).

Leveraging Technology to Forecast Daily Mortgage Rate Movements in Tennessee

In 2025’s fast-evolving mortgage landscape, harnessing technology is indispensable for buyers and investors aiming to capitalize on daily rate fluctuations. Advanced predictive analytics platforms aggregate macroeconomic data, local market trends, and lender pricing models to deliver near real-time forecasts of mortgage rate trajectories. These tools empower Tennessee homebuyers to anticipate rate shifts, making informed decisions about when to lock in a rate or wait for potential declines. Integrating such technology with personalized financial profiling can significantly enhance borrowing outcomes.

Moreover, these platforms often incorporate machine learning techniques to analyze past rate patterns and economic indicators, providing a nuanced understanding of how factors like Federal Reserve announcements or regional housing inventory influence daily rate volatility. For those interested, exploring mortgage rate comparison tools tailored for Tennessee can offer actionable insights and competitive edge.

How Can Borrowers Strategically Time Locking Their Mortgage Rates Amid Daily Fluctuations in Tennessee?

Timing the rate lock is arguably the most critical decision for Tennessee borrowers navigating daily mortgage rate changes. Locking too early might mean missing out on potential rate drops, while waiting too long risks exposure to rising costs. Expert strategies recommend monitoring key economic indicators such as Treasury yields, inflation data, and employment reports that historically influence mortgage rates. Additionally, regional housing market conditions—like inventory shortages or buyer demand spikes—can accelerate rate fluctuations locally.

Engaging with experienced mortgage brokers who provide daily updates and market insights can further refine timing decisions. Detailed guidance on this strategic approach is available in the comprehensive refinance and lock timing guide. Ultimately, borrowers who couple vigilant market tracking with expert advice position themselves to secure the most favorable mortgage terms.

Understanding the Impact of Regulatory Changes on Tennessee Mortgage Rate Volatility

Regulatory shifts at both federal and state levels play a subtle yet impactful role in daily mortgage rate changes. In 2025, modifications to lending standards, disclosure requirements, or state-specific housing policies can alter lender risk assessments, influencing rate quotes. For example, tighter underwriting rules may increase lender caution, leading to slightly higher rates or reduced loan product variety.

Conversely, regulatory incentives aimed at promoting affordable housing can expand access to lower-rate loan options, affecting the competitive landscape. Staying abreast of such developments through trusted sources like the Consumer Financial Protection Bureau ensures borrowers and investors understand the regulatory context behind daily rate fluctuations.

Furthermore, monitoring Tennessee-specific legislative updates helps anticipate localized impacts on mortgage pricing and availability. This awareness is crucial for those planning long-term investments or refinancing decisions.

For personalized assistance navigating these complexities, consider reaching out via our contact page to connect with mortgage professionals experienced in Tennessee’s evolving market.

According to a 2024 analysis by the Urban Institute, regulatory changes and macroeconomic factors combined contribute to subtle daily mortgage rate shifts, underscoring the importance of continuous market education for borrowers (Urban Institute Research).

We invite readers to share their experiences or questions about managing daily mortgage rate variability in Tennessee. Engaging with community insights enriches understanding and helps others navigate this dynamic market effectively.

Harnessing Machine Learning to Decode Tennessee’s Mortgage Rate Volatility Patterns

As mortgage markets grow increasingly complex, machine learning (ML) offers transformative insights into Tennessee’s daily mortgage rate fluctuations. By processing vast datasets—ranging from macroeconomic indicators, local housing inventory metrics, to borrower credit profiles—ML models uncover subtle nonlinear relationships that traditional analysis might miss. This enables lenders and borrowers alike to forecast short-term rate movements with enhanced precision.

For instance, recurrent neural networks (RNNs) can analyze sequential data such as daily Treasury yields and Federal Reserve announcements, capturing temporal dependencies that influence mortgage pricing. When integrated with regional real estate activity data, these models dynamically adjust predictions, reflecting Tennessee’s heterogeneous market conditions across cities like Nashville, Chattanooga, and Knoxville.

Adopting such advanced analytics not only empowers mortgage brokers to tailor competitive rate offers but also equips borrowers to optimize lock-in timing. Emerging platforms leveraging ML-driven rate forecasts offer Tennessee homebuyers a strategic vantage point, enabling proactive financial planning amidst daily market volatility.

What Are the Limitations and Ethical Considerations of Using AI in Mortgage Rate Prediction?

While AI and ML methodologies significantly enhance forecasting accuracy, they are not without limitations. Data quality and representativeness remain paramount; biased or incomplete datasets can lead to skewed predictions, potentially disadvantaging certain borrower demographics. Additionally, overreliance on algorithmic outputs may overlook nuanced human judgment factors intrinsic to mortgage underwriting.

Ethically, transparency in AI-driven decision-making processes is crucial, especially in regulated sectors like mortgage lending. Tennessee lenders must ensure compliance with fair lending laws and mitigate risks of algorithmic discrimination. Borrowers should seek clarity on how AI influences offered rates and maintain engagement with human advisors to contextualize predictions within their personal financial scenarios.

Integrating Behavioral Economics to Navigate Borrower Responses Amid Rate Fluctuations

Understanding borrower psychology is instrumental in devising strategies to manage the stress and decision paralysis that daily mortgage rate variability can induce. Behavioral economics sheds light on cognitive biases such as loss aversion and present bias, which may cause borrowers to lock rates prematurely or delay decisions excessively.

Mortgage professionals in Tennessee can incorporate nudging techniques—like personalized alerts highlighting favorable rate windows or scenario-based simulations demonstrating long-term savings—to guide borrowers toward optimal timing. Such interventions harness behavioral insights to enhance decision quality, reducing the emotional toll of rate uncertainty.

This nuanced approach fosters a more informed borrower experience, blending empirical rate analytics with psychological empowerment. It also aligns with emerging best practices in financial counseling tailored to fluctuating mortgage environments.

Exploring the Role of Secondary Mortgage Markets and Their Influence on Tennessee’s Daily Rates

The secondary mortgage market plays a pivotal role in shaping daily mortgage rate dynamics in Tennessee. Institutions such as Fannie Mae and Freddie Mac purchase mortgages from lenders, securitizing them into mortgage-backed securities (MBS) that trade on financial markets. The demand and pricing of these securities directly impact the rates lenders offer to Tennessee borrowers.

For example, heightened investor appetite for MBS can lower lender funding costs, translating into reduced mortgage rates. Conversely, market turbulence or changes in credit risk premiums can cause rate spikes. Monitoring MBS yields and investor sentiment provides advanced insight into imminent rate movements.

Moreover, regulatory changes affecting the conforming loan limits or credit risk retention requirements alter the secondary market’s risk profile, indirectly influencing Tennessee’s daily mortgage pricing. Mortgage professionals and investors who grasp these mechanisms can anticipate rate trends beyond surface-level economic indicators.

How Does the Secondary Mortgage Market Interact with Local Tennessee Lending Practices to Affect Daily Rate Offerings?

Local lenders in Tennessee calibrate their daily mortgage rate quotes by balancing secondary market conditions with competitive pressures and borrower risk profiles. When secondary market liquidity tightens, lenders might increase spreads to offset funding risks, especially for non-conforming or jumbo loans prevalent in certain Tennessee counties.

Conversely, robust secondary market demand can enable lenders to offer aggressive pricing to attract high-quality borrowers. This dynamic interaction underscores the importance of understanding both macro-financial flows and Tennessee’s localized lending ecosystem to navigate daily rate variability effectively.

For mortgage professionals seeking detailed secondary market analytics and their implications for Tennessee, resources such as the Freddie Mac 2025 Mortgage Market Outlook provide authoritative, data-driven perspectives.

We encourage Tennessee borrowers and investors to integrate these advanced insights into their mortgage planning toolkit and engage with expert advisors to refine strategies tailored to evolving market conditions.

Decoding the Intricacies of Mortgage Rate Risk Premiums in Tennessee’s Dynamic Market

In 2025, the composition of mortgage rate risk premiums in Tennessee is a critical factor that sophisticated borrowers and lenders must scrutinize. These premiums reflect perceived risks including borrower creditworthiness, loan-to-value ratios, and prevailing economic uncertainties at both macro and micro scales. Particularly, regional disparities in property appreciation rates and foreclosure statistics influence how lenders price these risk components daily.

Borrowers with nuanced knowledge of risk premium drivers can negotiate more effectively or adjust their loan structures to mitigate exposure. Leveraging granular data on Tennessee’s diverse housing submarkets, such as the rapid growth in Nashville compared to more static rural areas, informs these strategic adjustments.

How Do Mortgage Risk Premium Fluctuations Interact with Macroprudential Policies to Affect Tennessee Rates Daily?

Macroprudential policies—such as stress testing requirements and capital buffer mandates—imposed by federal regulators can indirectly impact Tennessee’s daily mortgage rates by altering lender capital costs and risk appetite. When regulators tighten these policies, lenders may increase risk premiums to safeguard financial health, which translates into higher offered rates.

Conversely, easing of such policies often results in more competitive rate offerings. Monitoring updates from the Federal Reserve’s monetary policy releases provides essential context for interpreting these dynamics and their localized effects in Tennessee.

Innovative Financing Structures: Navigating Hybrid Mortgage Products Amid Daily Rate Volatility

Recent years have seen an emergence of hybrid mortgage products in Tennessee that blend fixed and adjustable rate features to balance borrower flexibility with risk management. These products can dynamically adjust based on daily mortgage rate movements, offering tailored solutions for borrowers with variable income streams or investment portfolios.

Understanding the pricing models behind these hybrid loans requires advanced financial literacy and access to real-time market data. With daily rate volatility, borrowers can optimize cost savings by strategically timing conversion points or rate resets embedded in these products.

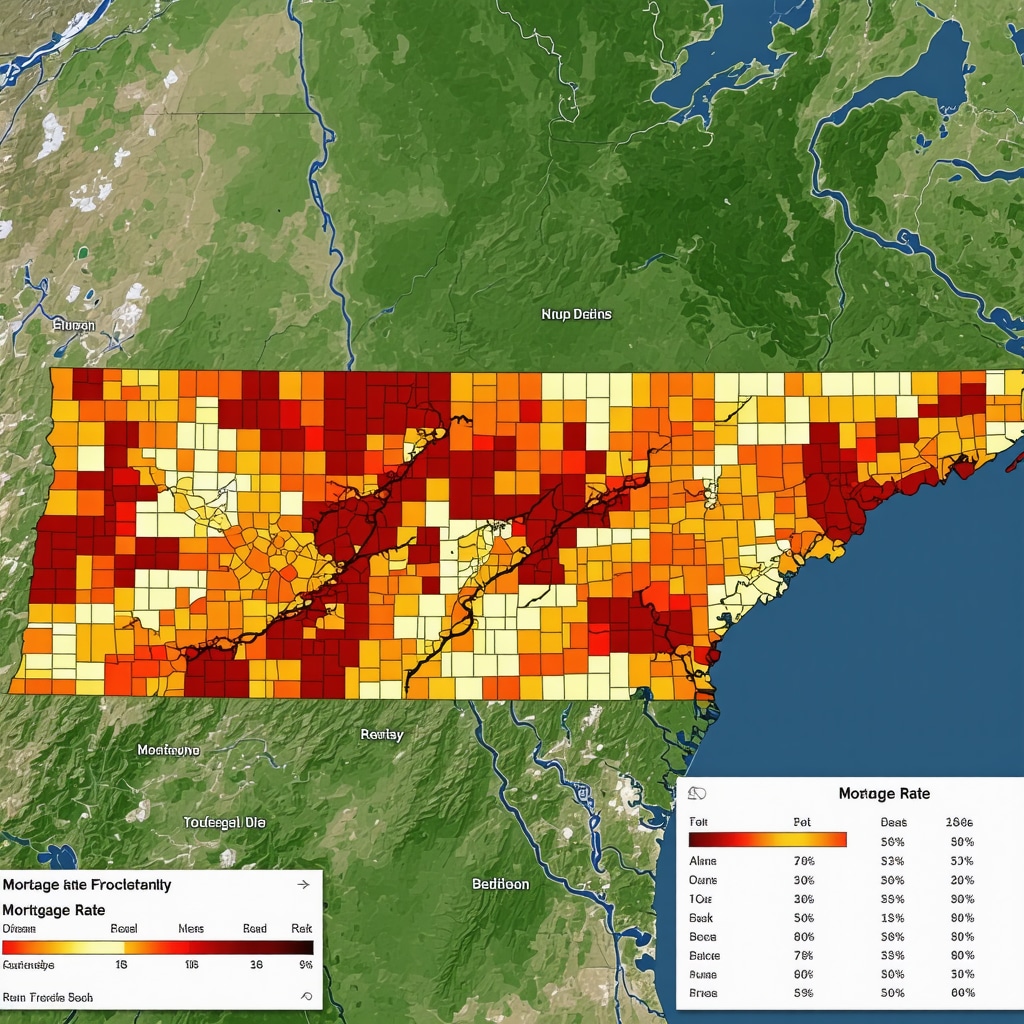

Integrating Geospatial Analytics to Anticipate Localized Rate Shifts Within Tennessee

The deployment of geospatial analytics models allows lenders and investors to predict mortgage rate movements at hyper-local levels within Tennessee. These models incorporate factors such as neighborhood-level economic trends, infrastructure developments, and demographic shifts that influence localized credit risk and housing demand.

Such granular forecasting facilitates precision pricing and underwriting, enabling competitive edge in rapidly evolving submarkets. For example, emerging tech corridors or revitalized urban districts may experience differential rate adjustments compared to traditional residential zones.

What Role Do Geospatial and Socioeconomic Data Play in Refining Mortgage Rate Forecast Models for Tennessee?

Incorporating geospatial and socioeconomic datasets enhances the robustness of mortgage rate forecasting by capturing non-linear interactions between borrower profiles and neighborhood characteristics. Factors such as income distribution, school quality, and crime rates contribute to risk assessments that influence daily pricing.

Advanced machine learning algorithms can fuse these diverse data layers, improving predictive accuracy particularly in heterogeneous markets like Tennessee. This multidimensional approach empowers lenders to tailor products and rates precisely, while borrowers benefit from more equitable and transparent pricing.

Call to Action: Harness These Cutting-Edge Insights to Master Tennessee’s 2025 Mortgage Landscape

As Tennessee’s mortgage market grows increasingly sophisticated and interconnected with technological and regulatory evolutions, proactive engagement with these advanced insights is imperative. Whether you are a seasoned investor, a first-time buyer, or refinancing homeowner, leveraging real-time data analytics, understanding macroprudential impacts, and applying geospatial intelligence can substantially enhance your mortgage strategy.

We invite you to connect with our network of expert mortgage advisors who specialize in navigating Tennessee’s complex daily rate environment. Unlock personalized strategies tailored to your unique financial goals and market conditions by visiting our contact page today.

Expert Insights & Advanced Considerations

Understanding the Nuance Behind Daily Mortgage Rate Volatility

Daily mortgage rates in Tennessee are influenced by an intricate blend of macroeconomic factors and localized market conditions. Beyond standard economic indicators, factors such as regional employment shifts, neighborhood-level housing inventory, and credit profile dynamics play decisive roles. Experts emphasize the importance of granular data analysis coupled with real-time monitoring to anticipate rate movements effectively.

Strategic Timing of Rate Locks Leveraging Predictive Analytics

Successful navigation of Tennessee’s daily mortgage rate fluctuations increasingly depends on integrating predictive analytics tools that process Treasury yields, Federal Reserve signals, and secondary market trends. Sophisticated borrowers use these insights to optimize lock-in timing, balancing the risks of locking too early against potential rate increases. Engaging with mortgage brokers adept in these analytical approaches can yield notable savings.

Impact of Regulatory and Secondary Market Dynamics on Daily Pricing

Regulatory changes and secondary mortgage market liquidity significantly affect daily mortgage rate offerings. Tennessee lenders must adjust risk premiums and spreads in response to evolving capital requirements and investor appetite for mortgage-backed securities. Awareness of these layers empowers borrowers and investors to better understand rate volatility beyond headline interest rates.

Leveraging Behavioral Economics to Improve Borrower Decision-Making

Behavioral economic principles reveal how cognitive biases influence borrower responses to fluctuating rates, often leading to suboptimal timing decisions. Incorporating nudging strategies, such as personalized rate alerts and scenario planning, can help Tennessee borrowers overcome decision paralysis and lock in favorable rates with increased confidence.

Advanced Use of Geospatial Analytics in Mortgage Pricing

Geospatial data analytics have become a transformative tool in predicting hyper-localized mortgage rate shifts within Tennessee. By integrating neighborhood socioeconomic indicators and infrastructure developments, lenders can refine risk assessments and pricing models. Borrowers aware of these insights can strategically target mortgage products suited to evolving local market dynamics.

Curated Expert Resources

Freddie Mac 2025 Mortgage Market Outlook: An authoritative source offering comprehensive analysis of national and regional secondary market trends affecting mortgage rates, including Tennessee-specific insights (Freddie Mac 2025 Mortgage Market Outlook).

Mortgage Bankers Association (MBA): Provides detailed reports on mortgage rate behavior and borrower credit trends critical for understanding daily rate fluctuations (MBA Official Site).

Urban Institute Research: Offers in-depth analyses on regulatory impacts and macroprudential policies influencing mortgage markets, valuable for Tennessee borrowers seeking context on rate volatility (Urban Institute Research).

Consumer Financial Protection Bureau (CFPB): Essential for staying updated on federal and state regulatory changes affecting mortgage lending practices in Tennessee (CFPB).

Tennessee Mortgage Rates Contact Page: Connect with local mortgage professionals who specialize in navigating Tennessee’s daily mortgage rate environment and can provide personalized guidance (Contact Tennessee Mortgage Rates).

Final Expert Perspective

Mastering Tennessee mortgage rates in 2025 requires a multi-dimensional approach that blends technological sophistication, behavioral insights, and an understanding of layered market forces. From leveraging machine learning-enhanced forecasts to appreciating the subtle influences of the secondary mortgage market and regulatory shifts, borrowers and investors who engage deeply with these factors position themselves for optimal financial outcomes. This expert synthesis underscores that vigilance, strategic timing, and informed decision-making are paramount in navigating Tennessee’s daily mortgage rate volatility.

We encourage readers to deepen their engagement by exploring our comprehensive guides on refinancing timing and credit score optimization. For tailored strategies aligned with your unique profile, connect with Tennessee mortgage experts via our contact page and transform insight into action today.