Understanding the Strategic Role of Mortgage Brokers in Tennessee’s Dynamic Market

In the complex landscape of Tennessee’s 2025 real estate market, mortgage brokers serve as pivotal intermediaries who navigate the intricate pathways between homebuyers and lenders. Their expertise extends beyond mere loan facilitation, encompassing a nuanced understanding of local market trends, credit dynamics, and regulatory frameworks that critically shape mortgage accessibility and affordability.

Advanced Functions and Value-Added Services Provided by Mortgage Brokers

Mortgage brokers meticulously analyze a borrower’s financial profile to tailor loan options from a broad spectrum of lenders, often including local banks, credit unions, and national institutions. This brokerage model generates competitive leverage, enabling buyers to secure optimal interest rates and loan structures aligned with Tennessee’s market particularities. Brokers also streamline the application process by managing documentation, pre-approvals, and lender negotiations, thereby reducing processing times and mitigating risks of approval delays.

How Do Mortgage Brokers Influence Interest Rates and Loan Terms in Tennessee’s 2025 Market?

Mortgage brokers possess specialized knowledge of how credit scores influence mortgage rates, as extensively covered in expert analyses on credit impact. By advising buyers on credit improvement strategies and presenting comprehensive loan portfolios, brokers can secure more favorable terms than direct lender applications. Their institutional relationships and understanding of lender risk appetites are instrumental in negotiating reduced fees and flexible repayment schedules, particularly for first-time homebuyers and those utilizing government-backed loans like FHA or VA products, which have unique eligibility and rate considerations in Tennessee.

Integrating Local Market Expertise with Regulatory Compliance

Licensed mortgage brokers in Tennessee must adhere to stringent state and federal regulations, ensuring transparent disclosures and ethical loan practices. Their local expertise is invaluable in interpreting nuances such as regional property valuations, tax implications, and mortgage insurance requirements that vary within Tennessee’s jurisdictions. This localized insight empowers buyers to make informed decisions that align with their long-term financial goals.

Leveraging Mortgage Brokers to Navigate Tennessee’s Diverse Loan Products

Mortgage brokers facilitate access to a diversified portfolio of loan products, including fixed-rate, adjustable-rate, FHA, VA, and investment property mortgages tailored to Tennessee’s homebuyer demographics. Their comprehensive understanding of these options enables clients to compare and contrast benefits, risks, and costs effectively. For example, prospective buyers interested in FHA loan trends or VA loan advantages can receive tailored guidance suited to their eligibility and financial goals.

Call to Action: Engage with Tennessee Mortgage Experts to Optimize Your Home Financing

To deepen your understanding and leverage specialized mortgage brokerage services in Tennessee, explore our curated expert content on how local mortgage brokers enhance loan outcomes. Your proactive engagement with these insights will empower your homebuying journey with strategic financial advantage and market acumen.

For more professional guidance or to initiate your mortgage application process with a trusted Tennessee broker, visit our Contact Us page.

External Source: According to the National Association of Mortgage Brokers’ 2023 report, brokers offer borrowers access to an average of 10-15 lenders, significantly increasing the probability of securing competitive loan terms (NAMB Research, 2023).

Advanced Negotiation Techniques Employed by Tennessee Mortgage Brokers

Mortgage brokers in Tennessee utilize sophisticated negotiation strategies that go beyond standard rate shopping. Their strong relationships with a diverse network of lenders allow them to advocate effectively on behalf of borrowers, especially in competitive or fluctuating markets. These techniques include leveraging multiple lender bids to create competitive tension, timing loan submissions to coincide with lender incentives, and structuring applications to highlight borrower strengths that mitigate perceived risks. Such nuanced negotiation often results in lower interest rates, waived fees, or more flexible loan terms that individual applicants might not secure independently.

Risk Management and Compliance: How Brokers Protect Tennessee Homebuyers

In addition to loan facilitation, mortgage brokers serve as critical risk management agents. They ensure that borrowers are not only qualified but also matched with loan products that align with their long-term financial health. This involves rigorous compliance with Tennessee’s regulatory framework, detailed disclosure of loan terms, and proactive identification of potential pitfalls such as prepayment penalties or balloon payments. Brokers also guide clients through credit repair or debt management strategies to improve eligibility and reduce overall borrowing costs, a service particularly valuable given the evolving mortgage landscape in 2025.

What Are the Emerging Trends in Tennessee Mortgage Brokerage That Buyers Should Watch in 2025?

As the Tennessee mortgage market evolves in 2025, several emerging trends are reshaping how brokers operate and how buyers benefit. Digital transformation is enabling brokers to use advanced analytics and AI-driven platforms to match borrowers with optimal loans faster and with greater precision. Additionally, there is a growing emphasis on sustainable and green home financing options, which offer incentives for energy-efficient properties, a factor increasingly important in Tennessee’s homebuyer demographics. Brokers are also adapting to tighter regulatory scrutiny and shifting economic conditions, requiring continuous education and agility to maintain competitive advantage. Staying informed about these trends can empower buyers to leverage broker expertise more effectively.

For a comprehensive understanding of Tennessee mortgage market dynamics and to stay ahead of these trends, the Consumer Financial Protection Bureau’s Mortgage Market Report 2023 offers authoritative insights into national and regional market shifts, including broker impact and regulatory updates.

Harnessing Technology: The Digital Edge of Tennessee Mortgage Brokers

Modern mortgage brokers in Tennessee increasingly integrate technology to streamline loan processing and enhance borrower experiences. Utilizing secure online portals, e-signatures, and real-time loan tracking, brokers reduce paperwork friction and improve transparency. These digital tools also facilitate faster pre-approvals and enable borrowers to compare loan scenarios with ease. Such advancements not only save time but help mitigate errors and miscommunications, critical factors in a market as active and competitive as Tennessee’s in 2025.

Understanding these technological enhancements can be pivotal for buyers aiming to optimize their mortgage journey. For more detailed guidance on leveraging local broker expertise and digital tools, explore our expert resource on how local Tennessee mortgage brokers secure the best home loan deals.

We invite readers to share their experiences or questions about working with mortgage brokers in Tennessee to foster a community of informed and empowered homebuyers.

Decoding Predictive Analytics: How Tennessee Mortgage Brokers Anticipate Market Fluctuations

In the ever-evolving Tennessee housing market of 2025, mortgage brokers are increasingly relying on predictive analytics to refine their loan matching processes and hedge against market unpredictability. By harnessing vast datasets — including borrower credit behaviors, regional economic indicators, and lender portfolio shifts — brokers can forecast interest rate trends and lending capacity constraints with remarkable accuracy. This forward-looking approach enables brokers to advise clients proactively, optimizing timing for loan lock-ins and identifying hidden opportunities in niche loan products.

For instance, predictive models may flag emerging risks such as rising default probabilities in specific counties or demographic segments, allowing brokers to tailor loan structures that mitigate such exposure. This data-driven sophistication not only enhances borrower outcomes but also strengthens lender relationships through reduced loan fallout rates.

Specialized Loan Structuring: Tailoring Complex Financing Solutions for Tennessee’s Diverse Buyers

Beyond conventional loan products, Tennessee mortgage brokers in 2025 demonstrate expert proficiency in crafting hybrid financing solutions that address multifaceted buyer needs. These may combine elements of fixed and adjustable rates, integrate interest-only periods, or leverage layered financing involving second mortgages or home equity lines of credit (HELOCs). Such structures demand an intricate understanding of cash flow modeling, tax implications, and long-term wealth-building strategies.

For high-net-worth individuals acquiring investment properties or multi-family units, brokers design bespoke financing arrangements that optimize leverage while minimizing risk exposure. Similarly, first-time homebuyers benefit from brokers’ expertise in stacking government-backed programs with private lender incentives to maximize down payment assistance and reduce monthly obligations.

How Do Tennessee Mortgage Brokers Navigate Complex Regulatory Changes Impacting Loan Products in 2025?

Regulatory shifts in 2025 have introduced nuanced challenges, particularly regarding consumer protection laws and disclosure mandates. Tennessee brokers maintain a rigorous compliance framework by engaging in continuous education and leveraging proprietary compliance management systems. These tools automate regulatory updates, flag potential non-compliance scenarios during loan packaging, and ensure transparent borrower communication.

Moreover, brokers actively participate in industry forums and collaborate with legal experts to interpret ambiguous regulations, translating these insights into practical application. This proactive stance mitigates legal risks and preserves borrower trust, essential in a market marked by heightened scrutiny from both state regulators and federal agencies.

According to the Consumer Financial Protection Bureau’s 2023 Mortgage Market Report, such adaptive compliance measures are linked to increased borrower satisfaction and reduced default rates, underscoring the strategic value of regulatory agility.

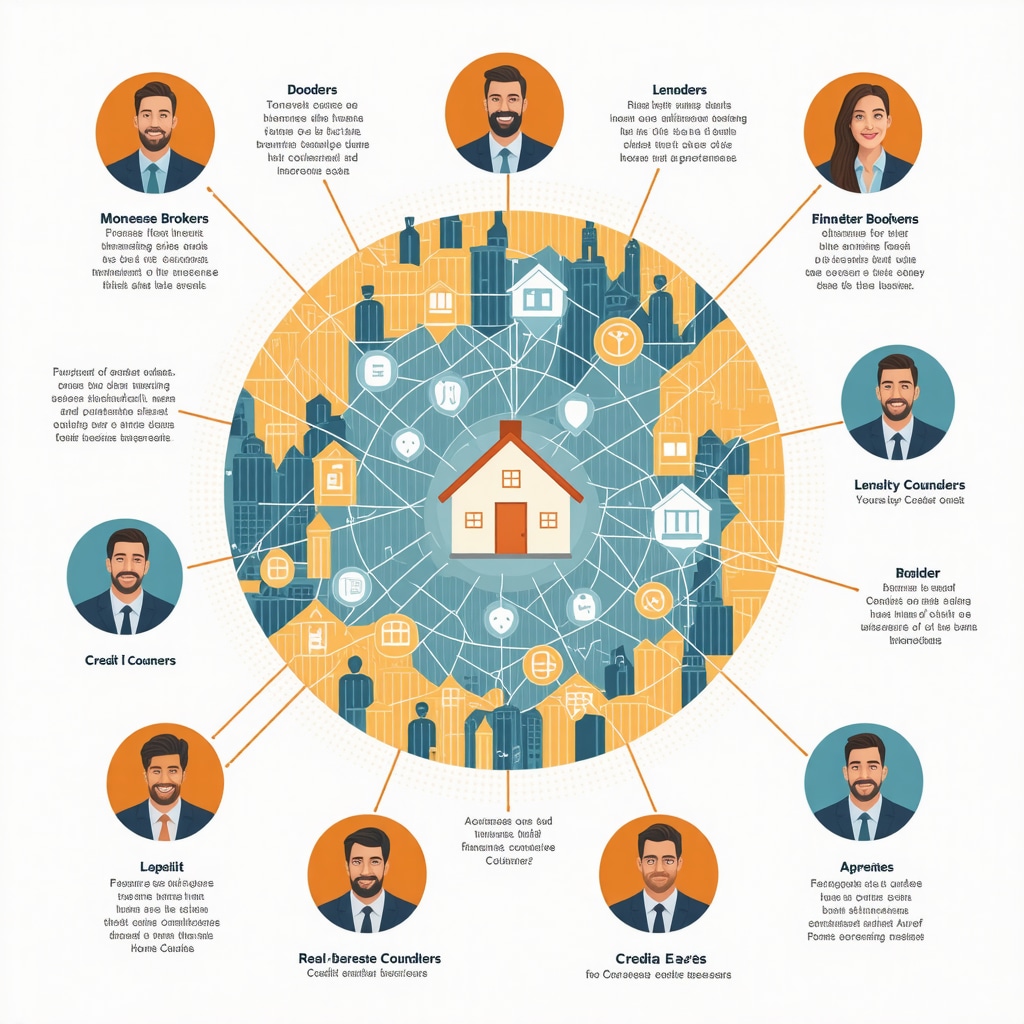

Harnessing Collaborative Networks: The Broker-Lender Ecosystem in Tennessee’s 2025 Landscape

Tennessee mortgage brokers cultivate dynamic ecosystems involving lenders, real estate agents, appraisers, and credit counselors to streamline the home financing journey. This networked approach enhances information flow and accelerates problem-solving. For example, brokers might partner with local appraisers to preempt valuation discrepancies that could delay loan approvals, or coordinate with credit counselors to facilitate rapid credit rehabilitation for marginally qualified buyers.

Such collaborative frameworks also enable brokers to access exclusive lender programs and negotiate fee waivers or rate buy-downs unavailable through standard channels. Consequently, borrowers benefit from a holistic support system that transcends transactional interactions, fostering long-term financial wellness and homeownership stability.

Engage further with our expert insights on leveraging Tennessee’s mortgage broker networks to maximize your loan benefits by visiting this comprehensive guide.

Integrating Sustainable Financing: Green Mortgage Innovations Tailored for Tennessee Homebuyers

In alignment with growing environmental consciousness, Tennessee mortgage brokers are spearheading the integration of green mortgage products that incentivize energy-efficient homes. These products often include rate reductions, closing cost credits, or increased borrowing limits for properties meeting specified sustainability criteria.

Broker expertise in navigating certification processes such as ENERGY STAR or LEED ensures that buyers fully capitalize on these benefits. Furthermore, brokers collaborate with lenders offering specialized programs that finance renewable energy installations or home retrofits, effectively embedding sustainability into the financing structure.

Embracing these innovations not only supports Tennessee’s environmental goals but also enhances property value and reduces long-term utility expenses for homeowners.

Deciphering the Impact of Macroeconomic Indicators on Tennessee Mortgage Brokerage Strategies

Mortgage brokers in Tennessee are increasingly integrating macroeconomic data—such as inflation rates, employment figures, and Federal Reserve policies—into their advisory frameworks. By interpreting these indicators, brokers anticipate shifts in mortgage rate cycles and lending standards, enabling them to counsel clients on optimal loan timing and product selection. This holistic economic perspective distinguishes expert brokers who can mitigate borrower exposure to interest rate volatility and tighten qualification thresholds prevalent in 2025’s uncertain financial climate.

Innovative Risk Mitigation Tactics in Broker-Led Loan Portfolios

Advanced mortgage brokers employ sophisticated risk stratification models, combining borrower credit analytics with property market volatility assessments to tailor loan proposals. These models incorporate stress testing for borrower repayment under scenarios of income disruption or market downturns, allowing brokers to preemptively adjust loan structures. This proactive risk management not only protects lenders but also fortifies borrower resilience, fostering sustainable homeownership within Tennessee’s diverse economic zones.

How Are Tennessee Mortgage Brokers Leveraging Blockchain Technology to Enhance Transparency and Security?

Emerging blockchain applications are transforming mortgage brokerage by creating immutable records of loan documentation, streamlining title verification, and accelerating transaction settlements. Tennessee brokers adopting blockchain platforms facilitate real-time data sharing among stakeholders, reducing fraud risk and enhancing regulatory compliance. This technological adoption underpins enhanced borrower trust and optimizes operational efficiency, positioning brokers at the forefront of digital mortgage innovation.

For detailed insights into blockchain integration within mortgage finance, the Mortgage Bankers Association’s Blockchain Research offers authoritative analysis and case studies.

Dynamic Client Profiling: Customizing Mortgage Solutions Through Behavioral Analytics

Mortgage brokers in Tennessee are advancing beyond traditional credit assessments by incorporating behavioral analytics to evaluate borrower decision-making patterns and financial habits. This granular profiling enables brokers to recommend loan products that align with client risk tolerance and long-term financial goals, improving approval rates and post-loan satisfaction. Such innovation exemplifies the evolving role of brokers as strategic financial consultants rather than mere intermediaries.

Expanding the Horizon: Cross-Border Mortgage Brokerage Opportunities in Tennessee

Given Tennessee’s growing appeal to international investors and relocating professionals, brokers are developing expertise in cross-border mortgage transactions. This includes navigating foreign income verification, currency exchange risks, and compliance with international tax treaties. Such specialized services position Tennessee brokers as vital facilitators in global capital flows into the state’s real estate market, broadening client bases and diversifying loan portfolios.

Call to Action: Engage with Tennessee Mortgage Brokerage Innovators to Harness Cutting-Edge Financing Solutions

To capitalize on these advanced strategies and emerging technologies, connect with Tennessee mortgage brokerage experts who are pioneering innovative loan structuring and digital transformation. Your engagement with these forward-thinking professionals will empower you to secure financing solutions tailored to the nuanced complexities of the 2025 market environment.

Discover more by visiting our Innovation in Tennessee Mortgage Brokerage resource hub or initiate personalized consultations through our Contact Page.

Expert Insights & Advanced Considerations

Leveraging Predictive Analytics to Anticipate Market Movements

Mortgage brokers in Tennessee are increasingly harnessing predictive analytics to forecast interest rate trends and lending environment shifts. By integrating borrower credit patterns with regional economic data, brokers can advise clients on optimal loan timing and product selection, thereby enhancing approval likelihood and cost efficiency.

Innovative Loan Structuring Beyond Conventional Products

Expert brokers craft hybrid financing solutions combining fixed and adjustable rates, interest-only periods, and layered financing such as HELOCs. This tailored approach addresses the diverse needs of Tennessee’s buyers—from first-time homeowners to high-net-worth investors—maximizing financial flexibility while mitigating risk.

Integrating Blockchain Technology for Transparency and Security

Adoption of blockchain platforms by Tennessee mortgage brokers is revolutionizing document management and title verification. Immutable, real-time data sharing enhances compliance and reduces fraud risk, positioning brokers at the forefront of mortgage innovation and fostering borrower trust.

Behavioral Analytics: Customizing Mortgage Recommendations

Advanced brokers analyze borrower financial behaviors and decision-making patterns to align loan products with individual risk appetites and long-term goals. This nuanced profiling elevates mortgage consulting from transactional service to strategic financial partnership.

Expanding Cross-Border Expertise Amid Growing International Investment

With Tennessee attracting international buyers, brokers adept in cross-border mortgage intricacies—including foreign income verification and tax treaty compliance—are essential. This specialization broadens client bases and facilitates global capital flow into the state’s real estate market.

Curated Expert Resources

Consumer Financial Protection Bureau’s Mortgage Market Report 2023: An authoritative source offering comprehensive insights into national and regional mortgage trends, lender behaviors, and regulatory updates crucial for understanding Tennessee’s market dynamics.

Mortgage Bankers Association’s Blockchain Research: Provides in-depth analysis and case studies on blockchain integration in mortgage finance, illuminating transformative technology applications relevant to Tennessee brokers.

Tennessee Mortgage Rates – How Credit Scores Shape Your Mortgage Interest Rates Today: A focused resource explaining the critical impact of credit profiles on loan terms, essential for brokers advising clients on credit improvement strategies.

Inside Tennessee’s FHA Loan Rates: Trends and Opportunities: Detailed exploration of government-backed loan products tailored to Tennessee’s first-time and budget-conscious buyers, facilitating informed brokerage guidance.

How Local Tennessee Mortgage Brokers Secure the Best Home Loan Deals: A practical guide highlighting brokerage techniques that optimize loan outcomes through local market expertise and lender relationships.

Final Expert Perspective

The role of Tennessee mortgage brokers in 2025 transcends simple loan facilitation; it embodies strategic financial consultancy powered by advanced analytics, innovative technology adoption, and deep regulatory acumen. These professionals are uniquely positioned to navigate complex market dynamics, tailor sophisticated financing solutions, and safeguard borrower interests in an evolving economic landscape. For homebuyers and investors seeking competitive advantage, engaging with expert Tennessee mortgage brokers is not merely advisable—it is indispensable. To explore nuanced mortgage strategies or initiate a consultation with a trusted professional, visit our Contact Page and step confidently into your home financing journey.