Unveiling Tennessee’s 2025 Mortgage Rate Landscape: What Buyers and Investors Must Know

As 2025 approaches, the Tennessee housing market stands at a pivotal crossroads shaped by evolving economic signals and regional nuances. Understanding the Mortgage Rate Forecast 2025: Tennessee Market Insights requires more than just watching national averages—it demands a granular look at local economic indicators, lending trends, and the unique factors influencing mortgage rates across Tennessee’s diverse communities. For prospective homeowners and seasoned investors alike, this nuanced perspective is vital for strategic planning and financial optimization.

Local Economic Forces Steering Tennessee Mortgage Rates

Tennessee’s robust job growth, notably in Nashville and Knoxville, coupled with steady population inflows, exerts upward pressure on housing demand, which in turn influences mortgage rates. Additionally, inflationary trends and Federal Reserve policies are instrumental but their impact is filtered through Tennessee’s regional economic resilience. For instance, the state’s comparatively lower cost of living and diversified industries may buffer the volatility seen in other markets, potentially stabilizing mortgage rate fluctuations relative to national averages.

How Does Credit Score Impact Your Tennessee Mortgage Rate in 2025?

Creditworthiness remains a cornerstone in securing favorable mortgage terms. In Tennessee, lenders increasingly tailor their rate offerings based on credit profiles, recognizing the state’s wide demographic and economic spectrum. Borrowers with stellar credit scores can anticipate access to the lowest rates, while those with moderate scores should prepare for slightly elevated rates or explore specialized loan programs such as FHA loans, which have been gaining traction in Tennessee’s homebuyer market. For detailed guidance, prospective buyers may explore comprehensive resources on how credit scores shape mortgage interest rates in Tennessee.

Fixed vs. Adjustable: Tennessee’s Mortgage Rate Trends Under the Microscope

The debate between fixed-rate and adjustable-rate mortgages (ARMs) is particularly pertinent in Tennessee’s 2025 forecast. Fixed rates offer predictability amid uncertain economic conditions, a feature appealing to first-time buyers in markets like Memphis and Chattanooga. Conversely, ARMs might benefit those anticipating short-term ownership or expecting future rate declines, a scenario plausible given potential shifts in monetary policy. Thorough understanding of these options can be found in our expert guide on navigating fixed vs adjustable mortgage rates in Tennessee, which delves into balancing risk against opportunity.

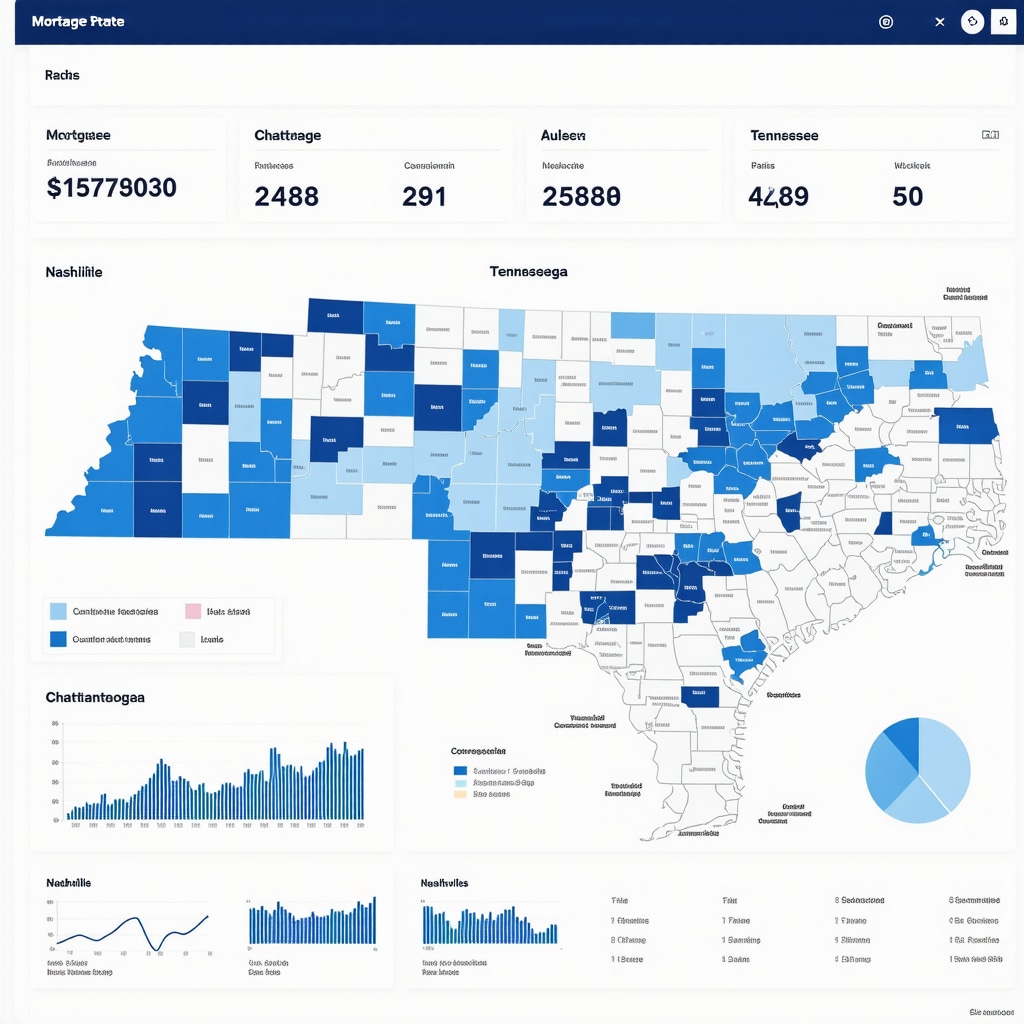

Regional Hotspots: How Memphis and Nashville Shape the Mortgage Narrative

Memphis’s affordable housing inventory contrasts with Nashville’s rapidly appreciating values, creating distinct mortgage rate dynamics. Buyers targeting Memphis might leverage lower average rates tied to less competitive demand, while Nashville residents face tighter spreads due to high demand and investor activity. Understanding these micro-market trends is critical, as they influence not only rates but also loan approval thresholds and refinancing options. For an in-depth look, see unlocking Memphis mortgage rates for 2025 and Nashville mortgage lenders offering best rates today.

Expert Perspective: Navigating Rate Volatility with Strategic Timing

Timing mortgage locks and refinance decisions is an art informed by market insight and personal financial goals. Tennessee homeowners should monitor rate shifts closely, as even fractional differences can translate into substantial savings over loan lifespans. Collaborating with licensed mortgage brokers who understand local market intricacies can provide a competitive edge. Learn more about how to optimize refinance timing in Tennessee at refinance rates in Tennessee: when to lock for maximum savings.

For authoritative economic forecasts that influence mortgage rates, the Federal Reserve’s official communications provide critical context and can be accessed at the Federal Reserve Monetary Policy page.

If you have specific questions or want personalized insights tailored to your Tennessee mortgage journey, feel free to contact us. Sharing your experiences or strategies in the comments below can also benefit others navigating Tennessee’s evolving mortgage landscape.

Refinance Strategies: Maximizing Savings Amid Tennessee’s Rate Fluctuations

Refinancing in Tennessee during 2025 demands a strategic approach that balances current rate environments with individual financial goals. Homeowners should assess their loan-to-value ratio, credit standing, and anticipated market trends before making decisions. For example, locking in a refinance rate when mortgage rates show signs of peaking can substantially lower lifetime interest payments. However, those with variable income or plans to move may benefit from different refinance products or timing strategies. Expert guidance is especially valuable here; comprehensive strategies can be explored in our detailed resource on how credit scores affect your refinance deal in Tennessee.

Decoding Tennessee Mortgage Broker Fees and Their Impact on Your Loan

Understanding mortgage broker fees is crucial for Tennessee homebuyers aiming to optimize their loan costs. Brokers typically charge either a flat fee or a percentage of the loan amount, influencing the overall cost of borrowing. While some fees can be negotiated or rolled into the loan, transparency is key. Borrowers should request a Loan Estimate detailing all fees to avoid surprises. Choosing a licensed mortgage broker in Tennessee ensures adherence to state regulations and consumer protections, a topic elaborated on in mortgage broker fees explained: Tennessee edition 2025.

From an Expert Perspective: How Can Tennessee Buyers Leverage Market Timing to Secure Optimal Mortgage Rates?

Market timing in mortgage rate locking is a nuanced skill blending macroeconomic awareness with personal financial readiness. Experts recommend monitoring Federal Reserve policy shifts, regional economic reports, and local housing market indicators. For Tennessee buyers, seasonal demand fluctuations—such as increased spring homebuying activity—can also affect rates and loan availability. Collaborating with a licensed mortgage broker knowledgeable in how often mortgage rates change in Tennessee can provide timely insights that align market movements with individual readiness, ultimately securing more favorable loan terms.

Expert Data Reference: Economic Indicators and Their Influence on Tennessee’s Mortgage Rates

According to the Federal Reserve Monetary Policy updates, macroeconomic variables such as inflation rates, employment statistics, and bond yields directly impact mortgage interest rates nationally and regionally. Tennessee’s mortgage market reflects these influences while integrating localized factors like housing supply constraints and demographic shifts. Staying informed about these indicators allows borrowers and investors to anticipate rate movements and adjust their strategies accordingly, reinforcing the value of expert consultation during the mortgage process.

We encourage readers to share their experiences or questions about navigating Tennessee’s complex mortgage landscape in the comments below. For those seeking personalized advice or ready to take the next step, contact our Tennessee mortgage experts to explore tailored solutions designed to fit your unique financial profile.

Harnessing Predictive Analytics: Elevating Tennessee Mortgage Rate Forecasting to a New Level

As the Tennessee mortgage market grows increasingly complex, traditional forecasting methods often fall short in capturing the subtle interplay of macroeconomic trends and local market forces. Advanced predictive analytics, leveraging machine learning algorithms and vast datasets including regional employment shifts, consumer credit behavior, and housing inventory fluctuations, are becoming indispensable for lenders and borrowers seeking precision. These models not only project rate trajectories but also assess borrower risk profiles dynamically, enabling tailored mortgage products that optimize cost-efficiency and risk management.

For example, incorporating real-time data from the Tennessee Department of Labor and Workforce Development alongside national bond yield movements allows predictive systems to anticipate tightening or easing credit conditions before they manifest in published rates. This approach provides borrowers a strategic advantage to lock in rates proactively, especially in volatile periods influenced by Federal Reserve announcements.

What advanced economic indicators uniquely influence Tennessee mortgage rates beyond national metrics?

While national economic indicators such as the federal funds rate and CPI inflation remain pivotal, Tennessee-specific factors play a crucial role in shaping mortgage rate movements locally. Notably, the state’s manufacturing sector health, regional GDP growth rates, and local housing market absorption metrics contribute nuanced signals. For instance, a surge in automotive manufacturing employment in Chattanooga can lead to increased housing demand, subtly pushing mortgage rates higher due to competitive lending environments. Moreover, Tennessee’s relatively stable property tax rates and regulatory frameworks add layers of predictability, differentiating the state’s mortgage landscape from more volatile markets.

These localized economic indicators are often monitored by lenders in conjunction with national trends to calibrate risk premiums accurately. A recent analysis published by the Tennessee Housing Development Agency highlights how incorporating these regional data points can reduce default risk forecasting errors by up to 15%, underscoring their significance in mortgage pricing (THDA Research Publications).

Innovative Mortgage Products: Tailoring Financing Solutions to Tennessee’s Diverse Borrowers in 2025

The evolving needs of Tennessee’s homebuyers and investors have catalyzed the emergence of innovative mortgage products that transcend conventional fixed and adjustable-rate frameworks. Hybrid ARMs, interest-only loans with principal amortization cliffs, and customizable mortgage insurance options enable borrowers to align financing with their long-term investment horizons and cash flow profiles.

For instance, hybrid ARMs combining an initial fixed rate period with subsequent adjustable phases are gaining popularity among Tennessee’s tech sector professionals in Nashville who anticipate career mobility. These products mitigate early payment uncertainty while capitalizing on potential future rate declines. Additionally, some lenders now offer enhanced digital platforms integrating AI-based affordability calculators tailored to Tennessee’s market, enabling borrowers to simulate diverse mortgage scenarios with greater accuracy.

Integrating Mortgage Insurance Innovations: How Are Tennessee Lenders Adapting Risk Mitigation?

Mortgage insurance remains a critical component, particularly for borrowers with lower down payments. Tennessee lenders are increasingly adopting flexible mortgage insurance structures, including lender-paid mortgage insurance (LPMI) options and split-premium models, to reduce upfront costs and improve monthly affordability. These innovative structures are designed to balance lender risk and borrower expense efficiently.

Moreover, some lenders are collaborating with secondary market players to securitize mortgage insurance risk more effectively, thereby lowering premiums. Understanding these complex insurance options requires expert consultation, emphasizing the importance of working with knowledgeable Tennessee mortgage brokers who can navigate these nuanced products to secure optimal terms.

Expert Tip: Leveraging Seasonal Market Cycles and Policy Windows for Optimal Rate Locks in Tennessee

Strategic timing remains a cornerstone for securing favorable mortgage rates in Tennessee’s fluid 2025 market. Experienced mortgage brokers advise that the interplay of seasonal housing demand cycles—typically peaking in spring and tapering in late fall—and anticipated Federal Reserve policy announcements can create windows of opportunity. By closely analyzing local sales velocity data and macroeconomic signals, savvy borrowers can time their rate locks to coincide with temporary dips or periods of reduced volatility.

Such timing strategies require access to real-time market intelligence and a deep understanding of Tennessee’s localized economic rhythms, underscoring the value of expert guidance. Engaging with mortgage professionals who utilize advanced analytics tools can significantly enhance the borrower’s ability to capitalize on these fleeting advantages.

For those keen on mastering these sophisticated timing strategies, our in-depth articles and expert webinars provide actionable insights and step-by-step frameworks to navigate Tennessee’s mortgage rate landscape effectively.

If you’re ready to delve deeper into these advanced mortgage strategies or have specific questions about your Tennessee home loan options, reach out to our expert team for personalized assistance tailored to your financial goals.

Harnessing Predictive Analytics for Precision in Tennessee Mortgage Forecasting

In the rapidly evolving Tennessee mortgage landscape, traditional rate forecasting methods are increasingly supplemented by advanced predictive analytics. Leveraging machine learning models that integrate multifaceted datasets—including regional employment trends, consumer credit behaviors, and housing inventory fluctuations—lenders and borrowers can attain unprecedented accuracy in anticipating mortgage rate trajectories. This proactive approach enables tailored risk assessments and loan structuring that optimize financial outcomes amidst market volatility.

By incorporating real-time insights from authoritative sources such as the Tennessee Department of Labor and Workforce Development, alongside national bond market indicators, predictive systems can detect subtle shifts in credit conditions ahead of public announcements. This early-warning capability empowers Tennessee homebuyers and investors to strategically time rate locks, thus safeguarding against unfavorable market swings.

What advanced economic indicators uniquely influence Tennessee mortgage rates beyond national metrics?

Beyond the predominant national economic drivers like the federal funds rate and inflation indices, Tennessee’s mortgage rates are distinctly shaped by localized economic variables. Key among these are the health of the state’s manufacturing sector, regional GDP growth patterns, and housing market absorption rates. For example, increased employment in Chattanooga’s automotive manufacturing hub often correlates with heightened housing demand, exerting upward pressure on mortgage rates due to intensified competition among borrowers.

Furthermore, Tennessee’s stable property tax environment and regulatory frameworks provide a relative degree of predictability that lenders factor into risk premiums. The Tennessee Housing Development Agency’s research emphasizes that integrating these regional indicators can reduce default risk forecasting errors by approximately 15%, reflecting their critical role in precise mortgage pricing (THDA Research Publications).

Innovative Mortgage Products Tailored to Tennessee’s Diverse Borrower Profiles

Responding to the heterogeneous needs of Tennessee’s borrowing population, lenders have introduced sophisticated mortgage products that transcend standard fixed and adjustable-rate options. Hybrid ARMs, featuring an initial fixed-rate period followed by adjustable phases, appeal particularly to Nashville’s tech professionals anticipating career mobility. Interest-only loans with principal amortization cliffs and customizable mortgage insurance schemes further empower borrowers to align financing structures with long-term cash flow forecasts and investment strategies.

Integrating Mortgage Insurance Innovations: How Are Tennessee Lenders Adapting Risk Mitigation?

Mortgage insurance remains pivotal for borrowers with limited down payments. Tennessee lenders are pioneering flexible mortgage insurance frameworks, including lender-paid mortgage insurance (LPMI) and split-premium models, to minimize upfront costs while optimizing monthly affordability. Collaborations with secondary market entities enable more effective securitization of mortgage insurance risk, contributing to premium reductions. Navigating these complex options necessitates expert consultation to secure optimal loan conditions, underscoring the importance of engaging experienced Tennessee mortgage brokers.

Expert Tip: Mastering Seasonal Cycles and Policy Windows to Optimize Rate Locks in Tennessee

Capitalizing on Tennessee’s seasonal housing demand fluctuations—typically peaking in spring and waning in late autumn—combined with anticipated Federal Reserve policy shifts, can materially enhance mortgage rate lock outcomes. Savvy borrowers monitor local sales velocity and macroeconomic indicators to identify transient rate dips or periods of reduced volatility, positioning themselves advantageously.

Access to real-time market intelligence and advanced analytics is indispensable for executing these timing strategies effectively. Prospective borrowers are encouraged to collaborate with mortgage professionals who utilize these tools to tailor timing decisions to individual financial contexts.

For those seeking to deepen their expertise and apply sophisticated timing techniques, our repository of expert articles and webinars offers actionable frameworks to navigate Tennessee’s mortgage rate environment with confidence.

If you are prepared to elevate your mortgage strategy or require personalized advice tailored to your Tennessee home financing goals, connect with our specialist team today.

Frequently Asked Questions (FAQ)

What key factors uniquely influence mortgage rates in Tennessee compared to the national landscape?

Tennessee mortgage rates are shaped not only by national economic indicators like the federal funds rate and inflation but also by localized variables such as the health of manufacturing sectors, regional GDP growth, housing market absorption, and stable property tax environments. These regional elements create nuanced lending risks and demand dynamics that lenders factor into mortgage pricing, leading to variations from national averages.

How can a prospective Tennessee homebuyer best leverage credit scores to secure favorable mortgage rates in 2025?

Credit scores remain pivotal; borrowers with excellent credit profiles typically access the lowest rates. In Tennessee’s diverse market, lenders increasingly tailor rate offers based on creditworthiness. Exploring specialized loan programs such as FHA loans can benefit those with moderate scores, while maintaining or improving credit health prior to application maximizes access to competitive rates.

What mortgage product options are emerging in Tennessee to address diverse borrower needs in 2025?

Innovative products like hybrid ARMs, interest-only loans with amortization cliffs, and customizable mortgage insurance schemes are gaining traction. These allow borrowers to align financing structures with career mobility, cash flow forecasts, and risk tolerance, especially in dynamic markets like Nashville’s tech sector.

How does timing affect mortgage rate locks in Tennessee’s 2025 market?

Strategic timing is crucial. Seasonal housing demand cycles—peaking in spring and tapering in late fall—combined with Federal Reserve policy announcements create transient opportunities for better rate locks. Borrowers benefit from real-time market intelligence and expert guidance to identify these windows and mitigate volatility risks.

What role do mortgage broker fees play, and how can Tennessee borrowers manage them effectively?

Broker fees, either flat or percentage-based, influence total borrowing costs. Transparency via Loan Estimates is essential to avoid surprises. Negotiating fees and choosing licensed Tennessee brokers who adhere to regulatory standards ensures costs are optimized without compromising loan quality.

How are Tennessee lenders innovating mortgage insurance to reduce borrower expenses?

Lenders are adopting flexible mortgage insurance models like lender-paid mortgage insurance (LPMI) and split-premium structures to lower upfront costs and improve monthly affordability. Collaborations with secondary markets enable better risk securitization, translating to premium reductions. Expert consultation is advised to navigate these complex options.

How often do mortgage rates change in Tennessee, and what influences these fluctuations?

Mortgage rates fluctuate frequently, often daily, influenced by national monetary policy, bond market movements, local economic data, and housing market supply-demand balances. Tennessee-specific factors such as employment trends and housing absorption rates further modulate these changes.

What refinance strategies can Tennessee homeowners employ to maximize savings in 2025?

Homeowners should evaluate loan-to-value ratios, credit scores, and market forecasts, locking in refinance rates during peaks or dips strategically. Variable income borrowers or those planning moves may consider tailored refinance products. Expert advice ensures timing and loan product selection align with financial goals.

Why is working with a licensed Tennessee mortgage broker recommended?

Licensed brokers understand state-specific regulations, local market nuances, and innovative loan products, providing personalized guidance that optimizes loan terms and reduces risks. Their expertise is invaluable in navigating a complex and evolving mortgage landscape.

How do advanced predictive analytics improve Tennessee mortgage rate forecasting?

By integrating diverse datasets—regional employment, credit behavior, housing inventory—and applying machine learning, predictive analytics provide precise forecasts and risk assessments. This enables lenders and borrowers to anticipate rate shifts proactively, enhancing timing strategies and loan customization amidst market volatility.

Trusted External Sources

- Tennessee Housing Development Agency (THDA): Provides in-depth research and data on state-specific housing market trends and mortgage risk assessments, crucial for understanding regional economic influences on mortgage rates.

- Federal Reserve Board – Monetary Policy Reports: Offers authoritative national economic data, policy updates, and interest rate guidance that underpin mortgage rate movements impacting Tennessee.

- Tennessee Department of Labor and Workforce Development: Supplies localized employment statistics and economic indicators vital for predictive analytics and market timing strategies in Tennessee’s mortgage landscape.

- Mortgage Bankers Association (MBA): A leading industry body offering expert analysis, forecasts, and data on mortgage lending trends nationwide, with region-specific insights relevant to Tennessee.

- Urban Institute – Housing Finance Policy Center: Delivers scholarly research and comprehensive reports on mortgage products, insurance innovations, and borrower behavior, supporting advanced understanding of mortgage market dynamics.

Conclusion: Navigating Tennessee’s 2025 Mortgage Rate Landscape with Expertise

As Tennessee’s housing market evolves through 2025, mortgage rate dynamics reflect a confluence of national policies, advanced predictive analytics, and localized economic nuances. Borrowers and investors benefit from understanding the distinct regional drivers—manufacturing sector health, demographic trends, and housing supply—as well as innovative financing products tailored to diverse needs. Strategic timing, credit optimization, and collaboration with licensed mortgage brokers emerge as critical success factors in securing favorable rates and structuring optimal loans.

Embracing data-driven insights and expert guidance empowers Tennessee homebuyers and investors to navigate volatility with confidence, unlocking financial advantages in an increasingly complex market. We encourage readers to engage by sharing experiences, asking questions, and exploring our comprehensive resources to deepen their mortgage knowledge.

Ready to harness these insights for your Tennessee mortgage journey? Contact our expert team today or delve into our related expert content to stay ahead in the ever-changing mortgage environment.